Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

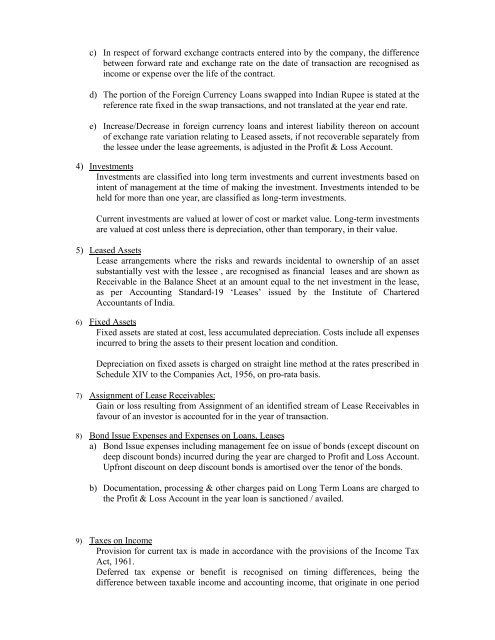

c) In respect <strong>of</strong> <strong>for</strong>ward exchange contracts entered into by the company, the differencebetween <strong>for</strong>ward rate <strong>and</strong> exchange rate on the date <strong>of</strong> transaction are recognised asincome or expense over the life <strong>of</strong> the contract.d) The portion <strong>of</strong> the Foreign Currency Loans swapped into Indian Rupee is stated at thereference rate fixed in the swap transactions, <strong>and</strong> not translated at the year end rate.e) Increase/Decrease in <strong>for</strong>eign currency loans <strong>and</strong> interest liability thereon on account<strong>of</strong> exchange rate variation relating to Leased assets, if not recoverable separately fromthe lessee under the lease agreements, is adjusted in the Pr<strong>of</strong>it & Loss Account.4) InvestmentsInvestments are classified into long term investments <strong>and</strong> current investments based onintent <strong>of</strong> management at the time <strong>of</strong> making the investment. Investments intended to beheld <strong>for</strong> more than one year, are classified as long-term investments.Current investments are valued at lower <strong>of</strong> cost or market value. Long-term investmentsare valued at cost unless there is depreciation, other than temporary, in their value.5) Leased <strong>Assets</strong>Lease arrangements where the risks <strong>and</strong> rewards incidental to ownership <strong>of</strong> an assetsubstantially vest with the lessee , are recognised as financial leases <strong>and</strong> are shown asReceivable in the Balance Sheet at an amount equal to the net investment in the lease,as per Accounting St<strong>and</strong>ard-19 ‘Leases’ issued by the Institute <strong>of</strong> CharteredAccountants <strong>of</strong> India.6) Fixed <strong>Assets</strong>Fixed assets are stated at cost, less accumulated depreciation. Costs include all expensesincurred to bring the assets to their present location <strong>and</strong> condition.Depreciation on fixed assets is charged on straight line method at the rates prescribed inSchedule XIV to the Companies Act, 1956, on pro-rata basis.7) Assignment <strong>of</strong> Lease Receivables:Gain or loss resulting from Assignment <strong>of</strong> an identified stream <strong>of</strong> Lease Receivables infavour <strong>of</strong> an investor is accounted <strong>for</strong> in the year <strong>of</strong> transaction.8) Bond Issue Expenses <strong>and</strong> Expenses on Loans, Leasesa) Bond Issue expenses including management fee on issue <strong>of</strong> bonds (except discount ondeep discount bonds) incurred during the year are charged to Pr<strong>of</strong>it <strong>and</strong> Loss Account.Upfront discount on deep discount bonds is amortised over the tenor <strong>of</strong> the bonds.b) Documentation, processing & other charges paid on Long Term Loans are charged tothe Pr<strong>of</strong>it & Loss Account in the year loan is sanctioned / availed.9) Taxes on IncomeProvision <strong>for</strong> current tax is made in accordance with the provisions <strong>of</strong> the Income TaxAct, 1961.Deferred tax expense or benefit is recognised on timing differences, being thedifference between taxable income <strong>and</strong> accounting income, that originate in one period