Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

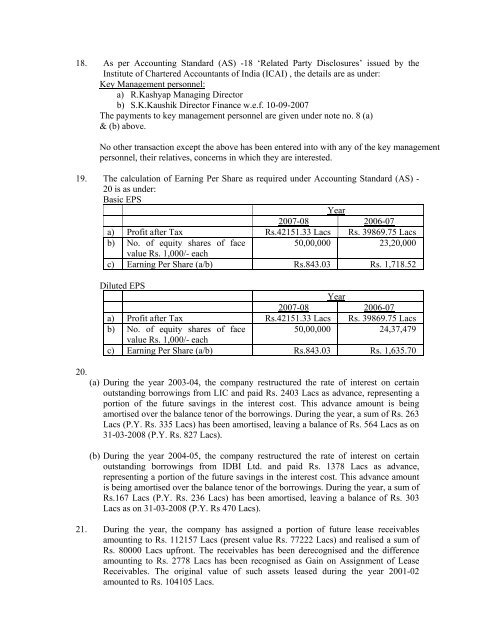

18. As per Accounting St<strong>and</strong>ard (AS) -18 ‘Related Party Disclosures’ issued by theInstitute <strong>of</strong> Chartered Accountants <strong>of</strong> India (ICAI) , the details are as under:Key Management personnel:a) R.Kashyap Managing Directorb) S.K.Kaushik Director Finance w.e.f. 10-09-2007The payments to key management personnel are given under note no. 8 (a)& (b) above.No other transaction except the above has been entered into with any <strong>of</strong> the key managementpersonnel, their relatives, concerns in which they are interested.19. The calculation <strong>of</strong> Earning Per Share as required under Accounting St<strong>and</strong>ard (AS) -20 is as under:Basic EPSYear2007-08 2006-07a) Pr<strong>of</strong>it after Tax Rs.42151.33 Lacs Rs. 39869.75 Lacsb) No. <strong>of</strong> equity shares <strong>of</strong> face50,00,000 23,20,000value Rs. 1,000/- eachc) Earning Per Share (a/b) Rs.843.03 Rs. 1,718.5220.Diluted EPSYear2007-08 2006-07a) Pr<strong>of</strong>it after Tax Rs.42151.33 Lacs Rs. 39869.75 Lacsb) No. <strong>of</strong> equity shares <strong>of</strong> face50,00,000 24,37,479value Rs. 1,000/- eachc) Earning Per Share (a/b) Rs.843.03 Rs. 1,635.70(a) During the year 2003-04, the company restructured the rate <strong>of</strong> interest on certainoutst<strong>and</strong>ing borrowings from LIC <strong>and</strong> paid Rs. 2403 Lacs as advance, representing aportion <strong>of</strong> the future savings in the interest cost. This advance amount is beingamortised over the balance tenor <strong>of</strong> the borrowings. During the year, a sum <strong>of</strong> Rs. 263Lacs (P.Y. Rs. 335 Lacs) has been amortised, leaving a balance <strong>of</strong> Rs. 564 Lacs as on31-03-2008 (P.Y. Rs. 827 Lacs).(b) During the year 2004-05, the company restructured the rate <strong>of</strong> interest on certainoutst<strong>and</strong>ing borrowings from IDBI Ltd. <strong>and</strong> paid Rs. 1378 Lacs as advance,representing a portion <strong>of</strong> the future savings in the interest cost. This advance amountis being amortised over the balance tenor <strong>of</strong> the borrowings. During the year, a sum <strong>of</strong>Rs.167 Lacs (P.Y. Rs. 236 Lacs) has been amortised, leaving a balance <strong>of</strong> Rs. 303Lacs as on 31-03-2008 (P.Y. Rs 470 Lacs).21. During the year, the company has assigned a portion <strong>of</strong> future lease receivablesamounting to Rs. 112157 Lacs (present value Rs. 77222 Lacs) <strong>and</strong> realised a sum <strong>of</strong>Rs. 80000 Lacs upfront. The receivables has been derecognised <strong>and</strong> the differenceamounting to Rs. 2778 Lacs has been recognised as Gain on Assignment <strong>of</strong> LeaseReceivables. The original value <strong>of</strong> such assets leased during the year 2001-02amounted to Rs. 104105 Lacs.