Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

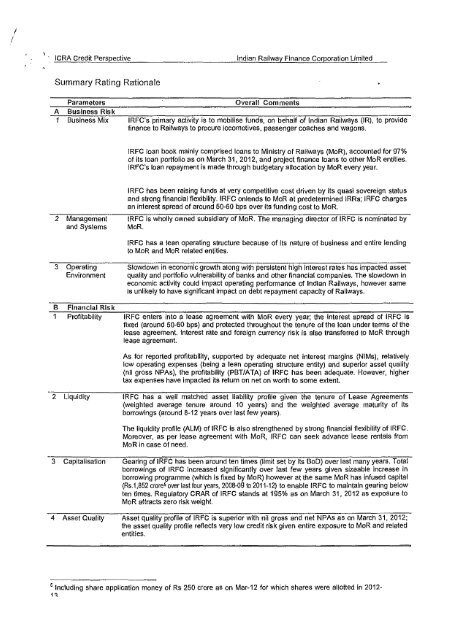

i(ICRA Credit PerspectiveIndian Railway Finance Corporation LimitedSummary Rating RationaleParametersA Business Risk1 Business MixOverall CommentsIRFC's primary activity is to mobilise funds, on behalf <strong>of</strong> Indian Railways (IR), to providefinance to Railways to procure locomotives, passenger coaches. <strong>and</strong> wagons.IRFC loan book mainly comprised loans to Ministry <strong>of</strong> Railways (MaR), accounted <strong>for</strong> g7%<strong>of</strong> its loan portfolio as on March 31, 2012, <strong>and</strong> project finance loans to other MaR entitles.IRFC's loan repayment is made through budgetary allocation by MoR every year.2 Management<strong>and</strong> SystemsIRFC has been raising funds at very competitive cost driven by its quasi sovereign status<strong>and</strong> strong financial flexibility. IRFC onlends to MoR at predetermined IRRs; IRFC chargesan interest spread <strong>of</strong> around 50-60 bps over Its funding cost to MoRlRFC Is wholly owned subsidiary <strong>of</strong> MaR. The managing director <strong>of</strong> IRFC Is nominated byMaR.lRFC has a lean operating structure because <strong>of</strong> Its nature <strong>of</strong> business <strong>and</strong> entire lendingto MaR <strong>and</strong> MoR related entities.3 OperatingEnvironmentB Financial Risk1 Pr<strong>of</strong>itabilitySlowdown in economic growth along with persistent high Interest rates has impacted assetquality <strong>and</strong> portfolio vulnerability <strong>of</strong> banks <strong>and</strong> other financial companies. The slowdown ineconomic activity could Impact operating per<strong>for</strong>mance <strong>of</strong> Indian Railways, however sameIs unlikely to have significant Impact on debt repayment capacity <strong>of</strong> Railways.IRFC enters into a tease agreement with MaR every year; the Interest spread <strong>of</strong> IRFC Isfixed (around 50-50 bps) <strong>and</strong> protected throughout the tenure <strong>of</strong> the loan under terms <strong>of</strong> thelease agreement. Interest rate <strong>and</strong> <strong>for</strong>eign currency risk is also transferred to MoR throughtease agreement.As <strong>for</strong> reported pr<strong>of</strong>itability, supported by adequate net Interest margins (NIMs), relativelylow operating expenses (being a lean operating structure entity) <strong>and</strong> superior asset quality(nil gross NPAs), the pr<strong>of</strong>itability (PBT/ATA) <strong>of</strong> IRFC has been adequate. However, highertax expenses have Impacted its retum on net on worth to some extent.2 LiquidityIRFC has a well matched asset liability pr<strong>of</strong>ile given the tenure <strong>of</strong> Lease Agreements(weighted average tenure around 10 years) <strong>and</strong> the weighted average maturity <strong>of</strong> itsborrowings (around 8-12 years over <strong>last</strong> few years).The liquidity pr<strong>of</strong>ile (ALM) <strong>of</strong> IRFC Is also strengthened by strong financial flexibility <strong>of</strong> IRFC.Moreover, as per lease agreement With MaR, IRFC can seek advance lease rentals fromMaR in case <strong>of</strong> need.3 Capitalisation4 Asset QualityGearing <strong>of</strong> IRFC has been around ten times (limit set by Its BoD) over <strong>last</strong> many years. Totalborrowings <strong>of</strong> IRFC increased significantly over <strong>last</strong> few years given sizeable increase Inborrowing programme {which Is fixed by MaR) however at the same MoR has infused capital(Rs.1 ,852 crore5 over <strong>last</strong> four years, 2008-09 to 2011-12) to enable IRFC to maintain gearing belowten times. Regulatory CRAR <strong>of</strong> IRFC st<strong>and</strong>s at 195% as on March 31, 2012 as exposure toMoR attracts zero risk weight.Asset quality pr<strong>of</strong>ile <strong>of</strong> IRFC is superior with nil gross <strong>and</strong> net NPAs as on March 31, 2012;the asset quality pr<strong>of</strong>ile reflects very low credit risk given entire exposure to MoR<strong>and</strong> relatedentities.5Including share application money <strong>of</strong> Rs 250 crcre as on Mar-12 <strong>for</strong> which shares were allotted in 2012-1-=t