Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

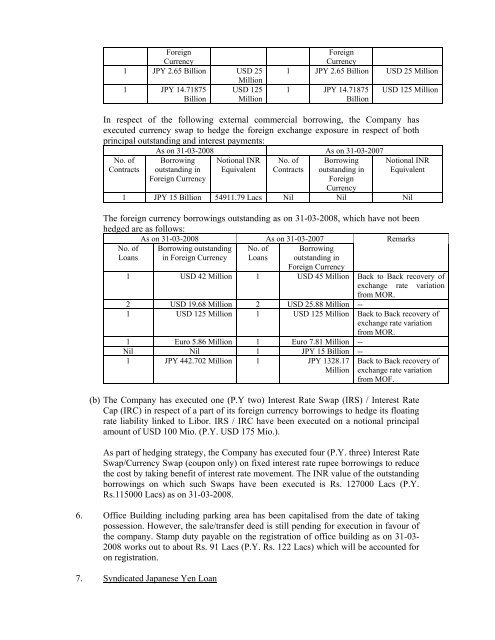

ForeignCurrency1 JPY 2.65 Billion USD 25Million1 JPY 14.71875 USD 125Billion MillionForeignCurrency1 JPY 2.65 Billion USD 25 Million1 JPY 14.71875BillionUSD 125 MillionIn respect <strong>of</strong> the following external commercial borrowing, the Company hasexecuted currency swap to hedge the <strong>for</strong>eign exchange exposure in respect <strong>of</strong> bothprincipal outst<strong>and</strong>ing <strong>and</strong> interest payments:As on 31-03-2008 As on 31-03-2007No. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inForeign CurrencyNotional INREquivalentNo. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inForeignCurrencyNotional INREquivalent1 JPY 15 Billion 54911.79 Lacs Nil Nil NilThe <strong>for</strong>eign currency borrowings outst<strong>and</strong>ing as on 31-03-2008, which have not beenhedged are as follows:As on 31-03-2008 As on 31-03-2007RemarksNo. <strong>of</strong>LoansBorrowing outst<strong>and</strong>ingin Foreign CurrencyNo. <strong>of</strong>LoansBorrowingoutst<strong>and</strong>ing inForeign Currency1 USD 42 Million 1 USD 45 Million Back to Back recovery <strong>of</strong>exchange rate variationfrom MOR.2 USD 19.68 Million 2 USD 25.88 Million --1 USD 125 Million 1 USD 125 Million Back to Back recovery <strong>of</strong>exchange rate variationfrom MOR.1 Euro 5.86 Million 1 Euro 7.81 Million --Nil Nil 1 JPY 15 Billion --1 JPY 442.702 Million 1 JPY 1328.17MillionBack to Back recovery <strong>of</strong>exchange rate variationfrom MOF.(b) The Company has executed one (P.Y two) Interest Rate Swap (IRS) / Interest RateCap (IRC) in respect <strong>of</strong> a part <strong>of</strong> its <strong>for</strong>eign currency borrowings to hedge its floatingrate liability linked to Libor. IRS / IRC have been executed on a notional principalamount <strong>of</strong> USD 100 Mio. (P.Y. USD 175 Mio.).As part <strong>of</strong> hedging strategy, the Company has executed four (P.Y. three) Interest RateSwap/Currency Swap (coupon only) on fixed interest rate rupee borrowings to reducethe cost by taking benefit <strong>of</strong> interest rate movement. The INR value <strong>of</strong> the outst<strong>and</strong>ingborrowings on which such Swaps have been executed is Rs. 127000 Lacs (P.Y.Rs.115000 Lacs) as on 31-03-2008.6. Office Building including parking area has been capitalised from the date <strong>of</strong> takingpossession. However, the sale/transfer deed is still pending <strong>for</strong> execution in favour <strong>of</strong>the company. Stamp duty payable on the registration <strong>of</strong> <strong>of</strong>fice building as on 31-03-2008 works out to about Rs. 91 Lacs (P.Y. Rs. 122 Lacs) which will be accounted <strong>for</strong>on registration.7. Syndicated Japanese Yen Loan