Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

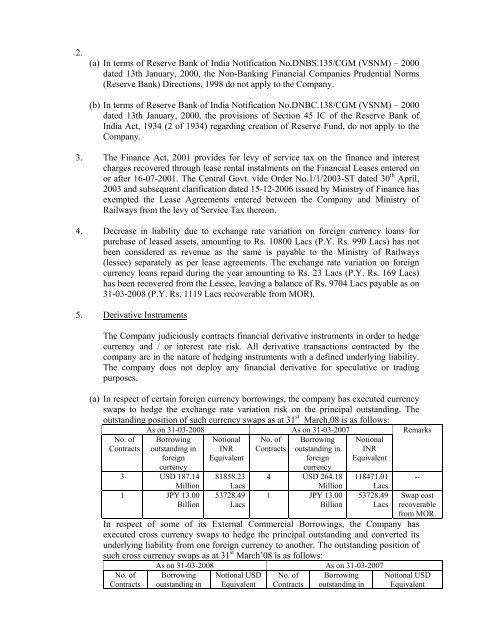

2.(a) In terms <strong>of</strong> Reserve Bank <strong>of</strong> India Notification No.DNBS.135/CGM (VSNM) – 2000dated 13th January, 2000, the Non-Banking Financial Companies Prudential Norms(Reserve Bank) Directions, 1998 do not apply to the Company.(b) In terms <strong>of</strong> Reserve Bank <strong>of</strong> India Notification No.DNBC.138/CGM (VSNM) – 2000dated 13th January, 2000, the provisions <strong>of</strong> Section 45 IC <strong>of</strong> the Reserve Bank <strong>of</strong>India Act, 1934 (2 <strong>of</strong> 1934) regarding creation <strong>of</strong> Reserve Fund, do not apply to theCompany.3. The Finance Act, 2001 provides <strong>for</strong> levy <strong>of</strong> service tax on the finance <strong>and</strong> interestcharges recovered through lease rental instalments on the Financial Leases entered onor after 16-07-2001. The Central Govt. vide Order No.1/1/2003-ST dated 30 th April,2003 <strong>and</strong> subsequent clarification dated 15-12-2006 issued by Ministry <strong>of</strong> Finance hasexempted the Lease Agreements entered between the Company <strong>and</strong> Ministry <strong>of</strong>Railways from the levy <strong>of</strong> Service Tax thereon.4. Decrease in liability due to exchange rate variation on <strong>for</strong>eign currency loans <strong>for</strong>purchase <strong>of</strong> leased assets, amounting to Rs. 10800 Lacs (P.Y. Rs. 990 Lacs) has notbeen considered as revenue as the same is payable to the Ministry <strong>of</strong> Railways(lessee) separately as per lease agreements. The exchange rate variation on <strong>for</strong>eigncurrency loans repaid during the year amounting to Rs. 23 Lacs (P.Y. Rs. 169 Lacs)has been recovered from the Lessee, leaving a balance <strong>of</strong> Rs. 9704 Lacs payable as on31-03-2008 (P.Y. Rs. 1119 Lacs recoverable from MOR).5. Derivative InstrumentsThe Company judiciously contracts financial derivative instruments in order to hedgecurrency <strong>and</strong> / or interest rate risk. All derivative transactions contracted by thecompany are in the nature <strong>of</strong> hedging instruments with a defined underlying liability.The company does not deploy any financial derivative <strong>for</strong> speculative or tradingpurposes.(a) In respect <strong>of</strong> certain <strong>for</strong>eign currency borrowings, the company has executed currencyswaps to hedge the exchange rate variation risk on the principal outst<strong>and</strong>ing. Theoutst<strong>and</strong>ing position <strong>of</strong> such currency swaps as at 31 st March,08 is as follows:As on 31-03-2008 As on 31-03-2007RemarksNo. <strong>of</strong>ContractsNo. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing in<strong>for</strong>eigncurrency3 USD 187.14Million1 JPY 13.00BillionNotionalINREquivalent81858.23Lacs53728.49LacsBorrowingoutst<strong>and</strong>ing in<strong>for</strong>eigncurrency4 USD 264.18Million1 JPY 13.00BillionNotionalINREquivalent118471.01Lacs53728.49Lacs--Swap costrecoverablefrom MOR.In respect <strong>of</strong> some <strong>of</strong> its External Commercial Borrowings, the Company hasexecuted cross currency swaps to hedge the principal outst<strong>and</strong>ing <strong>and</strong> converted itsunderlying liability from one <strong>for</strong>eign currency to another. The outst<strong>and</strong>ing position <strong>of</strong>such cross currency swaps as at 31 st March’08 is as follows:As on 31-03-2008 As on 31-03-2007No. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inNotional USDEquivalentNo. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing inNotional USDEquivalent