Annual Report English.pmd - Indian Railway Finance Corporation Ltd.

Annual Report English.pmd - Indian Railway Finance Corporation Ltd.

Annual Report English.pmd - Indian Railway Finance Corporation Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

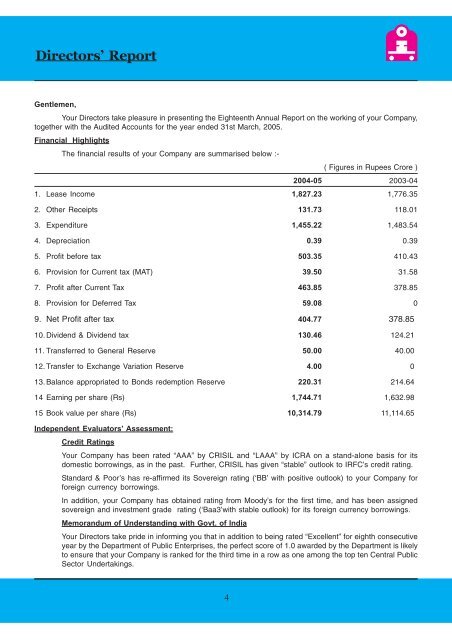

Directors’ <strong>Report</strong>Gentlemen,Your Directors take pleasure in presenting the Eighteenth <strong>Annual</strong> <strong>Report</strong> on the working of your Company,together with the Audited Accounts for the year ended 31st March, 2005.Financial HighlightsThe financial results of your Company are summarised below :-( Figures in Rupees Crore )2004-05 2003-041. Lease Income 1,827.23 1,776.352. Other Receipts 131.73 118.013. Expenditure 1,455.22 1,483.544. Depreciation 0.39 0.395. Profit before tax 503.35 410.436. Provision for Current tax (MAT) 39.50 31.587. Profit after Current Tax 463.85 378.858. Provision for Deferred Tax 59.08 09. Net Profit after tax 404.77 378.8510. Dividend & Dividend tax 130.46 124.2111. Transferred to General Reserve 50.00 40.0012. Transfer to Exchange Variation Reserve 4.00 013. Balance appropriated to Bonds redemption Reserve 220.31 214.6414 Earning per share (Rs) 1,744.71 1,632.9815 Book value per share (Rs) 10,314.79 11,114.65Independent Evaluators’ Assessment:Credit RatingsYour Company has been rated “AAA” by CRISIL and “LAAA” by ICRA on a stand-alone basis for itsdomestic borrowings, as in the past. Further, CRISIL has given “stable” outlook to IRFC’s credit rating.Standard & Poor’s has re-affirmed its Sovereign rating (‘BB’ with positive outlook) to your Company forforeign currency borrowings.In addition, your Company has obtained rating from Moody’s for the first time, and has been assignedsovereign and investment grade rating (‘Baa3’with stable outlook) for its foreign currency borrowings.Memorandum of Understanding with Govt. of IndiaYour Directors take pride in informing you that in addition to being rated “Excellent” for eighth consecutiveyear by the Department of Public Enterprises, the perfect score of 1.0 awarded by the Department is likelyto ensure that your Company is ranked for the third time in a row as one among the top ten Central PublicSector Undertakings.4

Media CoverageTwo reputed international publications viz. International Financing Review (IFR) and <strong>Finance</strong> Asia havelauded JPY 13 billion Euro Bond issue of IRFC for its aggressive pricing and choice of JPY as thiscurrency of borrowing. This is the first <strong>Indian</strong> Credit to issue publicly in Yen since 1991.Credit Research <strong>Report</strong>s on the Company brought out by Research Divisions of some of the banks havebeen circulated amongst prospective investors during the year. These <strong>Report</strong>s highlight the position ofpre-eminence of your Company amongst issuers out of India.Performance HighlightsDuring the year under report, your Company has posted profit after tax of Rs.404.77 crore, up Rs.25.92crore over the performance of the previous year. Earning per share has increased to Rs.1,744.71 fromRs.1,632.98 and the over-head to turnover ratio is only 0.15%.Your Directors have pleasure in informing that in spite of incremental borrowing for the year, prudentfinancial management has resulted in a reduction in expenditure by Rs.28.32 crore from Rs.1,483.54crore during 2003-04 to Rs.1,455.22 crore during 2004-05. The operating income has also gone up byabout Rs.38.08 crore. Increase in other income and the savings in expenditure have helped to shore upthe profit before tax by Rs.92.92 crore.The Balance Sheet size of your Company stands at Rs.20,450.04 crore, with a net worth of Rs.2,392.91crore and with no Non-performing Assets (NPA) in the books of your Company.Savings achieved through Financial EngineeringYour Directors take pleasure in informing that your Company has successfully negotiated and broughtdown the contracted interest payment liability of the existing outstanding borrowings, as outlined below :-(i) Interest re-structuring on Term Loans from BanksDuring the year under review, your Company has successfully refinanced / restructured some of the highcost term loans which would result in a saving of Rs.9.32 crore over the remaining life of these loans.(ii) Interest re-structuring on Bond IssueYour Company exercised call option and redeemed in March, 2005, 18 th Series taxable bonds bearing acoupon of 10.95% and having a residual maturity of two years. Refinancing has been done by availingterm loan of matching tenor. This would result in a saving of Rs.19.10 crore to your Company over theremaining life of these bonds.(iii) Foreign Currency Borrowings and risk managementDuring the year under review, your Company has successfully raised USD 250 Million equivalent of fundsthrough external commercial borrowings.A sum of USD 100 Million has been raised through syndicated Loan Market. Besides, IRFC raised JPY2.65 Billion (Equivalent to USD 25 Million) through private placement of bonds in the Japanese capitalmarket and JPY 13 Billion (equivalent to about USD 125 million) through Euro Yen Bonds in the offshoremarket at coupons of 1.85% and 1.43% respectively. This has enabled the Company to drive down thecost. This has also helped the Company to diversify its investor base further.Your Directors have pleasure in informing that your Company’s presence among the international investorshas been further established as evidenced from the overwhelming response received by its offshoreissues.Your Directors are also pleased to state that your company has prudently eliminated the exchange raterisk associated with the principal repayment in respect of USD 100 Million and JPY 13 Billion, at competitiveprices. Prudent timing of the hedging has resulted in reducing the principal repayment in rupee terms ata lower level than the inward remittances, resulting in upfront saving of Rs.11.17 crore.5

As regards JPY 2.65 billion borrowing, your Company has created a separate Exchange Variation Reserveand proposes to cover the risk on this relatively small amount through a methodology not adopted earlier.In respect of an earlier syndicated loan, your Company has converted the floating rate interest liability toa fixed rate through a swap, and has eliminated the interest rate risk associated with the upwardly movementof 6M USD Libor.Your Company has been adopting prudent risk management strategies. Your Company has eliminatedthe exchange rate fluctuation risk in respect of principal repayments in all cases where bullet repaymentsare involved with tenor not exceeding five years. Outstanding foreign currency borrowings with maturityprofile longer than five years, carry amortised half-yearly principal repayments, with the result that the riskgets mitigated by virtue of repayments taking place progressively at different points in time. Hedging ofprincipal repayment in such cases is considered selectively in a need based manner.During the current fiscal 2005-06, your Company proposes to refinance one of its earlier Syndicated Loanof USD 75 Million and reduce the margin over the 6M USD Libor, so as to effectively reduce the interestcost during its residual life.(iv) Interest Rate DerivativesYour company had in the past contracted interest rate derivative products in respect of a few bond issues,converting its liability to floating rates linked to appropriate bench mark indices. This has resulted in a totalsavings of about Rs.39.94 crore, which includes Rs.8.96 crore during 2004-05.Redemption of Bonds / Repayment of LoansYour Directors are pleased to inform that during the year under review, your company has successfullyredeemed / repaid its debt obligations amounting to Rs.2773.44 crore.Bonds amounting to Rs.747.36 crore were redeemed on their maturity, whereas bonds amounting toRs.200 crore were redeemed by exercising call option by the Company. Further, Floating Rate Notesamounting to USD 150 Million (Rs.672.10 crore) raised in July,1997 were successfully redeemed. Besides,a sum of Rs.1153.98 crore has gone towards principal repayment of term loans.During the current fiscal 2005-06, Bonds amounting to Rs.480.80 crore have been redeemed tillSeptember,2005 which includes a sum of Rs.399.80 crore redemption through exercise of call option.Further, bonds amounting to Rs.829.33 crore are scheduled to be redeemed by March,2006. Under thelong term loans, an amount of Rs.569.67 crore has been repaid till date and a further sum of Rs.589.66crore is scheduled to be repaid by March,2006.DividendThe Company has paid an interim Dividend of Rs.70 crore, in February 2005 and your Directors recommenda further amount of Rs.45 crore to be paid as dividend making the aggregate dividend payment of Rs.115crore for the year 2004-05. This is 49.56% of paid up Capital and 28.41% of Profit After tax.ReservesAfter providing for dividend and dividend tax for the year ended 31 st March, 2005, a sum of Rs.50 crorehas been transferred to General Reserve to meet the requirements of the Companies Act, 1956, a sum ofRs.4 crore has been transferred to Exchange Variation Reserve and the balance of Rs.220.31 crore hasbeen taken to the Bonds Redemption Reserve.Capital StructureThe entire paid-up share capital of the Company is held by the President of India and his nominees.During the year, there has been no change in the paid-up share capital of the Company, which stood atRs.232 Crore at the end of March 2005.6

Market Borrowings during 2004-05Despite hardening of interest rates, your Company has achieved an incremental weighted average costof 5.54% for the year 2004-2005 through judicious borrowings and raised Rs.2,887.92 crore. An openingbalance of Rs.131.77 crore existed with the Ministry of <strong>Railway</strong>s out of funds remitted in the previous yearwith weighted average cost of 5.70%. The overall weighted average cost of funds for the year worked outto 5.55% p.a. Including the opening balance available with the Ministry, the Company made available tothem a sum of Rs.2,968.48 crore during 2004-05 in fulfilment of the revised borrowing target set by theMinistry. The original borrowing target as conveyed by the Ministry in the beginning of the financial yearwas Rs.3,400 crore. The borrowings during the year comprised Rs.860 crore of domestic loans; Rs.736.80crore of taxable bonds, Syndicated foreign currency Loan of USD 100 Million (Rs.444.55 crore); JPYPrivate Placement Bonds 2.65 Bn (Rs.111.63 crore) and EURO Yen Bonds 13 Bn (Rs.539.60 crore).Besides, an amount of Rs.195.34 crore was raised through Securitisation of future lease receivables fromthe Ministry of <strong>Railway</strong>s. The weighted average tenor of all borrowings during the year was close to 8years.Lease Arrangement with the Ministry of <strong>Railway</strong>s for 2004-05As you are aware, the Lease arrangement between your Company and the Ministry of <strong>Railway</strong>s is governedby a standard lease agreement. For the incremental borrowing pertaining to 2004-05, lease rentals havebeen fixed at Rs. 49.82 per thousand per half-year (PTPH) over a primary lease tenor of 15 years. Thecost to Ministry of <strong>Railway</strong>s (IRR) is 6.10% p.a.Resource Mobilisation for 2005-06The Ministry of <strong>Railway</strong>s has decided that for manufacture / procurement of Rolling Stock assets of differenttypes viz. Electric & Diesel Locomotives, Wagons, Coaches etc, during 2005-06, assets of estimatedvalue of Rs.3,400 crore would be funded through extra budgetary resources to be provided by IRFC.Besides, the Ministry has also assigned to your Company the task of raising debt finance for Rail VikasNigam <strong>Ltd</strong>.During the current fiscal 2005-06, your Company has already mobilised Rs.1,850 crore at competitiverates and terms despite the hardening of interest rates and tightening of liquidity. Your Company is confidentof achieving the target of borrowing set by the Ministry of <strong>Railway</strong>s.<strong>Report</strong> on Corporate Governance<strong>Report</strong> on Corporate governance is enclosed as Annexure ‘I’ forming part of this report.Compliance with Accounting Standards(A) Accounting Standard (AS)-17Your Company is in the business of leasing and financing. As such, there are no separate reportablebusiness segments as per Accounting Standard (AS)-17 on ‘Segment <strong>Report</strong>ing’ issued by the ICAI.(B) Accounting Standard (AS)-19ICAI has made Accounting Standard (AS)–19 ‘Leases’ mandatory with effect from 1-4-2001. In accordancewith AS-19, the rolling stock assets given on finance lease are not capitalised in the books of the lessorand are instead recognised in its books as lease receivable at an amount equal to the net investment inthe Leased assets. Application of AS-19 has been made optional for earlier years. Your Company haschosen to adopt the accounting treatment provided therein in respect of all the assets leased since itsinception. Accordingly, all leased assets shown as fixed assets (net of accumulated depreciation andlease adjustment account) as at 31 st March, 2001 have been transferred to Lease Receivable Account.For the year under review, as per AS-19, the finance income is recognized in the Profit & Loss Accountand the capital recovery portion of lease rentals is treated as repayment of principal i.e. net investment inthe leased assets.7

Company to improve the quality of electronic connectivity. A website of the Company is presently underconstruction and will be launched shortly.Human Resource DevelopmentYour Company has been performing consistently well despite the constraint of total manpower strengthbeing limited to 15. While difficulties associated with such lean workforce are to an extent being overcomeby outsourcing various activities, your Company is in the process of marginally augmenting the organisationstrength to take on more challenges in the days to come.Official LanguageDuring the year under review, four quarterly meetings of the Official Language Implementation Committeewere held, and two Hindi Workshop were conducted.Your Company has progressively increased use of Hindi in accordance with the Official Language Policyof the Government. Letters received in Hindi are replied to in Hindi. Press Releases, including AdvertisementCampaigns, are published in Hindi also. Section 3 (3) of Official Language Act is invariably complied with.The <strong>Annual</strong> <strong>Report</strong> of the Company is also concurrently published in Hindi. Officers and staff possessworking knowledge of Hindi.Conservation of Energy & and Technology absorptionBeing a <strong>Finance</strong> Company, the provisions of Section 217(1) and (2-A) of the Companies Act, 1956 asamended by the Companies Amendment Act, 1988 in respect of Conservation of Energy and Technologyabsorption are not applicable to your Company.Particulars of EmployeesThere was no employee of the Company who received remuneration in excess of the limits prescribedunder Section 217(2A) of the Companies Act, 1956 read with Companies (Particulars of Employees)Rule, 1975.Women EmployeesYour Company has a very small organisational setup, comprising 15 employees in all. Out of these, threeemployees are in the category of Senior Assistants, which include one woman employee.Meetings of the Board of DirectorsNine meetings of the Board of Directors were held during the financial year 2004-05.Board of DirectorsDuring the financial year 2004-05 and up to the date of the <strong>Report</strong>, the following Directors held office :-Smt. Vijayalakshmi ViswanathanChairpersonFrom 29-11-2002 onwardsShri S.BalachandranManaging DirectorFrom 23-2-2001 onwardsShri R.SivadasanDirectorFrom 25.9.2001 onwardsShri R.KashyapDirector <strong>Finance</strong>From 31.1.2002 onwardsShri R.C.SaxenaDirector From 12.2.2002 to 30.09.2004Shri P. K. DebDirectorFrom 22.07.2003 onwards9

Shri T.K.BiswasDirectorProf. R.NarayanaswamyDirectorFrom 03.11.2004 onwardsFrom 08.02.2005 onwardsStatutory AuditorsM/s Vinod Kumar & Associates, Chartered Accountants, were re-appointed by the Comptroller & AuditorGeneral of India to audit the accounts of the Company for the year 2004-05.Remarks on the Qualifications of the Statutory Auditors on the Accounts for the year under review areplaced at Annexure ‘II’.Comments of the Comptroller & Auditor General of IndiaThere are nil comments from the Comptroller & Auditor General of India, on the Accounts of the Companyfor the year ended 31st March, 2005.AcknowledgementsYour Company is grateful to Ministry of <strong>Railway</strong>s, Ministry of <strong>Finance</strong>, Department of Public Enterprisesand other Departments, including the Reserve Bank of India, for their co-operation and continuedassistance, active & timely support and guidance received. The Company is also thankful to all the Bondholders,Banks, Financial Institutions and Life Insurance <strong>Corporation</strong> of India for reposing their confidenceand trust in the Company. The Company looks forward to their continued support and encouragementfrom time-to-time. The Company is also thankful to the Comptroller & Auditor General of India, the StatutoryAuditors and the Internal Auditors for their valuable support.The Board of Directors express their deep appreciation for the valuable contribution made by the Company’ssmall team of officers and employees, which has enabled the Company to consistently secure “Excellent”rating from the Government of India, and also consolidate its position as one of the vibrant public financialinstitutions in the country.For and on behalf of Board of DirectorsPlace : New DelhiDated : 29 September, 2005.Vijayalakshmi ViswanathanChairperson10