ANNEXURE TO AUDITOR'S REPORT (Referred to in paragraph 3 of ...

ANNEXURE TO AUDITOR'S REPORT (Referred to in paragraph 3 of ...

ANNEXURE TO AUDITOR'S REPORT (Referred to in paragraph 3 of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

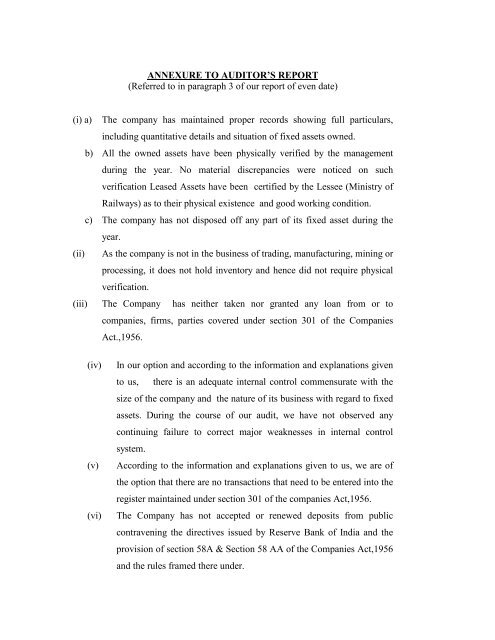

<strong>ANNEXURE</strong> <strong>TO</strong> AUDI<strong>TO</strong>R’S <strong>REPORT</strong>(<strong>Referred</strong> <strong>to</strong> <strong>in</strong> <strong>paragraph</strong> 3 <strong>of</strong> our report <strong>of</strong> even date)(i) a) The company has ma<strong>in</strong>ta<strong>in</strong>ed proper records show<strong>in</strong>g full particulars,<strong>in</strong>clud<strong>in</strong>g quantitative details and situation <strong>of</strong> fixed assets owned.b) All the owned assets have been physically verified by the managementdur<strong>in</strong>g the year. No material discrepancies were noticed on suchverification Leased Assets have been certified by the Lessee (M<strong>in</strong>istry <strong>of</strong>Railways) as <strong>to</strong> their physical existence and good work<strong>in</strong>g condition.c) The company has not disposed <strong>of</strong>f any part <strong>of</strong> its fixed asset dur<strong>in</strong>g theyear.(ii) As the company is not <strong>in</strong> the bus<strong>in</strong>ess <strong>of</strong> trad<strong>in</strong>g, manufactur<strong>in</strong>g, m<strong>in</strong><strong>in</strong>g orprocess<strong>in</strong>g, it does not hold <strong>in</strong>ven<strong>to</strong>ry and hence did not require physicalverification.(iii) The Company has neither taken nor granted any loan from or <strong>to</strong>companies, firms, parties covered under section 301 <strong>of</strong> the CompaniesAct.,1956.(iv)(v)(vi)In our option and accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given<strong>to</strong> us, there is an adequate <strong>in</strong>ternal control commensurate with thesize <strong>of</strong> the company and the nature <strong>of</strong> its bus<strong>in</strong>ess with regard <strong>to</strong> fixedassets. Dur<strong>in</strong>g the course <strong>of</strong> our audit, we have not observed anycont<strong>in</strong>u<strong>in</strong>g failure <strong>to</strong> correct major weaknesses <strong>in</strong> <strong>in</strong>ternal controlsystem.Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, we are <strong>of</strong>the option that there are no transactions that need <strong>to</strong> be entered <strong>in</strong><strong>to</strong> theregister ma<strong>in</strong>ta<strong>in</strong>ed under section 301 <strong>of</strong> the companies Act,1956.The Company has not accepted or renewed deposits from publiccontraven<strong>in</strong>g the directives issued by Reserve Bank <strong>of</strong> India and theprovision <strong>of</strong> section 58A & Section 58 AA <strong>of</strong> the Companies Act,1956and the rules framed there under.

(vii)(viii)(ix)In our option, the <strong>in</strong>ternal audit system <strong>of</strong> the company iscommensurate with the size and nature <strong>of</strong> its Bus<strong>in</strong>ess.The Central Government has not prescribed the ma<strong>in</strong>tenance <strong>of</strong> costrecords under Section 209 (1) (d) <strong>of</strong> the Companies Act,1956 for the<strong>in</strong>dustry <strong>to</strong> which the Company belongs.(a) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, theCompany has been regular <strong>in</strong> deposit<strong>in</strong>g with appropriate authoritiesundisputed statu<strong>to</strong>ry dues, <strong>in</strong>clud<strong>in</strong>g Provident fund, <strong>in</strong>ves<strong>to</strong>reducation protection fund, employees’ State Insurance, Income Tax,Sales Tax, Wealth Tax, Service Tax, Cus<strong>to</strong>ms Duty, Excise Duty, cessand other material statu<strong>to</strong>ry dues applicable <strong>to</strong> it.(b) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, noundisputed amounts payable <strong>in</strong> respect <strong>of</strong> <strong>in</strong>come tax, wealth tax, salestax, service tax, cus<strong>to</strong>m duty, excise duty and cess were <strong>in</strong> arrears ason 31, March 2007 for period <strong>of</strong> more than six months from the datethey became payable.(c) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, thereare no dues <strong>of</strong> <strong>in</strong>come tax, sales tax, wealth tax, service tax, cus<strong>to</strong>mduty, excise duty and cess which have not been deposited on accoun<strong>to</strong>f any dispute.(x)(xi)The company has neither accumulated losses as at 31 st March,2007 nor<strong>in</strong>curred any cash losses dur<strong>in</strong>g the year and immediately preced<strong>in</strong>gyear.In our option and accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given<strong>to</strong> us, the company has not defaulted any repayment <strong>of</strong> dues <strong>to</strong> af<strong>in</strong>ancial <strong>in</strong>stitution, bank or debenture holders.

(xii) The Company has not granted any loans and advances on the basis <strong>of</strong>security by way <strong>of</strong> pledge <strong>of</strong> shares, debentures and other securities.(xiii) In our op<strong>in</strong>ion, the company is not a chit fund or a nidhi/mutual benefitfund/society. Therefore, the provisions <strong>of</strong> clause 4 (xiii) <strong>of</strong> theCompanies (Audi<strong>to</strong>rs’report) Order (Amendment),2004 are notapplicable <strong>to</strong> the company.(xiv) In our op<strong>in</strong>ion, the company is not deal<strong>in</strong>g <strong>in</strong> or trad<strong>in</strong>g <strong>in</strong> shares,securities, debentures and other <strong>in</strong>vestments. Therefore, the provisions<strong>of</strong> clause 4 (xiv) <strong>of</strong> the companies (Audi<strong>to</strong>rs’ report) Order(Amendment).2004 are not applicable <strong>to</strong> the company.(xv) We have been <strong>in</strong>formed that the company has not given any guaranteefor loans taken by others from bank or f<strong>in</strong>ancial <strong>in</strong>stitution; as suchthe clause 4 (xv) is not applicable.(xvi) In our op<strong>in</strong>ion, the company has utilized the term loans for the purposefor which the loans were obta<strong>in</strong>ed.(xvii) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us and onoverall exam<strong>in</strong>ation <strong>of</strong> the balance sheet <strong>of</strong> the company, we reportthat the no funds raised on short-term basis have been used for longterm<strong>in</strong>vestment. No long-term funds have been used <strong>to</strong> f<strong>in</strong>ance shortterm assets.(xviii) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation given <strong>to</strong> us, the company has not madepreferential allotment <strong>of</strong> shares <strong>to</strong> parties and companies covered <strong>in</strong>register ma<strong>in</strong>ta<strong>in</strong>ed under section 301 <strong>of</strong> the Companies Act,1956.(xix) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, dur<strong>in</strong>g theperiod covered by our audit report, the company has issued 16200bonds <strong>of</strong> Rs.10,00,000 each. The company has created security <strong>in</strong>respect <strong>of</strong> bonds issued.(xx) The company has not raised funds by public issue; as such the clause4(xx) is not applicable.(xxi) Accord<strong>in</strong>g <strong>to</strong> the <strong>in</strong>formation and explanations given <strong>to</strong> us, no fraud onor by the company has been noticed or reported dur<strong>in</strong>g the year.

For M/s O.P.TULSYAN &COChartered AccountantsD<strong>in</strong>es Kumar GuptaPartnerM.No.86824Place: New DelhiDate: 18 th July,2007