IRFC Cover - ENGLISH - Indian Railway Finance Corporation Ltd.

IRFC Cover - ENGLISH - Indian Railway Finance Corporation Ltd.

IRFC Cover - ENGLISH - Indian Railway Finance Corporation Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Schedule "16" (Contd.)<br />

Significant Accounting Policies and Notes on Accounts<br />

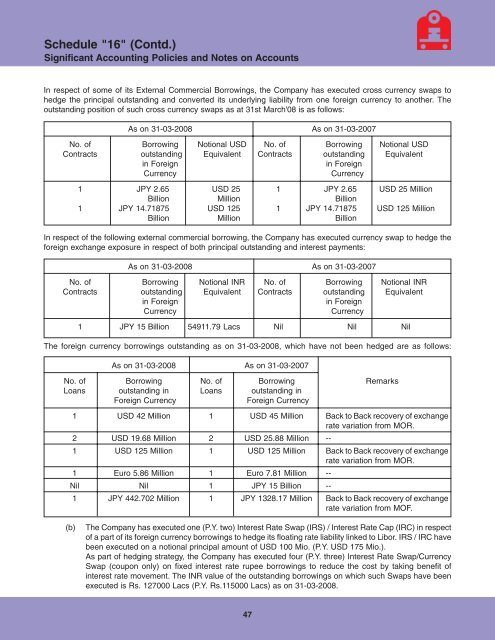

In respect of some of its External Commercial Borrowings, the Company has executed cross currency swaps to<br />

hedge the principal outstanding and converted its underlying liability from one foreign currency to another. The<br />

outstanding position of such cross currency swaps as at 31st March'08 is as follows:<br />

As on 31-03-2008 As on 31-03-2007<br />

No. of Borrowing Notional USD No. of Borrowing Notional USD<br />

Contracts outstanding Equivalent Contracts outstanding Equivalent<br />

in Foreign<br />

in Foreign<br />

Currency Currency<br />

1 JPY 2.65 USD 25 1 JPY 2.65 USD 25 Million<br />

Billion Million Billion<br />

1 JPY 14.71875 USD 125 1 JPY 14.71875 USD 125 Million<br />

Billion Million Billion<br />

In respect of the following external commercial borrowing, the Company has executed currency swap to hedge the<br />

foreign exchange exposure in respect of both principal outstanding and interest payments:<br />

As on 31-03-2008 As on 31-03-2007<br />

No. of Borrowing Notional INR No. of Borrowing Notional INR<br />

Contracts outstanding Equivalent Contracts outstanding Equivalent<br />

in Foreign<br />

in Foreign<br />

Currency Currency<br />

1 JPY 15 Billion 54911.79 Lacs Nil Nil Nil<br />

The foreign currency borrowings outstanding as on 31-03-2008, which have not been hedged are as follows:<br />

As on 31-03-2008 As on 31-03-2007<br />

No. of Borrowing No. of Borrowing Remarks<br />

Loans outstanding in Loans outstanding in<br />

Foreign Currency Foreign Currency<br />

1 USD 42 Million 1 USD 45 Million Back to Back recovery of exchange<br />

rate variation from MOR.<br />

2 USD 19.68 Million 2 USD 25.88 Million --<br />

1 USD 125 Million 1 USD 125 Million Back to Back recovery of exchange<br />

rate variation from MOR.<br />

1 Euro 5.86 Million 1 Euro 7.81 Million --<br />

Nil Nil 1 JPY 15 Billion --<br />

1 JPY 442.702 Million 1 JPY 1328.17 Million Back to Back recovery of exchange<br />

rate variation from MOF.<br />

(b)<br />

The Company has executed one (P.Y. two) Interest Rate Swap (IRS) / Interest Rate Cap (IRC) in respect<br />

of a part of its foreign currency borrowings to hedge its floating rate liability linked to Libor. IRS / IRC have<br />

been executed on a notional principal amount of USD 100 Mio. (P.Y. USD 175 Mio.).<br />

As part of hedging strategy, the Company has executed four (P.Y. three) Interest Rate Swap/Currency<br />

Swap (coupon only) on fixed interest rate rupee borrowings to reduce the cost by taking benefit of<br />

interest rate movement. The INR value of the outstanding borrowings on which such Swaps have been<br />

executed is Rs. 127000 Lacs (P.Y. Rs.115000 Lacs) as on 31-03-2008.<br />

47