Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Raiffeisen</strong> <strong>Bank</strong> <strong>Kosovo</strong> 2009<br />

Financial Statements<br />

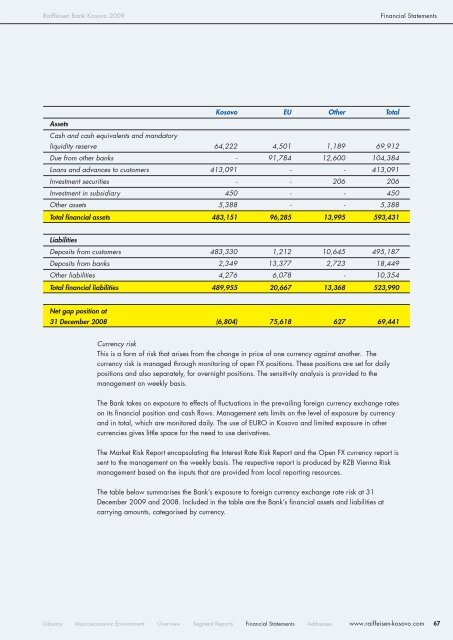

<strong>Kosovo</strong> EU Other Total<br />

Assets<br />

Cash and cash equivalents and mandatory<br />

liquidity reserve 64,222 4,501 1,189 69,912<br />

Due from other banks - 91,784 12,600 104,384<br />

Loans and advances to customers 413,091 - - 413,091<br />

Investment securities - - 206 206<br />

Investment in subsidiary 450 - - 450<br />

Other assets 5,388 - - 5,388<br />

Total financial assets 483,151 96,285 13,995 593,431<br />

Liabilities<br />

Deposits from customers 483,330 1,212 10,645 495,187<br />

Deposits from banks 2,349 13,377 2,723 18,449<br />

Other liabilities 4,276 6,078 - 10,354<br />

Total financial liabilities 489,955 20,667 13,368 523,990<br />

Net gap position at<br />

31 December 2008 (6,804) 75,618 627 69,441<br />

Currency risk<br />

This is a form of risk that arises from the change in price of one currency against another. The<br />

currency risk is managed through monitoring of open FX positions. These positions are set for daily<br />

positions and also separately, for overnight positions. The sensitivity analysis is provided to the<br />

management on weekly basis.<br />

The <strong>Bank</strong> takes on exposure to effects of fluctuations in the prevailing foreign currency exchange rates<br />

on its financial position and cash flows. Management sets limits on the level of exposure by currency<br />

and in total, which are monitored daily. The use of EURO in <strong>Kosovo</strong> and limited exposure in other<br />

currencies gives little space for the need to use derivatives.<br />

The Market Risk <strong>Report</strong> encapsulating the Interest Rate Risk <strong>Report</strong> and the Open FX currency report is<br />

sent to the management on the weekly basis. The respective report is produced by RZB Vienna Risk<br />

management based on the inputs that are provided from local reporting resources.<br />

The table below summarises the <strong>Bank</strong>’s exposure to foreign currency exchange rate risk at 31<br />

December 2009 and 2008. Included in the table are the <strong>Bank</strong>’s financial assets and liabilities at<br />

carrying amounts, categorised by currency.<br />

Glosary Macroeconomic Environment Overview Segment <strong>Report</strong>s Financial Statements Addresses<br />

www.raiffeisen-kosovo.com<br />

67