Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

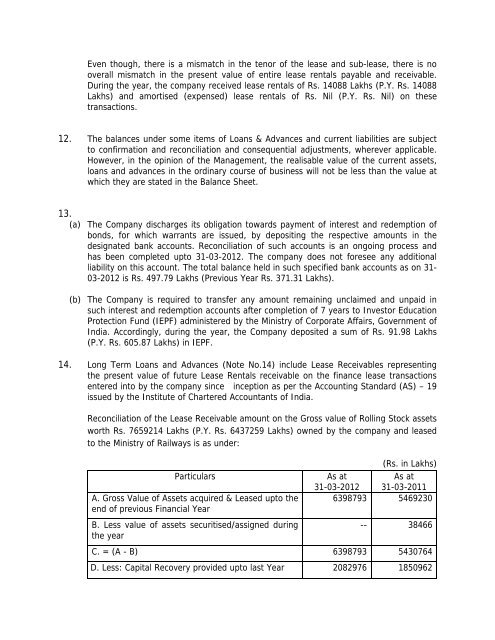

Even though, there is a mismatch in the tenor <strong>of</strong> the lease <strong>and</strong> sub-lease, there is nooverall mismatch in the present value <strong>of</strong> entire lease rentals payable <strong>and</strong> receivable.During the year, the company received lease rentals <strong>of</strong> Rs. 14088 Lakhs (P.Y. Rs. 14088Lakhs) <strong>and</strong> amortised (expensed) lease rentals <strong>of</strong> Rs. Nil (P.Y. Rs. Nil) on thesetransactions.12. The balances under some items <strong>of</strong> Loans & Advances <strong>and</strong> current liabilities are subjectto confirmation <strong>and</strong> reconciliation <strong>and</strong> consequential adjustments, wherever applicable.However, in the opinion <strong>of</strong> the Management, the realisable value <strong>of</strong> the current assets,loans <strong>and</strong> advances in the ordinary course <strong>of</strong> business will not be less than the value atwhich they are stated in the Balance Sheet.13.(a) The Company discharges its obligation towards payment <strong>of</strong> interest <strong>and</strong> redemption <strong>of</strong>bonds, <strong>for</strong> which warrants are issued, by depositing the respective amounts in thedesignated bank accounts. Reconciliation <strong>of</strong> such accounts is an ongoing process <strong>and</strong>has been completed upto 31-03-2012. The company does not <strong>for</strong>esee any additionalliability on this account. The total balance held in such specified bank accounts as on 31-03-2012 is Rs. 497.79 Lakhs (Previous Year Rs. 371.31 Lakhs).(b) The Company is required to transfer any amount remaining unclaimed <strong>and</strong> unpaid insuch interest <strong>and</strong> redemption accounts after completion <strong>of</strong> 7 years to Investor EducationProtection Fund (IEPF) administered by the Ministry <strong>of</strong> Corporate Affairs, Government <strong>of</strong>India. Accordingly, during the year, the Company deposited a sum <strong>of</strong> Rs. 91.98 Lakhs(P.Y. Rs. 605.87 Lakhs) in IEPF.14. Long Term Loans <strong>and</strong> Advances (Note No.14) include Lease Receivables representingthe present value <strong>of</strong> future Lease Rentals receivable on the finance lease transactionsentered into by the company since inception as per the Accounting St<strong>and</strong>ard (AS) – 19issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India.Reconciliation <strong>of</strong> the Lease Receivable amount on the Gross value <strong>of</strong> Rolling Stock assetsworth Rs. 7659214 Lakhs (P.Y. Rs. 6437259 Lakhs) owned by the company <strong>and</strong> leasedto the Ministry <strong>of</strong> Railways is as under:ParticularsA. Gross Value <strong>of</strong> <strong>Assets</strong> acquired & Leased upto theend <strong>of</strong> previous Financial YearB. Less value <strong>of</strong> assets securitised/assigned duringthe year(Rs. in Lakhs)As atAs at31-03-2012 31-03-20116398793 5469230-- 38466C. = (A - B) 6398793 5430764D. Less: Capital Recovery provided upto <strong>last</strong> Year 2082976 1850962