Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

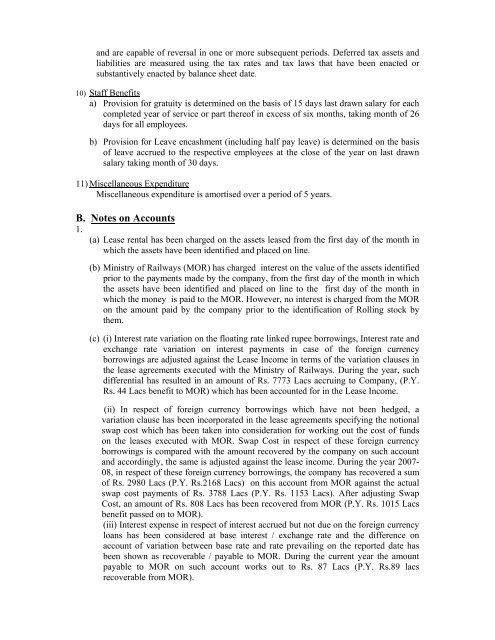

<strong>and</strong> are capable <strong>of</strong> reversal in one or more subsequent periods. Deferred tax assets <strong>and</strong>liabilities are measured using the tax rates <strong>and</strong> tax laws that have been enacted orsubstantively enacted by balance sheet date.10) Staff Benefitsa) Provision <strong>for</strong> gratuity is determined on the basis <strong>of</strong> 15 days <strong>last</strong> drawn salary <strong>for</strong> eachcompleted year <strong>of</strong> service or part there<strong>of</strong> in excess <strong>of</strong> six months, taking month <strong>of</strong> 26days <strong>for</strong> all employees.b) Provision <strong>for</strong> Leave encashment (including half pay leave) is determined on the basis<strong>of</strong> leave accrued to the respective employees at the close <strong>of</strong> the year on <strong>last</strong> drawnsalary taking month <strong>of</strong> 30 days.11) Miscellaneous ExpenditureMiscellaneous expenditure is amortised over a period <strong>of</strong> 5 years.B. Notes on Accounts1.(a) Lease rental has been charged on the assets leased from the first day <strong>of</strong> the month inwhich the assets have been identified <strong>and</strong> placed on line.(b) Ministry <strong>of</strong> Railways (MOR) has charged interest on the value <strong>of</strong> the assets identifiedprior to the payments made by the company, from the first day <strong>of</strong> the month in whichthe assets have been identified <strong>and</strong> placed on line to the first day <strong>of</strong> the month inwhich the money is paid to the MOR. However, no interest is charged from the MORon the amount paid by the company prior to the identification <strong>of</strong> Rolling stock bythem.(c) (i) Interest rate variation on the floating rate linked rupee borrowings, Interest rate <strong>and</strong>exchange rate variation on interest payments in case <strong>of</strong> the <strong>for</strong>eign currencyborrowings are adjusted against the Lease Income in terms <strong>of</strong> the variation clauses inthe lease agreements executed with the Ministry <strong>of</strong> Railways. During the year, suchdifferential has resulted in an amount <strong>of</strong> Rs. 7773 Lacs accruing to Company, (P.Y.Rs. 44 Lacs benefit to MOR) which has been accounted <strong>for</strong> in the Lease Income.(ii) In respect <strong>of</strong> <strong>for</strong>eign currency borrowings which have not been hedged, avariation clause has been incorporated in the lease agreements specifying the notionalswap cost which has been taken into consideration <strong>for</strong> working out the cost <strong>of</strong> fundson the leases executed with MOR. Swap Cost in respect <strong>of</strong> these <strong>for</strong>eign currencyborrowings is compared with the amount recovered by the company on such account<strong>and</strong> accordingly, the same is adjusted against the lease income. During the year 2007-08, in respect <strong>of</strong> these <strong>for</strong>eign currency borrowings, the company has recovered a sum<strong>of</strong> Rs. 2980 Lacs (P.Y. Rs.2168 Lacs) on this account from MOR against the actualswap cost payments <strong>of</strong> Rs. 3788 Lacs (P.Y. Rs. 1153 Lacs). After adjusting SwapCost, an amount <strong>of</strong> Rs. 808 Lacs has been recovered from MOR (P.Y. Rs. 1015 Lacsbenefit passed on to MOR).(iii) Interest expense in respect <strong>of</strong> interest accrued but not due on the <strong>for</strong>eign currencyloans has been considered at base interest / exchange rate <strong>and</strong> the difference onaccount <strong>of</strong> variation between base rate <strong>and</strong> rate prevailing on the reported date hasbeen shown as recoverable / payable to MOR. During the current year the amountpayable to MOR on such account works out to Rs. 87 Lacs (P.Y. Rs.89 lacsrecoverable from MOR).