Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

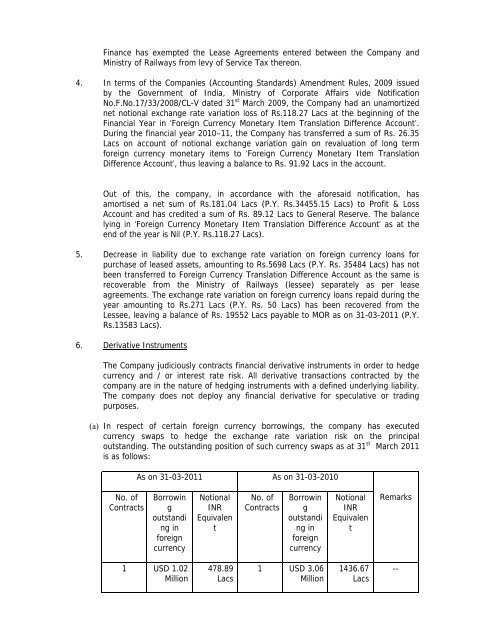

Finance has exempted the Lease Agreements entered between the Company <strong>and</strong>Ministry <strong>of</strong> Railways from levy <strong>of</strong> Service Tax thereon.4. In terms <strong>of</strong> the Companies (Accounting St<strong>and</strong>ards) Amendment Rules, 2009 issuedby the Government <strong>of</strong> India, Ministry <strong>of</strong> Corporate Affairs vide NotificationNo.F.No.17/33/2008/CL-V dated 31 st March 2009, the Company had an unamortizednet notional exchange rate variation loss <strong>of</strong> Rs.118.27 Lacs at the beginning <strong>of</strong> theFinancial Year in ‘Foreign Currency Monetary Item Translation Difference Account’.During the financial year 2010–11, the Company has transferred a sum <strong>of</strong> Rs. 26.35Lacs on account <strong>of</strong> notional exchange variation gain on revaluation <strong>of</strong> long term<strong>for</strong>eign currency monetary items to ‘Foreign Currency Monetary Item TranslationDifference Account’, thus leaving a balance to Rs. 91.92 Lacs in the account.Out <strong>of</strong> this, the company, in accordance with the a<strong>for</strong>esaid notification, hasamortised a net sum <strong>of</strong> Rs.181.04 Lacs (P.Y. Rs.34455.15 Lacs) to Pr<strong>of</strong>it & LossAccount <strong>and</strong> has credited a sum <strong>of</strong> Rs. 89.12 Lacs to General Reserve. The balancelying in ‘Foreign Currency Monetary Item Translation Difference Account’ as at theend <strong>of</strong> the year is Nil (P.Y. Rs.118.27 Lacs).5. Decrease in liability due to exchange rate variation on <strong>for</strong>eign currency loans <strong>for</strong>purchase <strong>of</strong> leased assets, amounting to Rs.5698 Lacs (P.Y. Rs. 35484 Lacs) has notbeen transferred to Foreign Currency Translation Difference Account as the same isrecoverable from the Ministry <strong>of</strong> Railways (lessee) separately as per leaseagreements. The exchange rate variation on <strong>for</strong>eign currency loans repaid during theyear amounting to Rs.271 Lacs (P.Y. Rs. 50 Lacs) has been recovered from theLessee, leaving a balance <strong>of</strong> Rs. 19552 Lacs payable to MOR as on 31-03-2011 (P.Y.Rs.13583 Lacs).6. Derivative InstrumentsThe Company judiciously contracts financial derivative instruments in order to hedgecurrency <strong>and</strong> / or interest rate risk. All derivative transactions contracted by thecompany are in the nature <strong>of</strong> hedging instruments with a defined underlying liability.The company does not deploy any financial derivative <strong>for</strong> speculative or tradingpurposes.(a) In respect <strong>of</strong> certain <strong>for</strong>eign currency borrowings, the company has executedcurrency swaps to hedge the exchange rate variation risk on the principaloutst<strong>and</strong>ing. The outst<strong>and</strong>ing position <strong>of</strong> such currency swaps as at 31 st March 2011is as follows:As on 31-03-2011 As on 31-03-2010No. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing in<strong>for</strong>eigncurrencyNotionalINREquivalentNo. <strong>of</strong>ContractsBorrowingoutst<strong>and</strong>ing in<strong>for</strong>eigncurrencyNotionalINREquivalentRemarks1 USD 1.02Million478.89Lacs1 USD 3.06Million1436.67Lacs--