Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

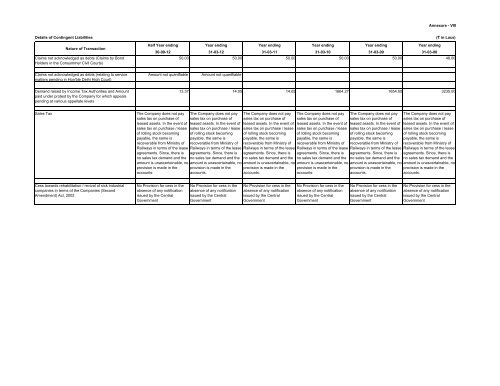

Annexure - VIIIDetails <strong>of</strong> Contingent <strong>Liabilities</strong>Nature <strong>of</strong> TransactionClaims not acknowledged as debts (Claims by BondHolders in the Consummer Civil Courts)( in Lacs)Half Year ending Year ending Year ending Year ending Year ending Year ending30-09-12 31-03-12 31-03-11 31-03-10 31-03-09 31-03-0850.00 50.00 50.00 50.00 50.00 48.00Claims not acknowledged as debts (relating to servicematters pending in Hon'ble Delhi High Court)Amount not quantfiableAmount not quantfiableDem<strong>and</strong> raised by Income Tax Authorities <strong>and</strong> Amountpaid under protest by the Company <strong>for</strong> which appealspending at various appellate levels13.37 14.05 14.05 1664.27 1654.00 3235.00Sales TaxThe Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.The Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.The Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.The Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.The Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.The Company does not paysales tax on purchase <strong>of</strong>leased assets. In the event <strong>of</strong>sales tax on purchase / lease<strong>of</strong> rolling stock becomingpayable, the same isrecoverable from Ministry <strong>of</strong>Railways in terms <strong>of</strong> the leaseagreements. Since, there isno sales tax dem<strong>and</strong> <strong>and</strong> theamount is unascertainable, noprovision is made in theaccounts.Cess towards rehabilitation / revival <strong>of</strong> sick industrialcompanies in terms <strong>of</strong> the Companies (SecondAmendment) Act, 2002No Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernmentNo Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernmentNo Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernmentNo Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernmentNo Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernmentNo Provision <strong>for</strong> cess in theabsence <strong>of</strong> any notificationissued by the CentralGovernment