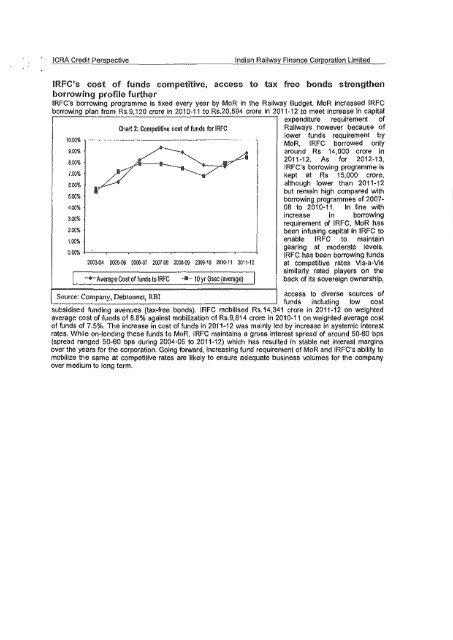

ICRA Credit PerspectiveIndian Railway Finance Corporation LimitedIRFC's cost <strong>of</strong> funds competitive, access to tax free bonds strengthenborrowing pr<strong>of</strong>ile furtherIRFC's borrowing programme is fixed every year by MoR in the Railway Budget. MoR increased IRFCborrowing plan from Rs.9,120 crore in 2010-11 to Rs.20,594 crore In 2011-12 to meet increase In capital10.00%9.00%8.00%7.00%6.00%5.00%4.00%3.00%2.00%1.00%Chart 2: Competitive cost <strong>of</strong> funds <strong>for</strong> IRFC2003-04 2005-06 2000-07 2007 -oo 2008-09 2009-10 201 (} 11 2011-12-+-Average Cost <strong>of</strong> fu~s to IRFC-e- 10 yr Gsec (average)around Rs 14,000 crore in1 2011-12. As <strong>for</strong> 2012-13,IRFC's borrowing programme iskept at Rs 15,000 crore,l although tower than 2011-12but remain high compared withborrowing programmes <strong>of</strong> 2007·Iexpenditure requirement <strong>of</strong>Railways however because <strong>of</strong>lower funds requirement byMoR, IRFC borrowed only08 to 2010-11. In line withIncrease In borrowingrequirement <strong>of</strong> IRFC, MoR hasbeen infusing capital in IRFC toenable IRFC to maintaingearing at moderate levels.IRFC has been borrowing fundsat competitive rates Vis·a-Vissimilarly rated players on theback <strong>of</strong> its sovereign ownership,Source: Company, Debtonnet, RBIaccess to diverse sources <strong>of</strong>funds including low costsubsidised funding avenues (tax-free bonds). IRFC mobilised Rs.14,341 crore in 2011"12 on weightedaverage cost <strong>of</strong> funds <strong>of</strong> 8.8% against mobilization <strong>of</strong> Rs.9,814 crore in 2010·11 on weighted average cost<strong>of</strong> funds <strong>of</strong> 7.5%. The increase In cost <strong>of</strong> funds In 2011·12 was mainly led by increase in systemic Interestrates. While on-lending these funds to MoR, IRFC maintains a gross Interest spread <strong>of</strong> around 50-60 bps(spread ranged 50-60 bps during 2004-05 to 2011-12) which has resulted in stable net interest marginsover the years <strong>for</strong> the corporation. Going <strong>for</strong>ward, Increasing fund requirement <strong>of</strong> MoR<strong>and</strong> IRFC's ability tomobilize the same at competitive rates are likely to ensure adequate business volumes <strong>for</strong> the companyover medium to long term.

Asset quality pr<strong>of</strong>ile favourableGiven that mosj <strong>of</strong> its lending Is to the MoR, IRFC continues to maintain a tow credit risk pr<strong>of</strong>ile, as evidentfrom its nil non-per<strong>for</strong>ming assets (NPAs) as on March 31, 2012. Besides the MaR, tRFC also lends toRVNL, an SPV <strong>of</strong> the MoR that undertakes construction <strong>of</strong> new railway lines, bridges, <strong>and</strong> rail links to port'>IRFC's loans to RVNL Increased from Rs. 968 crore as on March 31, 2007 to Rs. 1,854 crore as on March31, 2012, <strong>and</strong> accounted <strong>for</strong> around 34% <strong>of</strong> IRFC's net worth as on March 31, 2012. However, ICR/\expects IRFC's credit risk pr<strong>of</strong>ile to remain low owing to majority <strong>of</strong> lending to MoR <strong>and</strong> the supportiveMemor<strong>and</strong>um <strong>of</strong> Underst<strong>and</strong>ing between RVNL <strong>and</strong> MoR <strong>for</strong> the re-payment <strong>of</strong> RVNL's borrowings whicllIs likely to ensure timely re-payment by RVNL to IRFC. Any material change from such repaymentarrangement may entail a review <strong>of</strong> the assigned ratings.Capital structure likely to remain at prudent level as MOR likely to continuoinfusing capitalIRFC's gearing has been around 10 times (9.3 times as on Mar-12 <strong>and</strong> 8.9 times as on Mar-11) over <strong>last</strong>few years. Increasing business volumes (increase In lease disbursements to MoR) <strong>and</strong> low internal capitalgeneration due to high tax rate <strong>and</strong> dividend payouts has resulted in pressure on capital structure <strong>of</strong> thecorporation. However, to maintain its gearing levels below 10 times, IRFC has been receiving frequentcapital infusion from MoR (Rs. Rs.1,852 crore 1 over <strong>last</strong> four years, 2008-09 to 2011-12). Further, given largeborrowing programme in 2012-13, IRFC wilt need further equity infusion from MoR to keep Its gearing atmoderate lever; capital support from MoR has been <strong>for</strong>thcoming over <strong>last</strong> few years.In addition. as per Ministry <strong>of</strong> Finance (MoF) guidelines <strong>for</strong> Public Sector Entities (PSEs). IRFC is requiredto pay dividend equal to 20% <strong>of</strong> paid up capital or 20% <strong>of</strong> net pr<strong>of</strong>its, whichever is higher. Whlle during2011·12 IRFC paid dividend <strong>of</strong> Rs.100 crore (around 20% <strong>of</strong> PAT or 5% <strong>of</strong> IRFC's paid up capital) lowerthan the guidelines given IRFC's capital requirement <strong>for</strong> growth plans <strong>and</strong> as MaR' has infused capital over<strong>last</strong> four years at par value (without any share premium). Going <strong>for</strong>ward, though IRFC does not intend toIncrease dividend payment significantly from the current levels, but if it declares dividend in line with theMoF guidelines, its abfltty to generate capital from internal sources may be significantly impacted. But withthe regular capital Infusion from MoR, JRFC's gearing is not expected to increase from the current levels inthe medium term.Well-diversified borrowing mix a credit positiveHistorically IRFC has been able to raise funds at competitlve cost from domestic <strong>and</strong> international markets,Its borrowing pr<strong>of</strong>ile improved further In recent years with access to tax free bonds- around half <strong>of</strong> freshborrowing <strong>of</strong> 2011-12 was raised through tax free bonds (interest rate lower by 100-200 bps than taxablebonds). IRFC was given approval to raise tax free bonds <strong>of</strong> Rs 10,000 crore in 2011·12 <strong>of</strong> which it raisedRs 7,000 crore in 2011·12. In 2012·13 Budget also IRFC got tax free bonds allocation <strong>of</strong> Rs. 10,000 crore<strong>and</strong> Its borrowing programme is Rs 15,000 crore hence sizeable part <strong>of</strong> current year's borrowings areexpected to met through tax free bonds which will help corporation to keep lower cost <strong>of</strong> funds.Additionally, IRFC has been raising funds through longer tenure instruments (up to 25 years, weightedaverage maturity <strong>of</strong> fresh borrowings raised in 2011-12 was around 11 years) which enable it to maintain acom<strong>for</strong>table liquidity pr<strong>of</strong>ile. Overall, IRFC's well-diversified borrowing pr<strong>of</strong>ile is a credit positive <strong>and</strong> hashelped the corporation bring down Its cost <strong>of</strong> funds while keeping its asset-liability mismatches wl1hinmanageable limits.Liquidity pr<strong>of</strong>ile <strong>of</strong> IRFC is determined by the tenure <strong>of</strong> Lease agreement (primary lease period <strong>of</strong> 15 years<strong>and</strong> weighted average repayment tenure around 9-10 years) against which IRFC borrows <strong>for</strong> similar tenureliabilities (on an average 8-12 years) which Is likely to result com<strong>for</strong>table liquidity pr<strong>of</strong>ile <strong>of</strong> IRFC. Further,as regard marginal tenure mismatch in Its assets <strong>and</strong> liabilities, JRFC has managed to maintain com<strong>for</strong>tableliquidity pr<strong>of</strong>ile through principal recoveries from the earlier leases, internal accruals <strong>and</strong> raising short term:;:,:;(·; .. funds. ICRA expects the corporation to maintain com<strong>for</strong>table liquidity pr<strong>of</strong>ile going <strong>for</strong>ward as well, on the· .'./); :: . ,, strength <strong>of</strong> its financial flexibility <strong>and</strong> its focus on increasing the tenure <strong>of</strong> its borrowings to match its asset·;;::·.;. ,i,>:·' : pr<strong>of</strong>ile. Further, favorable lease agreement, as per which MOR can make advance lease rental payments'hould lRFC fall short <strong>of</strong> funds to service Its debt, is an additional liquidity support available to JRFC,. · \:t•;,;f\\;~ugh so far It has never resorted to the same.~~.3.\iot'.:il•".....______~ lnoiVd!Mg 1h01Herm loanslnal.~J[t~ ..•. hart application money <strong>of</strong> Rs 250 crore as on Mar-12 <strong>for</strong> which shares were allotted in 2012·13. 'l,-::.·.. ---····. ··~'\)i,

- Page 1 and 2:

Statement of Assets and Liabilities

- Page 3 and 4:

CASH FLOW STATEMENTAnnexure - III(

- Page 5 and 6:

2. Reserves and Surplus( in Lakhs)P

- Page 7 and 8:

3.1.1 Maturity profile and Rate of

- Page 9 and 10:

65th "J" Taxable Non‐Cum. Bonds 8

- Page 11 and 12:

starting from 27‐07‐201416th "O

- Page 13 and 14:

HDFC Bank Ltd. 8.44%, Fixed 1‐Apr

- Page 15 and 16:

Syndicated Foreign Currency Loan‐

- Page 17 and 18:

As at30‐09‐2012As at31‐03‐2

- Page 19 and 20:

Total FixedAssets 1,721.57 1,707.80

- Page 21 and 22:

Balance in Franking Machine 0.34 0.

- Page 23 and 24:

18. Other IncomeTotal 268780.41 464

- Page 25 and 26:

Office Maintenance Expenses 20.25 3

- Page 27 and 28:

Significant Accounting policies and

- Page 29 and 30:

y the Reserve Bank of India vide th

- Page 31 and 32:

(f) (i) Interest rate variation on

- Page 33 and 34:

1 JPY 3 Billion 37.04 Million 1 JPY

- Page 35 and 36:

11.a. The Company has not taken on

- Page 37 and 38:

Gross Investment in Lease and Prese

- Page 39 and 40:

the year plan assetsTotal Gain / (L

- Page 41 and 42:

*The above provisions are liabiliti

- Page 43 and 44:

A. Significant Accounting PoliciesF

- Page 45 and 46:

Further, in terms of Draft Guidelin

- Page 47 and 48:

(P.Y. Rs. 4590 Lakhs). After adjust

- Page 49 and 50:

No. ofContractsAs at 31-03-2012 As

- Page 51 and 52:

10. Expenditure in Foreign Currency

- Page 53 and 54:

E. Less Capital Recovery provided u

- Page 55 and 56:

Changes in the Fair Value of Plan A

- Page 57 and 58:

Actuarial Assumptions:AssumptionsGr

- Page 59 and 60:

amortised over the balance tenor of

- Page 61 and 62:

) Recognition at the end of Account

- Page 63 and 64:

Deferred tax expense or benefit is

- Page 65 and 66:

Finance has exempted the Lease Agre

- Page 67 and 68:

The foreign currency borrowings out

- Page 69 and 70:

10. Expenditure in Foreign Currency

- Page 71 and 72:

15. Major components of net deferre

- Page 73 and 74:

Current Service Cost 3.05 1.63 1.02

- Page 75 and 76:

Actuarial Assumptions:As on 31-03-2

- Page 77 and 78:

portion of the future savings in th

- Page 79 and 80:

) Recognition at the end of Account

- Page 81 and 82:

10) Employee BenefitsEmployee Benef

- Page 83 and 84:

5. Decrease in liability due to exc

- Page 85 and 86:

7. Office Building including parkin

- Page 87 and 88:

12. The balances under some items o

- Page 89 and 90:

Unearned Finance Income 2009322 171

- Page 91 and 92: the yearActualReturn onplan assets1

- Page 93 and 94: Statementof Profit &LossActuarial A

- Page 95 and 96: amortised over the balance tenor of

- Page 97 and 98: ) Recognition at the end of Account

- Page 99 and 100: 10) Employee BenefitsEmployee Benef

- Page 101 and 102: amortisation in future, of the amou

- Page 103 and 104: As part of hedging strategy, the Co

- Page 105 and 106: Since the entire future lease renta

- Page 107 and 108: assets assigned during the yearF. C

- Page 109 and 110: Benefits Paid - -Fair Value of Plan

- Page 111 and 112: value Rs. 1,000/- eachc) Earning Pe

- Page 113 and 114: Financial Year 2007-08A. Significan

- Page 115 and 116: and are capable of reversal in one

- Page 117 and 118: ForeignCurrency1 JPY 2.65 Billion U

- Page 119 and 120: Govt. may from time to time specify

- Page 121 and 122: previous Financial YearB. Less valu

- Page 123 and 124: 22. Payment to auditors include Rs.

- Page 125 and 126: Annexure - VIIStatement of Dividend

- Page 127 and 128: Annexure - IXRelated Party Transact

- Page 129 and 130: Annexure - XICapitalisation Stateme

- Page 131 and 132: ------ ----~---------~-- ---~------

- Page 133 and 134: '-. ,,, I__ , __ , _____ ~-~---..

- Page 135 and 136: Credit Rating Report 1Indian Railwa

- Page 137 and 138: Given IRFC's modest accruals to net

- Page 139 and 140: Credit Strengths.. Strong ownership

- Page 141: CREDIT PERSPECTIVEDependence on MOR

- Page 145 and 146: ANNEXURE 1: RATING DETAILSInstrumen

- Page 147 and 148: ICRA Credit PerspectiveIndian Railw

- Page 149 and 150: ·PROFIT: & .LOSS ACCOUNT_t'lo of O

- Page 151 and 152: This is a system generated report a

- Page 153 and 154: This is a system generated report a

- Page 155 and 156: Sub : Trade statistics of IRFC N1 f

- Page 157 and 158: This is a system generated report a

- Page 159 and 160: This is a system generated report a

- Page 161 and 162: Sub : Trade statistics of IRFC N2 f

- Page 163 and 164: SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 165 and 166: SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 167 and 168: SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 169 and 170: SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 171 and 172: Ref. No. :NSE/LIST/2012Date :Decemb

- Page 173 and 174: Sub : Trade Statistics Report from

- Page 175 and 176: Sub : Trade Statistics Report from

- Page 177 and 178: Sub : Trade Statistics Report from

- Page 179 and 180: Sub : Trade Statistics Report from

- Page 181 and 182: Sub : Trade Statistics Report from

- Page 183 and 184: Sub : Trade Statistics Report from

- Page 185 and 186: Sub : Trade Statistics Report from

- Page 187 and 188: Sub : Trade Statistics Report from

- Page 189 and 190: Sub : Trade Statistics Report from

- Page 191 and 192: Sub : Trade Statistics Report from

- Page 193 and 194:

Sub : Trade Statistics Report from

- Page 195 and 196:

Sub : Trade Statistics Report from

- Page 197 and 198:

Sub : Trade Statistics Report from

- Page 199 and 200:

Sub : Trade Statistics Report from

- Page 201 and 202:

Sub : Trade Statistics Report from

- Page 203 and 204:

Sub : Trade Statistics Report from

- Page 205 and 206:

Sub : Trade Statistics Report from

- Page 207 and 208:

Sub : Trade Statistics Report from

- Page 209 and 210:

Sub : Trade Statistics Report from

- Page 211 and 212:

Sub : Trade Statistics Report from

- Page 213 and 214:

Sub : Trade Statistics Report from

- Page 215 and 216:

Sub : Trade Statistics Report from

- Page 217 and 218:

Sub : Trade Statistics Report from

- Page 219 and 220:

Sub : Trade Statistics Report from

- Page 221 and 222:

Sub : Trade Statistics Report from

- Page 223 and 224:

Sub : Trade Statistics Report from

- Page 225 and 226:

ANNXEUREIVCONSENT OF DEBENTURE TRUS

- Page 227:

:,::O.F:.:iINi):nlA··' :.,: ." ":