Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

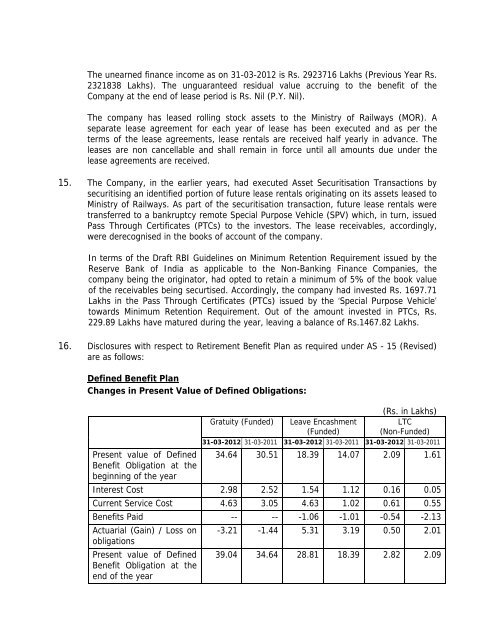

The unearned finance income as on 31-03-2012 is Rs. 2923716 Lakhs (Previous Year Rs.2321838 Lakhs). The unguaranteed residual value accruing to the benefit <strong>of</strong> theCompany at the end <strong>of</strong> lease period is Rs. Nil (P.Y. Nil).The company has leased rolling stock assets to the Ministry <strong>of</strong> Railways (MOR). Aseparate lease agreement <strong>for</strong> each year <strong>of</strong> lease has been executed <strong>and</strong> as per theterms <strong>of</strong> the lease agreements, lease rentals are received half yearly in advance. Theleases are non cancellable <strong>and</strong> shall remain in <strong>for</strong>ce until all amounts due under thelease agreements are received.15. The Company, in the earlier years, had executed Asset Securitisation Transactions bysecuritising an identified portion <strong>of</strong> future lease rentals originating on its assets leased toMinistry <strong>of</strong> Railways. As part <strong>of</strong> the securitisation transaction, future lease rentals weretransferred to a bankruptcy remote Special Purpose Vehicle (SPV) which, in turn, issuedPass Through Certificates (PTCs) to the investors. The lease receivables, accordingly,were derecognised in the books <strong>of</strong> account <strong>of</strong> the company.In terms <strong>of</strong> the Draft RBI Guidelines on Minimum Retention Requirement issued by theReserve Bank <strong>of</strong> India as applicable to the Non-Banking Finance Companies, thecompany being the originator, had opted to retain a minimum <strong>of</strong> 5% <strong>of</strong> the book value<strong>of</strong> the receivables being securtised. Accordingly, the company had invested Rs. 1697.71Lakhs in the Pass Through Certificates (PTCs) issued by the ‘Special Purpose Vehicle’towards Minimum Retention Requirement. Out <strong>of</strong> the amount invested in PTCs, Rs.229.89 Lakhs have matured during the year, leaving a balance <strong>of</strong> Rs.1467.82 Lakhs.16. Disclosures with respect to Retirement Benefit Plan as required under AS - 15 (Revised)are as follows:Defined Benefit PlanChanges in Present Value <strong>of</strong> Defined Obligations:Present value <strong>of</strong> DefinedBenefit Obligation at thebeginning <strong>of</strong> the yearGratuity (Funded)Leave Encashment(Funded)(Rs. in Lakhs)LTC(Non-Funded)31-03-2012 31-03-2011 31-03-2012 31-03-2011 31-03-2012 31-03-201134.64 30.51 18.39 14.07 2.09 1.61Interest Cost 2.98 2.52 1.54 1.12 0.16 0.05Current Service Cost 4.63 3.05 4.63 1.02 0.61 0.55Benefits Paid -- -- -1.06 -1.01 -0.54 -2.13Actuarial (Gain) / Loss onobligationsPresent value <strong>of</strong> DefinedBenefit Obligation at theend <strong>of</strong> the year-3.21 -1.44 5.31 3.19 0.50 2.0139.04 34.64 28.81 18.39 2.82 2.09