Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

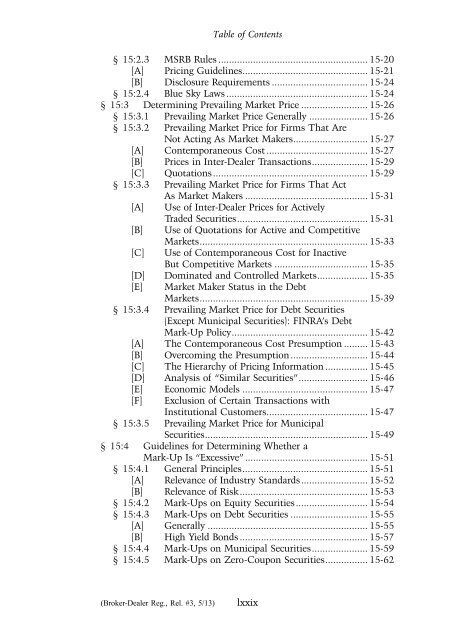

§ 15:2.3 MSRB Rules ........................................................ 15-20<br />

[A] Pricing Guidelines............................................... 15-21<br />

[B] Disclosure Requirements .................................... 15-24<br />

§ 15:2.4 Blue Sky <strong>Law</strong>s ..................................................... 15-24<br />

§ 15:3 Determining Prevailing Market Price ......................... 15-26<br />

§ 15:3.1 Prevailing Market Price Generally ...................... 15-26<br />

§ 15:3.2 Prevailing Market Price for Firms That Are<br />

Not Acting As Market Makers............................ 15-27<br />

[A] Contemporaneous Cost ...................................... 15-27<br />

[B] Prices in Inter-Dealer Transactions..................... 15-29<br />

[C] Quotations.......................................................... 15-29<br />

§ 15:3.3 Prevailing Market Price for Firms That Act<br />

As Market Makers .............................................. 15-31<br />

[A] Use <strong>of</strong> Inter-Dealer Prices for Actively<br />

Traded Securities................................................. 15-31<br />

[B] Use <strong>of</strong> Quotations for Active and Competitive<br />

Markets............................................................... 15-33<br />

[C] Use <strong>of</strong> Contemporaneous Cost for Inactive<br />

But Competitive Markets ................................... 15-35<br />

[D] Dominated and Controlled Markets................... 15-35<br />

[E]<br />

Market Maker Status in the Debt<br />

Markets............................................................... 15-39<br />

§ 15:3.4 Prevailing Market Price for Debt Securities<br />

(Except Municipal Securities): FINRA’s Debt<br />

Mark-Up Policy................................................... 15-42<br />

[A] The Contemporaneous Cost Presumption ......... 15-43<br />

[B] Overcoming the Presumption ............................. 15-44<br />

[C] The Hierarchy <strong>of</strong> Pricing Information ................ 15-45<br />

[D] Analysis <strong>of</strong> “Similar Securities”.......................... 15-46<br />

[E] Economic Models ............................................... 15-47<br />

[F]<br />

<strong>Table</strong> <strong>of</strong> <strong>Contents</strong><br />

Exclusion <strong>of</strong> Certain Transactions with<br />

Institutional Customers...................................... 15-47<br />

§ 15:3.5 Prevailing Market Price for Municipal<br />

Securities............................................................. 15-49<br />

§ 15:4 Guidelines for Determining Whether a<br />

Mark-Up Is “Excessive” .............................................. 15-51<br />

§ 15:4.1 General Principles............................................... 15-51<br />

[A] Relevance <strong>of</strong> Industry Standards......................... 15-52<br />

[B] Relevance <strong>of</strong> Risk................................................ 15-53<br />

§ 15:4.2 Mark-Ups on Equity Securities........................... 15-54<br />

§ 15:4.3 Mark-Ups on Debt Securities ............................. 15-55<br />

[A] Generally ............................................................ 15-55<br />

[B] High Yield Bonds ................................................ 15-57<br />

§ 15:4.4 Mark-Ups on Municipal Securities..................... 15-59<br />

§ 15:4.5 Mark-Ups on Zero-Coupon Securities................ 15-62<br />

(Broker-Dealer Reg., Rel. #3, 5/13)<br />

lxxix