Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

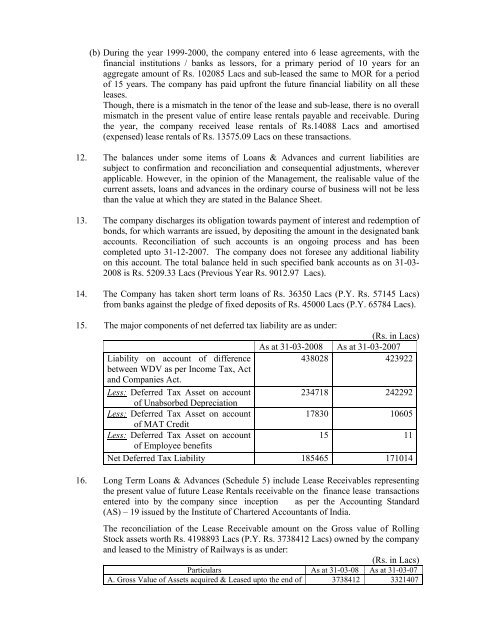

(b) During the year 1999-2000, the company entered into 6 lease agreements, with thefinancial institutions / banks as lessors, <strong>for</strong> a primary period <strong>of</strong> 10 years <strong>for</strong> anaggregate amount <strong>of</strong> Rs. 102085 Lacs <strong>and</strong> sub-leased the same to MOR <strong>for</strong> a period<strong>of</strong> 15 years. The company has paid upfront the future financial liability on all theseleases.Though, there is a mismatch in the tenor <strong>of</strong> the lease <strong>and</strong> sub-lease, there is no overallmismatch in the present value <strong>of</strong> entire lease rentals payable <strong>and</strong> receivable. Duringthe year, the company received lease rentals <strong>of</strong> Rs.14088 Lacs <strong>and</strong> amortised(expensed) lease rentals <strong>of</strong> Rs. 13575.09 Lacs on these transactions.12. The balances under some items <strong>of</strong> Loans & Advances <strong>and</strong> current liabilities aresubject to confirmation <strong>and</strong> reconciliation <strong>and</strong> consequential adjustments, whereverapplicable. However, in the opinion <strong>of</strong> the Management, the realisable value <strong>of</strong> thecurrent assets, loans <strong>and</strong> advances in the ordinary course <strong>of</strong> business will not be lessthan the value at which they are stated in the Balance Sheet.13. The company discharges its obligation towards payment <strong>of</strong> interest <strong>and</strong> redemption <strong>of</strong>bonds, <strong>for</strong> which warrants are issued, by depositing the amount in the designated bankaccounts. Reconciliation <strong>of</strong> such accounts is an ongoing process <strong>and</strong> has beencompleted upto 31-12-2007. The company does not <strong>for</strong>esee any additional liabilityon this account. The total balance held in such specified bank accounts as on 31-03-2008 is Rs. 5209.33 Lacs (Previous Year Rs. 9012.97 Lacs).14. The Company has taken short term loans <strong>of</strong> Rs. 36350 Lacs (P.Y. Rs. 57145 Lacs)from banks against the pledge <strong>of</strong> fixed deposits <strong>of</strong> Rs. 45000 Lacs (P.Y. 65784 Lacs).15. The major components <strong>of</strong> net deferred tax liability are as under:(Rs. in Lacs)As at 31-03-2008 As at 31-03-2007Liability on account <strong>of</strong> difference438028 423922between WDV as per Income Tax, Act<strong>and</strong> Companies Act.Less: Deferred Tax Asset on account234718 242292<strong>of</strong> Unabsorbed DepreciationLess: Deferred Tax Asset on account17830 10605<strong>of</strong> MAT CreditLess: Deferred Tax Asset on account15 11<strong>of</strong> Employee benefitsNet Deferred Tax Liability 185465 17101416. Long Term Loans & Advances (Schedule 5) include Lease Receivables representingthe present value <strong>of</strong> future Lease Rentals receivable on the finance lease transactionsentered into by the company since inception as per the Accounting St<strong>and</strong>ard(AS) – 19 issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India.The reconciliation <strong>of</strong> the Lease Receivable amount on the Gross value <strong>of</strong> RollingStock assets worth Rs. 4198893 Lacs (P.Y. Rs. 3738412 Lacs) owned by the company<strong>and</strong> leased to the Ministry <strong>of</strong> Railways is as under:(Rs. in Lacs)Particulars As at 31-03-08 As at 31-03-07A. Gross Value <strong>of</strong> <strong>Assets</strong> acquired & Leased upto the end <strong>of</strong> 3738412 3321407