Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

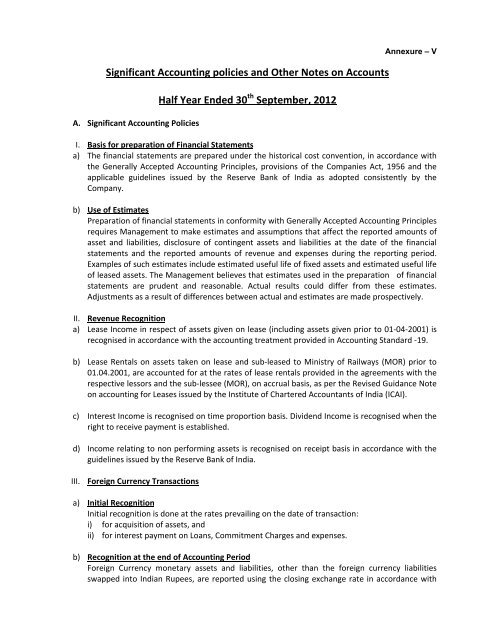

Significant Accounting policies <strong>and</strong> Other Notes on AccountsA. Significant Accounting PoliciesHalf Year Ended 30 th September, 2012Annexure – VI. Basis <strong>for</strong> preparation <strong>of</strong> Financial <strong>Statement</strong>sa) The financial statements are prepared under the historical cost convention, in accordance withthe Generally Accepted Accounting Principles, provisions <strong>of</strong> the Companies Act, 1956 <strong>and</strong> theapplicable guidelines issued by the Reserve Bank <strong>of</strong> India as adopted consistently by theCompany.b) Use <strong>of</strong> EstimatesPreparation <strong>of</strong> financial statements in con<strong>for</strong>mity with Generally Accepted Accounting Principlesrequires Management to make estimates <strong>and</strong> assumptions that affect the reported amounts <strong>of</strong>asset <strong>and</strong> liabilities, disclosure <strong>of</strong> contingent assets <strong>and</strong> liabilities at the date <strong>of</strong> the financialstatements <strong>and</strong> the reported amounts <strong>of</strong> revenue <strong>and</strong> expenses during the reporting period.Examples <strong>of</strong> such estimates include estimated useful life <strong>of</strong> fixed assets <strong>and</strong> estimated useful life<strong>of</strong> leased assets. The Management believes that estimates used in the preparation <strong>of</strong> financialstatements are prudent <strong>and</strong> reasonable. Actual results could differ from these estimates.Adjustments as a result <strong>of</strong> differences between actual <strong>and</strong> estimates are made prospectively.II. Revenue Recognitiona) Lease Income in respect <strong>of</strong> assets given on lease (including assets given prior to 01‐04‐2001) isrecognised in accordance with the accounting treatment provided in Accounting St<strong>and</strong>ard ‐19.b) Lease Rentals on assets taken on lease <strong>and</strong> sub‐leased to Ministry <strong>of</strong> Railways (MOR) prior to01.04.2001, are accounted <strong>for</strong> at the rates <strong>of</strong> lease rentals provided in the agreements with therespective lessors <strong>and</strong> the sub‐lessee (MOR), on accrual basis, as per the Revised Guidance Noteon accounting <strong>for</strong> Leases issued by the Institute <strong>of</strong> Chartered Accountants <strong>of</strong> India (ICAI).c) Interest Income is recognised on time proportion basis. Dividend Income is recognised when theright to receive payment is established.d) Income relating to non per<strong>for</strong>ming assets is recognised on receipt basis in accordance with theguidelines issued by the Reserve Bank <strong>of</strong> India.III. Foreign Currency Transactionsa) Initial RecognitionInitial recognition is done at the rates prevailing on the date <strong>of</strong> transaction:i) <strong>for</strong> acquisition <strong>of</strong> assets, <strong>and</strong>ii) <strong>for</strong> interest payment on Loans, Commitment Charges <strong>and</strong> expenses.b) Recognition at the end <strong>of</strong> Accounting PeriodForeign Currency monetary assets <strong>and</strong> liabilities, other than the <strong>for</strong>eign currency liabilitiesswapped into Indian Rupees, are reported using the closing exchange rate in accordance with