Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

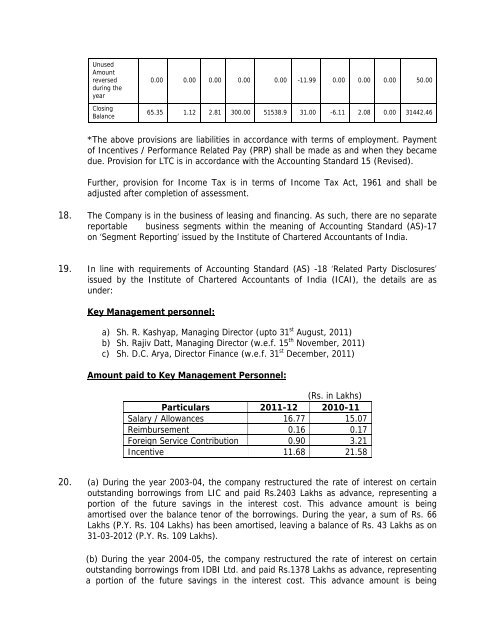

UnusedAmountreversedduring theyearClosingBalance0.00 0.00 0.00 0.00 0.00 -11.99 0.00 0.00 0.00 50.0065.35 1.12 2.81 300.00 51538.9 31.00 -6.11 2.08 0.00 31442.46*The above provisions are liabilities in accordance with terms <strong>of</strong> employment. Payment<strong>of</strong> Incentives / Per<strong>for</strong>mance Related Pay (PRP) shall be made as <strong>and</strong> when they becamedue. Provision <strong>for</strong> LTC is in accordance with the Accounting St<strong>and</strong>ard 15 (Revised).Further, provision <strong>for</strong> Income Tax is in terms <strong>of</strong> Income Tax Act, 1961 <strong>and</strong> shall beadjusted after completion <strong>of</strong> assessment.18. The Company is in the business <strong>of</strong> leasing <strong>and</strong> financing. As such, there are no separatereportable business segments within the meaning <strong>of</strong> Accounting St<strong>and</strong>ard (AS)-17on ‘Segment Reporting’ issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India.19. In line with requirements <strong>of</strong> Accounting St<strong>and</strong>ard (AS) -18 ‘Related Party Disclosures’issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India (ICAI), the details are asunder:Key Management personnel:a) Sh. R. Kashyap, Managing Director (upto 31 st August, 2011)b) Sh. Rajiv Datt, Managing Director (w.e.f. 15 th November, 2011)c) Sh. D.C. Arya, Director Finance (w.e.f. 31 st December, 2011)Amount paid to Key Management Personnel:(Rs. in Lakhs)Particulars 2011-12 2010-11Salary / Allowances 16.77 15.07Reimbursement 0.16 0.17Foreign Service Contribution 0.90 3.21Incentive 11.68 21.5820. (a) During the year 2003-04, the company restructured the rate <strong>of</strong> interest on certainoutst<strong>and</strong>ing borrowings from LIC <strong>and</strong> paid Rs.2403 Lakhs as advance, representing aportion <strong>of</strong> the future savings in the interest cost. This advance amount is beingamortised over the balance tenor <strong>of</strong> the borrowings. During the year, a sum <strong>of</strong> Rs. 66Lakhs (P.Y. Rs. 104 Lakhs) has been amortised, leaving a balance <strong>of</strong> Rs. 43 Lakhs as on31-03-2012 (P.Y. Rs. 109 Lakhs).(b) During the year 2004-05, the company restructured the rate <strong>of</strong> interest on certainoutst<strong>and</strong>ing borrowings from IDBI Ltd. <strong>and</strong> paid Rs.1378 Lakhs as advance, representinga portion <strong>of</strong> the future savings in the interest cost. This advance amount is being