Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

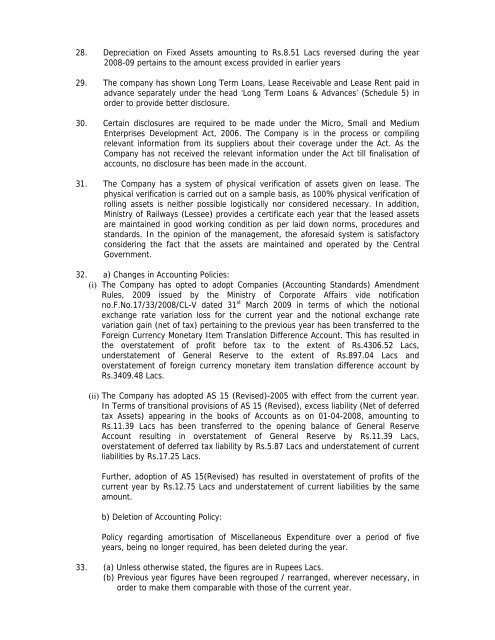

28. Depreciation on Fixed <strong>Assets</strong> amounting to Rs.8.51 Lacs reversed during the year2008-09 pertains to the amount excess provided in earlier years29. The company has shown Long Term Loans, Lease Receivable <strong>and</strong> Lease Rent paid inadvance separately under the head ‘Long Term Loans & Advances’ (Schedule 5) inorder to provide better disclosure.30. Certain disclosures are required to be made under the Micro, Small <strong>and</strong> MediumEnterprises Development Act, 2006. The Company is in the process or compilingrelevant in<strong>for</strong>mation from its suppliers about their coverage under the Act. As theCompany has not received the relevant in<strong>for</strong>mation under the Act till finalisation <strong>of</strong>accounts, no disclosure has been made in the account.31. The Company has a system <strong>of</strong> physical verification <strong>of</strong> assets given on lease. Thephysical verification is carried out on a sample basis, as 100% physical verification <strong>of</strong>rolling assets is neither possible logistically nor considered necessary. In addition,Ministry <strong>of</strong> Railways (Lessee) provides a certificate each year that the leased assetsare maintained in good working condition as per laid down norms, procedures <strong>and</strong>st<strong>and</strong>ards. In the opinion <strong>of</strong> the management, the a<strong>for</strong>esaid system is satisfactoryconsidering the fact that the assets are maintained <strong>and</strong> operated by the CentralGovernment.32. a) Changes in Accounting Policies:(i) The Company has opted to adopt Companies (Accounting St<strong>and</strong>ards) AmendmentRules, 2009 issued by the Ministry <strong>of</strong> Corporate Affairs vide notificationno.F.No.17/33/2008/CL-V dated 31 st March 2009 in terms <strong>of</strong> which the notionalexchange rate variation loss <strong>for</strong> the current year <strong>and</strong> the notional exchange ratevariation gain (net <strong>of</strong> tax) pertaining to the previous year has been transferred to theForeign Currency Monetary Item Translation Difference Account. This has resulted inthe overstatement <strong>of</strong> pr<strong>of</strong>it be<strong>for</strong>e tax to the extent <strong>of</strong> Rs.4306.52 Lacs,understatement <strong>of</strong> General Reserve to the extent <strong>of</strong> Rs.897.04 Lacs <strong>and</strong>overstatement <strong>of</strong> <strong>for</strong>eign currency monetary item translation difference account byRs.3409.48 Lacs.(ii) The Company has adopted AS 15 (Revised)-2005 with effect from the current year.In Terms <strong>of</strong> transitional provisions <strong>of</strong> AS 15 (Revised), excess liability (Net <strong>of</strong> deferredtax <strong>Assets</strong>) appearing in the books <strong>of</strong> Accounts as on 01-04-2008, amounting toRs.11.39 Lacs has been transferred to the opening balance <strong>of</strong> General ReserveAccount resulting in overstatement <strong>of</strong> General Reserve by Rs.11.39 Lacs,overstatement <strong>of</strong> deferred tax liability by Rs.5.87 Lacs <strong>and</strong> understatement <strong>of</strong> currentliabilities by Rs.17.25 Lacs.Further, adoption <strong>of</strong> AS 15(Revised) has resulted in overstatement <strong>of</strong> pr<strong>of</strong>its <strong>of</strong> thecurrent year by Rs.12.75 Lacs <strong>and</strong> understatement <strong>of</strong> current liabilities by the sameamount.b) Deletion <strong>of</strong> Accounting Policy:Policy regarding amortisation <strong>of</strong> Miscellaneous Expenditure over a period <strong>of</strong> fiveyears, being no longer required, has been deleted during the year.33. (a) Unless otherwise stated, the figures are in Rupees Lacs.(b) Previous year figures have been regrouped / rearranged, wherever necessary, inorder to make them comparable with those <strong>of</strong> the current year.