Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

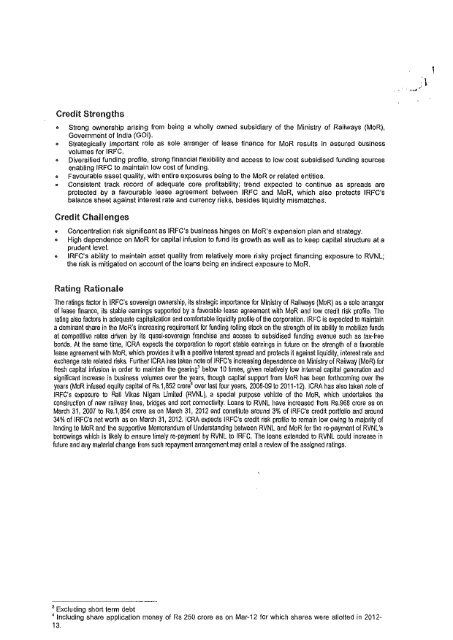

Credit Strengths.. Strong ownership arising from being a wholly owned subsidiary <strong>of</strong> the Ministry <strong>of</strong> Railways (MoR),Governme'nt <strong>of</strong> India (GO I)... Strategically Jmportant role as sole arranger <strong>of</strong> lease finance <strong>for</strong> MoR results in assured businessvolumes <strong>for</strong> IRFC... Diversified funding pr<strong>of</strong>ile, strong financial flexibility <strong>and</strong> access to low cost subsidised funding sourcesenabling IRFC to maintain low cost <strong>of</strong> funding... Favourable asset quality, with entire exposures being to the MoR or related entities." Consistent track record <strong>of</strong> adequate core pr<strong>of</strong>itability; trend expected to continue as spreads areprotected by a favourable lease agreement between IRFC <strong>and</strong> MoR, which also protects IRFC'sbalance sheet against interest rate <strong>and</strong> currency risks, besides liquidity mismatches.Credit Challenges• Concentration risk significant as IRFC's business hinges on MoR's expansion plan <strong>and</strong> strategy... High dependence on MoR <strong>for</strong> capital infusion to fund its growth as well as to keep capital structure at aprudent level... IRFC's ability to maintain asset quality from relatively more risky project financing exposure to RVNL;the risk is mitigated on account <strong>of</strong> the loans being an indirect exposure to MoR.Rating Rationalelhe ratings factor In lRFC's sovereign ownership, its strategic importance <strong>for</strong> Ministry <strong>of</strong> Railways (MoR) as a sole arranger<strong>of</strong> lease finance, its stable earnings supported by a favorable lease agreement with MoR <strong>and</strong> low credit risk pr<strong>of</strong>ile. Therating also factors ln adequate capitalization <strong>and</strong> com<strong>for</strong>table liquidity pr<strong>of</strong>ile <strong>of</strong> the corporation. IRFC is expected to maintaina dominant share in the MoR's Increasing requirement <strong>for</strong> funding rolling stock on the strength <strong>of</strong> its ability to mobilize fundsat competitive rates driven by its quasi-sovereign franchise <strong>and</strong> access to subsidised funding avenue such as tax-freebonds. At the same time, ICRA expects the corporation to report stable earnings in future on the strength <strong>of</strong> a favorablelease agreement with MoR, which provides it with a positive interest spread <strong>and</strong> protects it against liquidity, interest rate <strong>and</strong>exchange rate related risks. Further ICRA has taken note <strong>of</strong> IRFC's increasing dependence on Ministry <strong>of</strong> Railway (MoR) <strong>for</strong>fresh capital infusion in order to maintain the gearing 3 below 10 times, given relatively low internal capital generation <strong>and</strong>significant Increase in business volumes over the years, though capital support from MoR has been <strong>for</strong>thcoming over theyears (MoR infused equity capital <strong>of</strong> Rs.1 ,852 crore 4 over <strong>last</strong> four years, 2008-og to 2011-12). ICRA has also taken note <strong>of</strong>IRFC's exposure to Rail Vikas Nigam Limited (RVNL), a special purpose vehicle <strong>of</strong> the MoR, which undertakes theconstruction <strong>of</strong> new railway lines, bridges <strong>and</strong> port connectivity. Loans to RVNL have increased from Rs.968 crore as onMarch 31, 2007 to Rs.1,854 crore as on March 31, 2012 <strong>and</strong> constitute around 3% <strong>of</strong> fRFC's credit portfolio <strong>and</strong> around34% <strong>of</strong> IRFC's net worth as on March 31, 2012. ICRA expects IRFC's credit risk pr<strong>of</strong>ile to remain low owing to majority <strong>of</strong>lending to MoR <strong>and</strong> the supportive Memor<strong>and</strong>um <strong>of</strong> Underst<strong>and</strong>ing between RVNL <strong>and</strong> MoR <strong>for</strong> the re-payment <strong>of</strong> RVNL'sborrowings which Is likely to ensure timely re-payment by RVNL to IRFC. The loans extended to RVNL could increase infuture <strong>and</strong> any material change from such repayment arrangement may entail a review <strong>of</strong> the assigned ratings.3Excluding short term debt4Including share application money <strong>of</strong> Rs 250 crore as on Mar-12 <strong>for</strong> which shares were allotted in 2012-13.