Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

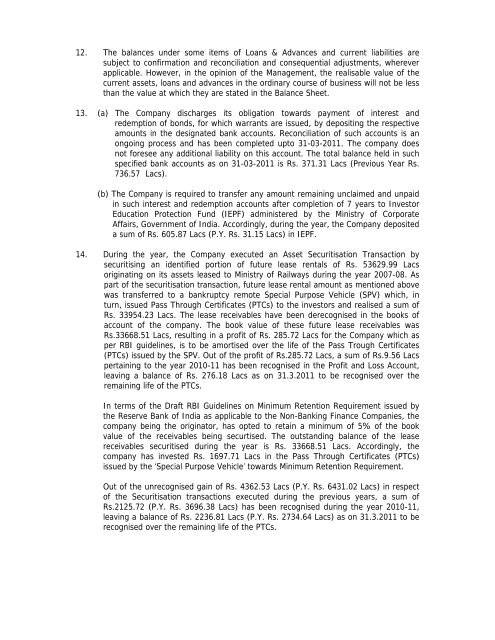

12. The balances under some items <strong>of</strong> Loans & Advances <strong>and</strong> current liabilities aresubject to confirmation <strong>and</strong> reconciliation <strong>and</strong> consequential adjustments, whereverapplicable. However, in the opinion <strong>of</strong> the Management, the realisable value <strong>of</strong> thecurrent assets, loans <strong>and</strong> advances in the ordinary course <strong>of</strong> business will not be lessthan the value at which they are stated in the Balance Sheet.13. (a) The Company discharges its obligation towards payment <strong>of</strong> interest <strong>and</strong>redemption <strong>of</strong> bonds, <strong>for</strong> which warrants are issued, by depositing the respectiveamounts in the designated bank accounts. Reconciliation <strong>of</strong> such accounts is anongoing process <strong>and</strong> has been completed upto 31-03-2011. The company doesnot <strong>for</strong>esee any additional liability on this account. The total balance held in suchspecified bank accounts as on 31-03-2011 is Rs. 371.31 Lacs (Previous Year Rs.736.57 Lacs).(b) The Company is required to transfer any amount remaining unclaimed <strong>and</strong> unpaidin such interest <strong>and</strong> redemption accounts after completion <strong>of</strong> 7 years to InvestorEducation Protection Fund (IEPF) administered by the Ministry <strong>of</strong> CorporateAffairs, Government <strong>of</strong> India. Accordingly, during the year, the Company depositeda sum <strong>of</strong> Rs. 605.87 Lacs (P.Y. Rs. 31.15 Lacs) in IEPF.14. During the year, the Company executed an Asset Securitisation Transaction bysecuritising an identified portion <strong>of</strong> future lease rentals <strong>of</strong> Rs. 53629.99 Lacsoriginating on its assets leased to Ministry <strong>of</strong> Railways during the year 2007-08. Aspart <strong>of</strong> the securitisation transaction, future lease rental amount as mentioned abovewas transferred to a bankruptcy remote Special Purpose Vehicle (SPV) which, inturn, issued Pass Through Certificates (PTCs) to the investors <strong>and</strong> realised a sum <strong>of</strong>Rs. 33954.23 Lacs. The lease receivables have been derecognised in the books <strong>of</strong>account <strong>of</strong> the company. The book value <strong>of</strong> these future lease receivables wasRs.33668.51 Lacs, resulting in a pr<strong>of</strong>it <strong>of</strong> Rs. 285.72 Lacs <strong>for</strong> the Company which asper RBI guidelines, is to be amortised over the life <strong>of</strong> the Pass Trough Certificates(PTCs) issued by the SPV. Out <strong>of</strong> the pr<strong>of</strong>it <strong>of</strong> Rs.285.72 Lacs, a sum <strong>of</strong> Rs.9.56 Lacspertaining to the year 2010-11 has been recognised in the Pr<strong>of</strong>it <strong>and</strong> Loss Account,leaving a balance <strong>of</strong> Rs. 276.18 Lacs as on 31.3.2011 to be recognised over theremaining life <strong>of</strong> the PTCs.In terms <strong>of</strong> the Draft RBI Guidelines on Minimum Retention Requirement issued bythe Reserve Bank <strong>of</strong> India as applicable to the Non-Banking Finance Companies, thecompany being the originator, has opted to retain a minimum <strong>of</strong> 5% <strong>of</strong> the bookvalue <strong>of</strong> the receivables being securtised. The outst<strong>and</strong>ing balance <strong>of</strong> the leasereceivables securitised during the year is Rs. 33668.51 Lacs. Accordingly, thecompany has invested Rs. 1697.71 Lacs in the Pass Through Certificates (PTCs)issued by the ‘Special Purpose Vehicle’ towards Minimum Retention Requirement.Out <strong>of</strong> the unrecognised gain <strong>of</strong> Rs. 4362.53 Lacs (P.Y. Rs. 6431.02 Lacs) in respect<strong>of</strong> the Securitisation transactions executed during the previous years, a sum <strong>of</strong>Rs.2125.72 (P.Y. Rs. 3696.38 Lacs) has been recognised during the year 2010-11,leaving a balance <strong>of</strong> Rs. 2236.81 Lacs (P.Y. Rs. 2734.64 Lacs) as on 31.3.2011 to berecognised over the remaining life <strong>of</strong> the PTCs.