Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

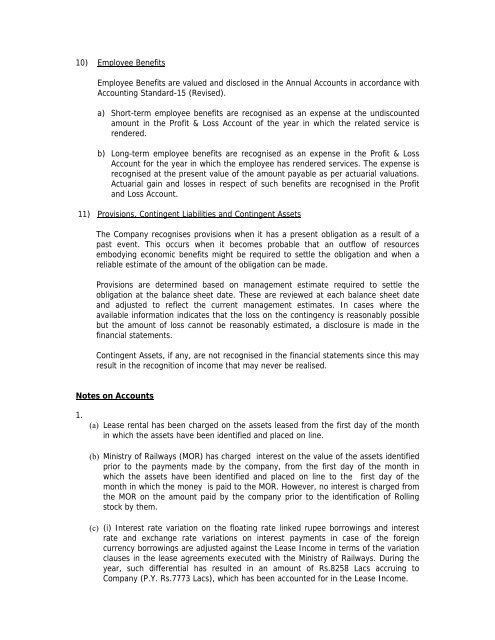

10) Employee BenefitsEmployee Benefits are valued <strong>and</strong> disclosed in the Annual Accounts in accordance withAccounting St<strong>and</strong>ard-15 (Revised).a) Short-term employee benefits are recognised as an expense at the undiscountedamount in the Pr<strong>of</strong>it & Loss Account <strong>of</strong> the year in which the related service isrendered.b) Long-term employee benefits are recognised as an expense in the Pr<strong>of</strong>it & LossAccount <strong>for</strong> the year in which the employee has rendered services. The expense isrecognised at the present value <strong>of</strong> the amount payable as per actuarial valuations.Actuarial gain <strong>and</strong> losses in respect <strong>of</strong> such benefits are recognised in the Pr<strong>of</strong>it<strong>and</strong> Loss Account.11) Provisions, Contingent <strong>Liabilities</strong> <strong>and</strong> Contingent <strong>Assets</strong>The Company recognises provisions when it has a present obligation as a result <strong>of</strong> apast event. This occurs when it becomes probable that an outflow <strong>of</strong> resourcesembodying economic benefits might be required to settle the obligation <strong>and</strong> when areliable estimate <strong>of</strong> the amount <strong>of</strong> the obligation can be made.Provisions are determined based on management estimate required to settle theobligation at the balance sheet date. These are reviewed at each balance sheet date<strong>and</strong> adjusted to reflect the current management estimates. In cases where theavailable in<strong>for</strong>mation indicates that the loss on the contingency is reasonably possiblebut the amount <strong>of</strong> loss cannot be reasonably estimated, a disclosure is made in thefinancial statements.Contingent <strong>Assets</strong>, if any, are not recognised in the financial statements since this mayresult in the recognition <strong>of</strong> income that may never be realised.Notes on Accounts1.(a) Lease rental has been charged on the assets leased from the first day <strong>of</strong> the monthin which the assets have been identified <strong>and</strong> placed on line.(b) Ministry <strong>of</strong> Railways (MOR) has charged interest on the value <strong>of</strong> the assets identifiedprior to the payments made by the company, from the first day <strong>of</strong> the month inwhich the assets have been identified <strong>and</strong> placed on line to the first day <strong>of</strong> themonth in which the money is paid to the MOR. However, no interest is charged fromthe MOR on the amount paid by the company prior to the identification <strong>of</strong> Rollingstock by them.(c) (i) Interest rate variation on the floating rate linked rupee borrowings <strong>and</strong> interestrate <strong>and</strong> exchange rate variations on interest payments in case <strong>of</strong> the <strong>for</strong>eigncurrency borrowings are adjusted against the Lease Income in terms <strong>of</strong> the variationclauses in the lease agreements executed with the Ministry <strong>of</strong> Railways. During theyear, such differential has resulted in an amount <strong>of</strong> Rs.8258 Lacs accruing toCompany (P.Y. Rs.7773 Lacs), which has been accounted <strong>for</strong> in the Lease Income.