Feasibility Study - Department of Transport

Feasibility Study - Department of Transport

Feasibility Study - Department of Transport

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

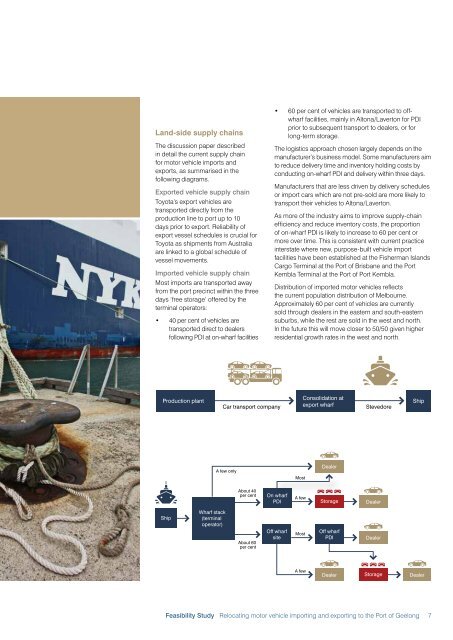

Land-side supply chains<br />

The discussion paper described<br />

in detail the current supply chain<br />

for motor vehicle imports and<br />

exports, as summarised in the<br />

following diagrams.<br />

Exported vehicle supply chain<br />

Toyota’s export vehicles are<br />

transported directly from the<br />

production line to port up to 10<br />

days prior to export. Reliability <strong>of</strong><br />

export vessel schedules is crucial for<br />

Toyota as shipments from Australia<br />

are linked to a global schedule <strong>of</strong><br />

vessel movements.<br />

Imported vehicle supply chain<br />

Most imports are transported away<br />

from the port precinct within the three<br />

days ‘free storage’ <strong>of</strong>fered by the<br />

terminal operators:<br />

• 40 per cent <strong>of</strong> vehicles are<br />

transported direct to dealers<br />

following PDI at on-wharf facilities<br />

• 60 per cent <strong>of</strong> vehicles are transported to <strong>of</strong>fwharf<br />

facilities, mainly in Altona/Laverton for PDI<br />

prior to subsequent transport to dealers, or for<br />

long-term storage.<br />

The logistics approach chosen largely depends on the<br />

manufacturer’s business model. Some manufacturers aim<br />

to reduce delivery time and inventory holding costs by<br />

conducting on-wharf PDI and delivery within three days.<br />

Manufacturers that are less driven by delivery schedules<br />

or import cars which are not pre-sold are more likely to<br />

transport their vehicles to Altona/Laverton.<br />

As more <strong>of</strong> the industry aims to improve supply-chain<br />

efficiency and reduce inventory costs, the proportion<br />

<strong>of</strong> on-wharf PDI is likely to increase to 60 per cent or<br />

more over time. This is consistent with current practice<br />

interstate where new, purpose-built vehicle import<br />

facilities have been established at the Fisherman Islands<br />

Cargo Terminal at the Port <strong>of</strong> Brisbane and the Port<br />

Kembla Terminal at the Port <strong>of</strong> Port Kembla.<br />

Distribution <strong>of</strong> imported motor vehicles reflects<br />

the current population distribution <strong>of</strong> Melbourne.<br />

Approximately 60 per cent <strong>of</strong> vehicles are currently<br />

sold through dealers in the eastern and south-eastern<br />

suburbs, while the rest are sold in the west and north.<br />

In the future this will move closer to 50/50 given higher<br />

residential growth rates in the west and north.<br />

Production plant<br />

Car transport company<br />

Consolidation at<br />

export wharf<br />

Stevedore<br />

Ship<br />

A few only<br />

Most<br />

Dealer<br />

About 40<br />

per cent<br />

On wharf<br />

PDI<br />

A few<br />

Storage<br />

Dealer<br />

Ship<br />

Wharf stack<br />

(terminal<br />

operator)<br />

About 60<br />

per cent<br />

Off wharf<br />

site<br />

Most<br />

Off wharf<br />

PDI<br />

Dealer<br />

A few<br />

Dealer<br />

Storage<br />

Dealer<br />

<strong>Feasibility</strong> <strong>Study</strong> Relocating motor vehicle importing and exporting to the Port <strong>of</strong> Geelong 7