BRF Hospital Holdings - LSUHSC Medical Communications Home ...

BRF Hospital Holdings - LSUHSC Medical Communications Home ...

BRF Hospital Holdings - LSUHSC Medical Communications Home ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Long Term Disability - Mutual of Omaha<br />

Eligibility<br />

Maximum Monthly Benefit<br />

Maximum Benefit Duration<br />

Elimination Period<br />

Waiver of Premium<br />

Survivor Income Benefit<br />

You must be actively at work (able to perform all normal duties of your job) to be eligible for coverage.<br />

You have the option to elect either 40% or 60% of your monthly covered earnings to a maximum of $12,000 per<br />

month. The minimum benefit is $100.<br />

Benefits continue to normal social security retirement age while you remain disabled.<br />

90 days - The number of days you must be disabled prior to collecting disability benefits.<br />

You will not be required to pay premiums during any time of approved total or partial disability.<br />

A 3 months survivor benefit may be paid to your beneficiary if you should die while receiving qualifying disability<br />

payments.<br />

Disability<br />

Partial Disability<br />

Continuation of Disability<br />

Pre-Existing Condition<br />

Benefit Exclusions<br />

Benefit Reductions<br />

Benefit Termination<br />

Portability<br />

Disability and disabled mean that because of an injury or illness, a significant change in your mental or functional<br />

abilities has occurred, for which you are prevented from performing at least one of the material duties of your regular<br />

job and are unable to generate current earnings which exceed 99% of your weekly earnings from your regular job.<br />

You can be totally or partially disabled during the elimination period.<br />

If you become disabled and can work part time (but not full time), you may be eligible for partial disability benefits,<br />

which will help supplement your income until you are able to return to work full time.<br />

If you return to work full time but become disabled from the same disability within six months of returning to work,<br />

you will begin receiving benefits again immediately.<br />

Any sickness or injury for which you have received medical treatment, consultation, care or services (including<br />

diagnostic measures or the taking of prescribed medications) during the 3 months prior to the coverage effective date.<br />

A disability arising from any such sickness or injury will be covered only if it begins after you have performed your<br />

regular occupation on a full time basis for 12 months following the coverage effective date.<br />

You will not receive benefits in the following circumstances:<br />

Your disability is the result of a self-inflicted injury<br />

You were involved in a felony commission, act of war or participation in a riot<br />

* See certificate for full list of exclusions<br />

Your benefits may be reduced if you are receiving benefits from any of the following sources:<br />

Any compulsory benefit act or law (such as state disability plans)<br />

Any governmental retirement system earned as a result of working for the current policyholder<br />

Any disability or retirement benefit received under a retirement plan<br />

Any Social Security, or similar plan or act, benefits<br />

Earnings the insured earns or receives from any form of employment<br />

Workers compensation<br />

<br />

This coverage will terminate when you terminate employment with this policyholder or at your retirement.<br />

When you are no longer an eligible employee, you will have 31 days to port coverage, allowing you to continue this<br />

insurance until you are 70.<br />

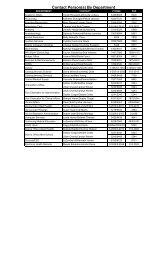

Your benefit is based on your Salary. Calculate your Bi-Weekly deduction using the<br />

following examples (This example assumes a 40 hour work week):<br />

40% of your Salary 60% of your Salary<br />

Hourly Pay Rate 20.00 20.00<br />

Times 40 - weekly payroll 800.00 800.00<br />

Times 52 / 12 3,466.67 3,466.67<br />

Times 40% / 60% - monthly benefit 1,386.67 2,080.00<br />

Times .0136 18.86 28.29<br />

Times 12 / 26 to get your<br />

Bi-Weekly Deduction<br />

$8.70 $13.06<br />

9<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits