Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

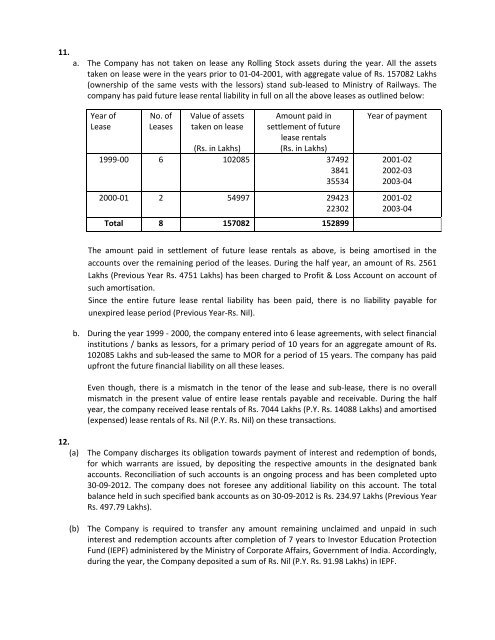

11.a. The Company has not taken on lease any Rolling Stock assets during the year. All the assetstaken on lease were in the years prior to 01‐04‐2001, with aggregate value <strong>of</strong> Rs. 157082 Lakhs(ownership <strong>of</strong> the same vests with the lessors) st<strong>and</strong> sub‐leased to Ministry <strong>of</strong> Railways. Thecompany has paid future lease rental liability in full on all the above leases as outlined below:Year <strong>of</strong>LeaseNo. <strong>of</strong>LeasesValue <strong>of</strong> assetstaken on leaseAmount paid insettlement <strong>of</strong> futurelease rentals(Rs. in Lakhs)(Rs. in Lakhs)1999‐00 6 102085 374923841355342000‐01 2 54997 2942322302Total 8 157082 152899Year <strong>of</strong> payment2001‐022002‐032003‐042001‐022003‐04The amount paid in settlement <strong>of</strong> future lease rentals as above, is being amortised in theaccounts over the remaining period <strong>of</strong> the leases. During the half year, an amount <strong>of</strong> Rs. 2561Lakhs (Previous Year Rs. 4751 Lakhs) has been charged to Pr<strong>of</strong>it & Loss Account on account <strong>of</strong>such amortisation.Since the entire future lease rental liability has been paid, there is no liability payable <strong>for</strong>unexpired lease period (Previous Year‐Rs. Nil).b. During the year 1999 ‐ 2000, the company entered into 6 lease agreements, with select financialinstitutions / banks as lessors, <strong>for</strong> a primary period <strong>of</strong> 10 years <strong>for</strong> an aggregate amount <strong>of</strong> Rs.102085 Lakhs <strong>and</strong> sub‐leased the same to MOR <strong>for</strong> a period <strong>of</strong> 15 years. The company has paidupfront the future financial liability on all these leases.Even though, there is a mismatch in the tenor <strong>of</strong> the lease <strong>and</strong> sub‐lease, there is no overallmismatch in the present value <strong>of</strong> entire lease rentals payable <strong>and</strong> receivable. During the halfyear, the company received lease rentals <strong>of</strong> Rs. 7044 Lakhs (P.Y. Rs. 14088 Lakhs) <strong>and</strong> amortised(expensed) lease rentals <strong>of</strong> Rs. Nil (P.Y. Rs. Nil) on these transactions.12.(a) The Company discharges its obligation towards payment <strong>of</strong> interest <strong>and</strong> redemption <strong>of</strong> bonds,<strong>for</strong> which warrants are issued, by depositing the respective amounts in the designated bankaccounts. Reconciliation <strong>of</strong> such accounts is an ongoing process <strong>and</strong> has been completed upto30‐09‐2012. The company does not <strong>for</strong>esee any additional liability on this account. The totalbalance held in such specified bank accounts as on 30‐09‐2012 is Rs. 234.97 Lakhs (Previous YearRs. 497.79 Lakhs).(b) The Company is required to transfer any amount remaining unclaimed <strong>and</strong> unpaid in suchinterest <strong>and</strong> redemption accounts after completion <strong>of</strong> 7 years to Investor Education ProtectionFund (IEPF) administered by the Ministry <strong>of</strong> Corporate Affairs, Government <strong>of</strong> India. Accordingly,during the year, the Company deposited a sum <strong>of</strong> Rs. Nil (P.Y. Rs. 91.98 Lakhs) in IEPF.