Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

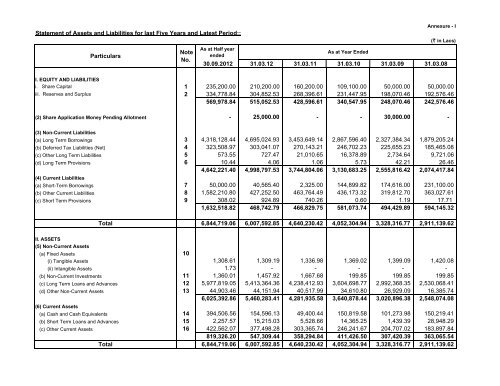

<strong>Statement</strong> <strong>of</strong> <strong>Assets</strong> <strong>and</strong> <strong>Liabilities</strong> <strong>for</strong> <strong>last</strong> <strong>Five</strong> <strong>Years</strong> <strong>and</strong> <strong>Latest</strong> Period::ParticularsNoteNo.Annexure - I( in Lacs)As at Half yearended30.09.2012 31.03.12 31.03.11As at Year Ended31.03.10 31.03.09 31.03.08I. EQUITY AND LIABILITIESi. Share Capital 1 235,200.00 210,200.00 160,200.00 109,100.00 50,000.00 50,000.00iii. Reserves <strong>and</strong> Surplus 2 334,778.84 304,852.53 268,396.61 231,447.95 198,070.46 192,576.46569,978.84 515,052.53 428,596.61 340,547.95 248,070.46 242,576.46(2) Share Application Money Pending Allotment - 25,000.00 - - 30,000.00 -(3) Non-Current <strong>Liabilities</strong>(a) Long Term Borrowings 3 4,318,128.44 4,695,024.93 3,453,649.14 2,867,596.40 2,327,384.34 1,879,205.24(b) Deferred Tax <strong>Liabilities</strong> (Net) 4 323,508.97 303,041.07 270,143.21 246,702.23 225,655.23 185,465.08(c) Other Long Term <strong>Liabilities</strong> 5 573.55 727.47 21,010.65 16,378.89 2,734.64 9,721.06(d) Long Term Provisions 6 10.44 4.06 1.06 5.73 42.21 26.464,642,221.40 4,998,797.53 3,744,804.06 3,130,683.25 2,555,816.42 2,074,417.84(4) Current <strong>Liabilities</strong>(a) Short-Term Borrowings 7 50,000.00 40,565.40 2,325.00 144,899.82 174,616.00 231,100.00(b) Other Current <strong>Liabilities</strong> 8 1,582,210.80 427,252.50 463,764.49 436,173.32 319,812.70 363,027.61(c) Short Term Provisions 9 308.02 924.89 740.26 0.60 1.19 17.711,632,518.82 468,742.79 466,829.75 581,073.74 494,429.89 594,145.32Total 6,844,719.06 6,007,592.85 4,640,230.42 4,052,304.94 3,328,316.77 2,911,139.62II. ASSETS(5) Non-Current <strong>Assets</strong>(a) Fixed <strong>Assets</strong> 10(i) Tangible <strong>Assets</strong> 1,308.61 1,309.19 1,336.98 1,369.02 1,399.09 1,420.08(ii) Intangible <strong>Assets</strong> 1.73 - - - - -(b) Non-Current Investments 11 1,360.01 1,457.92 1,667.68 199.85 199.85 199.85(c) Long Term Loans <strong>and</strong> Advances 12 5,977,819.05 5,413,364.36 4,238,412.93 3,604,698.77 2,992,368.35 2,530,068.41(d) Other Non-Current <strong>Assets</strong> 13 44,903.46 44,151.94 40,517.99 34,610.80 26,929.09 16,385.746,025,392.86 5,460,283.41 4,281,935.58 3,640,878.44 3,020,896.38 2,548,074.08(6) Current <strong>Assets</strong>(a) Cash <strong>and</strong> Cash Equivalents 14 394,506.56 154,596.13 49,400.44 150,819.58 101,273.98 150,219.41(b) Short Term Loans <strong>and</strong> Advances 15 2,257.57 15,215.03 5,528.66 14,365.25 1,439.39 28,948.29(c) Other Current <strong>Assets</strong> 16 422,562.07 377,498.28 303,365.74 246,241.67 204,707.02 183,897.84819,326.20 547,309.44 358,294.84 411,426.50 307,420.39 363,065.54Total 6,844,719.06 6,007,592.85 4,640,230.42 4,052,304.94 3,328,316.77 2,911,139.62

<strong>Statement</strong> <strong>of</strong> Pr<strong>of</strong>it <strong>and</strong> Loss <strong>for</strong> the Last <strong>Five</strong> <strong>Years</strong>Annexure - IIParticularsNoteNo.For Half yearendedFor the year ended( in Lacs)30.09.2012 31.03.12 31.03.11 31.03.10 31.03.09 31.03.08I. Revenue from operations 17 268,780.41 464,194.17 383,943.80 347,260.44 302,270.63 261,004.84II Other income 18 49.80 116.82 216.52 17.14 11.61 68.63III. Total Revenue (I+II) 268,830.21 464,310.99 384,160.32 347,277.58 302,282.24 261,073.47IV. Expenses:Employee benefits expense 19 109.77 188.22 202.58 155.50 166.14 95.46Finance costs 20 205,406.23 362,038.50 293,673.82 267,976.76 235,841.85 196,702.80Depreciation <strong>and</strong> amortization18.23 35.12 35.10 35.15 36.74 41.04expenseOther expenses 21 365.16 730.22 414.31 281.60 468.78 399.32Total Expenses 205,899.39 362,992.06 294,325.81 268,449.01 236,513.51 197,238.62V. Pr<strong>of</strong>it be<strong>for</strong>e exceptional <strong>and</strong>62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85extraordinary items <strong>and</strong> tax (III-IV)VI. Exceptional items - - - - - -VII. Pr<strong>of</strong>it be<strong>for</strong>e extraordinary items <strong>and</strong>62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85tax (V-VI)VIII. Extraordinary Items - - - - - -IX. Pr<strong>of</strong>it be<strong>for</strong>e tax (VII-VIII) 62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85X. Tax expense:(1) Current tax 12,596.74 20,342.90 17,923.13 13,512.50 7,500.00 7,227.00(2) Tax For Earlier <strong>Years</strong> (60.13) - (50.00) - (1.53) -(3) Deferred tax 20,467.90 32,897.86 23,440.98 21,047.00 22,355.92 14,451.07(4) Deferred Tax For Earlier <strong>Years</strong> - - - - 17,828.37 -(5) Fringe Benefit Tax - - - - 6.81 5.4533,004.51 53,240.76 41,314.11 34,559.50 47,689.57 21,683.52XI. Pr<strong>of</strong>it (Loss) <strong>for</strong> the period (IX-X) 29,926.31 48,078.17 48,520.40 44,269.07 18,079.16 42,151.33XII. Earning per equity share (in ): 22(1) Basic 127.24 283.89 362.80 553.32 361.58 843.03(2) Diluted 127.24 283.78 362.80 553.32 360.40 843.03

CASH FLOW STATEMENTAnnexure - III( in Lacs)For Half yearParticularsended30.09.2012 31.03.12 31.03.11For the year ended31.03.10 31.03.09 31.03.08A. Cash Flow from Operating activities::Pr<strong>of</strong>it Be<strong>for</strong>e Tax:: 62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85Adjustments <strong>for</strong>::1-Depreciation 18.23 35.12 35.11 35.15 28.48 41.042-(Pr<strong>of</strong>it) / Loss on sale <strong>of</strong> fixed assets (0.14) 1.49 0.81 (0.17) 0.38 0.953-Lease Rentals advance amortised 2,561.41 4,751.21 4,295.51 10,339.57 18,603.45 16,749.394-Provision <strong>for</strong> Employee benefits 7.16 4.21 0.48 0.36 16.49 12.205-Exchange Rate Variation 366.79 421.97 (4.85) (1,116.10) (195.85) (1,405.00)6-Amortisation <strong>of</strong> Foreign Currency Monetary Item Trans Diff. - - 181.04 3,455.15 - -7-Amortisation <strong>of</strong> Interest Restruturing Advance 31.23 101.61 151.64 212.56 309.67 -8-Amortisation <strong>of</strong> Gain on asset securitisation (349.03) (1,210.74) (2,135.28) (3,898.71) (936.72) -9-Provision <strong>for</strong> Interest Payable to Income Tax Authorities 28.47 69.36 103.87 - - -10-Misc. Expenditure written <strong>of</strong>f - - - - 20.00 5.0011-Provision <strong>for</strong> CSR Expenses (Net) 5.00 300.00 - - -65,599.94 105,793.16 92,462.84 87,856.37 83,614.63 79,238.43Adjustments <strong>for</strong>-1-<strong>Assets</strong> given on financial lease during the year (744,800.00) (1,260,421.10) (968,029.04) (901,777.50) (699,075.30) (460,480.95)2-Capital Recovery on assets given on financial lease 175,387.22 293,528.91 236,817.58 190,061.51 163,524.35 155,349.863-Advance <strong>for</strong> Project Funding (8,336.50) (210,136.50)4-Amount Riased through Securitisation <strong>of</strong> Lease Receivables - - 33,954.23 50,011.03 96,208.49 77,221.595-Receipt on account <strong>of</strong> Long term loans during the year 7,296.17 13,562.32 10,663.99 7,042.33 4,373.12 5,590.176-Term Loans disbursed during the year - (10,790.00) (10,000.00) (37,000.00) (29,300.00) (24,000.00)7-Loans & Advances (Net <strong>of</strong> Adv. Tax & ERV) 12,958.52 (9,461.65) 14,361.08 (21,185.58) 35,977.53 (6,271.30)8-Cash <strong>and</strong> Cash Equivalents (Fixed Deposits with maturity <strong>of</strong>more than 3 months) 33,925.00 (102,536.00) 64,951.00 (11,226.00) - (12,628.00)9-Other Non Current <strong>Assets</strong> (751.52) (3,633.95) (5,907.19) (7,681.71) (10,543.35) (9,972.64)10-Other Current <strong>Assets</strong> (3,224.84) (3,100.16) (634.53) 628.79 (2,695.75) (1,327.65)11-Current Liabilties 1,109,055.83 30,992.68 16,878.09 14,792.23 9,015.57 12,443.5812-Direct Taxes Paid (20,220.49) (20,528.83) (18,693.16) (9,850.59) (9,265.74) (7,483.23)561,289.39 (1,282,524.28) (625,637.95) (726,185.49) (441,781.08) (271,558.57)Net Cash flow from Operations 626,889.33 (1,176,731.12) (533,175.11) (638,329.12) (358,166.45) (192,320.14)BCCash Flow from Invetsment Activities:1-Purchase <strong>of</strong> Fixed <strong>Assets</strong> (19.84) (9.33) (3.90) (5.08) (7.95) (5.04)2-Proceeds from sale <strong>of</strong> Fixed <strong>Assets</strong> 0.60 0.50 0.03 0.17 0.08 0.123-Receipt on account <strong>of</strong> investment in PTCs 107.28 229.89 - - - -4-Investment in Pass Through Certificates - - (1,697.71) - - -5-Investment made during the year - -88.04 221.06 (1,701.58) (4.91) (7.87) (4.92)Cash flow from Financing activities::1-Dividend & Dividend Tax Paid during the year (1,622.25) (11,660.88) (10,000.00) (11,699.50) (13,399.00) (10,000.00)2-Share Capital Riased during the year - 50,000.00 51,100.00 29,100.00 - -3-Share Application Money Received during the year - 25,000.00 - - 30,000.00 -4-Funds raised through Bonds - 1,138,500.00 598,955.00 559,094.00 599,100.00 519,500.005-Bonds Redeemed during the year (94,830.00) (56,443.34) (184,893.33) (35,493.33) (157,313.33) (128,744.08)6-Term Loans raised during the year 351,357.00 294,272.00 61,480.13 1,194,151.11 828,976.69 291,100.007-Term Loans repaid during the year (591,650.32) (298,376.92) (287,772.27) (1,159,446.37) (985,109.00) (394,572.06)8-Funds raised through External Commercial Borrowings - 95,695.00 330,186.93 215,887.50 49,990.00 -9-Repayment <strong>of</strong> External Commercial Borrowings (16,396.37) (57,816.11) (60,647.91) (114,939.78) (43,016.47) (44,596.76)10-Share Registration Fees Paid during the year (25.00)(353,141.94) 1,179,169.75 498,408.55 676,653.63 309,228.89 232,662.10Net Cash Flow During the year(A+B+C) 273,835.43 2,659.69 (36,468.14) 38,319.60 (48,945.43) 40,337.04Opening Balance <strong>of</strong> Cash & Cash Equivalents::Balance in the Current Accounts 683.67 461.99 842.56 1,197.77 5,218.30 9,050.86Balance in the Term Deposit A/cs (orginal maturity <strong>of</strong> threemonths or less) 5,100.00 2,662.00 38,750.00 75.00 45,000.00 830.00Balance in Franking Machine 0.44 0.43 - 0.19 0.09 0.49Balance in RBI-PLA 1.02 1.02 1.02 1.02 1.02 1.025,785.13 3,125.44 39,593.58 1,273.98 50,219.41 9,882.37Closing Balance <strong>of</strong> Cash & Cash Equivalents 279,620.56 5,785.13 3,125.44 39,593.58 1,273.98 50,219.41Add Term Deposits with maturity <strong>of</strong> more than three months 114,886.00 148,811.00 46,275.00 111,226.00 100,000.00 100,000.00Closing Balance <strong>of</strong> Cash & Cash Equivalents as per <strong>Statement</strong> <strong>of</strong>Asset & Liability 394,506.56 154,596.13 49,400.44 150,819.58 101,273.98 150,219.41

Notes on Financial <strong>Statement</strong>sAnnexure - IV1. Share Capital( in lakhs)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008AUTHORISED500000.00 500000.00 200000.00 200000.00 100000.00 100000.00500,00,000 Equity Share <strong>of</strong> 1000/‐eachISSUED, SUBSCRIBED AND FULLY PAID‐UP 235200.00 210200.00 160200.00 109100.00 50000.00 50000.002,35,20,000 Equity Shares <strong>of</strong> 1000/‐ eachTotal 235200.00 210200.00 160200.00 109100.00 50000.00 50000.001.1 The Company has only one class <strong>of</strong> shares referred to as Equity Share having a par value <strong>of</strong> 1000/‐ each. Each holder <strong>of</strong> equity shares isentitled to one vote per share.1.2 The Company declares <strong>and</strong> pays dividend in Indian Rupees. During the half year ended September 30, 2012, no dividend has been paid by theCompany.1.3 Reconciliation <strong>of</strong> the number <strong>of</strong> shares outst<strong>and</strong>ing is setout below:Particulars As at 30‐09‐2012No. <strong>of</strong> sharesAs at 31‐03‐2012No. <strong>of</strong> sharesAs at 31‐03‐2011No. <strong>of</strong> sharesAs at 31‐03‐2010No. <strong>of</strong> sharesAs at 31‐03‐2009No. <strong>of</strong> sharesAs at 31‐03‐2008No. <strong>of</strong> sharesEquity Shares at the beginning <strong>of</strong> the period 21020000 16020000 10910000 5000000 5000000 2320000Add: Shares issued <strong>for</strong> cash at par 2500000 5000000 5110000 5910000 ‐ 2680000Equity Shares at the end <strong>of</strong> the period 23520000 21020000 16020000 10910000 5000000 50000001.4 Details <strong>of</strong> Shareholders holding more than 5% shares:Name <strong>of</strong> theShareholderAs at 30‐09‐2012 As at 31‐03‐2012 As at 31‐03‐2011 As at 31‐03‐2010As at 31‐03‐2009 As at 31‐03‐2008No <strong>of</strong>shares%heldNo <strong>of</strong>shares%heldNo <strong>of</strong>shares%heldNo <strong>of</strong>shares%heldNo <strong>of</strong>shares%heldNo <strong>of</strong>shares%heldGovernment <strong>of</strong> India(through Ministry <strong>of</strong>Railways)23519993 99.99 21019993 99.99 16019993 99.99 10909993 99.99 4999993 99.99 4999993 99.99

2. Reserves <strong>and</strong> Surplus( in Lakhs)ParticularsAs at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008General ReserveOpening Balance 60421.39 60421.39 55332.26 43230.34 42216.00 38000.00Add: Transfer from Foreign Currency Monetary Item 0.00 0.00 89.13 807.92 29.46 0.00Translation Difference AccountLess: Transfer to Foreign Currency Monetary Item0.00 0.00 0.00 0.00 926.51 0.00Translation Difference AccountAdd: Adjustment on account <strong>of</strong> Translational0.00 0.00 0.00 0.00 11.39 0.00Provision <strong>for</strong> Employee Benefits as per AS‐15Add: Transfer from Exchange Variation Reserve 0.00 0.00 0.00 6794.00 0.00 0.00Add: Transfer from Surplus 0.00 0.00 5000.00 4500.00 1900.00 4216.00Closing Balance ‐ ‘A’ 60421.39 60421.39 60421.39 55332.26 43230.34 42216.00Bonds Redemption ReserveOpening Balance 244431.14 207975.22 176115.69 148046.12 145513.46 120174.63Add: Transfer from Surplus 29926.31 36455.92 31859.53 28069.57 2532.66 25338.83Closing Balance ‐ ‘B’ 274357.45 244431.14 207975.22 176115.69 148046.12 145513.46Exchange Rate Variation ReserveOpening Balance 0.00 0.00 0.00 6794.00 4847.00 3950.00Add: Transfer from Surplus 0.00 0.00 0.00 0.00 1947.00 897.00Less: Transfer to General0.00 0.00 0.00 6794.00 0.00 0.00ReserveClosing Balance ‐ ‘C’ 0.00 0.00 0.00 0.00 6794.00 4847.00SurplusOpening Balance 0.00 0.00 0.00 0.00 0.00 0.00Add: Pr<strong>of</strong>it <strong>for</strong> the period after taxation as per29926.31 48078.17 48520.40 44269.07 18079.16 42151.33statement <strong>of</strong> Pr<strong>of</strong>it <strong>and</strong> LossSurplus available <strong>for</strong> appropriation 29926.31 48078.17 48520.40 44269.07 18079.16 42151.33Less: AppropriationsTransfer to General Reserve 0.00 0.00 5000.00 4500.00 1900.00 4216.00Transfer to Exchange Variation Reserve 0.00 0.00 0.00 0.00 1947.00 897.00

Transfer to Bonds Redemption Reserve 29926.31 36455.92 31859.53 28069.57 2532.66 25338.83Interim Dividend 0.00 10000.00 10000.00 10000.00 10000.00 10000.00Dividend Tax 0.00 1622.25 1660.87 1699.50 1699.50 1699.50Closing Balance ‐ ‘D’ 0.00 0.00 0.00 0.00 0.00 0.00Total A + B + C + D 334778.84 304852.53 268396.61 231447.95 198070.46 192576.463. Long Term Borrowings( in Lakhs)ParticularsAs at As at As at As at As at As at30‐09‐2012 31‐03‐2012 31‐03‐2011 31‐03‐2010 31‐03‐2009 31‐03‐2008SecuredBonds from Domestic Capital Market 3423302.38 3458532.38 2527495.71 1984984.04 1610783.37 1047176.70Rupee Term Loans from Banks 26704.90 397719.60 275398.22 495858.13 448180.45 527637.76Foreign Currency Term Loans 14000.47 14755.38 15155.88 19275.50 25811.79 25846.78Total Secured Borrowings 3464007.75 3871007.36 2818049.81 2500117.67 2084775.61 1600661.24UnsecuredBonds from Overseas Capital Market 171795.00 165522.50 145112.50 111161.79 118299.29 168640.28Rupee Term Loans from Banks 4166.94 5096.94 6956.94 8816.94 10211.94 16333.72Foreign Currency Term Loans 678158.75 653398.13 483529.89 247500.00 114097.50 93570.00Total Unsecured Borrowings 854120.69 824017.57 635599.33 367478.73 242608.73 278544.00Total Long Term Borrowings 4318128.44 4695024.93 3453649.14 2867596.40 2327384.34 1879205.243.1 All the bonds issued in the domestic capital market <strong>and</strong> outst<strong>and</strong>ing as on 30‐09‐2012 are secured by first pari passu charge on thepresent / future Rolling stock assets / lease receivables <strong>of</strong> the Company.

3.1.1 Maturity pr<strong>of</strong>ile <strong>and</strong> Rate <strong>of</strong> Interest <strong>of</strong> the bonds (classified as Long Term Borrowings) issued in the domestic capital market <strong>and</strong> amountoutst<strong>and</strong>ing as on 30‐09‐2012 is set out below:Series Interest Rate Amountoutst<strong>and</strong>ingTerms <strong>of</strong> Payment Date <strong>of</strong>Maturity( in Lakhs)71st "E" Taxable Non‐Cum. Bonds 8.83%, Semi Annual 22000.00 Bullet Repayment 14‐May‐3570th "E" Taxable Non‐Cum. Bonds 8.72%, Semi Annual 1500.00 Bullet Repayment 4‐May‐3571st "D" Taxable Non‐Cum. Bonds 8.83%, Semi Annual 22000.00 Bullet Repayment 14‐May‐3470th "D" Taxable Non‐Cum. Bonds 8.72%, Semi Annual 1500.00 Bullet Repayment 4‐May‐3471st "C" Taxable Non‐Cum. Bonds 8.83%, Semi Annual 22000.00 Bullet Repayment 14‐May‐3370th "C" Taxable Non‐Cum. Bonds 8.72%, Semi Annual 1500.00 Bullet Repayment 4‐May‐3371st "B" Taxable Non‐Cum. Bonds 8.83%, Semi Annual 22000.00 Bullet Repayment 14‐May‐3270th "B" Taxable Non‐Cum. Bonds 8.72%, Semi Annual 1500.00 Bullet Repayment 4‐May‐3271st "A" Taxable Non‐Cum. Bonds 8.83%, Semi Annual 22000.00 Bullet Repayment 14‐May‐3176th "B" Taxable Non‐Cum. Bonds 9.47%, Semi Annual 99500.00 Bullet Repayment 10‐May‐3170th "A" Taxable Non‐Cum. Bonds 8.72%, Semi Annual 1500.00 Bullet Repayment 4‐May‐3170th "AA" Taxable Non‐Cum. Bonds 8.79%, Semi Annual 141000.00 Bullet Repayment 4‐May‐3067th "B" Taxable Non‐Cum. Bonds 8.80%, Semi Annual 38500.00 Bullet Repayment 3‐Feb‐3054th "B" Taxable Non‐Cum. Bonds 10.04%,Semi Annual 32000.00 Bullet Repayment 7‐Jun‐2780th 'A' Series Cat‐1, Tax Free Bonds Public 8.10%, Annual 268754.88 Bullet Repayment 23‐Feb‐27Issue80th 'A' Series Cat‐2, Tax Free Bonds Public 8.30%, Annual 40810.31 Bullet Repayment 23‐Feb‐27Issue53rd "C" Taxable Non‐Cum. Bonds 8.75%, Semi Annual 41000.00 Bullet Repayment 29‐Nov‐2679th "A" Tax Free Non‐Cum. Bonds 7.77%, Annual 19151.00 Bullet Repayment 08‐Nov‐2676th "A" Taxable Non‐Cum. Bonds 9.33%, Semi Annual 25500.00 Bullet Repayment 10‐May‐2675th Taxable Non‐Cum. Bonds 9.09%, Semi Annual 15000.00 Bullet Repayment 31‐Mar‐2674th Taxable Non‐Cum. Bonds 9.09%, Semi Annual 107600.00 Bullet Repayment 29‐Mar‐2669th Taxable Non‐Cum. Bonds 8.95%, Semi Annual 60000.00 Bullet Repayment 10‐Mar‐2567th "A" Taxable Non‐Cum. Bonds 8.65%, Semi Annual 20000.00 Bullet Repayment 3‐Feb‐2565th "O" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐2463rd "B" Taxable Non‐Cum. Bonds 8.65%, Semi Annual 31500.00 Bullet Repayment 15‐Jan‐2462nd "B" Taxable Non‐Cum. Bonds 8.50%, Semi Annual 28500.00 Bullet Repayment 26‐Dec‐23

61st "A" Taxable Non‐Cum. Bonds 10.70%, Semi61500.00 Bullet Repayment 11‐Sep‐23Annual65th "N" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐2358th "A" Taxable Non‐Cum. Bonds 9.20%, Semi Annual 50000.00 Bullet Repayment 29‐Oct‐2254th "A" Taxable Non‐Cum. Bonds 9.81%, Semi Annual 15000.00 Bullet Repayment 7‐Jun‐2255th "O" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐2265th "M" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐2280th Series Cat‐1 Tax Free Bonds Public 8%, Annual 277663.65 Bullet Repayment 23‐Feb‐22Issue80th Series Cat‐2 Tax Free Bonds Public 8.15%, Annual 39660.16 Bullet Repayment 23‐Feb‐22Issue53rd "B" Taxable Non‐Cum. Bonds 8.68%, Semi Annual 22500.00 Bullet Repayment 29‐Nov‐2179th Tax Free Non‐Cum. Bonds 7.55%, Annual 53960.00 Bullet Repayment 08‐Nov‐2178th Taxable Non‐Cum. Bonds 9.41%, Semi Annual 150000.00 Bullet Repayment 28‐Jul‐2155th "N" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐2177th Taxable Non‐Cum. Bonds 9.57%, Semi Annual 124500.00 Bullet Repayment 31‐May‐2152nd "B" Taxable Non‐Cum. Bonds 8.64%, Semi Annual 70000.00 Bullet Repayment 17‐May‐2176th Taxable Non‐Cum. Bonds 9.27%, Semi Annual 39000.00 Bullet Repayment 10‐May‐2165th "L" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐2151st Taxable Non‐Cum. Bonds 7.74%, Semi Annual 45000.00 Bullet Repayment 22‐Dec‐2073rd "B" Tax Free Non‐Cum. Bonds 6.72%, Semi Annual 83591.00 Bullet Repayment 20‐Dec‐2049th "O" ‐ FLOATING RATE BONDS Taxable 8.57%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐20Non‐Cum. Bonds*72nd Taxable Non‐Cum. Bonds 8.50%, Semi Annual 80000.00 Bullet Repayment 22‐Jun‐2055th "M" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐2065th "K" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐2068th "B" Tax Free Non‐Cum. Bonds 6.70%, Semi Annual 92721.00 Bullet Repayment 8‐Mar‐2067th Taxable Non‐Cum. Bonds 8.55%, Semi Annual 17500.00 Bullet Repayment 3‐Feb‐2048th "JJ" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1949th "N" ‐ FLOATING RATE BONDS Taxable 8.51%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐19Non‐Cum. Bonds*66th Taxable Non‐Cum. Bonds 8.60%, Semi Annual 50000.00 Bullet Repayment 11‐Jun‐1955th "L" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1965th "AA" Taxable Non‐Cum. Bonds 8.19%, Semi Annual 56000.00 Bullet Repayment 27‐Apr‐19

65th "J" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1947th "O" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1963rd "A" Taxable Non‐Cum. Bonds 8.55%, Semi Annual 170500.00 Bullet Repayment 15‐Jan‐1962nd "A" Taxable Non‐Cum. Bonds 8.45%, Semi Annual 50000.00 Bullet Repayment 26‐Dec‐1857th Taxable Non‐Cum. Bonds 9.66%, Semi Annual 100000.00 Redeemable in 28‐Sep‐18five equal yearlyinstallmentscommencing from28‐09‐201848th "II" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1861st Taxable Non‐Cum. Bonds10.60%, Semi85500.00 Bullet Repayment 11‐Sep‐18Annual46th "EE" Taxable Non‐Cum. Bonds 6.20%, Semi Annual 2500.00 Bullet Repayment 12‐Aug‐1846th "O" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1849th "M" ‐ FLOATING RATE BONDS Taxable 8.43%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐18Non‐Cum. Bonds*55th "K" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1860th Taxable Non‐Cum. Bonds 9.43%, Semi Annual 60400.00 Bullet Repayment 23‐May‐1845th "OO" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1865th "I" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1847th "N" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1873rd "A" Tax Free Non‐Cum. Bonds 6.32%, Semi Annual 28456.00 Bullet Repayment 20‐Dec‐1743rd "OO" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐1748th "HH" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1742nd "O" Taxable Non‐Cum. Bonds 8%, Semi Annual 1000.00 Bullet Repayment 29‐Aug‐1746th "N" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1749th "L" ‐ FLOATING RATE BONDS Taxable 8.51%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐17Non‐Cum. Bonds*54th Taxable Non‐Cum. Bonds 9.81%, Semi Annual 22000.00 Bullet Repayment 7‐Jun‐1755th "J" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1745th "NN" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1765th "H" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1747th "M" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1768th "A" Tax Free Non‐Cum. Bonds 6.3%, Semi Annual 64262.00 Bullet Repayment 8‐Mar‐17

53rd "A" Taxable Non‐Cum. Bonds 8.57%, Semi Annual 12500.00 Bullet Repayment 29‐Nov‐1643rd "NN" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐1648th "GG" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1642nd "N" Taxable Non‐Cum. Bonds 8%, Semi Annual 1000.00 Bullet Repayment 29‐Aug‐1646th "M" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1649th "K" ‐ FLOATING RATE BONDS Taxable 8.49%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐16Non‐Cum. Bonds*55th "I" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1652nd "A" Taxable Non‐Cum. Bonds 8.41%, Semi Annual 11000.00 Bullet Repayment 17‐May‐1645th "MM" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1665th "G" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1647th "L" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1673rd Tax Free Non‐Cum. Bonds 6.05%, Semi Annual 18808.00 Bullet Repayment 20‐Dec‐1543rd "MM" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐1548th "FF" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1542nd "M" Taxable Non‐Cum. Bonds 8%, Semi Annual 1000.00 Bullet Repayment 29‐Aug‐1546th "L" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1549th "J" ‐ FLOATING RATE BONDS Taxable 8.39%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐15Non‐Cum. Bonds*55th "H" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1545th "LL" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1570th Taxable Non‐Cum. Bonds 7.845%, Semi Annual 7000.00 Bullet Repayment 4‐May‐1565th "F" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1547th "K" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1568th Tax Free Non‐Cum. Bonds 6%, Semi Annual 35011.00 Bullet Repayment 8‐Mar‐1517th Tax free Non‐Cum. Bonds 9%, Semi Annual 20000.00 Bullet Repayment 28‐Feb‐1543rd "LL" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐1448th "EE" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1448th "H" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 2960.00 Bullet Repayment 14‐Sep‐1442nd "L" Taxable Non‐Cum. Bonds 8%, Semi Annual 1000.00 Bullet Repayment 29‐Aug‐1446th "K" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1422nd Taxable Non‐Cum. Bonds11.50%, Semi160.00 Redeemable in 2 27‐Jul‐14Annualyearly equalinstallments

starting from 27‐07‐201416th "O" Taxable Non‐Cum. Bonds 12.80%, Semi1000.00 Bullet Repayment 15‐Jul‐14Annual15th "O" Taxable Non‐Cum. Bonds 12.90%, Semi1000.00 Bullet Repayment 22‐Jun‐14Annual49th "I" ‐ FLOATING RATE BONDS Taxable 8.48%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐14Non‐Cum. Bonds*55th "G" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1445th "KK" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1465th Taxable Non‐Cum. Bonds 7.45%, Semi Annual 35100.00 Bullet Repayment 27‐Apr‐1465th "E" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1413th "AA" Taxable Non‐Cum. Bonds 10%, Semi Annual 1333.38 Bullet Repayment 31‐Mar‐1464th Taxable Non‐Cum. Bonds 8.49%, Semi Annual 18200.00 Bullet Repayment 30‐Mar‐1447th "J" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1463rd Taxable Non‐Cum. Bonds 8.46%, Semi Annual 83000.00 Bullet Repayment 15‐Jan‐1462nd Taxable Non‐Cum. Bonds 8.40%, Semi Annual 10000.00 Bullet Repayment 26‐Dec‐1343rd "KK" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐13Total 3423302.383.1.2 Maturity pr<strong>of</strong>ile <strong>and</strong> Rate <strong>of</strong> Interest <strong>of</strong> the bonds (classified as Other Current <strong>Liabilities</strong>) issued in the domestic capital market <strong>and</strong>amount outst<strong>and</strong>ing as on 30‐09‐2012 is set out below:Series Interest Rate Amountoutst<strong>and</strong>ing( in Lakhs)Terms <strong>of</strong> PaymentDate <strong>of</strong>Maturity48th "DD" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 5000.00 Bullet Repayment 17‐Sep‐1348th "G" Taxable Non‐Cum. Bonds 6.85%, Semi Annual 2960.00 Bullet Repayment 14‐Sep‐1342nd "K" Taxable Non‐Cum. Bonds 8%, Semi Annual 1000.00 Bullet Repayment 29‐Aug‐1346th "DD" Taxable Non‐Cum. Bonds 6.20%, Semi Annual 2500.00 Bullet Repayment 12‐Aug‐1346th "J" Taxable Non‐Cum. Bonds 6.25%, Semi Annual 1300.00 Bullet Repayment 12‐Aug‐1346th "JJJ" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1500.00 Bullet Repayment 12‐Aug‐1322nd Taxable Non‐Cum. Bonds 11.50%, Semi Annual 70.00 AmortizedRepayment27‐Jul‐13

16th "N" Taxable Non‐Cum. Bonds 12.80%, Semi Annual 1000.00 Bullet Repayment 15‐Jul‐1315th "N" Taxable Non‐Cum. Bonds 12.90%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐1349th "H" – Floating Rate Bonds Taxable 8.36%, Semi Annual 1000.00 Bullet Repayment 22‐Jun‐13Non‐Cum. Bonds*55th "F" Taxable Non‐Cum. Bonds 9.86%, Semi Annual 3300.00 Bullet Repayment 7‐Jun‐1345th "E" Taxable Non‐Cum. Bonds 6.10%, Semi Annual 7900.00 Bullet Repayment 13‐May‐1345th "JJ" Taxable Non‐Cum. Bonds 6.39%, Semi Annual 700.00 Bullet Repayment 13‐May‐1365th "D" Taxable Non‐Cum. Bonds 8.20%, Semi Annual 6000.00 Bullet Repayment 27‐Apr‐1344th "JJ" Taxable Non‐Cum. Bonds 6.98%, Semi Annual 2300.00 Bullet Repayment 31‐Mar‐1312th "CC" Taxable Non‐Cum. Bonds 10%, Quarterly 2000.00 Amortised Annual 31‐Mar‐13Repayment13th "AA" Taxable Non‐Cum. Bonds 10%, Semi Annual 1333.33 Amortised Annual 31‐Mar‐13Repayment47th "I" Taxable Non‐Cum. Bonds 5.99%, Semi Annual 1000.00 Bullet Repayment 26‐Mar‐1359th "A" Taxable Non‐Cum. Bonds 8.75%, Semi Annual 82500.00 Bullet Repayment 7‐Jan‐1343rd "J" Taxable Non‐Cum. Bonds 6.90%, Semi Annual 500.00 Bullet Repayment 29‐Oct‐1243rd "JJ" Taxable Non‐Cum. Bonds 7.63%, Semi Annual 3000.00 Bullet Repayment 29‐Oct‐1258th Taxable Non‐Cum. Bonds 8.83%, Semi Annual 20000.00 Bullet Repayment 29‐Oct‐12Total 147863.33*Applicable interest rate as on 30.09.2012 (Interest rate is floating linked to Indian Benchmark (INBMK) Yield <strong>and</strong> reset at half yearly rest). Allother interest rates are fixed.3.2 Rupee Term Loans availed from Banks are secured by first pari passu charge on the present / future rolling stock assets / leasereceivables <strong>of</strong> the Company. Terms <strong>of</strong> Repayment <strong>of</strong> Secured Term Loans <strong>and</strong> amount outst<strong>and</strong>ing as on 30‐09‐2012 is set out below:( in Lakhs)Name <strong>of</strong> Bank Rate <strong>of</strong> Interest Date <strong>of</strong> Repayment Non‐ Current TotalMaturityCurrentCentral Bank <strong>of</strong> India(3) 8.25%, Fixed 1‐Oct‐16 Half Yearly 2318.00 668.00 2986.00United Bank <strong>of</strong> India (2) 8.91%, Fixed 1‐Oct‐16 Half Yearly 2341.00 666.00 3007.00Central Bank <strong>of</strong> India(4) 8.25%, Fixed 1‐Oct‐16 Half Yearly 2318.00 668.00 2986.00United Bank <strong>of</strong> India (1) 8.91%, Fixed 1‐Oct‐15 Half Yearly 1675.00 666.00 2341.00Bank <strong>of</strong> Tokyo‐Mitsubishi UFJ Ltd. 7.80%, Fixed 15‐May‐15 Annual 8000.00 4000.00 12000.00ICICI Bank 11.50%, Fixed 1‐Apr‐15 Half Yearly 7692.31 3846.15 11538.46Central Bank <strong>of</strong> India(2) 8.25%, Fixed 1‐Apr‐14 Half Yearly 1324.00 1334.00 2658.00

HDFC Bank Ltd. 8.44%, Fixed 1‐Apr‐14 Half Yearly 200.00 200.00 400.00Central Bank <strong>of</strong> India(1) 8.25%, Fixed 1‐Oct‐13 Half Yearly 500.00 1000.00 1500.00Allahabad Bank(1) 9%, Fixed 1‐Oct‐13 Half Yearly 336.59 666.00 1002.59Allahabad Bank(2) (Note‐1) 10.75%, Linked 25‐Jul‐18 Bullet 0.00 30000.00 30000.00to Base RateDena Bank (Note‐1)12.80%, Linked 1‐Apr‐15 Half Yearly 0.00 1592.00 1592.00to BPLROriental Bank <strong>of</strong> Commerce (Note‐ 12.50%, Linked 1‐Oct‐15 Half Yearly 0.00 1832.43 1832.431)to BPLRState Bank <strong>of</strong> India (Note‐1) 11.70%, Linked 1‐Oct‐15 Half Yearly 0.00 1750.00 1750.00to BPLRState Bank <strong>of</strong> Patiala (Note‐1) 12.91%, Linked 1‐Oct‐15 Half Yearly 0.00 981.42 981.42to BPLRUnited Bank <strong>of</strong> India (3) (Note‐1) 11.10%, Linked 30‐Jun‐16 Bullet 0.00 40000.00 40000.00to Base RateBank <strong>of</strong> Maharashtra(1) (Note‐1) 10.50%, Linked 30‐Mar‐17 Bullet 0.00 20000.00 20000.00to Base RateBank <strong>of</strong> Maharashtra(2) (Note‐1) 10.50%, Linked 25‐Jul‐18 Bullet 0.00 25000.00 25000.00to Base RateCorporation Bank (Note‐1)10.60%, Linked 29‐Jul‐18 Bullet 0.00 25000.00 25000.00to Base RateUCO Bank (Note‐1)10.75%, Linked 29‐Jul‐18 Bullet 0.00 25000.00 25000.00to Base RateTotal 26704.90 184870.01 211574.91Note‐1 IRFC has exercised the prepayment option as enshrined <strong>and</strong> prepaid these loans on 1 st October 2012.Note‐2 Date <strong>of</strong> Maturity in case <strong>of</strong> amortised repayments represents the final maturity date.3.3 Foreign Currency Term Loans availed are secured by first pari passu charge on the present / future rolling stock assets / lease receivables<strong>of</strong> the Company. Terms <strong>of</strong> Repayment <strong>of</strong> the Foreign Currency term loan <strong>and</strong> amount outst<strong>and</strong>ing as on 30‐09‐2012 is as follows:( in Lakhs)Description Rate <strong>of</strong> Interest Date <strong>of</strong> Repayment Non‐Current Current TotalMaturityBank <strong>of</strong> India (Note‐1) 6M USD LIBOR+1.25% 30‐Oct‐21 Half Yearly 13479.30 1585.80 15065.10

Export Development6M USD LIBOR+0.30% 15‐Oct‐15 Half Yearly 98.29 196.57 294.86Corporation, Canada‐1 (Note‐1)Export Development6M USD LIBOR+0.23% 15‐Oct‐13 Half Yearly 422.88 845.76 1268.64Corporation, Canada‐3 (Note‐1)Total 14000.47 2628.13 16628.60Note‐1 Date <strong>of</strong> Maturity in case <strong>of</strong> amortised repayments represents the final maturity date.3.4 Maturity pr<strong>of</strong>ile <strong>and</strong> interest rate on Unsecured Bonds from Overseas Capital Market (classified as long term borrowing) <strong>and</strong> amountoutst<strong>and</strong>ing as on 30‐09‐2012 is set out below:Particulars Interest Rate Amount outst<strong>and</strong>ing( in Lakhs)Term <strong>of</strong>RepaymentDate <strong>of</strong>MaturityUS PP Bonds 2017 (USD 125 Million) 5.94%, Semi Annual 66075.00 Bullet Repayment 28‐Mar‐17Euro Dollar Bonds (USD 200 Million) 4.406%, Semi Annual 105720.00 Bullet Repayment 30‐Mar‐16Total 171795.003.5 Terms <strong>of</strong> Repayment <strong>of</strong> the Unsecured Rupee Term Loans from Banks <strong>and</strong> amount outst<strong>and</strong>ing as on 30‐09‐2012 is as follows:( in Lakhs)Name <strong>of</strong> Bank Rate <strong>of</strong> Interest Date <strong>of</strong>MaturityRepayment Non‐Current Current TotalIDBI Ltd. 8.50% Fixed 01‐Oct‐15 Quarterly 4166.94 1860.00 6026.94Total 4166.94 1860.00 6029.94Note‐1 Date <strong>of</strong> Maturity in case <strong>of</strong> amortised repayments represents the final maturity date.3.6 Terms <strong>of</strong> Repayment <strong>of</strong> the Unsecured Foreign Currency Loans (classified as long term borrowings) <strong>and</strong> amount outst<strong>and</strong>ing as on 30‐09‐2012 is as follows:( in Lakhs)Description Rate <strong>of</strong> Interest Date <strong>of</strong> Repay Non‐ Current TotalMaturity ment CurrentLoan From AFLAC‐2 Fixed, 2.90% 30‐Mar‐26 Bullet 19577.78 0.00 19577.78Loan From AFLAC‐1 Fixed, 2.85% 10‐Mar‐26 Bullet 77120.97 0.00 77120.97

Syndicated Foreign Currency Loan‐USD 200 MioSyndicated Foreign Currency Loan‐USD 350 MioSyndicated Foreign Currency Loan‐USD 450 MioSyndicated Foreign Currency Loan‐USD 100 Mio6M USDLIBOR+1.25%6M USDLIBOR+1.34%6M USDLIBOR+2.34%6M USDLIBOR+1.45%23‐Sep‐16 Bullet 105720.00 0.00 105720.0028‐Sep‐15 Bullet 185010.00 0.00 185010.0029‐Sep‐14 Bullet 237870.00 0.00 237870.0025‐Nov‐13 Bullet 52860.00 0.00 52860.00Total 678158.75 0.00 678158.754. Deferred Tax Liability (Net)Major components <strong>of</strong> Net Deferred Tax Liability are as under:Liability on account <strong>of</strong> difference between WDV as perIncome Tax Act, 196 <strong>and</strong> the Companies Act, 1956.As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009( in Lakhs)As at31‐03‐2008662915.07 621110.77 544025.78 494754.01 463774.53 438028.08Less: Deferred Tax Asset on account <strong>of</strong> Unabsorbed 339307.14 317972.36 273880.95 248048.45 238105.05 234718.00DepreciationLess: Deferred Tax Asset on account <strong>of</strong> MAT Credit 0.00 0.00 0.00 0.00 0.00 17830.00Less: Deferred Tax Asset on account <strong>of</strong> Provision <strong>for</strong> CSR 98.96 97.34 0.00 0.00 0.00 0.00ExpensesLess: Deferred Tax Asset on Misc. Expenditure to be 0.00 0.00 1.62 3.32 5.10 0.00written <strong>of</strong>fLess: Deferred Tax Asset on Account <strong>of</strong> Employee benefits 0.00 0.00 0.00 0.00 9.15 15.00Net Deferred Tax Liability 323508.97 303041.07 270143.21 246702.23 225655.23 185465.08Pursuant to the clarification issued by the Central Board <strong>of</strong> Direct Taxes (CBDT) vide their circular No. 2 dated 9 th February 2001, the Company,being the legal owner <strong>of</strong> the assets given on financial lease, continues to claim depreciation under the Income Tax Act, by adding back thedepreciation as per the Companies Act, on notional basis, as the leased assets are not capitalized in the books <strong>of</strong> account <strong>of</strong> the Company.Similarly, the WDV <strong>of</strong> assets under the Income Tax Act <strong>and</strong> as worked out as per the Companies Act, is considered <strong>for</strong> providing DTL.MAT Credit is not being recognised on consideration <strong>of</strong> prudence, as the Company does not expect to utilize the same during the period allowedunder the Income Tax Act.

5. Other Long Term <strong>Liabilities</strong>( in Lakhs)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008SecuredUnamortised Portion <strong>of</strong> Securitisation Gain 573.55 727.47 1302.24 2236.81 2734.64 0.00Amount payable to MOR on account <strong>of</strong> ERV 0.00 0.00 19708.41 14142.08 0.00 9721.06Total 573.55 727.47 21010.65 16378.89 2734.64 9721.066. Long Term Provisions( in Lakhs)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008Provision <strong>for</strong> Leave Encashment (Net) <strong>of</strong> funded assets 6.18 2.36 0.00 0.00 19.69 12.52Provision <strong>for</strong> Gratuity (Net) <strong>of</strong> funded assets 2.16 0.00 0.00 4.72 22.52 13.94Provision <strong>for</strong> Leave Travel Concession 2.10 1.70 1.06 1.01 0.00 0.00Total 10.44 4.06 1.06 5.73 42.21 26.467. Short Term Borrowings( in Lakhs)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008SecuredRupee Term Loans from Banks 0.00 14740.00 2325.00 0.00 50000.00 36350.000.00 14740.00 2325.00 0.00 50000.00 36350.00UnsecuredRupee Term Loans from Banks 50000.00 10800.00 0.00 144899.82 124616.00 194750.00Foreign Currency Term Loans 0.00 15025.40 0.00 0.00 0.00 0.0050000.00 25825.40 0.00 144899.82 124616.00 194750.00Total 50000.00 40565.40 2325.00 144899.82 174616.00 231100.008. Other Current <strong>Liabilities</strong>( in Lakhs)

As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008Current Maturities <strong>of</strong> Long Term Debts‐Bonds from Domestic Capital Market (Secured) 147863.33 207463.33 56443.33 184893.33 35493.33 157313.33‐Rupee Term Loans from Banks (Secured) 184870.01 77678.61 240459.91 102322.32 79457.31 90188.31‐Foreign Currency Term Loans (Secured) 2628.13 2532.18 2798.46 3500.60 5822.22 5878.09‐Bonds from Overseas Capital Market (Unsecured) 0.00 0.00 54911.79 0.00 66405.99 0.00‐Rupee Term Loans from Banks (Unsecured) 1860.00 1860.00 1860.00 1395.00 6121.78 9460.00‐Foreign Currency Term Loans (Unsecured) 0.00 0.00 0.00 56250.00 43570.00 36711.80Amount payable to MOR 1085470.31 0.00 0.00 0.00 8304.47 0.00Interest Accrued but not due 156800.89 132974.49 101931.57 82628.76 67999.06 54099.72Unamortised Securitisation Gain 379.66 574.77 1210.74 2125.72 3696.38 0.00Liability <strong>for</strong> Matured <strong>and</strong> Unclaimed Bonds / Interest 234.97 497.79 371.31 736.57 1153.68 5209.33Other Payables: 0.00Statutory Dues 1.61 1.33 1.30 1.26 0.93 0.68Tax Deducted at Source Payable 1757.52 1623.75 860.38 729.88 623.66 1501.02Dividend Tax 0.00 1622.25 1660.88 0.00 0.00 1699.50Others 344.37 424.00 1254.82 1589.88 1163.89 965.83Total 1582210.80 427252.50 463764.49 436173.32 319812.70 363027.619. Short Term Provisions( in Lakhs)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010As at31‐03‐2009As at31‐03‐2008Provision <strong>for</strong> Tax (NET <strong>of</strong> Taxes Paid) 0 622.65 739.23 0 0 0Provision <strong>for</strong> Interest Payable on Income Tax 0 0 0 0 0 0Provision <strong>for</strong> FBT 0 0 0 0 0Provision <strong>for</strong> CSR & SD 305.00 300.00 0 0 0 0Provision <strong>for</strong> Employee Benefits 3.02 2.24 1.03 0.60 1.19 17.71Total 308.02 924.89 740.26 0.60 1.19 17.7110. Fixed <strong>Assets</strong>

S.No.DESCRIPTIONAs at30-09-2012( in Lakhs)GROSS BLOCK ACCUMULATED DEPRECIATION NET BLOCKAs at March 31As atAs at March 31As atAs at March 3130-09-30-09-2012 2011 2010 2009 2008 2012 2012 2011 2010 2009 2008 2012 2012 2011 2010 2009 2008Tangible<strong>Assets</strong>Office1.Building 1,524.23 1,524.23 1,524.23 1,524.23 1,524.23 1,524.23 287.24 274.82 249.97 225.13 200.28 175.43 1,236.99 1,249.41 1,274.26 1,299.10 1,323.95 1,348.80Airconditioners,2. Room19.12 18.72 18.02 18.02 18.02 17.29 9.63 9.18 8.39 7.53 6.66 5.81 9.49 9.54 9.63 10.49 11.36 11.48Coolers,HeatersOffice3.Equipments 26.70 19.87 18.89 17.73 15.05 13.77 8.43 8.12 7.23 6.24 5.01 4.65 18.27 11.75 11.66 11.49 10.04 9.12Furniture &4.Fixtures 84.68 84.68 82.28 82.19 82.19 82.19 62.28 59.66 54.49 49.26 44.09 38.94 22.40 25.02 27.79 32.93 38.10 43.25Franking5.Machine 0.68 0.68 0.68 0.68 0.68 1.30 0.15 0.13 0.09 0.06 0.03 0.61 0.53 0.55 0.59 0.62 0.65 0.696. Computer50.01 48.62 46.37 44.57 55.99 50.76 38.43 39.39 37.60 35.05 46.49 49.93 11.58 9.23 8.77 9.52 9.50 0.837. Motor Car10.24 7.01 7.01 7.01 7.01 7.01 3.61 6.14 5.73 5.33 4.92 4.71 6.63 0.87 1.28 1.68 2.09 2.308.PhotoCopier 1.90 1.90 1.90 2.35 2.35 2.35 0.33 0.28 0.19 0.54 0.43 0.32 1.57 1.62 1.71 1.81 1.92 2.039.WaterCooler 0.29 0.29 0.29 0.29 0.29 0.29 0.14 0.13 0.11 0.10 0.09 0.08 0.15 0.16 0.18 0.19 0.20 0.2110. Electrical-Installation 1.80 1.80 1.80 1.80 1.80 1.80 0.82 0.78 0.69 0.61 0.52 0.43 0.98 1.02 1.11 1.19 1.28 1.37Total1,719.65 1,707.80 1,701.47 1,698.87 1,707.61 1,700.99 411.04 398.61 364.49 329.85 308.52 280.91 1,308.61 1,309.19 1,336.98 1,369.02 1,399.09 1,420.08Intangible<strong>Assets</strong>1.ComputerS<strong>of</strong>tware 1.92 - - - - - 0.19 - - - - - 1.73 - - - - -Total1.92 - - - - - 0.19 - - - - - 1.73 - - - - -

Total Fixed<strong>Assets</strong> 1,721.57 1,707.80 1,701.47 1,698.87 1,707.61 1,700.99 411.23 398.61 364.49 329.85 308.52 280.91 1,310.34 1,309.19 1,336.98 1,369.02 1,399.09 1,420.0811. Non Current Investments (At Cost)As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Investments (Unquoted Non‐Trade)Investments in EquityEquity Shares <strong>of</strong> IRCON International Ltd. 199.85 199.85 199.85 199.85 199.85 199.85Other InvestmentsSenior Pass Through Certificates 'D' to 'W' Series <strong>of</strong> 1160.16 1258.07 1467.83 0 0 0NOVO X Trust LocomotivesAggregate Value <strong>of</strong> Unquoted Investments 1360.01 1457.92 1667.68 199.85 199.85 199.8512. Long Term Loans & AdvancesAs at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Secured Considered GoodHouse Building Advance 0.55 0.67 0.91 1.15 1.28 1.40Loan to Pipavav Railway Corporation Ltd. 0.00 0.00 1026.65 1411.65 1924.98 2566.63Unsecured Considered GoodCapital Advances‐ Advance to FA & CAO 253.01 253.01 253.01 253.01 253.01 253.01‐ Advance to Indian Railways <strong>for</strong> Projects 218473.00 210136.50 0 0 0 0Lease Receivables from Ministry <strong>of</strong> Railways 5466250.23 4937876.72 4039333.33 3396285.71 2779958.40 2353357.63Security Deposits 12.91 10.86 9.28 8.97 9.06 9.06Loan to Railtel Corporation <strong>of</strong> India Ltd. 0.00 0.00 2080.00 4164.00 6248.00 8332.00Loan to Rail Vikas Nigam Ltd. 165135.84 172931.67 174650.00 174716.67 145783.33 120800.00Advance to Employees 1.25 1.76 1.84 0.64 0 0Funded <strong>Assets</strong> (Net) on account <strong>of</strong> Gratuity/LeaveEncashment0.00 2.36 5.08 9.04 0 0

TDS & Advance Tax (Net <strong>of</strong> Provisions) 7032.75 0 0 1942.29 5604.21 3843.75Amount Recoverable from MOR on account <strong>of</strong>107767.04 76414.12 0 0 21845.17 0Exchange Rate VariationLease Rentals Paid in Advance 12873.38 15704.72 20961.77 25712.98 30008.49 40348.06Interest Restructuring Advance to IDBI 15.11 23.81 48.21 83.34 130.72 194.33Interest Restructuring Advance to LIC 3.98 8.16 42.85 109.32 213.59 362.54Foreign Currency Monetary Item Translational0 0 0 0 388.11 0Difference AccountTotal 5977819.05 5413364.36 4238412.93 3604698.77 2992368.35 2530068.4113. Other Non Current <strong>Assets</strong>ParticularsAs at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Unsecured Considered GoodInterest Accrued but not due on Loans 44727.26 44027.14 40514.05 34610.12 26928.60 16385.74Interest Accrued on Investment in Pass Through175.00 123.49 2.94 0.00 0.00 0.00CertificatesInterest Accrued on Advances to Employees 1.20 1.31 1.00 0.68 0.49 0.00Total 44903.46 44151.94 40517.99 34610.80 26929.09 16385.7414. Cash & Cash EquivalentsAs at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Balance with Banks‐ In Current Accounts 184.23 185.88 90.68 105.99 44.09 8.97‐ In Term Deposit Accounts 394086.00 153911.00 48937.00 149976.00 100075.00 145000.00Deposit with Reserve Bank <strong>of</strong> India1.02 1.02 1.02 1.02 1.02 1.02‐In Public Deposit AccountOther Bank Balance‐ In Interest / Redemption Accounts 234.97 497.79 371.31 736.57 1153.68 5209.33

Balance in Franking Machine 0.34 0.44 0.43 0.00 0.19 0.09Total 394506.56 154596.13 49400.44 150819.58 101273.98 150219.4115. Short Term Loans & AdvancesAs at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Unsecured Considered GoodBridge Loan to Rail L<strong>and</strong> Development Authority 0 0 0 0 0 6600.00Deposit with NCRDC New Delhi 4.38 4.38 4.38 4.38 0 0Security Deposits 300.00 301.80 0 0.18 0 0Amount Recoverable from MOR 0.00 13120.88 1859.81 14310.22 0 20176.57Advance to Bank <strong>for</strong> the interest payment on Bonds 5.26 5.26 5.26 0 0 2000.00Tax Refund Receivable 1746.82 1746.82 3418.31 20.64 20.64 20.64Interest Recoverable from IT Department 0 0 202.03 0 1349.10 0Amount Recoverable from Others 3.63 2.21 13.41 1.45 28.00 107.46Prepaid Expenses 194.87 33.38 25.20 27.91 27.72 42.81Advance to Employees 2.61 0.30 0.26 0.47 13.93 0.8116. Other Current <strong>Assets</strong>Total 2257.57 15215.03 5528.66 14365.25 1439.39 28948.29As at30‐09‐2012As at31‐03‐2012As at31‐03‐2011As at31‐03‐2010( in Lakhs)As at As at31‐03‐2009 31‐03‐2008Current Maturities <strong>of</strong> Long Term Loans <strong>and</strong> AdvancesLease Receivables from Ministry <strong>of</strong> Railways 385871.88 344832.61 276483.82 221982.00 174886.00 154171.00Loan to Rail Vikas Nigam Ltd 14050.00 12508.33 10066.67 8066.66 4316.67 0.00Loan to Rail Tel Corporation <strong>of</strong> India Ltd 1038.00 2080.00 2084.00 2084.00 2084.00 2084.00Loan to Pipavav Railway Corporation Ltd 0 0 385.00 513.33 641.65 513.33Loan to MOF 0 0 0 0 0 1775.80House Building Advance 0.24 0.24 0.24 0.13 0.12 0.12

Advance to Employees 1.05 1.16 0.80 0.34 0.00 0Amount Recoverable from MOR on account <strong>of</strong>402.60 344.70 156.30 559.14 105.67 16.80Exchange Rate VariationFunded (Net) on account <strong>of</strong> Gratuity / Leave0 0 1.03 0.00 0.00 0.00EncashmentInterest Accrued but not due on Loans & Deposits 15430.17 12205.33 9105.17 8470.64 9099.43 6403.68Lease Rentals Paid in Advance 5526.99 5257.05 4751.21 4295.51 10339.57 18603.45Interest Restructuring Advance to IDBI 19.64 24.40 35.14 47.38 63.61 108.15Interest Restructuring Advance to LIC 21.11 34.70 66.47 104.27 148.94 201.51Foreign Currency Monetary Item Translation Diff.0 0 0 118.27 3021.36 0AccountShare Registration Charges Capitalised 0 0 0 0 0 20.00Current Maturity <strong>of</strong> InvestmentsSenior Pass Through Certificates 'D' to 'W' Series <strong>of</strong>200.39 209.76 229.89 0 0 0NOVO X Trust LocomotivesTotal 422562.07 377498.28 303365.74 246241.67 204707.02 183897.8417. Revenue from OperationsHalf Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009( in Lakhs)Year ended31‐03‐2008Lease Income:‐ On Finance Lease Transactions 242444.53 421437.65 349198.78 307376.10 272645.17 237433.61Interest Income from:‐ Loans 10367.57 20615.46 20128.29 17249.31 14141.74 12044.65‐ Deposits 15547.30 20783.08 12478.05 18736.32 14547.00 8748.17‐ Investments 71.98 147.24 3.40 0 0.00 0.0025986.85 41545.78 32609.74 35985.63 28688.74 20792.82Other Financial Services‐ Gain on <strong>Assets</strong> Securitization 349.03 1210.74 2135.28 3898.71 936.72 2778.41

18. Other IncomeTotal 268780.41 464194.17 383943.80 347260.44 302270.63 261004.84Half Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009( in Lakhs)Year ended31‐03‐2008Dividend Income 0.00 13.18 10.20 7.54 7.32 64.47Interest on Income Tax Refund 0.00 8.42 202.03 0.00 0.00 0.00Provisions written back 49.66 95.22 4.27 9.43 4.29 4.16Pr<strong>of</strong>it on sale <strong>of</strong> Fixed <strong>Assets</strong> 0.14 0.00 0.02 0.17 0.00 0.00Total 49.80 116.82 216.52 17.14 11.61 68.6319. Employee BenefitsHalf Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009( in Lakhs)Year ended31‐03‐2008Salaries, Incentives etc. 89.31 165.23 194.07 132.88 132.15 73.08Contribution to Provident <strong>and</strong> Other Funds 19.85 22.94 8.48 19.88 33.10 19.99Staff Welfare Expenses 0.61 0.05 0.03 2.74 0.89 2.3920. Finance CostTotal 109.77 188.22 202.58 155.50 166.14 95.46Half Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009( in Lakhs)Year ended31‐03‐2008Amortisation <strong>of</strong> Lease Rentals paid in advance 2561.41 4751.21 4295.51 10339.57 18603.45 16749.39Interest on Bonds 148083.22 265023.03 208832.57 164486.38 119454.65 85989.00Interest on Rupee Term Loans 24108.51 53571.69 51453.46 60066.58 70516.05 74943.18Interest <strong>and</strong> Swap Cost on Foreign Currency Loans 16043.44 31055.76 19831.20 19554.06 19620.24 19749.96

Interest on delayed payment to MOR 13967.69 1065.60 2680.41 1650.62 6688.68 346.28Interest Payable to Income Tax Authorities 28.47 69.36 103.87 0 0 0Bond Issue Expenses / Expenses on Raising <strong>of</strong> Loans 101.12 5674.14 6085.36 9342.77 969.25 177.71Bond/Loan/Securitization Servicing Expenses 145.58 405.74 215.25 197.73 185.38 152.28Exchange Rate Variation on Foreign Currencytransaction (Gain)/LossAmortisation <strong>of</strong> Foreign Currency Monetary ItemTranslational Diff. A/c21. Other Expenses366.79 421.97 (4.85) (1116.10) ‐195.85 ‐1405.000 0 181.04 3455.15 0 0Total 205406.23 362038.50 293673.82 267976.76 235841.85 196702.80Half Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009( in Lakhs)Year ended31‐03‐2008Filing Fee 0.10 0.38 0.70 0.21 0.10 0.03Legal & Pr<strong>of</strong>essional Charges 30.96 69.85 56.68 67.22 57.65 43.69Commission / Brokerage 0.59 0.77 0 0 0.00 0.00Advertisement & Publicity 7.64 14.24 25.72 7.26 18.53 13.65Printing & Copying Charges 0.84 5.12 3.51 4.40 2.49 3.45Stationery Charges 3.73 7.64 7.30 5.41 5.28 4.23News Paper, Books & Periodicals 1.13 0.69 0.20 0.72 0.68 0.32Conveyance Expenses 4.92 11.68 13.40 9.68 8.00 6.49Travelling – Local‐ Directors 9.75 9.01 9.18 9.16 10.37 8.64‐ Others 5.34 7.55 10.75 6.85 11.64 9.41Travelling – Foreign‐ Directors 10.62 14.51 35.30 20.38 30.27 4.82‐ Others 6.17 13.56 51.35 7.90 6.10 5.85Transport Hire Charges 13.69 22.48 22.69 29.83 22.30 21.64

Office Maintenance Expenses 20.25 39.72 34.08 26.43 22.91 24.84Vehicle Running & Maintenance 1.95 2.50 2.00 1.49 2.54 1.67Office Equipment Maintenance 4.37 7.41 7.77 5.84 6.34 7.50Electricity Charges 8.36 11.30 7.44 9.53 9.54 9.77Loss on Sale <strong>of</strong> Fixed <strong>Assets</strong> 0.00 1.49 0.81 0.00 0.61 0.95Postage Charges 0.68 4.47 4.06 5.07 2.23 1.65Telephone Charges 3.88 7.46 11.75 10.21 8.24 8.16Training Expenses 6.71 1.20 2.46 10.71 4.95 4.44Bank Charges 0.89 3.23 0.36 0.13 0.36 0.01Payment to Auditors‐ Audit Fees 3.79 7.51 4.96 2.48 2.48 3.37‐ Tax Audit Fee 0.00 1.26 1.66 0.83 0.83 1.04‐ Quarterly Review 2.08 3.76 4.96 2.48 2.48 3.37‐ Other Certification etc. 0.00 6.89 5.76 0.11 0.77 0.98‐ Reimbursement <strong>of</strong> Expenses 0.00 1.61 1.43 0.85 0.31 0.08Miscellaneous Expenses 8.49 25.79 19.86 17.43 20.71 25.30Insurance 0.05 0.06 0.29 0.18 0.25 0.10Fees & Subscription 0.68 2.95 16.09 3.12 2.21 8.03Sponsorship/Donation 0.00 0.66 0.60 0.65 200.75 6.55Stipend 0.49 0.30 0.55 0.30 0.10 0.00Ground Rent 0.43 1.15 1.15 1.15 1.01 1.24Property Tax 0.98 1.96 1.96 1.31 1.31 1.31Corporate Social Responsibility 150.00 301.25 24.96 0.00 0.00 0.00Sustainable Development 50.00 100.00 22.57 0.00 0.00 0.00Prior Period Adjustment 5.60 18.81 0 12.28 4.44 166.73Total 365.16 730.22 414.31 281.60 468.78 399.32

22. Earnings Per ShareHalf Yearended30‐09‐2012Year ended31‐03‐2012Year ended31‐03‐2011Year ended31‐03‐2010Year ended31‐03‐2009Year ended31‐03‐2008Basic EPSNet Pr<strong>of</strong>it ( in Lakhs) 29926.31 48078.17 48520.40 44269.07 18079.16 42151.33Weighted Average Number <strong>of</strong> Equity shares 23520000 16935301 13374000 8000658 5000000 5000000outst<strong>and</strong>ingEarnings Per Share () – Basic [Face value <strong>of</strong> 1,000/‐ 127.24 283.89 362.80 553.32 361.58 843.03per share]Diluted EPSNet Pr<strong>of</strong>it ( in Lakhs) 29926.31 48078.17 48520.40 44269.07 18079.16 42151.33Weighted Average Number <strong>of</strong> Equity shares 23520000 16935301 13374000 8000658 5000000 5000000outst<strong>and</strong>ingAdd: Number <strong>of</strong> Potential Equity Shares on account <strong>of</strong>0 6831 0 0 16438 0receipt <strong>of</strong> Share Application Money Pending AllotmentWeighted Average Number <strong>of</strong> Equity shares (including 23520000 16942132 13374000 8000658 5016438 5000000Dilutive Equity Share) outst<strong>and</strong>ingEarnings Per Share () – Diluted [Face value <strong>of</strong> 1,000/‐ per share]127.24 283.78 362.80 553.32 360.40 843.03

Significant Accounting policies <strong>and</strong> Other Notes on AccountsA. Significant Accounting PoliciesHalf Year Ended 30 th September, 2012Annexure – VI. Basis <strong>for</strong> preparation <strong>of</strong> Financial <strong>Statement</strong>sa) The financial statements are prepared under the historical cost convention, in accordance withthe Generally Accepted Accounting Principles, provisions <strong>of</strong> the Companies Act, 1956 <strong>and</strong> theapplicable guidelines issued by the Reserve Bank <strong>of</strong> India as adopted consistently by theCompany.b) Use <strong>of</strong> EstimatesPreparation <strong>of</strong> financial statements in con<strong>for</strong>mity with Generally Accepted Accounting Principlesrequires Management to make estimates <strong>and</strong> assumptions that affect the reported amounts <strong>of</strong>asset <strong>and</strong> liabilities, disclosure <strong>of</strong> contingent assets <strong>and</strong> liabilities at the date <strong>of</strong> the financialstatements <strong>and</strong> the reported amounts <strong>of</strong> revenue <strong>and</strong> expenses during the reporting period.Examples <strong>of</strong> such estimates include estimated useful life <strong>of</strong> fixed assets <strong>and</strong> estimated useful life<strong>of</strong> leased assets. The Management believes that estimates used in the preparation <strong>of</strong> financialstatements are prudent <strong>and</strong> reasonable. Actual results could differ from these estimates.Adjustments as a result <strong>of</strong> differences between actual <strong>and</strong> estimates are made prospectively.II. Revenue Recognitiona) Lease Income in respect <strong>of</strong> assets given on lease (including assets given prior to 01‐04‐2001) isrecognised in accordance with the accounting treatment provided in Accounting St<strong>and</strong>ard ‐19.b) Lease Rentals on assets taken on lease <strong>and</strong> sub‐leased to Ministry <strong>of</strong> Railways (MOR) prior to01.04.2001, are accounted <strong>for</strong> at the rates <strong>of</strong> lease rentals provided in the agreements with therespective lessors <strong>and</strong> the sub‐lessee (MOR), on accrual basis, as per the Revised Guidance Noteon accounting <strong>for</strong> Leases issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India (ICAI).c) Interest Income is recognised on time proportion basis. Dividend Income is recognised when theright to receive payment is established.d) Income relating to non per<strong>for</strong>ming assets is recognised on receipt basis in accordance with theguidelines issued by the Reserve Bank <strong>of</strong> India.III. Foreign Currency Transactionsa) Initial RecognitionInitial recognition is done at the rates prevailing on the date <strong>of</strong> transaction:i) <strong>for</strong> acquisition <strong>of</strong> assets, <strong>and</strong>ii) <strong>for</strong> interest payment on Loans, Commitment Charges <strong>and</strong> expenses.b) Recognition at the end <strong>of</strong> Accounting PeriodForeign Currency monetary assets <strong>and</strong> liabilities, other than the <strong>for</strong>eign currency liabilitiesswapped into Indian Rupees, are reported using the closing exchange rate in accordance with

the provisions <strong>of</strong> Accounting St<strong>and</strong>ard – 11 (AS 11) issued by the Institute <strong>of</strong> CharteredAccountants <strong>of</strong> India.Foreign Currency <strong>Liabilities</strong> swapped into Indian Rupees are stated at the reference rates fixed inthe swap transactions, <strong>and</strong> not translated at the year end rate.c) Exchange Differencesi) Exchange differences arising on the actual settlement <strong>of</strong> monetary assets <strong>and</strong> liabilities atrates different from those at which they were initially recorded during the year, or reportedin previous financial statements, other than the exchange differences on settlement <strong>of</strong><strong>for</strong>eign currency loans <strong>and</strong> interest thereon recoverable separately from the lessee underthe lease agreements, are recognised as income or expenses in the year in which they arise.ii) Notional exchange differences arising on reporting <strong>of</strong> outst<strong>and</strong>ing monetary assets <strong>and</strong>liabilities at rates different from those at which they were initially recorded during the year,or reported in previous financial statements, other than the exchange differences ontranslation <strong>of</strong> such monetary assets <strong>and</strong> liabilities recoverable separately from the lesseeunder the lease agreement, are recognised as income or expenses in the year in which theyarise.iii) In respect <strong>of</strong> <strong>for</strong>ward exchange contracts, the difference between the <strong>for</strong>ward rate <strong>and</strong>exchange rate on the date <strong>of</strong> transaction are recognised as income or expenses over the life<strong>of</strong> the contract.IV. InvestmentsInvestments are classified into long term investments <strong>and</strong> current investments based on intent<strong>of</strong> Management at the time <strong>of</strong> making the investment. Investments intended to be held <strong>for</strong>more than one year, are classified as long‐term investments.Current investments are valued at the lower <strong>of</strong> the cost or the market value. Long‐terminvestments are valued at cost unless there is diminution, other than temporary, in their value.V. Leased <strong>Assets</strong>Lease arrangements where the risks <strong>and</strong> rewards incidental to ownership <strong>of</strong> an assetsubstantially vest with the lessee, are recognised as financial leases <strong>and</strong> are shown asReceivable in the Balance Sheet at an amount equal to the net investment in the lease, inaccordance with Accounting St<strong>and</strong>ard ‐19 ‘Leases’ issued by the Institute <strong>of</strong> CharteredAccountants <strong>of</strong> India.VI. Fixed <strong>Assets</strong>Fixed assets are stated at cost, less accumulated depreciation. Cost includes all expensesincurred to bring the assets to their present location <strong>and</strong> condition.Depreciation on fixed assets is charged on straight line method at the rates prescribed inSchedule XIV to the Companies Act, 1956, on pro‐rata basis.VII. (a) Securitisation <strong>of</strong> Lease ReceivablesLease Receivables securitised out to Special Purpose Vehicle in a securitisation transaction arede‐recognised in the balance sheet when they are transferred <strong>and</strong> consideration has beenreceived by the Company. In terms <strong>of</strong> the guidelines on Securitisation <strong>of</strong> St<strong>and</strong>ard <strong>Assets</strong> issued

y the Reserve Bank <strong>of</strong> India vide their circular no. DBOD.No.B.P.BC.60/21.04.048/2005‐06dated 1 st February 2006, the Company amortises any pr<strong>of</strong>it arising from the securitisation overthe life <strong>of</strong> the Pass Through Certificates (PTCs) / Securities issued by the Special Purpose Vehicle(SPV). Loss, if any, is recognised immediately in the Pr<strong>of</strong>it & Loss Account.Further, in terms <strong>of</strong> Draft Guideline on minimum holding period <strong>and</strong> minimum retentionrequirement <strong>for</strong> securitisation transaction undertaken by NBFCs dated June 3, 2010, thecompany has opted <strong>for</strong> investment in SPV’s equity tranche <strong>of</strong> minimum 5% <strong>of</strong> the book value <strong>of</strong>loan being securitised.(b) Assignment <strong>of</strong> Lease ReceivablesLease Receivables assigned through direct assignment route are de‐recognised in the balancesheet when they are transferred <strong>and</strong> consideration has been received by the Company. Pr<strong>of</strong>it orloss resulting from such assignment is accounted <strong>for</strong> in the year <strong>of</strong> transaction.VIII. Bond Issue Expenses <strong>and</strong> Expenses on Loans, Leases <strong>and</strong> Securitisation Transactiona) Bond Issue expenses including management fee on issue <strong>of</strong> bonds (except discount on deepdiscount bonds) are charged to Pr<strong>of</strong>it <strong>and</strong> Loss Account in the year <strong>of</strong> occurrence. Upfrontdiscount on deep discount bonds is amortised over the tenor <strong>of</strong> the bonds.b) Documentation, processing & other charges paid on Long Term Loans are charged to the Pr<strong>of</strong>it& Loss Account in the year loan is availed.c) Incidental expenses incurred in connection with the Securitisation transaction executed duringthe year are charged to the Pr<strong>of</strong>it <strong>and</strong> Loss Account.IX. Taxes on IncomeTax expense comprises Current Tax <strong>and</strong> Deferred Tax.Provision <strong>for</strong> current income tax is made in accordance with the provisions <strong>of</strong> the Income TaxAct, 1961.Deferred tax expense or benefit is recognised on timing differences, being the differencebetween taxable incomes <strong>and</strong> accounting income, that originate in one period <strong>and</strong> are capable<strong>of</strong> reversal in one or more subsequent periods. Deferred tax assets <strong>and</strong> liabilities are measuredusing the tax rates <strong>and</strong> tax laws that have been enacted or substantively enacted by the balancesheet date.X. Employee BenefitsEmployee Benefits are valued <strong>and</strong> disclosed in the Annual Accounts in accordance withAccounting St<strong>and</strong>ard ‐15 (Revised):a) Short‐term employee benefits are recognised as an expense at the undiscounted amount inthe Pr<strong>of</strong>it & Loss Account <strong>of</strong> the year in which the employees have rendered services entitlingthem to contributions.b) Long‐term employee benefits are recognised as an expense in the Pr<strong>of</strong>it & Loss Account <strong>for</strong>the year in which the employee has rendered services. The expense is recognised at thepresent value <strong>of</strong> the amount payable as per actuarial valuations. Actuarial gain <strong>and</strong> losses inrespect <strong>of</strong> such benefits are recognised in the Pr<strong>of</strong>it <strong>and</strong> Loss Account.XI. Provisions, Contingent <strong>Liabilities</strong> <strong>and</strong> Contingent <strong>Assets</strong>

The Company recognises provisions when it has a present obligation as a result <strong>of</strong> a past event.This occurs when it becomes probable that an outflow <strong>of</strong> resources embodying economicbenefits might be required to settle the obligation <strong>and</strong> when a reliable estimate <strong>of</strong> the amount<strong>of</strong> the obligation can be made.Provisions are determined based on Management estimate required to settle the obligation atthe balance sheet date. These are reviewed at each balance sheet date <strong>and</strong> adjusted to reflectthe current management estimates. In cases, where the available in<strong>for</strong>mation indicates that aloss on the contingency is reasonably possible but the amount <strong>of</strong> loss cannot be reasonablyestimated, a disclosure is made in the financial statements.Contingent <strong>Assets</strong>, if any, are not recognised in the financial statements since this may result inthe recognition <strong>of</strong> income that may never be realised.XII.Borrowing CostsBorrowing Cost (net <strong>of</strong> any income on the temporary investments <strong>of</strong> these borrowings)attributable to acquisition, construction or production <strong>of</strong> qualifying assets are capitalized as part<strong>of</strong> the cost till the assets are ready <strong>for</strong> use. Any recovery from the prospective lessee (MOR) <strong>of</strong>these assets is reduced from the cost <strong>of</strong> the qualifying assets. Other borrowing costs arerecognized as expense in the period in which they are incurred.B. Other Notes on Accounts1.(a) As per the St<strong>and</strong>ard Lease Agreement between the Company (Lessor) <strong>and</strong> MOR (Lessee), theleased assets are reckoned to be acquired <strong>and</strong> placed on line from the first day <strong>of</strong> the month <strong>of</strong>their acquisition. As such, lease rental is charged on the assets leased from the first day <strong>of</strong> themonth in which the assets have been identified <strong>and</strong> placed on line.(b) Ministry <strong>of</strong> Railways (MOR) charges interest on the value <strong>of</strong> the assets identified prior to thepayments made by the company, from the first day <strong>of</strong> the month in which the assets have beenidentified <strong>and</strong> placed on line to the first day <strong>of</strong> the month in which the money is paid to theMOR.(c) No interest is paid by the MOR on the amount paid by the Company in excess <strong>of</strong> the value <strong>of</strong>Rolling Stock assets identified by them on monthly basis.(d) During the half year ended 30 th September 2012, the assets have been assumed as acquired <strong>and</strong>put on line by MOR on monthly pro‐rata basis <strong>of</strong> the total m<strong>and</strong>ated amount <strong>of</strong> Rs. 1489600Lakhs <strong>for</strong> FY 2012‐13. Thus, the total assets assumed as acquired <strong>and</strong> leased out to MOR duringthe half year ended 30 th September 2012 is Rs. 744800 Lakhs on which lease income <strong>of</strong> Rs.17378 Lakhs has accrued to the Company.(e) Against the acquisition <strong>of</strong> assets <strong>of</strong> Rs. 744800 Lakhs during the half year ended 30 th September2012, the actual amount <strong>of</strong> funds transferred by the Company to MOR is Rs. 109640 Lakhs. TheCompany has accounted <strong>for</strong> interest expenditure <strong>of</strong> Rs. 13968 Lakhs payable to MOR due toshort transfer <strong>of</strong> funds during the half year period.

(f) (i) Interest rate variation on the floating rate linked rupee borrowings <strong>and</strong> interest rate <strong>and</strong>exchange rate variations on interest payments in case <strong>of</strong> the <strong>for</strong>eign currency borrowings areadjusted against the Lease Income in terms <strong>of</strong> the variation clauses in the lease agreementsexecuted with the Ministry <strong>of</strong> Railways. During the half year, such differential has resulted in anamount <strong>of</strong> Rs. 4522 Lakhs accruing to the company (P.Y. Rs. 7578 Lakhs), which has beenaccounted <strong>for</strong> in the Lease Income.(ii) In respect <strong>of</strong> <strong>for</strong>eign currency borrowings, which have not been hedged, variation clause havebeen incorporated in the lease agreements specifying notional swap cost adopted <strong>for</strong> workingout the cost <strong>of</strong> funds on the leases executed with MOR. Swap cost in respect <strong>of</strong> these <strong>for</strong>eigncurrency borrowings is compared with the amount recovered by the company on such account<strong>and</strong> accordingly, the same is adjusted against the lease income. During the half year ended 30thSeptember, 2012 in respect <strong>of</strong> these <strong>for</strong>eign currency borrowings, the company has recovered asum <strong>of</strong> Rs. 5563 Lakhs (P.Y. Rs. 11133 Lakhs) on this account from MOR against the actual swapcost payments <strong>of</strong> Rs. NIL (P.Y. Rs. 2203 Lakhs). After adjusting swap cost, an amount <strong>of</strong> Rs. 5563Lakhs has been refunded to MOR (P.Y. Rs. 8930 Lakhs refunded to MOR).(iii) Interest expense in respect <strong>of</strong> interest accrued but not due on <strong>for</strong>eign currency loans hasbeen considered at base interest / exchange rate <strong>and</strong> the difference on account <strong>of</strong> variationbetween base rate <strong>and</strong> the rate prevailing on the reporting date has been shown as recoverable/ payable to MOR. During the current year, the amount payable to MOR on such account worksout to Rs. 40 Lakhs (P.Y. Rs. 453 Lakhs).2.(a) The Reserve Bank <strong>of</strong> India has issued Non‐Banking Financial (Non‐Deposit Accepting or Holding)Companies Prudential Norms (Reserve Bank) Directions, 2007 vide notification no.DNBS.193DG(VL)‐2007 dated 22 nd February 2007. The Company, being a Government Company <strong>and</strong> notaccepting / holding public deposits, these Directions, except the provisions contained inParagraph 19 there<strong>of</strong>, are not applicable to the Company. Further, Reserve Bank <strong>of</strong> India (RBI)vide letter dated 19 th March 2010 has sought a road map from the Company <strong>for</strong> compliancewith the prudential norms issued by RBI. The Company has asked <strong>for</strong> certain clarifications fromRBI after which road map <strong>for</strong> complying with RBI prudential norms will be submitted.(b) In terms <strong>of</strong> Reserve Bank <strong>of</strong> India Notification No.DNBC.138/CGM (VSNM) – 2000 dated 13 thJanuary 2000, provisions <strong>of</strong> Section 45 IC <strong>of</strong> the Reserve Bank <strong>of</strong> India Act, 1934 (2 <strong>of</strong> 1934)regarding creation <strong>of</strong> Reserve Fund, do not apply to the Company.(c) In terms <strong>of</strong> Ministry <strong>of</strong> Corporate Affairs (MCA) circular no.9/2002 dated 18th April, 2002, theCompany, being a Non‐Banking Finance Company registered with RBI, is required to create BondRedemption Reserve equivalent to 50% <strong>of</strong> the value <strong>of</strong> the bonds raised through Public issue.The Company has raised Rs.626889 Lacs through public issue <strong>of</strong> tax free bonds in FY 2011‐12.Accordingly, the entire pr<strong>of</strong>it <strong>of</strong> <strong>for</strong> the half year ended 30th September, 2012 has beentransferred to Bond Redemption Reserve.3. The Finance Act, 2001 provides <strong>for</strong> levy <strong>of</strong> service tax on the finance <strong>and</strong> interest chargesrecovered through lease rental installments on the Financial Leases entered on or after 16‐07‐2001. The Central Government vide Order No.1/1/2003‐ST dated 30 th April 2003 <strong>and</strong>subsequent clarification dated 15‐12‐2006 issued by Ministry <strong>of</strong> Finance has exempted the Lease

Agreements entered between the Company <strong>and</strong> Ministry <strong>of</strong> Railways from levy <strong>of</strong> Service Taxthereon.With the introduction <strong>of</strong> Finance Act 2012, the Government <strong>of</strong> India (GOI) has introduced theconcept <strong>of</strong> negative list. Besides, specifically exempted services do not attract service tax.Services being provided by IRFC are not covered under negative list <strong>and</strong> exempted servicesnotifications. However, the Finance Ministry has not withdrawn the above said exemptionorder. As the St<strong>and</strong>ard Lease Agreements provide that Service Tax, if any, payable by theCompany is recoverable from MOR, the Company has brought out the above facts to the notice<strong>of</strong> MOR <strong>for</strong> further necessary action, if any.4. Increase in liability due to exchange rate variation on <strong>for</strong>eign currency loans <strong>for</strong> purchase <strong>of</strong>leased assets, amounting to Rs. 31607 Lakhs (P.Y. Rs. 96534 Lakhs) has not been charged to<strong>Statement</strong> <strong>of</strong> Pr<strong>of</strong>it <strong>and</strong> Loss as the same is recoverable from the Ministry <strong>of</strong> Railways (lessee)separately as per lease agreements. The exchange rate variation on <strong>for</strong>eign currency loansrepaid during the year amounting to Rs. 196 Lakhs (P.Y. Rs. 223 Lakhs) has been recovered fromthe Lessee, leaving a balance <strong>of</strong> Rs. 108170 Lakhs recoverable from MOR as on 31‐03‐2012 (P.Y.Rs. 76759 Lakhs).5. Advance given to Railways <strong>for</strong> Railway Projects amounting to Rs. 218473.00 Lakhs (PY Rs.210136.50 Lakhs) is inclusive <strong>of</strong> Capitalized Interest <strong>and</strong> Finance Charges (net) <strong>of</strong> Rs. 10623.57lakhs (PY Rs. 2287.07 lakhs) accrued till the Balance Sheet date.6. Derivative InstrumentsThe Company judiciously contracts financial derivative instruments in order to hedge currency<strong>and</strong> / or interest rate risk. All derivative transactions contracted by the company are in thenature <strong>of</strong> hedging instruments with a defined underlying liability. The company does not deployany financial derivative <strong>for</strong> speculative or trading purposes.a. In respect <strong>of</strong> certain <strong>for</strong>eign currency borrowings, the company has executed currency swaps tohedge the exchange rate variation risk on the principal outst<strong>and</strong>ing. The outst<strong>and</strong>ing position <strong>of</strong>such currency swaps as at 30 th September 2012 is as follows:In respect <strong>of</strong> following External Commercial Borrowings, the Company has executed currencyswap to hedge the <strong>for</strong>eign exchange exposure in respect <strong>of</strong> both principal outst<strong>and</strong>ing <strong>and</strong>interest payments:In respect <strong>of</strong> following External Commercial Borrowings, the Company has executed crosscurrency swap to hedge the <strong>for</strong>eign exchange exposure in respect <strong>of</strong> both principal outst<strong>and</strong>ing<strong>and</strong> interest payments <strong>and</strong> converted its underlying liability from one <strong>for</strong>eign currency toanother:As at 30‐09‐2012 As at 31‐03‐2012No. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inForeign CurrencyNotional USDEquivalentNo. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inForeign CurrencyNotionalUSDEquivalent1 JPY 12 Billion 145.90 Million 1 JPY 12 Billion 145.90Million