Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

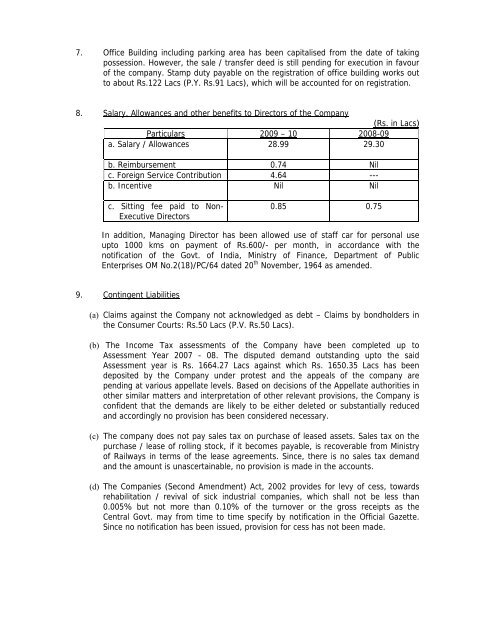

7. Office Building including parking area has been capitalised from the date <strong>of</strong> takingpossession. However, the sale / transfer deed is still pending <strong>for</strong> execution in favour<strong>of</strong> the company. Stamp duty payable on the registration <strong>of</strong> <strong>of</strong>fice building works outto about Rs.122 Lacs (P.Y. Rs.91 Lacs), which will be accounted <strong>for</strong> on registration.8. Salary, Allowances <strong>and</strong> other benefits to Directors <strong>of</strong> the Company(Rs. in Lacs)Particulars 2009 – 10 2008-09a. Salary / Allowances 28.99 29.30b. Reimbursement 0.74 Nilc. Foreign Service Contribution 4.64 ---b. Incentive Nil Nilc. Sitting fee paid to Non-Executive Directors0.85 0.75In addition, Managing Director has been allowed use <strong>of</strong> staff car <strong>for</strong> personal useupto 1000 kms on payment <strong>of</strong> Rs.600/- per month, in accordance with thenotification <strong>of</strong> the Govt. <strong>of</strong> India, Ministry <strong>of</strong> Finance, Department <strong>of</strong> PublicEnterprises OM No.2(18)/PC/64 dated 20 th November, 1964 as amended.9. Contingent <strong>Liabilities</strong>(a) Claims against the Company not acknowledged as debt – Claims by bondholders inthe Consumer Courts: Rs.50 Lacs (P.V. Rs.50 Lacs).(b) The Income Tax assessments <strong>of</strong> the Company have been completed up toAssessment Year 2007 - 08. The disputed dem<strong>and</strong> outst<strong>and</strong>ing upto the saidAssessment year is Rs. 1664.27 Lacs against which Rs. 1650.35 Lacs has beendeposited by the Company under protest <strong>and</strong> the appeals <strong>of</strong> the company arepending at various appellate levels. Based on decisions <strong>of</strong> the Appellate authorities inother similar matters <strong>and</strong> interpretation <strong>of</strong> other relevant provisions, the Company isconfident that the dem<strong>and</strong>s are likely to be either deleted or substantially reduced<strong>and</strong> accordingly no provision has been considered necessary.(c) The company does not pay sales tax on purchase <strong>of</strong> leased assets. Sales tax on thepurchase / lease <strong>of</strong> rolling stock, if it becomes payable, is recoverable from Ministry<strong>of</strong> Railways in terms <strong>of</strong> the lease agreements. Since, there is no sales tax dem<strong>and</strong><strong>and</strong> the amount is unascertainable, no provision is made in the accounts.(d) The Companies (Second Amendment) Act, 2002 provides <strong>for</strong> levy <strong>of</strong> cess, towardsrehabilitation / revival <strong>of</strong> sick industrial companies, which shall not be less than0.005% but not more than 0.10% <strong>of</strong> the turnover or the gross receipts as theCentral Govt. may from time to time specify by notification in the Official Gazette.Since no notification has been issued, provision <strong>for</strong> cess has not been made.