Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

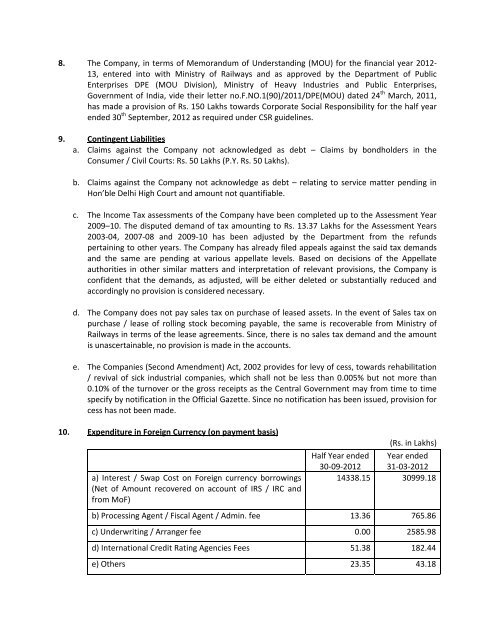

8. The Company, in terms <strong>of</strong> Memor<strong>and</strong>um <strong>of</strong> Underst<strong>and</strong>ing (MOU) <strong>for</strong> the financial year 2012‐13, entered into with Ministry <strong>of</strong> Railways <strong>and</strong> as approved by the Department <strong>of</strong> PublicEnterprises DPE (MOU Division), Ministry <strong>of</strong> Heavy Industries <strong>and</strong> Public Enterprises,Government <strong>of</strong> India, vide their letter no.F.NO.1(90)/2011/DPE(MOU) dated 24 th March, 2011,has made a provision <strong>of</strong> Rs. 150 Lakhs towards Corporate Social Responsibility <strong>for</strong> the half yearended 30 th September, 2012 as required under CSR guidelines.9. Contingent <strong>Liabilities</strong>a. Claims against the Company not acknowledged as debt – Claims by bondholders in theConsumer / Civil Courts: Rs. 50 Lakhs (P.Y. Rs. 50 Lakhs).b. Claims against the Company not acknowledge as debt – relating to service matter pending inHon’ble Delhi High Court <strong>and</strong> amount not quantifiable.c. The Income Tax assessments <strong>of</strong> the Company have been completed up to the Assessment Year2009–10. The disputed dem<strong>and</strong> <strong>of</strong> tax amounting to Rs. 13.37 Lakhs <strong>for</strong> the Assessment <strong>Years</strong>2003‐04, 2007‐08 <strong>and</strong> 2009‐10 has been adjusted by the Department from the refundspertaining to other years. The Company has already filed appeals against the said tax dem<strong>and</strong>s<strong>and</strong> the same are pending at various appellate levels. Based on decisions <strong>of</strong> the Appellateauthorities in other similar matters <strong>and</strong> interpretation <strong>of</strong> relevant provisions, the Company isconfident that the dem<strong>and</strong>s, as adjusted, will be either deleted or substantially reduced <strong>and</strong>accordingly no provision is considered necessary.d. The Company does not pay sales tax on purchase <strong>of</strong> leased assets. In the event <strong>of</strong> Sales tax onpurchase / lease <strong>of</strong> rolling stock becoming payable, the same is recoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the lease agreements. Since, there is no sales tax dem<strong>and</strong> <strong>and</strong> the amountis unascertainable, no provision is made in the accounts.e. The Companies (Second Amendment) Act, 2002 provides <strong>for</strong> levy <strong>of</strong> cess, towards rehabilitation/ revival <strong>of</strong> sick industrial companies, which shall not be less than 0.005% but not more than0.10% <strong>of</strong> the turnover or the gross receipts as the Central Government may from time to timespecify by notification in the Official Gazette. Since no notification has been issued, provision <strong>for</strong>cess has not been made.10. Expenditure in Foreign Currency (on payment basis)a) Interest / Swap Cost on Foreign currency borrowings(Net <strong>of</strong> Amount recovered on account <strong>of</strong> IRS / IRC <strong>and</strong>from MoF)(Rs. in Lakhs)Half Year ended Year ended30‐09‐2012 31‐03‐201214338.15 30999.18b) Processing Agent / Fiscal Agent / Admin. fee 13.36 765.86c) Underwriting / Arranger fee 0.00 2585.98d) International Credit Rating Agencies Fees 51.38 182.44e) Others 23.35 43.18