Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

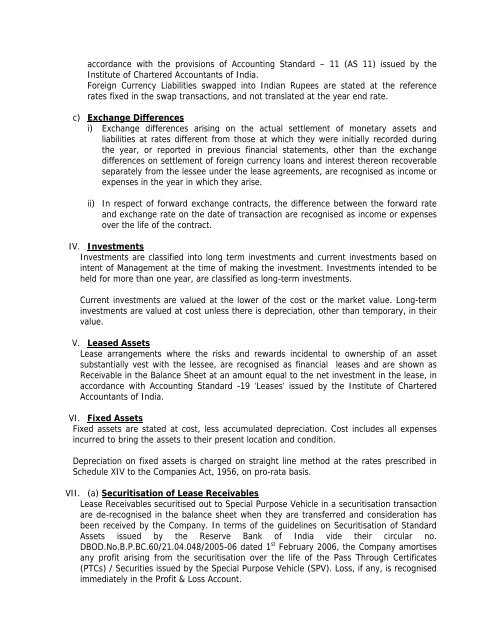

accordance with the provisions <strong>of</strong> Accounting St<strong>and</strong>ard – 11 (AS 11) issued by theInstitute <strong>of</strong> Chartered Accountants <strong>of</strong> India.Foreign Currency <strong>Liabilities</strong> swapped into Indian Rupees are stated at the referencerates fixed in the swap transactions, <strong>and</strong> not translated at the year end rate.c) Exchange Differencesi) Exchange differences arising on the actual settlement <strong>of</strong> monetary assets <strong>and</strong>liabilities at rates different from those at which they were initially recorded duringthe year, or reported in previous financial statements, other than the exchangedifferences on settlement <strong>of</strong> <strong>for</strong>eign currency loans <strong>and</strong> interest thereon recoverableseparately from the lessee under the lease agreements, are recognised as income orexpenses in the year in which they arise.ii) In respect <strong>of</strong> <strong>for</strong>ward exchange contracts, the difference between the <strong>for</strong>ward rate<strong>and</strong> exchange rate on the date <strong>of</strong> transaction are recognised as income or expensesover the life <strong>of</strong> the contract.IV. InvestmentsInvestments are classified into long term investments <strong>and</strong> current investments based onintent <strong>of</strong> Management at the time <strong>of</strong> making the investment. Investments intended to beheld <strong>for</strong> more than one year, are classified as long-term investments.Current investments are valued at the lower <strong>of</strong> the cost or the market value. Long-terminvestments are valued at cost unless there is depreciation, other than temporary, in theirvalue.V. Leased <strong>Assets</strong>Lease arrangements where the risks <strong>and</strong> rewards incidental to ownership <strong>of</strong> an assetsubstantially vest with the lessee, are recognised as financial leases <strong>and</strong> are shown asReceivable in the Balance Sheet at an amount equal to the net investment in the lease, inaccordance with Accounting St<strong>and</strong>ard -19 ‘Leases’ issued by the Institute <strong>of</strong> CharteredAccountants <strong>of</strong> India.VI. Fixed <strong>Assets</strong>Fixed assets are stated at cost, less accumulated depreciation. Cost includes all expensesincurred to bring the assets to their present location <strong>and</strong> condition.Depreciation on fixed assets is charged on straight line method at the rates prescribed inSchedule XIV to the Companies Act, 1956, on pro-rata basis.VII. (a) Securitisation <strong>of</strong> Lease ReceivablesLease Receivables securitised out to Special Purpose Vehicle in a securitisation transactionare de-recognised in the balance sheet when they are transferred <strong>and</strong> consideration hasbeen received by the Company. In terms <strong>of</strong> the guidelines on Securitisation <strong>of</strong> St<strong>and</strong>ard<strong>Assets</strong> issued by the Reserve Bank <strong>of</strong> India vide their circular no.DBOD.No.B.P.BC.60/21.04.048/2005-06 dated 1 st February 2006, the Company amortisesany pr<strong>of</strong>it arising from the securitisation over the life <strong>of</strong> the Pass Through Certificates(PTCs) / Securities issued by the Special Purpose Vehicle (SPV). Loss, if any, is recognisedimmediately in the Pr<strong>of</strong>it & Loss Account.