Businesses That Last - Planters Development Bank

Businesses That Last - Planters Development Bank

Businesses That Last - Planters Development Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

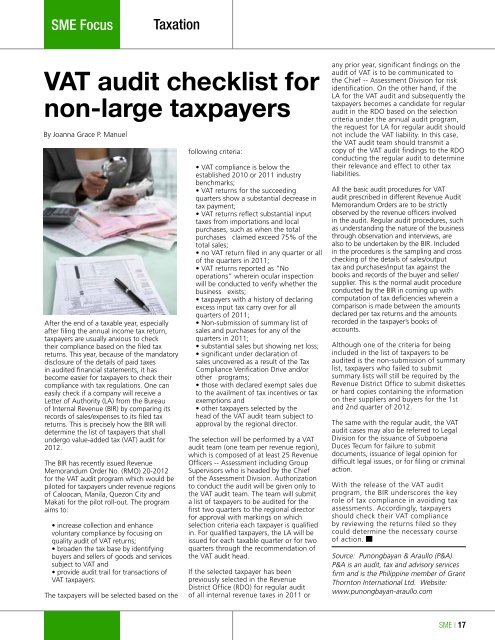

SME SME Focus<br />

Focus<br />

Taxation<br />

VAT audit checklist for<br />

non-large taxpayers<br />

By Joanna Grace P. Manuel<br />

After the end of a taxable year, especially<br />

after filing the annual income tax return,<br />

taxpayers are usually anxious to check<br />

their compliance based on the filed tax<br />

returns. This year, because of the mandatory<br />

disclosure of the details of paid taxes<br />

in audited financial statements, it has<br />

become easier for taxpayers to check their<br />

compliance with tax regulations. One can<br />

easily check if a company will receive a<br />

Letter of Authority (LA) from the Bureau<br />

of Internal Revenue (BIR) by comparing its<br />

records of sales/expenses to its filed tax<br />

returns. This is precisely how the BIR will<br />

determine the list of taxpayers that shall<br />

undergo value-added tax (VAT) audit for<br />

2012.<br />

The BIR has recently issued Revenue<br />

Memorandum Order No. (RMO) 20-2012<br />

for the VAT audit program which would be<br />

piloted for taxpayers under revenue regions<br />

of Caloocan, Manila, Quezon City and<br />

Makati for the pilot roll-out. The program<br />

aims to:<br />

• increase collection and enhance<br />

voluntary compliance by focusing on<br />

quality audit of VAT returns;<br />

• broaden the tax base by identifying<br />

buyers and sellers of goods and services<br />

subject to VAT and<br />

• provide audit trail for transactions of<br />

VAT taxpayers.<br />

The taxpayers will be selected based on the<br />

following criteria:<br />

• VAT compliance is below the<br />

established 2010 or 2011 industry<br />

benchmarks;<br />

• VAT returns for the succeeding<br />

quarters show a substantial decrease in<br />

tax payment;<br />

• VAT returns reflect substantial input<br />

taxes from importations and local<br />

purchases, such as when the total<br />

purchases claimed exceed 75% of the<br />

total sales;<br />

• no VAT return filed in any quarter or all<br />

of the quarters in 2011;<br />

• VAT returns reported as “No<br />

operations” wherein ocular inspection<br />

will be conducted to verify whether the<br />

business exists;<br />

• taxpayers with a history of declaring<br />

excess input tax carry over for all<br />

quarters of 2011;<br />

• Non-submission of summary list of<br />

sales and purchases for any of the<br />

quarters in 2011;<br />

• substantial sales but showing net loss;<br />

• significant under declaration of<br />

sales uncovered as a result of the Tax<br />

Compliance Verification Drive and/or<br />

other programs;<br />

• those with declared exempt sales due<br />

to the availment of tax incentives or tax<br />

exemptions and<br />

• other taxpayers selected by the<br />

head of the VAT audit team subject to<br />

approval by the regional director.<br />

The selection will be performed by a VAT<br />

audit team (one team per revenue region),<br />

which is composed of at least 25 Revenue<br />

Officers -- Assessment including Group<br />

Supervisors who is headed by the Chief<br />

of the Assessment Division. Authorization<br />

to conduct the audit will be given only to<br />

the VAT audit team. The team will submit<br />

a list of taxpayers to be audited for the<br />

first two quarters to the regional director<br />

for approval with markings on which<br />

selection criteria each taxpayer is qualified<br />

in. For qualified taxpayers, the LA will be<br />

issued for each taxable quarter or for two<br />

quarters through the recommendation of<br />

the VAT audit head.<br />

If the selected taxpayer has been<br />

previously selected in the Revenue<br />

District Office (RDO) for regular audit<br />

of all internal revenue taxes in 2011 or<br />

any prior year, significant findings on the<br />

audit of VAT is to be communicated to<br />

the Chief -- Assessment Division for risk<br />

identification. On the other hand, if the<br />

LA for the VAT audit and subsequently the<br />

taxpayers becomes a candidate for regular<br />

audit in the RDO based on the selection<br />

criteria under the annual audit program,<br />

the request for LA for regular audit should<br />

not include the VAT liability. In this case,<br />

the VAT audit team should transmit a<br />

copy of the VAT audit findings to the RDO<br />

conducting the regular audit to determine<br />

their relevance and effect to other tax<br />

liabilities.<br />

All the basic audit procedures for VAT<br />

audit prescribed in different Revenue Audit<br />

Memorandum Orders are to be strictly<br />

observed by the revenue officers involved<br />

in the audit. Regular audit procedures, such<br />

as understanding the nature of the business<br />

through observation and interviews, are<br />

also to be undertaken by the BIR. Included<br />

in the procedures is the sampling and cross<br />

checking of the details of sales/output<br />

tax and purchases/input tax against the<br />

books and records of the buyer and seller/<br />

supplier. This is the normal audit procedure<br />

conducted by the BIR in coming up with<br />

computation of tax deficiencies wherein a<br />

comparison is made between the amounts<br />

declared per tax returns and the amounts<br />

recorded in the taxpayer’s books of<br />

accounts.<br />

Although one of the criteria for being<br />

included in the list of taxpayers to be<br />

audited is the non-submission of summary<br />

list, taxpayers who failed to submit<br />

summary lists will still be required by the<br />

Revenue District Office to submit diskettes<br />

or hard copies containing the information<br />

on their suppliers and buyers for the 1st<br />

and 2nd quarter of 2012.<br />

The same with the regular audit, the VAT<br />

audit cases may also be referred to Legal<br />

Division for the issuance of Subpoena<br />

Duces Tecum for failure to submit<br />

documents, issuance of legal opinion for<br />

difficult legal issues, or for filing or criminal<br />

action.<br />

With the release of the VAT audit<br />

program, the BIR underscores the key<br />

role of tax compliance in avoiding tax<br />

assessments. Accordingly, taxpayers<br />

should check their VAT compliance<br />

by reviewing the returns filed so they<br />

could determine the necessary course<br />

of action.<br />

Source: Punongbayan & Araullo (P&A).<br />

P&A is an audit, tax and advisory services<br />

firm and is the Philippine member of Grant<br />

Thornton International Ltd. Website:<br />

www.punongbayan-araullo.com<br />

SME | 17