Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

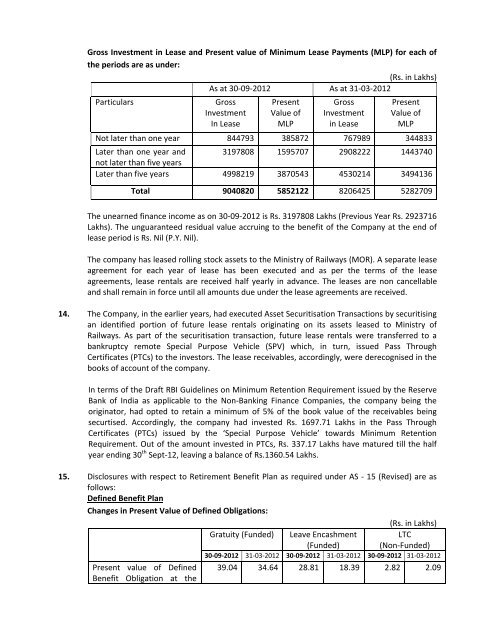

Gross Investment in Lease <strong>and</strong> Present value <strong>of</strong> Minimum Lease Payments (MLP) <strong>for</strong> each <strong>of</strong>the periods are as under:(Rs. in Lakhs)As at 30‐09‐2012 As at 31‐03‐2012ParticularsGrossInvestmentIn LeasePresentValue <strong>of</strong>MLPGrossInvestmentin LeasePresentValue <strong>of</strong>MLPNot later than one year 844793 385872 767989 344833Later than one year <strong>and</strong> 3197808 1595707 2908222 1443740not later than five yearsLater than five years 4998219 3870543 4530214 3494136Total 9040820 5852122 8206425 5282709The unearned finance income as on 30‐09‐2012 is Rs. 3197808 Lakhs (Previous Year Rs. 2923716Lakhs). The unguaranteed residual value accruing to the benefit <strong>of</strong> the Company at the end <strong>of</strong>lease period is Rs. Nil (P.Y. Nil).The company has leased rolling stock assets to the Ministry <strong>of</strong> Railways (MOR). A separate leaseagreement <strong>for</strong> each year <strong>of</strong> lease has been executed <strong>and</strong> as per the terms <strong>of</strong> the leaseagreements, lease rentals are received half yearly in advance. The leases are non cancellable<strong>and</strong> shall remain in <strong>for</strong>ce until all amounts due under the lease agreements are received.14. The Company, in the earlier years, had executed Asset Securitisation Transactions by securitisingan identified portion <strong>of</strong> future lease rentals originating on its assets leased to Ministry <strong>of</strong>Railways. As part <strong>of</strong> the securitisation transaction, future lease rentals were transferred to abankruptcy remote Special Purpose Vehicle (SPV) which, in turn, issued Pass ThroughCertificates (PTCs) to the investors. The lease receivables, accordingly, were derecognised in thebooks <strong>of</strong> account <strong>of</strong> the company.In terms <strong>of</strong> the Draft RBI Guidelines on Minimum Retention Requirement issued by the ReserveBank <strong>of</strong> India as applicable to the Non‐Banking Finance Companies, the company being theoriginator, had opted to retain a minimum <strong>of</strong> 5% <strong>of</strong> the book value <strong>of</strong> the receivables beingsecurtised. Accordingly, the company had invested Rs. 1697.71 Lakhs in the Pass ThroughCertificates (PTCs) issued by the ‘Special Purpose Vehicle’ towards Minimum RetentionRequirement. Out <strong>of</strong> the amount invested in PTCs, Rs. 337.17 Lakhs have matured till the halfyear ending 30 th Sept‐12, leaving a balance <strong>of</strong> Rs.1360.54 Lakhs.15. Disclosures with respect to Retirement Benefit Plan as required under AS ‐ 15 (Revised) are asfollows:Defined Benefit PlanChanges in Present Value <strong>of</strong> Defined Obligations:(Rs. in Lakhs)Gratuity (Funded) Leave Encashment(Funded)LTC(Non‐Funded)30‐09‐2012 31‐03‐2012 30‐09‐2012 31‐03‐2012 30‐09‐2012 31‐03‐2012Present value <strong>of</strong> DefinedBenefit Obligation at the39.04 34.64 28.81 18.39 2.82 2.09