BRF Hospital Holdings - LSUHSC Medical Communications Home ...

BRF Hospital Holdings - LSUHSC Medical Communications Home ...

BRF Hospital Holdings - LSUHSC Medical Communications Home ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

Benefit Guide 2013 - 2014

Welcome to <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

Welcome to <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

In recognition of the diverse needs of its employees, <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> offers a variety of employee benefit programs,<br />

allowing you to select a level of protection and security best suited to your personal situation. This booklet provides an<br />

overview of the following Benefit Plans:<br />

Paid Time Off<br />

Retirement<br />

<strong>Medical</strong><br />

Dental<br />

Vision<br />

Flexible Spending Accounts (Health Care and Dependent Care)<br />

Basic Life & Accidental Death & Dismemberment<br />

Voluntary Life & Accidental Death & Dismemberment<br />

Short and Long Term Disability<br />

Critical Illness<br />

Employee Assistance Program<br />

Travel Assistance<br />

More detailed plan information, access to carrier websites, and claim forms are available on the online enrollment website<br />

www.enrollme.biz.<br />

Each Plan described in this booklet is governed by a legal document called the Plan Document which can be found on the<br />

online enrollment website, www.enrollme.biz. This booklet is not intended to be all-inclusive or supersede the individual<br />

Plan Documents, rules or policies. Therefore, in the event of a discrepancy between this booklet and the Plan Documents,<br />

the Plan Documents will be followed.<br />

It is important for you to have a good understanding of each Benefit Plan that is offered. Please review this booklet<br />

carefully and if you have any questions, please contact your local Human Resource/Benefits Department or HUB<br />

International at 318-629-8769 or 877-309-2224.<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

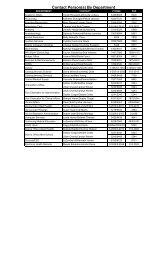

Table of Contents and Contact Information<br />

Eligibility<br />

Cost of coverage<br />

See page:<br />

Benefit<br />

Full Time<br />

60 hours/<br />

bi-weekly<br />

pay period<br />

Part Time<br />

40 hours/<br />

bi-weekly<br />

pay period<br />

Family<br />

Paid Time Off Shared 2<br />

Retirement Shared 2<br />

Basic Life & AD&D Employer Paid 3<br />

<strong>Medical</strong> & Prescription Drugs Shared 3<br />

Dental Employee paid 5<br />

Vision Employee paid 6<br />

Voluntary Life & AD&D Employee paid 7<br />

Short Term Disability Employee paid 8<br />

Long Term Disability Employee paid 9<br />

Critical Illness Employee paid 10<br />

Flexible Spending Accounts Employee paid 11<br />

Online Enrollment 12<br />

Contact Information<br />

Provider Phone Number Website<br />

HUB Benefits Helpline<br />

318-629-8769<br />

877-309-2224<br />

Online Enrollment: www.enrollme.biz<br />

Email: <strong>BRF</strong>HH@hubinternational.com<br />

BlueCross BlueShield<br />

<strong>Medical</strong><br />

AlwaysCare<br />

Dental<br />

Vision<br />

Boon-Chapman<br />

Health Care and Dependent Care<br />

Flexible Spending Accounts<br />

Mutual of Omaha<br />

Basic Life & AD&D<br />

Voluntary Life & AD&D<br />

<br />

<br />

Short Term Disability<br />

Long Term Disability<br />

Employee Assistance Program (EAP)<br />

Travel Assistance<br />

HM Life Insurance Company<br />

Critical Illness<br />

Great-West Financial<br />

Retirement Plan<br />

800-830-1501 www.MyHealthToolKitLA.com<br />

888-729-5433 x 2013 www.alwaysassist.com<br />

800-252-9653 - Option 6 www.boonchapman.com<br />

Claims:<br />

Life: 800-775-8805<br />

Disability: 800-877-5176<br />

Portability / Conversion:<br />

877-466-8367<br />

800-316-2796<br />

800-856-9947<br />

Customer Service/Eligibility:<br />

800-323-0774<br />

Claims: 888-529-8983<br />

www.mutualofomaha.com/<br />

customer-service<br />

www.mutualofomaha.com/EAP<br />

www.hmig.com<br />

800-338-4015 www.gwrs.com<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

Benefits and Eligibility<br />

Eligibility<br />

This booklet provides a summary of the benefits you are<br />

eligible to select as a benefits eligible employee of <strong>BRF</strong><br />

<strong>Hospital</strong> <strong>Holdings</strong>. Benefits eligible employees are employees<br />

working at least 60 hours per bi-weekly pay period who have<br />

satisfied the company defined waiting periods. This booklet<br />

contains information that is important for you to know in<br />

order to select the benefits that are best for you and your<br />

family. All benefits and an individual’s right to them are<br />

subject to federal regulations, <strong>BRF</strong> <strong>Hospital</strong> Holding’s policies<br />

and procedures, the individual plan documents, and our<br />

receipt of your executed and recorded election.<br />

Effective Date of Coverage<br />

Benefits are effective the first day of the month following<br />

your first full calendar month of employment. For Example:<br />

Date of hire = August 20th, Effective Date = October 1st<br />

Dependent Coverage<br />

An eligible dependent is defined as:<br />

Your lawful spouse<br />

You or your spouse’s child who is under age 26, including<br />

a natural child, step child, a legally adopted child, a child<br />

placed for adoption, or a child for whom you or your<br />

spouse are the legal guardian; or<br />

An unmarried child age 26 or over who is or becomes<br />

disabled and dependent upon you<br />

Dependent Certification Required for <strong>Medical</strong><br />

Insurance:<br />

To deter fraud, abuse, and assure the proper use of<br />

company funds and Plan Members’ premium dollars, <strong>BRF</strong><br />

<strong>Hospital</strong> <strong>Holdings</strong> joins the majority of public and private<br />

health benefit programs by requiring proof that the<br />

dependents covered are your legal dependents. All Active<br />

employees are required to provide written proof that each<br />

dependent to be covered under Your <strong>Medical</strong> Plan is your<br />

actual legal dependent. This documentation is necessary<br />

ONLY if you are enrolling in <strong>Medical</strong> Insurance. Failure to<br />

provide this documentation within 30 days will result in the<br />

inability to enroll your dependents under your <strong>Medical</strong> Plan.<br />

If you have any questions about the dependent<br />

verification policy, contact your local HR/Benefits<br />

Department or HUB International.<br />

Written Verification Required for Dependents:<br />

If you are adding a dependent to your <strong>Medical</strong> Plan you<br />

MUST submit dependent eligibility documentation.<br />

Spouse:<br />

To document a Legal Spousal Relationship, submit a copy of:<br />

Marriage License, and Page 1 of your Federal Income Tax<br />

Return if your filing status is “joint” – or Marriage License,<br />

and if your filing status is “Married Filing Separate” also<br />

submit Page 1 of both Federal Income Tax Returns; and<br />

If you have not been married long enough to file a “joint”<br />

Federal Income Tax Return, please only submit a<br />

photocopy of your marriage license.<br />

Children up to age 26 and disabled children:<br />

Natural Child<br />

A copy of the Certified Birth Certificate showing the<br />

subscriber as the Parent;<br />

Step Child<br />

A copy of the Certified Birth Certificate showing the name<br />

of the natural Parent, and proof that the natural parent<br />

and the subscriber are married (e.g., Marriage License);<br />

Adopted Child<br />

Court documentation verifying completion of Adoption<br />

Proceedings; or<br />

A letter of placement from an Adoption Agency, an<br />

Attorney or the State Department of Social Services,<br />

verifying that adoption is in process;<br />

Foster Child<br />

A Court Order or other legal document placing the Child<br />

with the subscriber, who is a licensed foster parent;<br />

Other Children<br />

For all other children for whom a subscriber has legal<br />

custody, a Court Order or other legal document granting<br />

custody to the subscriber. Documentation must verify that<br />

the subscriber has guardianship responsibility for child, not<br />

merely financial responsibility.<br />

Incapacitated Child<br />

Proof that incapacitation was established at time of<br />

enrollment, and for the appropriate child type<br />

documentation as outlined above based on relationship.<br />

In addition, you should submit a copy of Page 1 of your<br />

Federal Income Tax Return to demonstrate that the child<br />

is principally dependent on you/the subscriber for support<br />

and maintenance. If your incapacitated child is employed,<br />

you may be asked to also submit a copy of Page 1 of his/<br />

her Federal Income Tax Return.<br />

1 <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> 2013 - 2014 Benefits

Benefits and Eligibility<br />

Qualifying Events<br />

Once you have enrolled in benefits, you cannot change your<br />

elections unless you have a “qualifying event”, and you must<br />

submit a change form to your HR/Benefits Department within<br />

30 days of the event. You can obtain a change form from<br />

your HR/Benefits Department or from the enrollment<br />

website, www.enrollme.biz. For newly eligible dependents,<br />

coverage will be effective as of the date of the event, when a<br />

change form is submitted within 30 days.<br />

IMPORTANT NOTE: Newborns are not automatically added<br />

to your policy. You must complete a change form in order to<br />

effectively add them to your coverage.<br />

Change in Family Status affecting covered persons<br />

such as:<br />

Marriage or divorce<br />

Death of a spouse or dependent child<br />

Birth or adoption of a child<br />

Loss of other coverage<br />

Loss of dependent status (if a child reaches the age limit<br />

under the plan or is no longer eligible as a dependent)<br />

Change in your employment status affecting your<br />

benefits such as:<br />

Beginning or returning from a leave of absence<br />

Changing to/from part time<br />

Change in your spouse’s employment status causing<br />

a gain or loss of health coverage for you, your spouse<br />

or your eligible dependents:<br />

Beginning or ending employment<br />

Increasing or decreasing hours<br />

Changes associated with a spouse’s open enrollment<br />

period including changes in the type and cost of<br />

coverage<br />

Gain or loss of eligibility for Medicare/Medicaid for<br />

you, your spouse, or your eligible dependents (Note -<br />

Changes must be made within 60 days)<br />

Paid Time Off (PTO)<br />

Termination of Benefits<br />

Your benefits will terminate on your termination<br />

date.<br />

Continuation of <strong>Medical</strong> Coverage<br />

At Termination of Employment or Ineligibility of a<br />

Dependent:<br />

COBRA (Consolidated Omnibus Budget Reconciliation Act) is<br />

a federal law, which requires that group plans offer covered<br />

employees and dependents the opportunity to continue<br />

health insurance coverage when coverage would normally<br />

end for certain specified reasons. The following provisions<br />

outline the requirements for continued coverage in<br />

accordance with the law:<br />

<br />

<br />

You and your covered dependents may continue<br />

coverage for up to 18 months if coverage ends because<br />

of either a permanent reduction in the number of hours<br />

worked or termination of employment for any reason<br />

other than gross misconduct. You and/or your covered<br />

dependent must apply within 60 days of the date<br />

coverage ends or the date you are notified of your<br />

continuation rights, whichever is later<br />

Your dependents may continue their coverage under the<br />

group plan for up to 36 months if their coverage ends for<br />

any of the following reasons<br />

Divorce from the employee<br />

<br />

<br />

Death of the employee, or<br />

Dependent child reaches the maximum age or<br />

otherwise ceases to qualify as a dependent under<br />

the plan<br />

Coverage would be effective the day after the event.<br />

Paid time off will include between 15 and 25 days based on length of service, up to 10 days of Extended Sick Leave, and 9<br />

paid holidays for all eligible employees (New Year’s Day, Memorial Day, Good Friday or Easter Sunday, 4 th of July, Labor Day,<br />

Thanksgiving Day, Christmas Eve, Christmas Day, and 1 Floating Holiday). Eligible employees are those that work at least 40<br />

hours per bi-weekly pay period. Please refer to the employee manual for more information.<br />

Retirement Plan - Great-West Financial<br />

The Retirement Plan encourages personal savings. <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> will contribute 3% of your pay into a 401k<br />

retirement plan for all eligible employees. An eligible employee is one who works at least 40 hours per bi-weekly pay period.<br />

In addition, employees can receive a matched benefit of 50% if they choose to contribute pre tax dollars from their check.<br />

Employees can contribute up to $17,500 annually ($23,000 if over age 50). The maximum amount the hospital will match will<br />

not exceed 3% of employees compensation. You are eligible to participate after 1 year of service, however if you are<br />

employed on October 1, 2013 you are immediately eligible to participate. You can enroll on the first day of each quarter<br />

(January 1 st , April 1 st , July 1 st and October 1 st ). Gradual vesting applies to the matching contributions. Please refer to the<br />

Summary Plan Description and Enrollment Materials for more information.<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

2

Basic Life & AD&D / EAP / Travel Assistance / <strong>Medical</strong><br />

Employer Paid Basic Life & AD&D<br />

As an employee of <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> you are<br />

provided with a Basic Life & Accidental Death &<br />

Dismemberment (AD&D) policy in the amount of<br />

$25,000 at no cost to you. Mutual of Omaha is the carrier<br />

for this company paid benefit. It provides protection for you in<br />

the event of a disabling injury or death. In addition to this<br />

basic coverage, you have the option to purchase additional life<br />

insurance for yourself and your family members. Your amount<br />

of Basic Life & AD&D insurance will be reduced by 50% at age<br />

70. If you leave the company, you may convert this Basic Life<br />

policy into an individual, whole life policy.<br />

Employee Assistance Program (EAP)<br />

Mutual of Omaha sponsors your Employer Paid Employee<br />

Assistance Program (EAP). This benefit provides free<br />

confidential consultation and resource services to you and<br />

your dependents. Master’s level professionals can provide<br />

assistance for a variety of personal and professional matters<br />

such as: emotional well being, family and relationships, legal<br />

and financial, healthy life styles, and work and life transitions.<br />

Your EAP includes a robust network of licensed and/or<br />

certified mental health professionals. EAP Benefits include:<br />

Unlimited telephonic access to EAP Professionals 24/7<br />

3 face-to-face sessions (per calendar year) with a counselor,<br />

legal, or financial consultant<br />

Legal, financial, mental health, and substance abuse<br />

assistance<br />

Connecting employees with resources for:<br />

Dependent Care Assistance & Referral Services<br />

Elder Care Assistance & Referral Services<br />

Travel Assistance<br />

Travel Assistance through Mutual of Omaha provides access to<br />

support professionals who can help you, your spouse, and<br />

dependents find quality local medical care or provide other<br />

emergency assistance functions in foreign locations. Services<br />

include: Translation/interpreter services, locating legal<br />

services, and assistance with lost, stolen, or delayed baggage.<br />

Summary of Benefits & Coverage (SBC)<br />

In accordance with Patient Protection and Affordable<br />

Care Act (PPACA), BlueCross BlueShield has created a<br />

Summary of Benefits & Coverage (SBC), which<br />

provides additional information about your medical<br />

plan. You can find the SBC online at<br />

www.enrollme.biz, or you may request a copy by<br />

contacting your HR representative.<br />

Health Insurance Options<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> is committed to providing a<br />

comprehensive medical benefits program that will serve to<br />

protect both your physical health as well as your financial well<br />

being. You are offered two plan options through BlueCross<br />

BlueShield (BCBS):<br />

Plan 1 - Preferred Provider Organization (PPO)<br />

The PPO plan provides a network of Louisiana providers.<br />

There are no referrals required to see a specialist. As an<br />

employee of <strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong>, you are encouraged to<br />

utilize <strong>BRF</strong> <strong>Hospital</strong> Holding’s health care providers and will<br />

receive lower out-of-pocket amounts by doing so. You may<br />

also choose to use BCBS’s In-Network and Out-of-Network<br />

providers, however, you will be subject to a higher copay and<br />

deductible for services rendered.<br />

Plan 2 - High Deductible Health Plan (HDHP)<br />

This plan starts once you satisfy your deductible. You must<br />

pay the deductible, $5,500 (individual), out-of-pocket before<br />

your plan begins covering your care. HDHPs will cover<br />

preventive services before you meet your deductible and<br />

without having to pay a copay or coinsurance. Keep in mind<br />

that this applies to services provided by In-Network providers.<br />

Case Management<br />

Case management is a special service of BCBS and ensures<br />

your care is appropriate. The program assesses, plans, assists,<br />

and backs options and services to meet an individual’s health<br />

needs.<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong> will be assigned a Specific Case<br />

Manager and all employees on the <strong>Medical</strong> Plans MUST<br />

participate to achieve the most efficient and effective use of<br />

medical resources.<br />

Waive <strong>Medical</strong> Insurance<br />

Note: If you elect not to participate in <strong>BRF</strong> <strong>Hospital</strong><br />

<strong>Holdings</strong> medical plans, you will need to go online and<br />

enter your electronic signature ‘pin’ indicating you are<br />

waiving health coverage. You will be prompted for<br />

your pin on the Confirmation Page. If the reason for your<br />

waiver of this coverage on you and your dependents<br />

(including your spouse) is because of other health coverage,<br />

you may be able to enroll yourself or your dependents in this<br />

plan at a later date if such other coverage ends. You must<br />

request enrollment within thirty (30) days after your other<br />

coverage ends.<br />

3<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

<strong>Medical</strong> - BlueCross BlueShield<br />

Feature<br />

Annual Deductible 1<br />

(Individual/Family 2 )<br />

<strong>BRF</strong>HH Provider<br />

PPO<br />

BCBS<br />

HDHP<br />

BCBS - Bronze<br />

In-Network Out-of-Network In-Network Out-of-Network<br />

$0 $500 / $1,500 $2,500 / $7,500 $5,500 / $16,500 $11,000 / $33,000<br />

Coinsurance Percentage 100% 85% 40% 80% 40%<br />

Annual Out-of-Pocket Maximum 1<br />

(Individual/Family 2 )<br />

$1,000 / $3,000 $4,000 / $12,000<br />

Unlimited /<br />

Unlimited<br />

$6,250 / $18,750<br />

(Inc ded)<br />

Unlimited / Unlimited<br />

Preventive Care 100% 100% 40% after ded 100% 40% after ded<br />

Office Copays / Coinsurance<br />

Primary Care Physician<br />

Specialist<br />

High Tech Imaging (MRI, CAT<br />

Scan, PET)<br />

Office Diagnostic Lab & X-Ray<br />

$10<br />

$20<br />

$20<br />

$40<br />

40% after ded<br />

40% after ded<br />

80% after ded<br />

80% after ded<br />

40% after ded<br />

40% after ded<br />

$25 $200 40% after ded 80% after ded 40% after ded<br />

Included in Office<br />

Visit Copay<br />

Included in Office<br />

Visit Copay<br />

Outpatient Diagnostic Lab & X-Ray 100% 85% 40% after ded<br />

40% after ded 80% after ded 40% after ded<br />

Urgent Care N/A $75 per visit 40% after ded 80% after ded 40% after ded<br />

<strong>Hospital</strong> Services<br />

Inpatient <strong>Hospital</strong> Service<br />

(requires preauthorization)<br />

$250 per admit $600 per admit<br />

40% after $2,500<br />

Copay + ded<br />

80% after ded 40% after ded<br />

Outpatient <strong>Hospital</strong> Services $100 per visit $250 per visit 40% after ded 80% after ded 40% after ded<br />

Emergency Room<br />

(True Emergency/Non-Emergency)<br />

$50 / $100<br />

per visit<br />

$150 / $250<br />

per visit<br />

80% after ded 40% after ded<br />

Rehab Services $10 $30 40% after ded 80% after ded 40% after ded<br />

<strong>Home</strong> Health - 100 visits per year<br />

(requires preauthorization)<br />

Mental Health<br />

Inpatient Office Visits<br />

N/A $40 40% after ded 80% after ded 40% after ded<br />

$50 per day up to<br />

$250 per admit<br />

$100 per day up to<br />

$600 per admit<br />

40% after ded 80% after ded 40% after ded<br />

Outpatient Office Visits $10 $20 40% after ded 80% after ded 40% after ded<br />

Pharmacy - Caremark<br />

RX Deductible 1<br />

$150 (Brand Only)<br />

Generic $10 (No deductible) 80% after ded 40% after ded<br />

Brand<br />

$30 Preferred / $60 Non-preferred / $120 Specialty<br />

after deductible<br />

80% after ded 40% after ded<br />

1<br />

Deductible and Out-of-Pocket Maximum - Based on Calendar Year. For the remainder of 2013 you will only be responsible for 25% of the amounts shown above.<br />

2<br />

Family Deductible and Out-of-Pocket Maximum - No one covered member is required to pay more than the Individual amount<br />

<strong>BRF</strong> <strong>Hospital</strong> Holding’s Monthly Contribution to your <strong>Medical</strong> Plan<br />

<strong>Medical</strong> Employee Only Employee & Spouse Employee & Children<br />

(up to age 26)<br />

Employee & Family<br />

PPO $452.46 $606.55 $620.94 $914.48<br />

HDHP $336.72 $422.08 $444.66 $660.14<br />

Employee Bi-Weekly <strong>Medical</strong> Deduction<br />

<strong>Medical</strong> Employee Only Employee & Spouse Employee & Children<br />

(up to age 26)<br />

Employee & Family<br />

PPO $46.15 $196.15 $138.46 $276.92<br />

HDHP $23.08 $138.46 $92.31 $184.62<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

4

Dental - AlwaysCare<br />

Basic Plan Enhanced Plan<br />

Benefit Year<br />

Maximum<br />

$1,500 per calendar year for Type 1, 2, 3 $2,000 per calendar year for Type 1,2, 3<br />

Plan Year<br />

Deductible<br />

No deductible for Preventive Services<br />

One time $100 Lifetime applies to Basic and Major Services.<br />

Deductible amount applies separately to each covered person<br />

No deductible<br />

Carryover Benefit<br />

Members who take care of their teeth, but use only part of their annual maximum benefit during a benefit period are rewarded with<br />

extra benefits in future years. If an insured submits qualifying claims for covered expenses during a benefit year and, in that benefit<br />

year, receives benefits that are less than their group’s Threshold Limit, the insured will be credited a Carryover Benefit. Carryover<br />

Benefits will be accrued and stored in the Insured’s Carryover Account to be used in the next benefit year. If an insured reaches his<br />

or her Certificate Year Maximum Benefit, a benefit from the Insured’s Carryover Account will be paid up to the amount stored in the<br />

Insured’s Carryover account. The accrued Carryover Benefits stored in the Carryover Account may not be greater than the<br />

Carryover Account Limit.<br />

Coinsurance<br />

Type 1<br />

Type 2<br />

Type 3<br />

Type 4<br />

Type 1 /<br />

Preventive<br />

Services<br />

Type 2 / Basic<br />

Services<br />

Type 3 / Major<br />

Services<br />

Type 4 /<br />

Orthodontics<br />

Carryover Benefit $350, Threshold Limit $700, Carryover Account<br />

Limit $1,250<br />

In-Network and Out-of-Network<br />

100% of usual and customary fees<br />

100% of scheduled fees<br />

100% of scheduled fees<br />

N/A<br />

Waiting Period: None<br />

· Routine exams (2 per 12 mos.)<br />

· Prophylaxis (2 per 12 mos.)<br />

· Bitewing x-rays (max 4 films; 1 per 12 mos.)<br />

· Full mouth x-ray (1 per 24 mos.)<br />

· Space maintainers to age 16 (1 per 24 mos.)<br />

· Fluoride to age 16 (1 per 12 mos.)<br />

· Sealants to age 16 (permanent molars, 1 per 36 mos.)<br />

· Adjunctive pre-diagnostic oral cancer screening (max 1 per 12<br />

mo for age 40+)<br />

Waiting Period: None<br />

· Emergency Pain (1 per 12 mos.)<br />

· Fillings<br />

· Anesthesia (subject to review, covered with complex oral<br />

surgery)<br />

· Simple extractions<br />

· Non-Surgical Periodontics<br />

· Oral surgery (surgical extractions & impactions)<br />

· Crown, denture, bridge repair<br />

· Full mouth x-ray (1 per 24 mos.)<br />

Waiting Period: None<br />

· Simple Periodontics<br />

· Endodontics (root canals)<br />

· Surgical Periodontics (gum treatments)<br />

· Inlays and Onlays<br />

· Crowns, Bridges, Dentures, and Endosteal Implants<br />

N/A<br />

Carryover Benefit $400, Threshold Limit $800, Carryover<br />

Account Limit $1,500<br />

In-Network - Negotiated Discount Fees (no balance billing) /<br />

Out-of-Network - usual and customary<br />

100%<br />

80%<br />

50%<br />

50%<br />

Waiting Period: None<br />

· Routine exams (2 per 12 mos.)<br />

· Prophylaxis (2 per 12 mos.)<br />

· Bitewing x-rays (max 4 films; 1 per 12 mos.)<br />

· Full mouth x-ray (1 per 24 mos.)<br />

· Emergency Pain (1 per12 mos.)<br />

· Space maintainers to age 16 (1 per 24 mos.)<br />

· Fluoride to age 16 (1 per 12 mos.)<br />

· Sealants to age 16 (permanent molars, 1 per 36 mos.)<br />

· Adjunctive pre-diagnostic oral cancer screening (max 1 per 12<br />

mo for age 40+)<br />

Waiting Period: None<br />

· Fillings<br />

· Anesthesia (subject to review, covered with complex oral<br />

surgery)<br />

· Simple extractions<br />

· Non-Surgical Periodontics<br />

· Oral Surgery (surgical extractions & impactions)<br />

· Endodontics (root canals)<br />

· Crown, denture, bridge repairs<br />

Waiting Period: None<br />

· Inlays and Onlays<br />

· Crowns, Bridges, Dentures, and Endosteal Implants<br />

· Surgical Periodontics (gum treatments)<br />

Waiting Period: None<br />

· Separate Lifetime maximum: $1500<br />

· Dependent children to age 19 only<br />

Dental Employee Only Employee & Spouse<br />

Employee & Children<br />

(up to age 26)<br />

Employee & Family<br />

Basic Bi-Weekly Deduction $8.39 $15.77 $21.80 $29.17<br />

Enhanced Bi-Weekly Deduction $13.31 $26.03 $31.64 $44.37<br />

5<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

Vision - AlwaysCare<br />

EXAM covered every 12 months<br />

<br />

<br />

Prescription Glasses<br />

Standard Plastic Lenses covered every 12 months<br />

Frames - once every 12 months<br />

<br />

<br />

Once every 12 months<br />

Contact Lenses<br />

Includes evaluation, fitting, and follow-up care<br />

Vision Care Services In-Network Out-of-Network Allowance<br />

Exam $10 Copay Up to $35<br />

Materials<br />

Standard Plastic Lenses:<br />

Single Vision<br />

Bifocal Lined<br />

Trifocal Lined<br />

Lenticular<br />

Progressive<br />

$0 Copay<br />

Covered<br />

Covered<br />

Covered<br />

$80 Allowance<br />

$70 Allowance<br />

Up to $25<br />

Up to $40<br />

Up to $50<br />

Up to $50<br />

Up to $50<br />

Lens Options:<br />

Scratch resistant coating<br />

Solid / Gradient tint<br />

UV Coating<br />

Frames:<br />

Members choose from any<br />

frame available at provider<br />

locations<br />

Covered<br />

Covered<br />

Covered<br />

$130 Retail Allowance<br />

($94 retail frame at Costco, WalMart, and<br />

Sam’s Club)<br />

N/A<br />

N/A<br />

N/A<br />

Up to $50 retail allowance<br />

Contact Lenses: Includes evaluation, fitting,<br />

and follow up care<br />

Elective<br />

<strong>Medical</strong>ly Necessary<br />

No Copay<br />

Up to $130 Retail<br />

Covered in full<br />

Up to $100 retail<br />

Up to $210 retail<br />

Vision Employee Only Employee & Spouse<br />

Employee & Children<br />

(14 days up to age 26)<br />

Employee & Family<br />

Bi-Weekly Deduction $3.54 $5.95 $6.08 $9.80<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

6

Voluntary Life & AD&D - Mutual Of Omaha<br />

Life Benefit Employee Spouse Dependent<br />

Amount<br />

Increments of $10,000 up to 7 times<br />

annual salary or $300,000<br />

Increments of $10,000 up to $100,000<br />

$10,000 for children 14 days old up to age 26<br />

Age Reduction: Benefit will be reduced<br />

by 50% at age 70 and will terminate at<br />

retirement<br />

Employee must elect coverage for<br />

spouse to be eligible. Benefit not to<br />

exceed 100% of employees elected<br />

amount, benefit will terminate at<br />

employee age 70<br />

Employee must elect coverage for child(ren)<br />

to be eligible. Newborn children to age 13<br />

days are not eligible for a benefit.<br />

Guarantee Issue<br />

$300,000<br />

$100,000<br />

$10,000<br />

Eligibility<br />

Accidental Death &<br />

Dismemberment<br />

Living Care Benefit<br />

Guarantee Issue<br />

Portability<br />

Conversion<br />

You must be actively at work (able to perform all normal duties of your job) to be eligible for this benefit. Your spouse must be<br />

able to perform normal activities and not confined at home, in a hospital, or in any other care facility<br />

AD&D coverage is available if you or your dependents are injured or die as a result of an accident, and the injury or death is<br />

independent of sickness and all other causes. The benefit amount depends on the type of loss incurred, and is either all or a<br />

portion of the Principal Sum, which is equal to the amount of the life insurance benefit.<br />

When diagnosed as terminally ill (having 12 months or less to live), you may withdraw up to 80% of your life insurance coverage<br />

to a maximum of $240,000. The death benefit will be reduced by the amount withdrawn.<br />

For timely entrants enrolled within 31 days of becoming eligible, the Guarantee Issue amount is available without any Evidence of<br />

Insurability requirement. For late enrollees, Evidence of Insurability will be required for any amount and it will be provided at your<br />

own expense.<br />

When you are no longer an eligible employee, you will have 31 days to port coverage. This feature allows you to continue this<br />

insurance for yourself and your dependents (if applicable), allowing you to keep the coverage until you are 70.<br />

When you are no longer an eligible employee, you will have 31 days to convert coverage. This takes the term life policy to an<br />

individual life insurance policy.<br />

Waiver of Premium If you become totally and permanently disabled prior to age 60, your life insurance will continue in force without further payment<br />

of premium on a year-to-year basis. You must be totally disabled for 9 months in order to qualify, and waiver terms at age 65.<br />

*Subject to periodic submission of evidence of total and permanent disability.<br />

Voluntary Life & AD&D Insurance Bi-Weekly Deduction<br />

Spouse age is based on Employee age<br />

Age $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 $100,000 $200,000 $300,000<br />

0-19 $0.31 $0.63 $0.94 $1.26 $1.57 $1.88 $2.20 $2.51 $2.82 $3.14 $6.28 $9.42<br />

20-24 $0.44 $0.88 $1.32 $1.75 $2.19 $2.63 $3.07 $3.51 $3.95 $4.38 $8.77 $13.15<br />

25-29 $0.44 $0.88 $1.32 $1.75 $2.19 $2.63 $3.07 $3.51 $3.95 $4.38 $8.77 $13.15<br />

30 - 34 $0.44 $0.88 $1.32 $1.75 $2.19 $2.63 $3.07 $3.51 $3.95 $4.38 $8.77 $13.15<br />

35 - 39 $0.52 $1.03 $1.55 $2.07 $2.58 $3.10 $3.62 $4.14 $4.65 $5.17 $10.34 $15.51<br />

40 - 44 $0.70 $1.40 $2.10 $2.81 $3.51 $4.21 $4.91 $5.61 $6.31 $7.02 $14.03 $21.05<br />

45 - 49 $1.01 $2.01 $3.02 $4.02 $5.03 $6.04 $7.04 $8.05 $9.06 $10.06 $20.12 $30.18<br />

50 - 54 $1.55 $3.09 $4.64 $6.18 $7.73 $9.28 $10.82 $12.37 $13.92 $15.46 $30.92 $46.38<br />

55 - 59 $2.43 $4.86 $7.30 $9.73 $12.16 $14.59 $17.03 $19.46 $21.89 $24.32 $48.65 $72.97<br />

60 - 64 $3.68 $7.36 $11.04 $14.71 $18.39 $22.07 $25.75 $29.43 $33.11 $36.78 $73.57 $110.35<br />

65 - 69 $6.17 $12.34 $18.51 $24.68 $30.85 $37.02 $43.20 $49.37 $55.54 $61.71 $123.42 $185.12<br />

Age $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 $100,000 $150,000<br />

70 -74 $5.82 $11.63 $14.45 $23.26 $29.08 $34.89 $40.71 $46.52 $52.34 $58.15 $116.31 $174.46<br />

75-99 $10.94 $21.88 $32.82 $43.76 $54.70 $65.64 $76.59 $87.53 $98.47 $109.41 $218.82 $328.22<br />

Voluntary Life & AD&D Insurance Bi-Weekly Deduction for Children<br />

Age $10,000<br />

14 days up to 26 years $1.06<br />

7<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

Short Term Disability - Mutual of Omaha<br />

Income Protection<br />

Insurance<br />

Eligibility<br />

Maximum Weekly Benefit<br />

Waiver of Premium<br />

Pays a benefit for a disability resulting from a covered injury or sickness. Benefits begin on the 8th day (after a 7<br />

day waiting period) for both injury and sickness, and continue while you are disabled up to the maximum benefit<br />

duration of 12 weeks.<br />

You must be actively at work (able to perform all normal duties of your job) to be eligible for coverage.<br />

You have the option to elect either 40% or 60% of your weekly covered earnings to $1,500. The minimum benefit<br />

amount is $25.<br />

Beginning on the first of the month following the date of disability, you will not be required to pay premiums during<br />

any time of approved total or partial disability.<br />

Disability<br />

Partial Disability<br />

Continuation of Disability<br />

Pre-Existing Condition<br />

Benefit Exclusions<br />

Portability<br />

Disability and disabled mean that because of an injury or illness, a significant change in your mental or functional<br />

abilities has occurred, for which you are prevented from performing at least one of the material duties of your<br />

regular job and are unable to generate current earnings which exceed 99% of your weekly earnings from your<br />

regular job. You can be totally or partially disabled during the elimination period.<br />

If you become disabled and can work part time (but not full time), you may be eligible for partial disability benefits,<br />

which will help supplement your income until you are able to return to work full time.<br />

If you return to work full time but become disabled from the same disability within two weeks of returning to work,<br />

you will begin receiving benefits again immediately.<br />

Any sickness or injury for which you have received medical treatment, consultation, care or services (including<br />

diagnostic measures or took prescribed medications) during the three (3) months prior to the coverage effective<br />

date. Benefits will not be paid for a disability caused by, contributed to by or resulting from a pre-existing condition<br />

unless the insured has been actively at work for one (1) full day following the end of six (6) consecutive months<br />

from the date he/she became an Insured.<br />

You will not receive benefits in the following circumstances:<br />

Your disability is the result of a self-inflicted injury<br />

An act of war, declared or undeclared<br />

Your disability is the result of committing a felony<br />

Your disability is covered under a worker’s compensation plan and/or is due to a job-related sickness or injury<br />

which occurs out of or in the course of work for wage or profit<br />

When you are no longer an eligible employee, you will have 31 days to port coverage. This will allow you to keep<br />

the coverage up to age 70.<br />

Your benefit is based on your Salary. Calculate your Bi-Weekly deduction using<br />

the following examples (This example assumes a 40 hour work week):<br />

40% of your Salary 60% of your Salary<br />

Hourly Pay Rate 20.00 20.00<br />

Times 40 - weekly payroll 800.00 800.00<br />

Times 40% / 60% - weekly benefit 320.00 480.00<br />

Times .060 19.20 28.80<br />

Times 12 / by 26 to get your<br />

Bi-Weekly Deduction<br />

$8.86 $13.29<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

8

Long Term Disability - Mutual of Omaha<br />

Eligibility<br />

Maximum Monthly Benefit<br />

Maximum Benefit Duration<br />

Elimination Period<br />

Waiver of Premium<br />

Survivor Income Benefit<br />

You must be actively at work (able to perform all normal duties of your job) to be eligible for coverage.<br />

You have the option to elect either 40% or 60% of your monthly covered earnings to a maximum of $12,000 per<br />

month. The minimum benefit is $100.<br />

Benefits continue to normal social security retirement age while you remain disabled.<br />

90 days - The number of days you must be disabled prior to collecting disability benefits.<br />

You will not be required to pay premiums during any time of approved total or partial disability.<br />

A 3 months survivor benefit may be paid to your beneficiary if you should die while receiving qualifying disability<br />

payments.<br />

Disability<br />

Partial Disability<br />

Continuation of Disability<br />

Pre-Existing Condition<br />

Benefit Exclusions<br />

Benefit Reductions<br />

Benefit Termination<br />

Portability<br />

Disability and disabled mean that because of an injury or illness, a significant change in your mental or functional<br />

abilities has occurred, for which you are prevented from performing at least one of the material duties of your regular<br />

job and are unable to generate current earnings which exceed 99% of your weekly earnings from your regular job.<br />

You can be totally or partially disabled during the elimination period.<br />

If you become disabled and can work part time (but not full time), you may be eligible for partial disability benefits,<br />

which will help supplement your income until you are able to return to work full time.<br />

If you return to work full time but become disabled from the same disability within six months of returning to work,<br />

you will begin receiving benefits again immediately.<br />

Any sickness or injury for which you have received medical treatment, consultation, care or services (including<br />

diagnostic measures or the taking of prescribed medications) during the 3 months prior to the coverage effective date.<br />

A disability arising from any such sickness or injury will be covered only if it begins after you have performed your<br />

regular occupation on a full time basis for 12 months following the coverage effective date.<br />

You will not receive benefits in the following circumstances:<br />

Your disability is the result of a self-inflicted injury<br />

You were involved in a felony commission, act of war or participation in a riot<br />

* See certificate for full list of exclusions<br />

Your benefits may be reduced if you are receiving benefits from any of the following sources:<br />

Any compulsory benefit act or law (such as state disability plans)<br />

Any governmental retirement system earned as a result of working for the current policyholder<br />

Any disability or retirement benefit received under a retirement plan<br />

Any Social Security, or similar plan or act, benefits<br />

Earnings the insured earns or receives from any form of employment<br />

Workers compensation<br />

<br />

This coverage will terminate when you terminate employment with this policyholder or at your retirement.<br />

When you are no longer an eligible employee, you will have 31 days to port coverage, allowing you to continue this<br />

insurance until you are 70.<br />

Your benefit is based on your Salary. Calculate your Bi-Weekly deduction using the<br />

following examples (This example assumes a 40 hour work week):<br />

40% of your Salary 60% of your Salary<br />

Hourly Pay Rate 20.00 20.00<br />

Times 40 - weekly payroll 800.00 800.00<br />

Times 52 / 12 3,466.67 3,466.67<br />

Times 40% / 60% - monthly benefit 1,386.67 2,080.00<br />

Times .0136 18.86 28.29<br />

Times 12 / 26 to get your<br />

Bi-Weekly Deduction<br />

$8.70 $13.06<br />

9<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

Critical Illness - HM Life<br />

Covered Critical Illnesses <br />

Covered<br />

Critical Illness<br />

Myocardial Infarction (Heart<br />

Attack)<br />

Percentage of<br />

Face amount<br />

Covered<br />

Critical Illness<br />

100% + Major Organ Transplant 100%<br />

Percentage of<br />

Face amount<br />

Coronary Artery Bypass 25% * End-stage Renal Disease<br />

(Kidney Disease)<br />

Stroke 100% Loss of Sight, Speech or<br />

Hearing<br />

100%<br />

100% *<br />

Invasive Cancer 100% + Coma 100% *<br />

Carcinoma in Situ 25 % * Paralysis 100% *<br />

Skin Cancer 10% *<br />

+ Benefits paid for Carcinoma in Situ, Skin Cancer and Coronary Artery Bypass Surgery, reduce the benefit payable for<br />

subsequently diagnosed Invasive Cancer and Heart Attack, respectively.<br />

* Payable once per lifetime. Minimum benefit is $250.<br />

Plan Type & Age<br />

Guidelines<br />

Benefit Options<br />

Guarantee Issue Amount<br />

Healthy Screening<br />

Coverage<br />

Pays a lump sum for<br />

three types of<br />

diagnoses – initial,<br />

reoccurrence and<br />

additional covered<br />

occurrences<br />

Employee and Spouse may be covered from ages 18 to 69 years, benefits reduce by 50% at 70<br />

Children up to age 26<br />

Employee - $2,500 up to $100,000; Spouse – Up to 100% of employee amount to a max of $100,000; Children<br />

automatically get 25% of employee amount up to $20,000 at no additional cost<br />

Employee - $25,000; Spouse - 50% of employee amount<br />

$50 - One per covered individual per year. Benefit paid regardless of diagnosis or results of the test.<br />

First Occurrence – provides a lump sum payment when a covered critical illness is first diagnosed<br />

Reoccurrence – pays when a covered critical illness reoccurs. The reoccurrence must be separated from the initial<br />

diagnosis by at least 180 days (365 days treatment - free for cancer) or separated from another reoccurrence by at least<br />

180 days (365 days treatment - free for cancer)<br />

Additional Occurrence – pays an additional benefit upon the diagnosis of a covered condition for which benefits<br />

previously have not been paid. The diagnosis must be separated from the other critical illness by at least 180 days<br />

Continuation of Coverage Employees continuously insured for at least 12 consecutive months under this plan or a prior plan may have the<br />

opportunity to continue their coverage.<br />

Pre-Existing Condition<br />

Limitation<br />

Issue Age<br />

No benefits will be provided for the first 12 months a person is covered under the policy for conditions for which medical<br />

advice or treatment was received or recommended during the 12 month period prior to the effective date of coverage.<br />

If elected, your Critical Illness deductions will not change from year to year; your deductions will remain the same<br />

throughout the life of your policy.<br />

Employee<br />

Issue Age<br />

Critical Illness Benefit Amounts & Bi-Weekly Deduction<br />

$2,500 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $50,000 $75,000 $100,000<br />

18 - 24 $0.47 $0.70 $1.18 $1.65 $2.13 $2.60 $3.07 $4.97 $7.34 $9.55<br />

25 - 29 $0.69 $1.06 $1.80 $2.54 $3.28 $4.02 $4.76 $7.71 $11.40 $14.93<br />

30 - 34 $1.03 $1.61 $2.77 $3.93 $5.09 $6.25 $7.41 $12.05 $17.84 $23.47<br />

35 - 39 $1.58 $2.54 $4.44 $6.35 $8.26 $10.17 $12.07 $19.70 $29.24 $38.61<br />

40 - 44 $2.42 $3.98 $7.08 $10.18 $13.28 $16.39 $19.49 $31.90 $47.41 $62.76<br />

45 - 49 $3.59 $5.99 $10.79 $15.58 $20.38 $25.17 $29.97 $49.15 $73.13 $96.94<br />

50 - 54 $5.17 $8.74 $15.88 $23.03 $30.17 $37.32 $44.46 $73.04 $108.77 $144.32<br />

55 - 59 $6.94 $11.92 $21.89 $31.86 $41.83 $51.80 $61.77 $101.65 $151.49 $201.17<br />

60 - 64 $8.67 $15.09 $27.93 $40.77 $53.61 $66.45 $79.30 $130.66 $194.88 $258.92<br />

65 - 69 $9.20 $16.20 $30.21 $44.21 $58.22 $72.22 $86.23 $142.25 $212.28 $282.15<br />

Guarantee Issue - Employee Only<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

10

Flexible Spending Account - Boon-Chapman<br />

Flexible Spending Account (FSA)<br />

This benefit provides you with the opportunity to set aside<br />

tax-exempt dollars for out-of-pocket health care or<br />

dependent care expenses incurred by you and/or your<br />

eligible dependents. The deduction is made before taxes<br />

are computed, thus making the spending account dollars<br />

tax-free. FSA contributions are “use it or lose it” and<br />

balances do not roll over from year to year.<br />

You will have two different FSA policy years, the<br />

first will begin October 1, 2013 and will end<br />

December 31, 2013. The second FSA policy year will<br />

begin January 1, 2014 and will end December 31,<br />

2014.<br />

You must determine the amount to be deducted from each<br />

paycheck, and you will be provided with a Debit Card. Your<br />

Health Care election will be pre-loaded with this amount for<br />

your use throughout the 2013 Plan Year. The dependent<br />

Care election is not preloaded and is only available as the<br />

funds are payroll deducted. Determine the amount to be<br />

withheld by forecasting your out-of-pocket health care and/<br />

or dependent care expenses for the entire Plan year, plus<br />

the grace period (January 1 st through March 15 th ). To<br />

access the money in your account, you can either use your<br />

FSA Debit Card at the time of service, or you can file a<br />

claim form to request reimbursement. This form is available<br />

in your HR / Benefits Department or you can find it on the<br />

website www.enrollme.biz.<br />

Qualifications and Eligible Expenses:<br />

Many health care expenses, such as Copayments and<br />

deductibles, are not fully reimbursed by health, dental, or<br />

vision insurance and may be eligible for reimbursement<br />

through a Health Care FSA. For a detailed list of health care<br />

expenses that may qualify for reimbursement under the<br />

Health Care Spending Account, visit the website<br />

www.boonchapman.com.<br />

Dependent Care FSA<br />

Qualifications:<br />

You may receive tax-exempt reimbursements for the care<br />

of certain individuals in your household, which includes your<br />

dependent children age 12 or younger and any other<br />

individuals who reside with you and who rely on you for at<br />

least half of their support or are physically or mentally<br />

unable to care for themselves.<br />

Eligible Expenses:<br />

Daycare expenses are defined as those that are necessary<br />

in order for you (and your spouse, if you’re married) to<br />

continue working. You are required to report on your<br />

annual federal income tax return the name(s) of those<br />

providers of dependent care expenses whose expenses<br />

have been reimbursed to you through your Dependent Care<br />

Account.<br />

Eligible Dependent Care Account expenses include:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Day-care costs for children 12 and under.<br />

Schooling costs, not including food and clothing, for<br />

either private or public schools, for children not yet in<br />

kindergarten.<br />

If expenses for food and clothing cannot be separated<br />

from the total cost of child care, then they are eligible<br />

expenses.<br />

If your child is 12 years or younger and you pay for<br />

before/after-school care, it is reimbursable<br />

Babysitting and licensed day-care center costs<br />

Minimal housekeeping services in your home as long as<br />

day care is the primary duty<br />

Elder care if dependent is claimed on your tax return<br />

Costs of transportation, overnight camping, nursing care<br />

facilities, and the schooling costs of children in the first<br />

grade or above are generally ineligible expenses.<br />

Health Care FSA Contributions<br />

Minimum per year $150<br />

Maximum per year $2,500<br />

Dependent Care FSA Contributions<br />

Minimum per year $150<br />

Maximum per year $5,000 per household<br />

11<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits

Online Enrollment Instructions<br />

The Benefit Administration Systems website is home to all of the tools and resources you will need during Annual<br />

Enrollment and throughout the year. It is also where you will enroll in your benefits. See below for a list of detailed<br />

instructions that will navigate you through the enrollment process with ease.<br />

Log On<br />

Using any computer with Internet access, go to<br />

www.enrollme.biz<br />

Enter your user name and password:<br />

Employee Username – Your Social Security<br />

Number (no dashes)<br />

Password – Last 4 digits of your Social Security<br />

Number<br />

You will change your password on the next screen -<br />

Re-enter the last 4 digits of your Social Security<br />

Number as the previous password, enter a new one<br />

that is at least 5 characters, then re-enter the new<br />

password<br />

Click ‘Enroll In Benefits’ to proceed to your benefits<br />

Employee / Dependent Information<br />

<br />

<br />

<br />

<br />

From the menu on the left, click:<br />

Employee Info – Verify your information on this page<br />

and make necessary changes to address, phone<br />

number, and/or email address<br />

Dependent Info – Add or make changes to Dependent<br />

information on this screen<br />

Enter dependent information BEFORE selecting<br />

your benefits<br />

SSN, DOB, and Address are required for<br />

each dependent<br />

*Note: Specific documentation required -<br />

See page 1 if enrolling dependents in<br />

<strong>Medical</strong> coverage<br />

Beneficiary info – Add or make changes to beneficiary<br />

information on this screen. Since the company<br />

provides a Basic Life policy all employees need to<br />

provide this information<br />

Electing Benefits<br />

<br />

<br />

<br />

Click on each of the benefits from the left menu. On<br />

the right, you will have the option to attain more<br />

information and elect that benefit<br />

If you are interested in the benefit, check the ‘I elect<br />

coverage for this benefit’ box, and select the<br />

dependents you wish to cover under that benefit<br />

You may also use the left and right arrow keys to<br />

scroll through each benefit<br />

Confirm<br />

<br />

<br />

<br />

<br />

<br />

Once you’ve made your choices, from the menu on<br />

the left, click Confirmation<br />

Verify the elections are what you want<br />

Check the ’I Accept’ Box, enter your NEW password,<br />

and click the blue ‘I Accept’ button<br />

Wait for a message to appear telling you that you<br />

have successfully enrolled in benefits<br />

Print a confirmation of your enrollment or enter your<br />

email address at the top of the screen to have a copy<br />

of your confirmation page emailed directly to you<br />

If you have any questions regarding the online<br />

enrollment or if you do not have access to a<br />

computer and are unable to enroll online, please<br />

contact HUB International at 318-629-8769 or<br />

877-309-2224, or you can contact HUB by email at<br />

<strong>BRF</strong>HH@hubinternational.com.<br />

Note: You MUST go to the online enrollment<br />

website whether enrolling in benefits or not<br />

to:<br />

1) Enter beneficiaries for your Basic Life Policy<br />

2) Decline <strong>Medical</strong> coverage by electronically<br />

signing with your Pin number<br />

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

2013 - 2014 Benefits<br />

12

<strong>BRF</strong> <strong>Hospital</strong> <strong>Holdings</strong><br />

Benefit Guide 2013 - 2014<br />

8/19/13