Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

Statement of Assets and Liabilities for last Five Years and Latest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

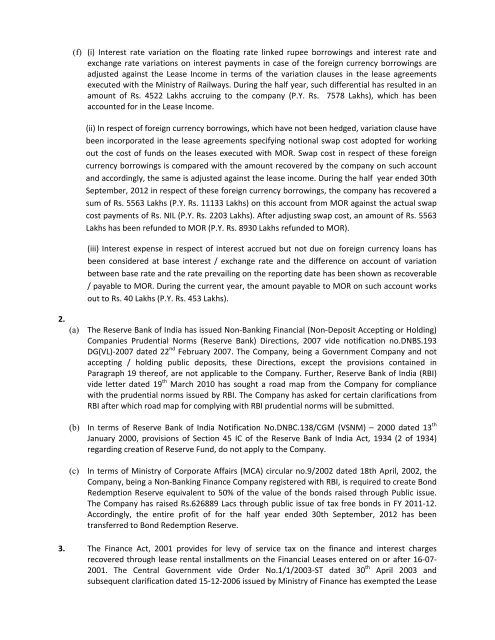

(f) (i) Interest rate variation on the floating rate linked rupee borrowings <strong>and</strong> interest rate <strong>and</strong>exchange rate variations on interest payments in case <strong>of</strong> the <strong>for</strong>eign currency borrowings areadjusted against the Lease Income in terms <strong>of</strong> the variation clauses in the lease agreementsexecuted with the Ministry <strong>of</strong> Railways. During the half year, such differential has resulted in anamount <strong>of</strong> Rs. 4522 Lakhs accruing to the company (P.Y. Rs. 7578 Lakhs), which has beenaccounted <strong>for</strong> in the Lease Income.(ii) In respect <strong>of</strong> <strong>for</strong>eign currency borrowings, which have not been hedged, variation clause havebeen incorporated in the lease agreements specifying notional swap cost adopted <strong>for</strong> workingout the cost <strong>of</strong> funds on the leases executed with MOR. Swap cost in respect <strong>of</strong> these <strong>for</strong>eigncurrency borrowings is compared with the amount recovered by the company on such account<strong>and</strong> accordingly, the same is adjusted against the lease income. During the half year ended 30thSeptember, 2012 in respect <strong>of</strong> these <strong>for</strong>eign currency borrowings, the company has recovered asum <strong>of</strong> Rs. 5563 Lakhs (P.Y. Rs. 11133 Lakhs) on this account from MOR against the actual swapcost payments <strong>of</strong> Rs. NIL (P.Y. Rs. 2203 Lakhs). After adjusting swap cost, an amount <strong>of</strong> Rs. 5563Lakhs has been refunded to MOR (P.Y. Rs. 8930 Lakhs refunded to MOR).(iii) Interest expense in respect <strong>of</strong> interest accrued but not due on <strong>for</strong>eign currency loans hasbeen considered at base interest / exchange rate <strong>and</strong> the difference on account <strong>of</strong> variationbetween base rate <strong>and</strong> the rate prevailing on the reporting date has been shown as recoverable/ payable to MOR. During the current year, the amount payable to MOR on such account worksout to Rs. 40 Lakhs (P.Y. Rs. 453 Lakhs).2.(a) The Reserve Bank <strong>of</strong> India has issued Non‐Banking Financial (Non‐Deposit Accepting or Holding)Companies Prudential Norms (Reserve Bank) Directions, 2007 vide notification no.DNBS.193DG(VL)‐2007 dated 22 nd February 2007. The Company, being a Government Company <strong>and</strong> notaccepting / holding public deposits, these Directions, except the provisions contained inParagraph 19 there<strong>of</strong>, are not applicable to the Company. Further, Reserve Bank <strong>of</strong> India (RBI)vide letter dated 19 th March 2010 has sought a road map from the Company <strong>for</strong> compliancewith the prudential norms issued by RBI. The Company has asked <strong>for</strong> certain clarifications fromRBI after which road map <strong>for</strong> complying with RBI prudential norms will be submitted.(b) In terms <strong>of</strong> Reserve Bank <strong>of</strong> India Notification No.DNBC.138/CGM (VSNM) – 2000 dated 13 thJanuary 2000, provisions <strong>of</strong> Section 45 IC <strong>of</strong> the Reserve Bank <strong>of</strong> India Act, 1934 (2 <strong>of</strong> 1934)regarding creation <strong>of</strong> Reserve Fund, do not apply to the Company.(c) In terms <strong>of</strong> Ministry <strong>of</strong> Corporate Affairs (MCA) circular no.9/2002 dated 18th April, 2002, theCompany, being a Non‐Banking Finance Company registered with RBI, is required to create BondRedemption Reserve equivalent to 50% <strong>of</strong> the value <strong>of</strong> the bonds raised through Public issue.The Company has raised Rs.626889 Lacs through public issue <strong>of</strong> tax free bonds in FY 2011‐12.Accordingly, the entire pr<strong>of</strong>it <strong>of</strong> <strong>for</strong> the half year ended 30th September, 2012 has beentransferred to Bond Redemption Reserve.3. The Finance Act, 2001 provides <strong>for</strong> levy <strong>of</strong> service tax on the finance <strong>and</strong> interest chargesrecovered through lease rental installments on the Financial Leases entered on or after 16‐07‐2001. The Central Government vide Order No.1/1/2003‐ST dated 30 th April 2003 <strong>and</strong>subsequent clarification dated 15‐12‐2006 issued by Ministry <strong>of</strong> Finance has exempted the Lease