Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

Annual Report - Raiffeisen Bank Kosovo JSC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statements <strong>Raiffeisen</strong> <strong>Bank</strong> <strong>Kosovo</strong> 2009<br />

In order to hedge for the gaps in fixed-mid to long term loans vs. variable short to mid term debt,<br />

financial derivative called Interest Rate Swap is used, whereby <strong>Raiffeisen</strong> <strong>Bank</strong> <strong>Kosovo</strong> is mainly a<br />

fixed side interest payer, where as in return the counterparty is variable rate payer, and the variable<br />

side is indexed to 6 Month EURIBOR, to insure optimal sensitivity.<br />

<strong>Raiffeisen</strong> <strong>Bank</strong> <strong>Kosovo</strong> applies active risk management to hedge against market risk positions.<br />

Interest rate risk is hedged through financial derivatives. In order to ensure long term profitability on<br />

existing loan portfolios, maturing in 2009 up to 15 years, these positions are hedged through Interest<br />

Rate Swaps. The positions up to 5 years are hedged 75% and positions from 5- 10 are hedged<br />

100%. This Risk controlling approach insures optimal VaR (value at risk).<br />

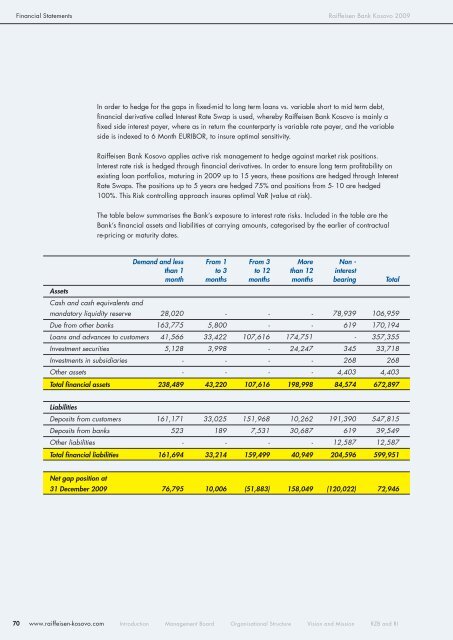

The table below summarises the <strong>Bank</strong>’s exposure to interest rate risks. Included in the table are the<br />

<strong>Bank</strong>’s financial assets and liabilities at carrying amounts, categorised by the earlier of contractual<br />

re-pricing or maturity dates.<br />

Demand and less From 1 From 3 More Non -<br />

than 1 to 3 to 12 than 12 interest<br />

month months months months bearing Total<br />

Assets<br />

Cash and cash equivalents and<br />

mandatory liquidity reserve 28,020 - - - 78,939 106,959<br />

Due from other banks 163,775 5,800 - - 619 170,194<br />

Loans and advances to customers 41,566 33,422 107,616 174,751 - 357,355<br />

Investment securities 5,128 3,998 - 24,247 345 33,718<br />

Investments in subsidiaries - - - - 268 268<br />

Other assets - - - - 4,403 4,403<br />

Total financial assets 238,489 43,220 107,616 198,998 84,574 672,897<br />

Liabilities<br />

Deposits from customers 161,171 33,025 151,968 10,262 191,390 547,815<br />

Deposits from banks 523 189 7,531 30,687 619 39,549<br />

Other liabilities - - - - 12,587 12,587<br />

Total financial liabilities 161,694 33,214 159,499 40,949 204,596 599,951<br />

Net gap position at<br />

31 December 2009 76,795 10,006 (51,883) 158,049 (120,022) 72,946<br />

70 www.raiffeisen-kosovo.com Introduction Management Board Organisational Structure Vision and Mission RZB and RI