Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

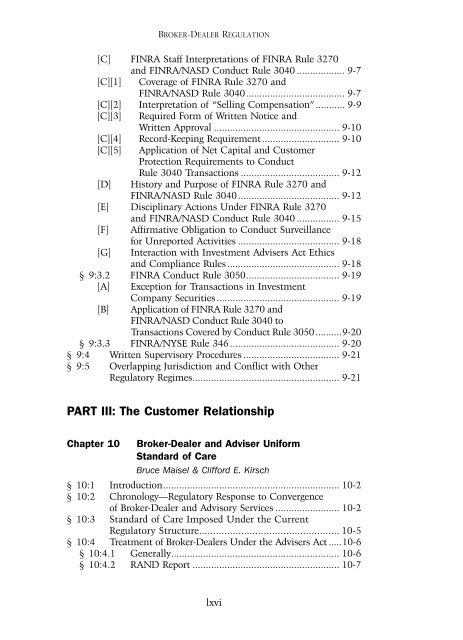

BROKER-DEALER REGULATION<br />

[C] FINRA Staff Interpretations <strong>of</strong> FINRA Rule 3270<br />

and FINRA/NASD Conduct Rule 3040 .................. 9-7<br />

[C][1] Coverage <strong>of</strong> FINRA Rule 3270 and<br />

FINRA/NASD Rule 3040..................................... 9-7<br />

[C][2] Interpretation <strong>of</strong> “Selling Compensation” ........... 9-9<br />

[C][3] Required Form <strong>of</strong> Written Notice and<br />

Written Approval ............................................... 9-10<br />

[C][4] Record-Keeping Requirement ............................. 9-10<br />

[C][5] Application <strong>of</strong> Net Capital and Customer<br />

Protection Requirements to Conduct<br />

Rule 3040 Transactions ..................................... 9-12<br />

[D] History and Purpose <strong>of</strong> FINRA Rule 3270 and<br />

FINRA/NASD Rule 3040...................................... 9-12<br />

[E] Disciplinary Actions Under FINRA Rule 3270<br />

and FINRA/NASD Conduct Rule 3040 ................ 9-15<br />

[F] Affirmative Obligation to Conduct Surveillance<br />

for Unreported Activities ...................................... 9-18<br />

[G] Interaction with Investment Advisers Act Ethics<br />

and Compliance Rules .......................................... 9-18<br />

§ 9:3.2 FINRA Conduct Rule 3050................................... 9-19<br />

[A] Exception for Transactions in Investment<br />

Company Securities .............................................. 9-19<br />

[B] Application <strong>of</strong> FINRA Rule 3270 and<br />

FINRA/NASD Conduct Rule 3040 to<br />

Transactions Covered by Conduct Rule 3050 ..........9-20<br />

§ 9:3.3 FINRA/NYSE Rule 346 ......................................... 9-20<br />

§ 9:4 Written Supervisory Procedures .................................... 9-21<br />

§ 9:5 Overlapping Jurisdiction and Conflict with Other<br />

Regulatory Regimes....................................................... 9-21<br />

PART III: The Customer Relationship<br />

Chapter 10 Broker-Dealer and Adviser Uniform<br />

Standard <strong>of</strong> Care<br />

Bruce Maisel & Clifford E. Kirsch<br />

§ 10:1 Introduction.................................................................. 10-2<br />

§ 10:2 Chronology—Regulatory Response to Convergence<br />

<strong>of</strong> Broker-Dealer and Advisory Services ........................ 10-2<br />

§ 10:3 Standard <strong>of</strong> Care Imposed Under the Current<br />

Regulatory Structure.................................................. 10-5<br />

§ 10:4 Treatment <strong>of</strong> Broker-Dealers Under the Advisers Act .....10-6<br />

§ 10:4.1 Generally............................................................... 10-6<br />

§ 10:4.2 RAND Report ....................................................... 10-7<br />

lxvi