Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

Table of Contents - Practising Law Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

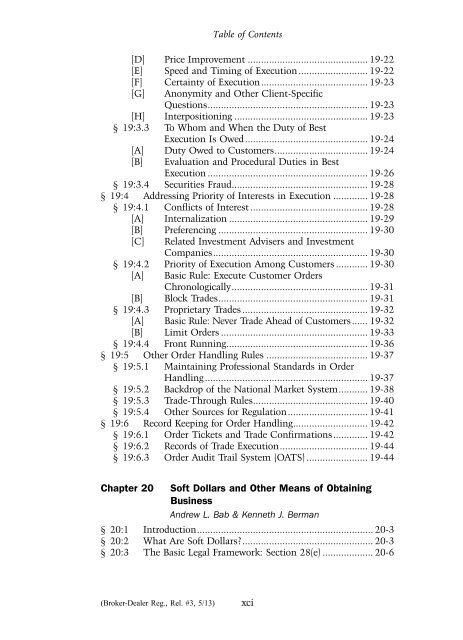

[D] Price Improvement ............................................. 19-22<br />

[E] Speed and Timing <strong>of</strong> Execution .......................... 19-22<br />

[F] Certainty <strong>of</strong> Execution........................................ 19-23<br />

[G]<br />

Anonymity and Other Client-Specific<br />

Questions............................................................ 19-23<br />

[H] Interpositioning .................................................. 19-23<br />

§ 19:3.3 To Whom and When the Duty <strong>of</strong> Best<br />

Execution Is Owed.............................................. 19-24<br />

[A] Duty Owed to Customers................................... 19-24<br />

[B]<br />

Evaluation and Procedural Duties in Best<br />

Execution ............................................................ 19-26<br />

§ 19:3.4 Securities Fraud................................................... 19-28<br />

§ 19:4 Addressing Priority <strong>of</strong> Interests in Execution ............. 19-28<br />

§ 19:4.1 Conflicts <strong>of</strong> Interest ............................................ 19-28<br />

[A] Internalization .................................................... 19-29<br />

[B] Preferencing ........................................................ 19-30<br />

[C] Related Investment Advisers and Investment<br />

Companies.......................................................... 19-30<br />

§ 19:4.2 Priority <strong>of</strong> Execution Among Customers ............ 19-30<br />

[A]<br />

<strong>Table</strong> <strong>of</strong> <strong>Contents</strong><br />

Basic Rule: Execute Customer Orders<br />

Chronologically................................................... 19-31<br />

[B] Block Trades........................................................ 19-31<br />

§ 19:4.3 Proprietary Trades ............................................... 19-32<br />

[A] Basic Rule: Never Trade Ahead <strong>of</strong> Customers ...... 19-32<br />

[B] Limit Orders ....................................................... 19-33<br />

§ 19:4.4 Front Running..................................................... 19-36<br />

§ 19:5 Other Order Handling Rules ...................................... 19-37<br />

§ 19:5.1 Maintaining Pr<strong>of</strong>essional Standards in Order<br />

Handling ............................................................. 19-37<br />

§ 19:5.2 Backdrop <strong>of</strong> the National Market System........... 19-38<br />

§ 19:5.3 Trade-Through Rules........................................... 19-40<br />

§ 19:5.4 Other Sources for Regulation.............................. 19-41<br />

§ 19:6 Record Keeping for Order Handling............................ 19-42<br />

§ 19:6.1 Order Tickets and Trade Confirmations............. 19-42<br />

§ 19:6.2 Records <strong>of</strong> Trade Execution................................. 19-44<br />

§ 19:6.3 Order Audit Trail System (OATS) ....................... 19-44<br />

Chapter 20 S<strong>of</strong>t Dollars and Other Means <strong>of</strong> Obtaining<br />

Business<br />

Andrew L. Bab & Kenneth J. Berman<br />

§ 20:1 Introduction.................................................................. 20-3<br />

§ 20:2 What Are S<strong>of</strong>t Dollars?................................................. 20-3<br />

§ 20:3 The Basic Legal Framework: Section 28(e) ................... 20-6<br />

(Broker-Dealer Reg., Rel. #3, 5/13)<br />

xci