<strong>Statement</strong> <strong>of</strong> Pr<strong>of</strong>it <strong>and</strong> Loss <strong>for</strong> the Last <strong>Five</strong> <strong>Years</strong>Annexure - IIParticularsNoteNo.For Half yearendedFor the year ended( in Lacs)30.09.2012 31.03.12 31.03.11 31.03.10 31.03.09 31.03.08I. Revenue from operations 17 268,780.41 464,194.17 383,943.80 347,260.44 302,270.63 261,004.84II Other income 18 49.80 116.82 216.52 17.14 11.61 68.63III. Total Revenue (I+II) 268,830.21 464,310.99 384,160.32 347,277.58 302,282.24 261,073.47IV. Expenses:Employee benefits expense 19 109.77 188.22 202.58 155.50 166.14 95.46Finance costs 20 205,406.23 362,038.50 293,673.82 267,976.76 235,841.85 196,702.80Depreciation <strong>and</strong> amortization18.23 35.12 35.10 35.15 36.74 41.04expenseOther expenses 21 365.16 730.22 414.31 281.60 468.78 399.32Total Expenses 205,899.39 362,992.06 294,325.81 268,449.01 236,513.51 197,238.62V. Pr<strong>of</strong>it be<strong>for</strong>e exceptional <strong>and</strong>62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85extraordinary items <strong>and</strong> tax (III-IV)VI. Exceptional items - - - - - -VII. Pr<strong>of</strong>it be<strong>for</strong>e extraordinary items <strong>and</strong>62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85tax (V-VI)VIII. Extraordinary Items - - - - - -IX. Pr<strong>of</strong>it be<strong>for</strong>e tax (VII-VIII) 62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85X. Tax expense:(1) Current tax 12,596.74 20,342.90 17,923.13 13,512.50 7,500.00 7,227.00(2) Tax For Earlier <strong>Years</strong> (60.13) - (50.00) - (1.53) -(3) Deferred tax 20,467.90 32,897.86 23,440.98 21,047.00 22,355.92 14,451.07(4) Deferred Tax For Earlier <strong>Years</strong> - - - - 17,828.37 -(5) Fringe Benefit Tax - - - - 6.81 5.4533,004.51 53,240.76 41,314.11 34,559.50 47,689.57 21,683.52XI. Pr<strong>of</strong>it (Loss) <strong>for</strong> the period (IX-X) 29,926.31 48,078.17 48,520.40 44,269.07 18,079.16 42,151.33XII. Earning per equity share (in ): 22(1) Basic 127.24 283.89 362.80 553.32 361.58 843.03(2) Diluted 127.24 283.78 362.80 553.32 360.40 843.03

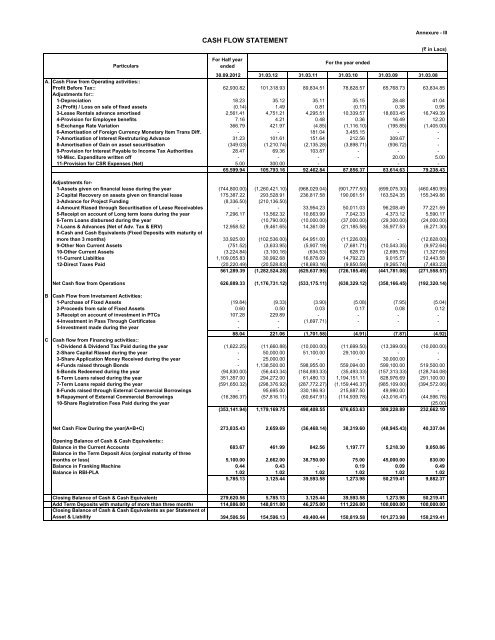

CASH FLOW STATEMENTAnnexure - III( in Lacs)For Half yearParticularsended30.09.2012 31.03.12 31.03.11For the year ended31.03.10 31.03.09 31.03.08A. Cash Flow from Operating activities::Pr<strong>of</strong>it Be<strong>for</strong>e Tax:: 62,930.82 101,318.93 89,834.51 78,828.57 65,768.73 63,834.85Adjustments <strong>for</strong>::1-Depreciation 18.23 35.12 35.11 35.15 28.48 41.042-(Pr<strong>of</strong>it) / Loss on sale <strong>of</strong> fixed assets (0.14) 1.49 0.81 (0.17) 0.38 0.953-Lease Rentals advance amortised 2,561.41 4,751.21 4,295.51 10,339.57 18,603.45 16,749.394-Provision <strong>for</strong> Employee benefits 7.16 4.21 0.48 0.36 16.49 12.205-Exchange Rate Variation 366.79 421.97 (4.85) (1,116.10) (195.85) (1,405.00)6-Amortisation <strong>of</strong> Foreign Currency Monetary Item Trans Diff. - - 181.04 3,455.15 - -7-Amortisation <strong>of</strong> Interest Restruturing Advance 31.23 101.61 151.64 212.56 309.67 -8-Amortisation <strong>of</strong> Gain on asset securitisation (349.03) (1,210.74) (2,135.28) (3,898.71) (936.72) -9-Provision <strong>for</strong> Interest Payable to Income Tax Authorities 28.47 69.36 103.87 - - -10-Misc. Expenditure written <strong>of</strong>f - - - - 20.00 5.0011-Provision <strong>for</strong> CSR Expenses (Net) 5.00 300.00 - - -65,599.94 105,793.16 92,462.84 87,856.37 83,614.63 79,238.43Adjustments <strong>for</strong>-1-<strong>Assets</strong> given on financial lease during the year (744,800.00) (1,260,421.10) (968,029.04) (901,777.50) (699,075.30) (460,480.95)2-Capital Recovery on assets given on financial lease 175,387.22 293,528.91 236,817.58 190,061.51 163,524.35 155,349.863-Advance <strong>for</strong> Project Funding (8,336.50) (210,136.50)4-Amount Riased through Securitisation <strong>of</strong> Lease Receivables - - 33,954.23 50,011.03 96,208.49 77,221.595-Receipt on account <strong>of</strong> Long term loans during the year 7,296.17 13,562.32 10,663.99 7,042.33 4,373.12 5,590.176-Term Loans disbursed during the year - (10,790.00) (10,000.00) (37,000.00) (29,300.00) (24,000.00)7-Loans & Advances (Net <strong>of</strong> Adv. Tax & ERV) 12,958.52 (9,461.65) 14,361.08 (21,185.58) 35,977.53 (6,271.30)8-Cash <strong>and</strong> Cash Equivalents (Fixed Deposits with maturity <strong>of</strong>more than 3 months) 33,925.00 (102,536.00) 64,951.00 (11,226.00) - (12,628.00)9-Other Non Current <strong>Assets</strong> (751.52) (3,633.95) (5,907.19) (7,681.71) (10,543.35) (9,972.64)10-Other Current <strong>Assets</strong> (3,224.84) (3,100.16) (634.53) 628.79 (2,695.75) (1,327.65)11-Current Liabilties 1,109,055.83 30,992.68 16,878.09 14,792.23 9,015.57 12,443.5812-Direct Taxes Paid (20,220.49) (20,528.83) (18,693.16) (9,850.59) (9,265.74) (7,483.23)561,289.39 (1,282,524.28) (625,637.95) (726,185.49) (441,781.08) (271,558.57)Net Cash flow from Operations 626,889.33 (1,176,731.12) (533,175.11) (638,329.12) (358,166.45) (192,320.14)BCCash Flow from Invetsment Activities:1-Purchase <strong>of</strong> Fixed <strong>Assets</strong> (19.84) (9.33) (3.90) (5.08) (7.95) (5.04)2-Proceeds from sale <strong>of</strong> Fixed <strong>Assets</strong> 0.60 0.50 0.03 0.17 0.08 0.123-Receipt on account <strong>of</strong> investment in PTCs 107.28 229.89 - - - -4-Investment in Pass Through Certificates - - (1,697.71) - - -5-Investment made during the year - -88.04 221.06 (1,701.58) (4.91) (7.87) (4.92)Cash flow from Financing activities::1-Dividend & Dividend Tax Paid during the year (1,622.25) (11,660.88) (10,000.00) (11,699.50) (13,399.00) (10,000.00)2-Share Capital Riased during the year - 50,000.00 51,100.00 29,100.00 - -3-Share Application Money Received during the year - 25,000.00 - - 30,000.00 -4-Funds raised through Bonds - 1,138,500.00 598,955.00 559,094.00 599,100.00 519,500.005-Bonds Redeemed during the year (94,830.00) (56,443.34) (184,893.33) (35,493.33) (157,313.33) (128,744.08)6-Term Loans raised during the year 351,357.00 294,272.00 61,480.13 1,194,151.11 828,976.69 291,100.007-Term Loans repaid during the year (591,650.32) (298,376.92) (287,772.27) (1,159,446.37) (985,109.00) (394,572.06)8-Funds raised through External Commercial Borrowings - 95,695.00 330,186.93 215,887.50 49,990.00 -9-Repayment <strong>of</strong> External Commercial Borrowings (16,396.37) (57,816.11) (60,647.91) (114,939.78) (43,016.47) (44,596.76)10-Share Registration Fees Paid during the year (25.00)(353,141.94) 1,179,169.75 498,408.55 676,653.63 309,228.89 232,662.10Net Cash Flow During the year(A+B+C) 273,835.43 2,659.69 (36,468.14) 38,319.60 (48,945.43) 40,337.04Opening Balance <strong>of</strong> Cash & Cash Equivalents::Balance in the Current Accounts 683.67 461.99 842.56 1,197.77 5,218.30 9,050.86Balance in the Term Deposit A/cs (orginal maturity <strong>of</strong> threemonths or less) 5,100.00 2,662.00 38,750.00 75.00 45,000.00 830.00Balance in Franking Machine 0.44 0.43 - 0.19 0.09 0.49Balance in RBI-PLA 1.02 1.02 1.02 1.02 1.02 1.025,785.13 3,125.44 39,593.58 1,273.98 50,219.41 9,882.37Closing Balance <strong>of</strong> Cash & Cash Equivalents 279,620.56 5,785.13 3,125.44 39,593.58 1,273.98 50,219.41Add Term Deposits with maturity <strong>of</strong> more than three months 114,886.00 148,811.00 46,275.00 111,226.00 100,000.00 100,000.00Closing Balance <strong>of</strong> Cash & Cash Equivalents as per <strong>Statement</strong> <strong>of</strong>Asset & Liability 394,506.56 154,596.13 49,400.44 150,819.58 101,273.98 150,219.41

- Page 1: Statement of Assets and Liabilities

- Page 5 and 6: 2. Reserves and Surplus( in Lakhs)P

- Page 7 and 8: 3.1.1 Maturity profile and Rate of

- Page 9 and 10: 65th "J" Taxable Non‐Cum. Bonds 8

- Page 11 and 12: starting from 27‐07‐201416th "O

- Page 13 and 14: HDFC Bank Ltd. 8.44%, Fixed 1‐Apr

- Page 15 and 16: Syndicated Foreign Currency Loan‐

- Page 17 and 18: As at30‐09‐2012As at31‐03‐2

- Page 19 and 20: Total FixedAssets 1,721.57 1,707.80

- Page 21 and 22: Balance in Franking Machine 0.34 0.

- Page 23 and 24: 18. Other IncomeTotal 268780.41 464

- Page 25 and 26: Office Maintenance Expenses 20.25 3

- Page 27 and 28: Significant Accounting policies and

- Page 29 and 30: y the Reserve Bank of India vide th

- Page 31 and 32: (f) (i) Interest rate variation on

- Page 33 and 34: 1 JPY 3 Billion 37.04 Million 1 JPY

- Page 35 and 36: 11.a. The Company has not taken on

- Page 37 and 38: Gross Investment in Lease and Prese

- Page 39 and 40: the year plan assetsTotal Gain / (L

- Page 41 and 42: *The above provisions are liabiliti

- Page 43 and 44: A. Significant Accounting PoliciesF

- Page 45 and 46: Further, in terms of Draft Guidelin

- Page 47 and 48: (P.Y. Rs. 4590 Lakhs). After adjust

- Page 49 and 50: No. ofContractsAs at 31-03-2012 As

- Page 51 and 52: 10. Expenditure in Foreign Currency

- Page 53 and 54:

E. Less Capital Recovery provided u

- Page 55 and 56:

Changes in the Fair Value of Plan A

- Page 57 and 58:

Actuarial Assumptions:AssumptionsGr

- Page 59 and 60:

amortised over the balance tenor of

- Page 61 and 62:

) Recognition at the end of Account

- Page 63 and 64:

Deferred tax expense or benefit is

- Page 65 and 66:

Finance has exempted the Lease Agre

- Page 67 and 68:

The foreign currency borrowings out

- Page 69 and 70:

10. Expenditure in Foreign Currency

- Page 71 and 72:

15. Major components of net deferre

- Page 73 and 74:

Current Service Cost 3.05 1.63 1.02

- Page 75 and 76:

Actuarial Assumptions:As on 31-03-2

- Page 77 and 78:

portion of the future savings in th

- Page 79 and 80:

) Recognition at the end of Account

- Page 81 and 82:

10) Employee BenefitsEmployee Benef

- Page 83 and 84:

5. Decrease in liability due to exc

- Page 85 and 86:

7. Office Building including parkin

- Page 87 and 88:

12. The balances under some items o

- Page 89 and 90:

Unearned Finance Income 2009322 171

- Page 91 and 92:

the yearActualReturn onplan assets1

- Page 93 and 94:

Statementof Profit &LossActuarial A

- Page 95 and 96:

amortised over the balance tenor of

- Page 97 and 98:

) Recognition at the end of Account

- Page 99 and 100:

10) Employee BenefitsEmployee Benef

- Page 101 and 102:

amortisation in future, of the amou

- Page 103 and 104:

As part of hedging strategy, the Co

- Page 105 and 106:

Since the entire future lease renta

- Page 107 and 108:

assets assigned during the yearF. C

- Page 109 and 110:

Benefits Paid - -Fair Value of Plan

- Page 111 and 112:

value Rs. 1,000/- eachc) Earning Pe

- Page 113 and 114:

Financial Year 2007-08A. Significan

- Page 115 and 116:

and are capable of reversal in one

- Page 117 and 118:

ForeignCurrency1 JPY 2.65 Billion U

- Page 119 and 120:

Govt. may from time to time specify

- Page 121 and 122:

previous Financial YearB. Less valu

- Page 123 and 124:

22. Payment to auditors include Rs.

- Page 125 and 126:

Annexure - VIIStatement of Dividend

- Page 127 and 128:

Annexure - IXRelated Party Transact

- Page 129 and 130:

Annexure - XICapitalisation Stateme

- Page 131 and 132:

------ ----~---------~-- ---~------

- Page 133 and 134:

'-. ,,, I__ , __ , _____ ~-~---..

- Page 135 and 136:

Credit Rating Report 1Indian Railwa

- Page 137 and 138:

Given IRFC's modest accruals to net

- Page 139 and 140:

Credit Strengths.. Strong ownership

- Page 141 and 142:

CREDIT PERSPECTIVEDependence on MOR

- Page 143 and 144:

Asset quality profile favourableGiv

- Page 145 and 146:

ANNEXURE 1: RATING DETAILSInstrumen

- Page 147 and 148:

ICRA Credit PerspectiveIndian Railw

- Page 149 and 150:

·PROFIT: & .LOSS ACCOUNT_t'lo of O

- Page 151 and 152:

This is a system generated report a

- Page 153 and 154:

This is a system generated report a

- Page 155 and 156:

Sub : Trade statistics of IRFC N1 f

- Page 157 and 158:

This is a system generated report a

- Page 159 and 160:

This is a system generated report a

- Page 161 and 162:

Sub : Trade statistics of IRFC N2 f

- Page 163 and 164:

SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 165 and 166:

SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 167 and 168:

SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 169 and 170:

SCRIP CODE TRADE DATE ABBREVIATEDNA

- Page 171 and 172:

Ref. No. :NSE/LIST/2012Date :Decemb

- Page 173 and 174:

Sub : Trade Statistics Report from

- Page 175 and 176:

Sub : Trade Statistics Report from

- Page 177 and 178:

Sub : Trade Statistics Report from

- Page 179 and 180:

Sub : Trade Statistics Report from

- Page 181 and 182:

Sub : Trade Statistics Report from

- Page 183 and 184:

Sub : Trade Statistics Report from

- Page 185 and 186:

Sub : Trade Statistics Report from

- Page 187 and 188:

Sub : Trade Statistics Report from

- Page 189 and 190:

Sub : Trade Statistics Report from

- Page 191 and 192:

Sub : Trade Statistics Report from

- Page 193 and 194:

Sub : Trade Statistics Report from

- Page 195 and 196:

Sub : Trade Statistics Report from

- Page 197 and 198:

Sub : Trade Statistics Report from

- Page 199 and 200:

Sub : Trade Statistics Report from

- Page 201 and 202:

Sub : Trade Statistics Report from

- Page 203 and 204:

Sub : Trade Statistics Report from

- Page 205 and 206:

Sub : Trade Statistics Report from

- Page 207 and 208:

Sub : Trade Statistics Report from

- Page 209 and 210:

Sub : Trade Statistics Report from

- Page 211 and 212:

Sub : Trade Statistics Report from

- Page 213 and 214:

Sub : Trade Statistics Report from

- Page 215 and 216:

Sub : Trade Statistics Report from

- Page 217 and 218:

Sub : Trade Statistics Report from

- Page 219 and 220:

Sub : Trade Statistics Report from

- Page 221 and 222:

Sub : Trade Statistics Report from

- Page 223 and 224:

Sub : Trade Statistics Report from

- Page 225 and 226:

ANNXEUREIVCONSENT OF DEBENTURE TRUS

- Page 227:

:,::O.F:.:iINi):nlA··' :.,: ." ":