Chemical Industries NewsletterâJanuary 2009 - Chemical Insight ...

Chemical Industries NewsletterâJanuary 2009 - Chemical Insight ...

Chemical Industries NewsletterâJanuary 2009 - Chemical Insight ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

August 2008<br />

January <strong>2009</strong><br />

A monthly compilation of SRIC<br />

A monthly report abstracts compilation and news of SRIC<br />

report abstracts and news<br />

CEH Marketing Research Report Abstract<br />

CYCLOHEXANOL AND CYCLOHEXANONE<br />

By Michael Malveda with Hiroaki Mori<br />

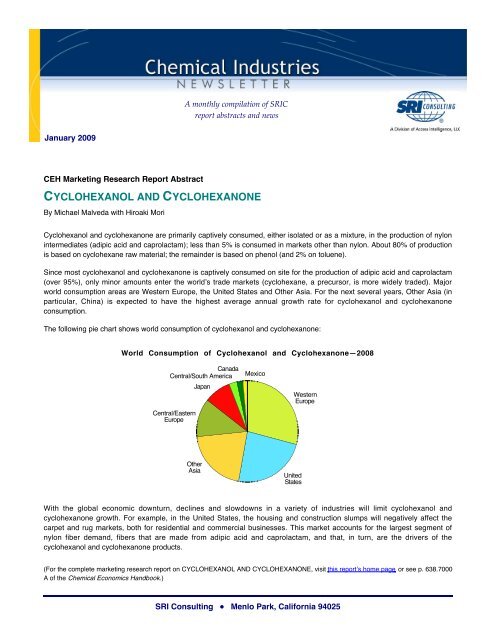

Cyclohexanol and cyclohexanone are primarily captively consumed, either isolated or as a mixture, in the production of nylon<br />

intermediates (adipic acid and caprolactam); less than 5% is consumed in markets other than nylon. About 80% of production<br />

is based on cyclohexane raw material; the remainder is based on phenol (and 2% on toluene).<br />

Since most cyclohexanol and cyclohexanone is captively consumed on site for the production of adipic acid and caprolactam<br />

(over 95%), only minor amounts enter the world’s trade markets (cyclohexane, a precursor, is more widely traded). Major<br />

world consumption areas are Western Europe, the United States and Other Asia. For the next several years, Other Asia (in<br />

particular, China) is expected to have the highest average annual growth rate for cyclohexanol and cyclohexanone<br />

consumption.<br />

The following pie chart shows world consumption of cyclohexanol and cyclohexanone:<br />

World Consumption of Cyclohexanol and Cyclohexanone—2008<br />

Canada<br />

Central/South America<br />

Central/Eastern<br />

Europe<br />

Japan<br />

Mexico<br />

Western<br />

Europe<br />

Other<br />

Asia<br />

United<br />

States<br />

With the global economic downturn, declines and slowdowns in a variety of industries will limit cyclohexanol and<br />

cyclohexanone growth. For example, in the United States, the housing and construction slumps will negatively affect the<br />

carpet and rug markets, both for residential and commercial businesses. This market accounts for the largest segment of<br />

nylon fiber demand, fibers that are made from adipic acid and caprolactam, and that, in turn, are the drivers of the<br />

cyclohexanol and cyclohexanone products.<br />

(For the complete marketing research report on CYCLOHEXANOL AND CYCLOHEXANONE, visit this report’s home page or see p. 638.7000<br />

A of the <strong>Chemical</strong> Economics Handbook.)<br />

SRI Consulting ● Menlo Park, California 94025

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CEH Product Review Abstract<br />

ETHANOLAMINES<br />

By Elvira O. Camara Greiner with Milen Blagoev and Kazuteru Yokose<br />

Ethanolamines are a class of organic compounds that include monoethanolamine (MEA), diethanolamine (DEA) and<br />

triethanolamine (TEA). They are used in surfactants, gas purification, herbicides and wood preservatives. Commercially,<br />

ethanolamines are created by reacting an appropriate amount of an amine (either ammonia, MEA or DEA) with ethylene oxide.<br />

Over 27% of ethanolamine consumption in 2007 was for the production of surfactants. Herbicides (which may include some<br />

ethanolamines consumed for other agricultural chemicals) accounted for over 14% of total consumption in 2007, followed by<br />

gas treatment applications (10%).<br />

The following pie chart shows world consumption of ethanolamines:<br />

World Consumption of Ethanolamines—2007<br />

Rep. of Korea<br />

Middle East<br />

Canada<br />

Mexico<br />

Central/Eastern Europe<br />

Japan<br />

Central/South<br />

America<br />

India<br />

Taiwan<br />

Other<br />

United<br />

States<br />

China<br />

Western<br />

Europe<br />

In North America, ethanolamines consumption is forecast to grow at a rate of about 3% annually between 2007 and 2013.<br />

Herbicides will drive ethanolamines consumption in North America and the world, followed by surfactants (to a lesser extent).<br />

Gas treatment applications will also grow at a healthy rate of almost 4% per year through 2013. Overall, world ethanolamines<br />

consumption is forecast to grow at an average annual rate of 3.5–4.0% during 2007–2013.<br />

Key findings and future implications for the ethanolamines market include:<br />

• The market tightness experienced during 2004 and 2005 has eased since additional world capacity started coming<br />

on stream in 2006 (in Europe) and 2007 (in the United States).<br />

• The increase in the production of ammoniacal (or alkaline) copper quaternary (ACQ) wood preservatives (a major<br />

MEA consumer) in the United States has leveled off. Nearly all of the growth for ACQ wood preservatives occurred<br />

in late 2003 and 2004.<br />

• Several capacity expansions in various regions are planned in order to meet future demand:<br />

Given current market conditions, all of the planned capacity may not come on stream by the planned on-stream dates. It may<br />

be difficult for market demand to absorb these planned new capacities, especially with the lingering world economic crisis. The<br />

markets with the most growth potential will be herbicides (for DEA), ethyleneamines (for MEA) and ester quats (for TEA).<br />

Prices have risen significantly in the last few years as a result of high energy and feedstock costs.<br />

(For the complete product review on ETHANOLAMINES, visit this report’s home page or see p. 642.5000 A of the <strong>Chemical</strong> Economics<br />

Handbook.)<br />

2 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

CEH Marketing Research Report Abstract<br />

INDUSTRIAL PHOSPHATES<br />

By Bala Suresh with Chiyo Funada<br />

The industrial phosphates market has been influenced to a large extent by the dramatic rise in raw material prices, especially<br />

during the past year. The price of purified phosphoric acid has been increasing dramatically as a result of the increase in the<br />

price of phosphate rock, which is the raw material used for producing the acid. That, coupled with the spike in sulfur prices<br />

caused by supply shortages, along with increasing utility costs, has increased the price of phosphate products enormously.<br />

Traditionally, phosphate rock producers have sold the product at relatively lower prices and value was added by the producer<br />

of downstream products. This trend has shifted suddenly wherein the maximum value generation has been moved to the<br />

phosphate rock producers. Phosphate rock prices have escalated fourfold in the past year.<br />

Additionally, China, which is a high-volume exporting country, raised its export tax to between 100% and 175% in April and<br />

September 2008. This was valid for the remainder of 2008. As a result, the gap between the domestic and international prices<br />

increased and exports also increased. This caused some degree of uncertainty in the market as the tax measures could cause<br />

supply shortages and consequently higher prices. However, phosphate rock prices started to stabilize in November 2008 and<br />

this could stabilize the market.<br />

The following pie chart shows consumption of industrial phosphates by major region:<br />

Consumption of Industrial Phosphates by Major Region—2008<br />

Japan<br />

Brazil<br />

Canada<br />

Mexico<br />

Western<br />

Europe<br />

China<br />

United<br />

States<br />

STPP use as a detergent builder no longer accounts for the majority of phosphoric acid consumption in the United States,<br />

Canada or Japan; however, it was the largest market in Western Europe and in Mexico in 2007. Phosphates are excellent<br />

builders, but they are also plant nutrients, and phosphate wastes entering surface water systems can result in excessive<br />

growth of algae. This eutrophication is a significant problem in a number of regions and in particular in the developed<br />

countries. Although detergent phosphates are not normally the major source of phosphate contamination (fertilizer runoff and<br />

animal or human wastes are typically larger sources), they can be readily controlled by restricting use.<br />

Environmental concerns will continue as a strong determinant of phosphate demand in detergents in Western Europe and<br />

North America and accordingly, consumption will stagnate, if not decline. Growth is expected in India, China, other Asian<br />

countries and South America, where increasingly detergents in the mid and premium segments gain market share and these<br />

typically contain phosphate builder systems.<br />

(For the complete marketing research report on INDUSTRIAL PHOSPHATES, visit this report’s home page or see p. 760.2500 A of the<br />

<strong>Chemical</strong> Economics Handbook.)<br />

Visit us at www.sriconsulting.com 3

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CEH Marketing Research Report Abstract<br />

LIGNOSULFONATES<br />

By Sebastian N. Bizzari with Hossein Janshekar and Kazuteru Yokose<br />

Lignosulfonates are complex polymeric materials obtained as coproducts of wood pulping; they consist of a mixture of<br />

sulfonated lignin, sugars, sugar acids, resins and inorganic chemicals. Most lignosulfonates are obtained from the spent<br />

pulping liquor of sulfite pulping operations, although some are also produced by postsulfonation of lignins obtained by sulfate<br />

pulping (kraft process). Recovered coproduct lignosulfonates may be used with little or no additional treatment or they may be<br />

converted to specialty materials with the chemical and physical properties adjusted for specific end-use markets.<br />

Lignosulfonates function primarily as dispersants and binders. Concrete admixtures are the leading market for lignosulfonates,<br />

accounting for 38% of world consumption in 2008. Consumption as binders in copper mining, carbon black and coal is the next<br />

largest world market, accounting for 12% of world consumption in 2008.<br />

The following pie chart shows world consumption of lignosulfonates:<br />

World Consumption of Lignosulfonates—2008<br />

Taiwan<br />

India<br />

Mexico<br />

Canada<br />

Middle East<br />

Central/South America<br />

Rep. of Korea<br />

Japan<br />

Africa<br />

Other<br />

Western<br />

Europe<br />

China<br />

United<br />

States<br />

Central/Eastern<br />

Europe<br />

Dispersant applications of lignosulfonates accounted for 67.5% of world consumption in 2008 followed by binder and adhesive<br />

applications at 32.5%. Major end-use markets include construction, mining, animal feeds and agriculture. Overall economic<br />

performance will continue to be the best indicator of future demand for lignosulfonates. Demand in most downstream markets<br />

is greatly influenced by general economic conditions. As a result, demand largely follows the patterns of the leading world<br />

economies.<br />

Central and Eastern Europe is expected to become the largest market for lignosulfonates in 2013, accounting for 20% of world<br />

consumption, with increased demand in most applications including construction, oil drilling and mining.<br />

Overall economic performance will continue to be the best indicator of future demand for lignosulfonates. The major end-use<br />

markets include construction, mining, animal feeds and agriculture. The market is at risk for further consolidation. Additional<br />

plant closures are expected in the next five years; this should help increase world capacity utilization since demand is growing<br />

at an average annual rate of 1.4%.<br />

(For the complete marketing research report on LIGNOSULFONATES, visit this report’s home page or see p. 671.5000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

4 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

CEH Marketing Research Report Abstract<br />

NATURAL RUBBER<br />

By Emanuel Ormonde and Thomas Kälin<br />

Asia has continued to dominate the world supply of natural rubber, averaging more than 90% of total world production. The<br />

largest natural rubber–producing countries include Thailand, Indonesia and Malaysia. Thailand is currently the largest<br />

producer, but Indonesia is closing in on Thai NR production, and is expected to overtake Thai NR production in coming years.<br />

Malaysia, which accounted for 32% of world production in 1988, shifted emphasis to other crops and nonagricultural<br />

investments and produced only 8% of the world total by 1998. Today, Malaysia represents roughly 12% of total world natural<br />

rubber production. Other regions that are expecting high growth in natural rubber production in the forecast period include<br />

Brazil, Guatemala, India, Sri Lanka, the Philippines and Vietnam.<br />

The shift toward radial tires, which use a higher percentage of natural rubber than bias-ply tires, has resulted in an increase in<br />

natural rubber consumption over the past twenty years. Natural rubber accounted for about 30% of the total world<br />

consumption of rubber in 1981; the share had increased to about 42–43% in 2007. Increased rubber consumption in the<br />

natural rubber–producing countries has also been a factor, as well as the greatly increasing demand for natural rubber in<br />

China and India. In the latter part of 2008, there was a slowdown in natural rubber demand as a result of the world economic<br />

downturn.<br />

The following pie chart shows world production of natural rubber:<br />

World Production of Natural Ruber—2008p<br />

Philippines<br />

Liberia<br />

Brazil<br />

Sri Lanka<br />

Côte d’Ivoire<br />

Vietnam<br />

Other Asia<br />

Other Africa<br />

Other Latin America<br />

Thailand<br />

China<br />

India<br />

Malaysia<br />

Indonesia<br />

Two long-standing development programs—one involving epoxidized natural rubber (ENR) and the other involving<br />

thermoplastic natural rubber (TPNR)—offer potentially increased use of natural rubber. ENR is aimed primarily at tire<br />

applications and TPNR at nontire uses, such as weather seals for vehicles, window seals for buildings, shoe sole applications<br />

and certain automotive components. However, developments to date have not flourished. Most industry observers do not<br />

expect either product to have a significant impact on natural rubber consumption.<br />

In contrast, there have been recent developments in the United States and Australia regarding guayule. Guayule rubber,<br />

developed first in the United States and now Australia, is currently at the forefront of commercial viability. In the current<br />

situation, guayule latex would impact substantially on natural rubber for medical devices and consumer markets, and may<br />

eventually impact the industrial markets for tires during 2015–2020.<br />

(For the complete marketing research report on NATURAL RUBBER, visit this report’s home page or see p. 525.2000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

Visit us at www.sriconsulting.com 5

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CEH Industry Overview Abstract<br />

PAINT AND COATINGS OVERVIEW<br />

By Eric Linak with Akihiro Kishi<br />

The paint and coatings industry in the United States, Western Europe and Japan is mature and generally correlates with the<br />

health of the economy, especially housing and construction and transportation. Overall demand from 2007 to 2012 will<br />

increase at average annual rates of 2% in the United States and 1.5% in Western Europe. In Japan, however, consumption of<br />

paints and coatings will experience relatively slow growth during this period (0.3%) as a result of no growth in major markets<br />

such as automotive OEM, machinery and appliances.<br />

In the less industrialized world, coatings are growing at a much faster rate. The best prospects for growth are in Asia Pacific<br />

(10–15% growth per year in the near future), Eastern Europe (6%) and Latin America (6%). Growth of coatings in China is<br />

expected to continue at 8–10% per year. Most of the major multinational paint producers, including PPG, Akzo Nobel, Kansai<br />

Paint, Nippon Paint, BASF, DuPont, Chugoku Marine Paint, and Hempel, have production in China.<br />

The following chart shows consumption of paints and coatings by country and market:<br />

Percent Market Share in Each Region<br />

Consumption of Paints and Coatings by Market—2007<br />

Architectural Coatings<br />

Automotive OEM<br />

Other Product Finishes<br />

Special-Purpose Coatings<br />

Australia Brazil Canada China France Germany India Japan<br />

Korea,<br />

Rep. of Mexico Spain<br />

United<br />

Kingdom<br />

United<br />

States<br />

The major change that has taken place in the coatings industry during the last twenty years has been the adoption of new<br />

coating technologies. Until the early 1970s, most of the coatings were conventional low-solids, solvent-based formulations;<br />

waterborne (latex) paints, used in architectural applications, accounted for 30–35% of the total. In the late 1970s, however,<br />

impending government regulations on air pollution control focusing on industrial coating operations stimulated the<br />

development of low-solvent and solventless coatings that could reduce the emission of volatile organic compounds (VOCs).<br />

Energy conservation and rising solvent costs were also contributing factors. These new coating technologies include<br />

waterborne (thermosetting emulsion, colloidal dispersion, water-soluble) coatings, high-solids coatings, two-component<br />

systems, powder coatings and radiation-curable coatings.<br />

(For the complete industry overview, PAINT AND COATINGS OVERVIEW, visit this report’s home page or see p. 592.5100 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

6 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

CEH Marketing Research Report Abstract<br />

UNSATURATED POLYESTER RESINS<br />

By Henry Chinn with Uwe Löchner and Yosuke Ishikawa<br />

Unsaturated polyester resins are produced by the polycondensation of saturated and unsaturated dicarboxylic acids with<br />

glycols. Unsaturated polyester resins form highly durable structures and coatings when they are cross-linked with a vinylic<br />

reactive monomer, most commonly styrene. The properties of the cross-linked unsaturated polyester resins depend on the<br />

types of acids and glycols used and their relative proportions.<br />

This report also covers vinyl ester resins, since the industry and government have chosen to group them with unsaturated<br />

polyester when collecting their statistics; however, vinyl esters are actually hybrids between unsaturated polyester and<br />

epoxies. They are linear reaction products of bisphenol A and epichlorohydrin that are terminated with an unsaturated (vinylic)<br />

acid such as methacrylic acid. This product is dissolved in styrene and is applied and cross-linked in the same way as<br />

unsaturated polyesters.<br />

On their own, cross-linked unsaturated polyester and vinyl ester resins have limited structural integrity, so they are often<br />

combined with fiberglass or mineral fillers before cross-linking to enhance their mechanical strength. Resins combined with<br />

fiberglass are referred to as fiberglass-reinforced plastic (FRP). Both lightweight and durable, FRP composites are consumed<br />

primarily by the construction, marine and land transportation industries, although they find use in a variety of other<br />

applications. Nonreinforced cross-linked unsaturated polyester resin is used to make cultured marble and solid surface counter<br />

tops, gel coats, automotive repair putty and filler, and other items such as bowling balls and buttons.<br />

The following pie chart shows world consumption of unsaturated polyester resins:<br />

World Consumption of Unsaturated Polyester Resins—2007<br />

Mexico<br />

Central/South America<br />

Central/Eastern Europe<br />

Japan<br />

Middle East/Africa<br />

Canada<br />

Oceania<br />

China<br />

Other Asia<br />

Western<br />

Europe<br />

United<br />

States<br />

Sales in the primary end markets for unsaturated polyester resin—construction, automotive and marine—depend on the<br />

performance of the general economy and unsaturated polyester resin consumption tends to swing dramatically with any<br />

change in gross domestic product (GDP).<br />

Future demand growth (2007–2012) in North America is forecast to slow somewhat especially in the United States. U.S.<br />

demand had a considerable drop in 2008, with a decline of 15–16% and will continue to decline in <strong>2009</strong>.<br />

Future demand growth (2007–2012) in Europe, the Middle East and Africa is forecast to slow somewhat. The industry will not<br />

be able to decouple from the financial crises, which reached the producing sector in 2008. In fact in 2008, demand was down,<br />

especially in the last quarter of 2008. Highest growth in the region is forecast for Russia, which will continue to grow at a<br />

double-digit rate, albeit from a small base. Future demand growth (2007–2012) in Asia is forecast to slow somewhat.<br />

Visit us at www.sriconsulting.com 7

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

The most dynamic market for unsaturated polyester resins is wind energy. On a global basis, new installed wind energy<br />

capacity in 2007 was about 20 gigawatts (GW). For 2012, new installed capacity worldwide is forecast to grow to almost<br />

approximately 53 GW (or 18% per year). Unsaturated polyester resins (including vinyl ester) are used to produce rotor blades,<br />

engine housings and gel coats in competition with epoxy resins. In Western Europe, annual growth of 7–8% is forecast for<br />

unsaturated polyester resin consumption in this segment during 2007–2012. Growth will be higher in Asia.<br />

(For the complete marketing research report on UNSATURATED POLYESTER RESINS, visit this report’s home page or see p. 580.1200 A of<br />

the <strong>Chemical</strong> Economics Handbook.)<br />

PEP Review Abstract<br />

ADVANCED PYROLYSIS GASOLINE UPGRADING<br />

By Abe Gelbein<br />

One of the major sources of BTX aromatics is the pyrolysis gasoline by-product from steam cracking of naphtha for olefins<br />

production. A variety of process schemes is available to recover the aromatics as well as other value-added products from the<br />

feedstock. One such process is the subject of a recent U.S. patent assigned to the SK Corporation. The process is named<br />

Advanced Pygas Upgrading or APU and is exclusively licensed by Axens. It involves the use of a catalytic hydrodealkylation<br />

step that produces a BTX mixture with low ethylbenzene content, LPG and fuel gas from the C 6+ fraction derived from<br />

stabilized pygas. Simple distillation is used to recover the pure aromatics fractions and the LPG.<br />

This review compares the relative economics of the APU process with that of an alternative conventional scheme that<br />

incorporates C 7 /C 8 splitting, extractive distillation to separate the aromatics and nonaromatics from the C 7 fraction and thermal<br />

hydrodealkylation to convert the C 8+ fraction to additional benzene and toluene. Products are benzene, toluene, C 6 - raffinate<br />

and fuel gas. Conceptual process designs, capital estimates and production cost estimates are developed for both processes<br />

for plants processing ~22,000 bbls/day of pygas.<br />

The estimated CAPEX and OPEX for both processes are roughly the same. The relative economics hinge on the value of the<br />

product slates. Based on third-quarter 2008 Gulf Coast prices the APU process has very favorable economics (B/T ROI >25%)<br />

and has a distinct advantage over the conventional route (B/T ROI

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

Specifically, this report examines the production of the biomonomer lactic acid by fermentation for the production of PLA and<br />

the production of the biomonomer PDO by fermentation and its reaction with terephthalic acid to produce the bioplastic PTT.<br />

For those engaged in the production of biopolymers and their petroleum-based competitors, it is useful for its comparative<br />

economics and understanding of the importance of feedstock costs to the overall economics of biopolymers.<br />

(For the complete December 2008 Report 265 on BIO-BASED POLYMERS, visit this report’s home page .)<br />

PEP Report Abstract<br />

BIOBUTANOL<br />

By Greg Bohlmann and Ron Bray<br />

World production of biofuels has experienced phenomenal growth. Various drivers for this phenomenon include high fuel<br />

prices, concerns about the environment, energy security and rural development. The majority of the growth in biofuels has<br />

been in the production of ethanol. However, there are other biofuels, so-called second-generation biofuels, that may offer<br />

some advantages over ethanol. Second-generation biofuels include cellulosic ethanol, covered in PEP Report 263 Cellulosic<br />

Ethanol, and the subject of this report, biobutanol.<br />

Biobutanol has a number of advantages over ethanol—it has a higher heating value, it is more hydrophobic than ethanol and<br />

can be transported via pipeline integrated in the existing petroleum-based fuels infrastructure and it can be added to gasoline<br />

at higher levels without engine modification.<br />

Biobutanol has garnered the interest not only of early-stage companies such as Tetravitae and Gevo, whose technologies are<br />

covered in this report, but also of major oil and chemical companies. BP and DuPont have formed a JV to develop biobutanol<br />

as a gasoline additive.<br />

This report covers the technological and economic aspects of the production of biobutanol via two processes. The first one is a<br />

modification of the established acetone-butanol-ethanol (ABE) fermentation developed by the University of Illinois and licensed<br />

to Tetravitae. It incorporates an improved microorganism (Clostridium beijerincki BA101) and a gas stripping system for in situ<br />

product removal (ISPR), originally covered in PEP Review 2007-1. The second process is based on a combination of patents<br />

from Gevo and DuPont. It incorporates a novel pathway for the production of isobutanol by a solvent-tolerant microorganism<br />

developed by Gevo and a recovery process based on a DuPont patent application. Neither process is commercial but is in the<br />

process demonstration phase.<br />

We also include for reference a conventional corn dry mill for the production of ethanol because it is likely that if the biobutanol<br />

development program is successful some existing ethanol plants may be converted to biobutanol.<br />

(For the complete December 2008 Report 264 on BIOBUTANOL, visit this report’s home page .)<br />

PEP Report Abstract<br />

CARBON CAPTURE FROM COAL FIRED POWER GENERATION<br />

By Ron Smith with Dipti Dave<br />

Carbon dioxide (CO 2 ), which causes global warming, is emitted industrially from refineries, petrochemical plants, cement, iron<br />

and steel manufacturing plants, and electric power plants. The prospect of global climate change is a matter of genuine public<br />

and private concern. From the viewpoint of the amount of emission, power plant flue gases account for the largest portion.<br />

Thus, the recovery of CO 2 from power plant flue gas is very important for preserving the global environment by way of<br />

prevention of CO 2 emission.<br />

Visit us at www.sriconsulting.com 9

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CO 2 capture and storage or sale offer a new set of options for reducing greenhouse gas emissions that can complement the<br />

current strategies of improving energy efficiency and increasing the use of low-carbon or nonfossil energy resources. In this<br />

report we intend to concentrate on evaluation of technology alternatives for capturing CO 2 from large-scale (200–400<br />

megawatt) gas turbine power plants of the type recently installed in California to deal with the Enron energy trading scheme<br />

fiasco.<br />

This report reviews and evaluates three principal technology alternatives for reducing gas turbine power plant CO 2 emissions<br />

including direct-fired postcombustion gas scrubbing; precombustion decarbonization of natural gas whereby natural gas is<br />

converted to hydrogen and CO 2 by reforming, with hydrogen used as a combustion fuel to drive turbo-generator sets; and the<br />

use of oxyfuel created by separating oxygen from air and burning hydrocarbons with oxygen to produce a turbine exhaust with<br />

high concentration of CO 2 for capture and storage.<br />

(For the complete December 2008 Report 180B on CARBON CAPTURE FROM COAL FIRED POWER GENERATION, visit this report’s<br />

home page .)<br />

PEP Review Abstract<br />

CARBON CAPTURE VIA OXYCOMBUSTION<br />

By Mike Arné<br />

One of the options currently being investigated for carbon capture from coal-fired electric power generation is to use a<br />

predominately oxygen feed to the boiler. This technique, sometimes called oxyfuel or oxycombustion, produces a flue gas that<br />

is mostly composed of carbon dioxide. In effect, it replaces a postcombustion scrubber with a precombustion air separation<br />

unit.<br />

In this review we present our estimate of the capital cost and heat rate/energy efficiency of a pulverized coal-fired power plant<br />

using oxycombustion with 99% oxygen. Net plant output is 550 megawatts. Total fixed capital cost on a December 2008 basis<br />

is $1.8 billion, or roughly $3,300/kW. Gross power output is 790 megawatts; over half of the parasitic load is due to the air<br />

separation unit. The net plant heat rate (HHV) is 11,916 Btu/kWh. Net plant efficiency (HHV) is 28.6%. The power plant<br />

presented is based in large part on information from a U.S. Department of Energy study, Pulverized Coal Oxycombustion<br />

Power Plants, DOE/NETL-2007/1291 published in revised form in October 2007.<br />

(For the complete December 2008 Review 2008-11 on CARBON CAPTURE VIA OXYCOMBUSTION, visit this report’s home page .)<br />

PEP Report Abstract<br />

HYDROCRACKING OF HEAVY OILS AND RESIDUA<br />

By Richard Nielsen<br />

Hydrocracking of heavy oils and residua is increasingly important to refiners because of the increased global production of<br />

heavy and extra-heavy crude oils coupled with increased demand worldwide for low-sulfur middle distillates and residual fuel<br />

oils. Upgrading bitumen into synthetic crude oil (SCO) is of great current and future interest because of the planned and<br />

forecast large expansion of Canadian tar sands production and subsequent bitumen upgrading by hydrocracking into SCO.<br />

Hydrocracking of residual oils mainly increases the production of high-quality middle distillates for blending into jet and diesel<br />

fuels while reducing the volume of low-value, high-sulfur residual fuel oil. Hydrocracking increases the degree of saturation of<br />

the products, which increases product quality, for example, the diesel fuel’s cetane number. Of recent interest is the integration<br />

of hydrocracking with hydrotreating of the hydrocracked products to produce either very-low-sulfur middle distillates or lowsulfur<br />

SCO valued at a premium to many conventional crude oils. Capital and operating costs of the integrated plant are lower<br />

than two separate plants.<br />

10 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

This PEP Report provides an overview of the heavy oil hydrocracking process, feed and product supply and demand,<br />

hydrocracking chemistry, catalysts and hardware technology since PEP Report 228, Refinery Residue Upgrading, issued in<br />

2000. We then develop process economics for two bitumen upgrading processes that both integrate hydrocracking with<br />

hydrotreating of the hydrocracked gas oil and lighter products to produce SCO. The first process hydrocracks vacuum residue<br />

in ebullated bed reactors in a single stage without heavy oil recycle. Bitumen-derived naphtha and gas oils from the crude unit<br />

are also charged to the single-stage hydrotreating section of this plant. The second process hydrocracks atmospheric residue<br />

in a slurry reactor with a portion of the residue oil recycled to the hydrocracking reactor. Two-stage hydrotreating is used. Both<br />

processes use conventional fixed-bed hydrotreating reactors.<br />

(For the complete December 2008 Report 211B on HYDROCRACKING OF HEAVY OILS AND RESIDUA, visit this report’s home page .)<br />

PEP Review Abstract<br />

PROCESSING ACIDIC CRUDE OILS<br />

By Richard H. Nielsen<br />

Acidic crude oils are grades of crude oil that contain substantial amounts of naphthenic acids (NAs) or other acids. They are<br />

also called high-TAN crudes after the most common measure of acidity, the total acid number (TAN). Crude oils with as little<br />

as 0.5 mg KOH/g acid or petroleum fractions greater than about 1.0 mg KOH/g oil usually qualify as a high-acid crude or oil. At<br />

the 1.0 mg/g level, crude oils begin to be heavily discounted in value. Other than acidity, there appear to be no distinguishing<br />

properties that characterize these oils, although most high-TAN crudes’ gravities are often less than 29 API and often are low<br />

in sulfur (except for Venezuelan grades) and frequently produce high yields of gas oil. Acidic oils can vary widely in most other<br />

properties.<br />

Refining acidic crude oils is of increasing interest because of their increased production and usually discounted value.<br />

According to one study, incremental high-TAN crude production will rise by 1.8 million B/D from 2005 to 2010. Output will<br />

continue to rise at least through 2015. Acidic crudes are produced in every oil producing region. China will dominate<br />

production, which is forecast to more than double from 2006 to 2015. Other locations historically noted for high-NA crudes<br />

include Venezuela, India, Russia and some fields in California. Newer regions include the North Sea, West Africa, Mexico and<br />

offshore Brazil.<br />

NAs are known to cause severe corrosion problems, especially when NAs are in low-sulfur crude oils. Potential corrosion<br />

occurs at temperatures between about 450° and 750°F (232° to 399°C). NAs and their salts stabilize the oil-water emulsion,<br />

creating problems during desalting and in downstream separators. Decomposition of NAs produces CO 2 that increases the<br />

level of heat-stable salts formation in the dry gas amine absorbers and cause foaming. CO 2 in the aqueous phase increases<br />

the tendency for carbonate stress corrosion cracking.<br />

Acidity in petroleum oils is due to two main sources: organic sulfur and naphthenic acids. This review emphasizes naphthenic<br />

acids since corrosion by sulfur compounds is much more well known and understood.<br />

(For the complete December 2008 Review 2008-14 on PROCESSING ACIDIC CRUDE OILS, visit this report’s home page .)<br />

PEP Review Abstract<br />

PROCESS WATER MANAGEMENT AND TREATMENT<br />

By Charles Butcher<br />

With increasing pressure on water resources worldwide, increasing numbers of facilities are now recycling water within their<br />

own boundaries. Rising costs of raw water and discharge permits, plus more-stringent rules on the quantity and quality of<br />

treated effluent, make water reuse and recycling increasingly attractive.<br />

Visit us at www.sriconsulting.com 11

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

At present, the trend is largely limited to recycling selected water streams within the plant boundaries, and to reusing treated<br />

municipal wastewater as a source of process water. “Zero liquid discharge” (ZLD) and reuse of plants’ own treated effluent<br />

remain generally uneconomic, though they will increasingly be required in dry or environmentally sensitive locations.<br />

Key to this convergence between process water and wastewater are the various membrane-based treatment processes,<br />

especially reverse osmosis (RO). Thanks in large part to their ability to desalinate seawater at reasonable cost, large-scale RO<br />

systems are forecast to see sales growth of up to 50% over the next four years. The resulting fall in costs will further<br />

encourage the use of RO in wastewater recycling. Membrane technologies have also significantly improved the economics of<br />

water treatment for demanding uses such as boiler feed, semiconductor manufacturing and pharmaceuticals.<br />

A landmark water reuse project is at Dow <strong>Chemical</strong>’s Terneuzen site in the Netherlands, where 30,000 m 3 /d, representing half<br />

the water used on site, now comes from recycled process water, rainwater and household wastewater. Dow claims to have<br />

reduced its overall consumption of process water by 35% in thirteen years, and the company’s external water business<br />

proposes to cut the cost of water reuse by 35% by 2015.<br />

All water and wastewater treatment processes are sensitive to site conditions, and this is especially true of membranes. Done<br />

correctly, however, water reuse and recycling bring significant economic, environmental and social benefits.<br />

(For the complete December 2008 Review 2008-15 on PROCESS WATER MANAGEMENT AND TREATMENT, visit this report’s home<br />

page .)<br />

PEP Review Abstract<br />

SOIL REMEDIATION<br />

By Jamie Lacson<br />

Soil remediation is a significant part of environmental services. Most remediation projects have been conducted by<br />

environmental service companies, including engineering and environmental consulting firms. The technologies employed for<br />

soil remediation include traditional technologies such as incineration and solidification/stabilization, and emerging/innovative<br />

technologies such as air sparging, soil-vapor extraction, thermal desorption, and bioremediation. From a cost estimation<br />

perspective, soil remediation technologies can be broadly classified into two groups: in situ technologies and ex situ<br />

technologies. These two groups of treatment methods entail major differences in the provision of remedial services and,<br />

consequently, in the methods used to estimate costs. In this PEP Review, we discuss the process and economics of two ex<br />

situ soil remediation technologies: solvent extraction and soil washing.<br />

(For the complete December 2008 Review 2008-4 on SOIL REMEDIATION, visit this report’s home page .)<br />

PEP Review Abstract<br />

TOLUENE DIISOCYANATE FROM TOLUENE DIAMINE BY BAYER GAS PHASE<br />

PHOSGENATION PRELIMINARY EVALUATION<br />

By P.D. Pavlechko<br />

The recent developments announced by Bayer MaterialScience concerning technology to make toluene diisocyanate by gasphase<br />

phosgenation seem to offer new technology to a fairly mature industry. Announcements of scale, performance, energy<br />

savings and actions to build a new facility in China imply that there is something to the new technology. The patent literature is<br />

somewhat sparse on the subject and few details are published, so there are a lot of questions to be answered before an<br />

analysis of the potential design can be completed. Initial attempts wandered down several erroneous paths because of the<br />

lack of hard data and definitive route information. The limited information has raised questions about the scale of the project,<br />

12 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

and whether it is a single line or parallel lines. Since comments seem to suggest that the scale is a single process line, this<br />

analysis attempted to build a design based on the maximum scale announced.<br />

The effort managed to compile a plausible design as a single process line to the 300 kmt/yr scale. Limitations in costing<br />

correlation functions limit that design though by forcing parallel equipment and disallowing extrapolation beyond the limit of the<br />

correlations. However, extrapolation of refrigeration costs introduced an anomaly to the analysis too. Therefore, this analysis is<br />

limited to a preliminary assessment that shows promise, but will require more data and analysis to improve the result.<br />

(For the complete December 2008 Review 2008-1 on TOLUENE DIISOCYANATE FROM TOLUENE DIAMINE BY BAYER GAS PHASE<br />

PHOSGENATION PRELIMINARY EVALUATION, visit this report’s home page .)<br />

SCUP REPORTS SCHEDULED FOR <strong>2009</strong><br />

Report Title Author Status<br />

Specialty <strong>Chemical</strong>s Overview Uwe Fink In preparation<br />

Mining <strong>Chemical</strong>s Patricia Thiers In preparation<br />

Synthetic Lubricants Stefan Müller In preparation<br />

Rubber Processing <strong>Chemical</strong>s Fred Hajduk In preparation<br />

Specialty Paper <strong>Chemical</strong>s Ray Will In preparation<br />

Antioxidants Fred Hajduk In preparation<br />

Printing Inks Ray Will In preparation<br />

Corrosion Inhibitors Stefan Müller In preparation<br />

Imaging <strong>Chemical</strong>s: Inkjet Technologies Uwe Fink In preparation<br />

Plastics Additives Stefan Müller In preparation<br />

Specialty Films Fred Hajduk In preparation<br />

Adhesives and Sealants Ray Will In preparation<br />

To view a list of SCUP reports for sale separately, please see our website at<br />

http://www.sriconsulting.com/SCUP/Public/Reports/ . For additional information, please contact:<br />

Ralf Gubler, Acting Director<br />

Specialty <strong>Chemical</strong>s Update Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

Visit us at www.sriconsulting.com 13

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CEH REPORTS AND PRODUCT<br />

REVIEWS IN PREPARATION<br />

Report Title<br />

Aromatic Ketone Polymers<br />

Chlorinated Polyethylene Resins<br />

Detergent Alcohols<br />

Diisocyanates<br />

Explosives<br />

Fumigants/Nematicides<br />

Gasoline Octane Improvers<br />

Hydrogen<br />

Liquid Crystal Polymers<br />

Maleic Anhydride<br />

Natural Fatty Acids<br />

Phosphorus <strong>Chemical</strong>s<br />

Plasticizer Alcohols<br />

Plastics Recycling<br />

Polyester Film<br />

Polyether Polyols for Urethanes<br />

Polystyrene<br />

Polysulfide Elastomers<br />

Polyurethane Foams<br />

Polyvinyl Alcohol<br />

Sulfone Polymers<br />

Surfactants, Household Detergents<br />

Zeolites<br />

Author<br />

Thomas Kälin<br />

Emanuel Ormonde<br />

Robert Modler<br />

Henry Chinn<br />

Stefan Schlag<br />

Mike Malveda<br />

Eric Linak<br />

Stefan Schlag<br />

Thomas Kälin<br />

Elvira Greiner<br />

Sebastian Bizzari<br />

Bala Suresh<br />

Sebastian Bizzari<br />

Jim Glauser<br />

Barbara Sesto<br />

Henry Chinn<br />

Koon-Ling Ring<br />

Emanuel Ormonde<br />

Henry Chinn<br />

Henry Chinn<br />

Eric Linak<br />

Bob Modler<br />

Sean Davis<br />

This list is provided for the benefit of <strong>Chemical</strong> Economics<br />

Handbook users who may simultaneously be undertaking their<br />

own studies in these areas. Clients are welcome to write or call<br />

us in order to discuss the work in progress.<br />

CEH REPORTS AVAILABLE SEPARATELY<br />

To obtain a list of CEH marketing research reports or product<br />

reviews for sale separately, please see our website at<br />

http://www.sriconsulting.com/CEH/Public/Reports/ or<br />

contact:<br />

Koon-Ling Ring, Director<br />

<strong>Chemical</strong> Economics Handbook Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

14 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter January <strong>2009</strong><br />

Need to know what’s happening with plant capital expenditures and construction activity<br />

Now you can get the latest data easily through <strong>Chemical</strong> Week’s Engineering &<br />

Construction Database. This database, updated weekly, has the most recent data on<br />

engineering and construction projects in the chemical industry, and has worldwide coverage.<br />

Go to www.chemweek.com/ECPD to see for yourself!<br />

This data is garnered from exclusive news items discovered via the editorial expertise at<br />

<strong>Chemical</strong> Week, so it is proprietary and unique among other information on the market.<br />

As a matter of fact, you won’t find it available to just ANYBODY—access is being given to<br />

only a select few people at this time, so once you register, you’ll have to bookmark<br />

www.chemweek.com/ecprojects to get to the data on a regular basis.<br />

When you get access, you can search by a variety of categories, including:<br />

• Producer<br />

• Location<br />

• Product Capacity (thousands of metric tons per year, unless otherwise specified)<br />

• Start-up Date<br />

• Contracting Services Provider<br />

• Technology Provider<br />

Also, you can search by region or look for a specific company.<br />

This database is updated weekly, so you get the latest data to stay on top of the biggest<br />

project investment activity in the industry!<br />

Go to www.chemweek.com/ECPD NOW to register for your free trial.<br />

Then, to make sure you continue to get access, bookmark<br />

www.chemweek.com/ecprojects to get our exclusive data.<br />

<strong>Chemical</strong> Week<br />

A Publication of Access Intelligence, LLC<br />

4 Choke Cherry Road, Suite 200<br />

Rockville, MD 20850<br />

www.chemweek.com<br />

Visit us at www.sriconsulting.com 15

January <strong>2009</strong><br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

CHEMICAL INDUSTRIES NEWSLETTER<br />

The <strong>Chemical</strong> <strong>Industries</strong> Newsletter is published monthly by SRI Consulting. The contents of the Newsletter are drawn from current research<br />

and publications of SRIC’s multiclient programs. Readers are welcome to call or write for more information about the subjects and programs<br />

mentioned (see addresses and telephone/fax numbers below).<br />

SRI Consulting offers the world’s most comprehensive ongoing multiclient databases on the chemical industry. The major multiclient programs<br />

include<br />

<strong>Chemical</strong> Economics Handbook<br />

Directory of <strong>Chemical</strong> Producers<br />

The China Report Canada Mexico<br />

Process Economics Program China Middle East<br />

Specialty <strong>Chemical</strong>s Update Program East Asia South/Central America<br />

World Petrochemicals Europe United States<br />

India<br />

Companies may participate in these continuing programs for the chemical industry through annual subscriptions or by purchasing individual<br />

reports. Each program is supported by inquiry and consulting privileges; electronic access is also available for all of these products.<br />

SRI Consulting.......................................................John Pearson, President and CEO<br />

George Intille, Senior Vice President<br />

Ralf Gubler, Vice President<br />

Russell Heinen, Vice President<br />

Linda Henderson, Vice President<br />

<strong>Chemical</strong> Economics Handbook..................................Koon-Ling Ring, Director<br />

Directory of <strong>Chemical</strong> Producers....................................Carolyn Read, Director<br />

Process Economics Program...............................................R.J. Chang, Director<br />

Production/Databases ...................................................Steven F. Read, Director<br />

Specialty <strong>Chemical</strong>s Update Program ...................Ralf Gubler, Acting Director<br />

World Petrochemicals............................................................Ed Gartner, Director<br />

About SRI Consulting<br />

SRI Consulting provides the world’s most comprehensive ongoing databases on the chemical industries. We offer an array of research-based<br />

programs designed to provide clients with specific market intelligence and analysis. These programs, combined with strategic information<br />

services, help clients define new market opportunities, identify and communicate future challenges, formulate and implement business<br />

strategies, and develop innovative products, processes and services. SRIC provides creative yet practical strategies, supported by renowned<br />

industry and technology expertise and delivered by multidisciplinary teams working closely with clients to ensure implementation. SRI<br />

Consulting is a division of Access Intelligence, LLC.<br />

About Access Intelligence, LLC<br />

Access Intelligence, LLC is a full-service global information and marketing solutions provider of competitive business-to-business information.<br />

The company publishes daily news services, premium-value newsletters, subscription-based websites, magazines, directories, and<br />

databases.<br />

SRI Consulting<br />

Headquarters<br />

_________________________ International Offices ____________________________<br />

Menlo Park, CA Europe, Middle East and Africa Beijing<br />

John Pearson, President and CEO Alfred-Escher-Strasse 34 Suite 1606, Tower B, Global Trade Center<br />

4300 Bohannon Drive, Suite 200 CH 8002 Zürich, Switzerland 36 North Third Ring Road East<br />

Menlo Park, CA 94025 Telephone: 41 44 283 63 33 Dongcheng District, Beijing 100013<br />

Telephone: (650) 384-4300 Fax: 41 44 283 63 30 China<br />

Fax: (650) 330-1149 zurich@sriconsulting.com Telephone: 8610-58256826<br />

menlopark@sriconsulting.com Fax: 8610-58256830<br />

beijing@sriconsulting.com<br />

U.S. Offices<br />

East Asia<br />

Houston<br />

Takeda Honcho Building, 8th Floor<br />

2002 Timberloch Place, Suite 110 2-1-7 Nihonbashi Honcho<br />

The Woodlands, TX 77380<br />

Chuoku, Tokyo 103-0023, Japan<br />

Telephone: (281) 203-6280 Telephone: 81 3 5202-7320<br />

Fax: (281) 203-6287 Fax: 81 3 5202-7333<br />

houston@sriconsulting.com<br />

tokyo@sriconsulting.com<br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

Ellen Blue, Editor<br />

© <strong>2009</strong> by SRI Consulting.<br />

All rights reserved. Unauthorized reproduction prohibited.<br />

16 Visit us at www.sriconsulting.com

December 2007<br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

(For the complete December 2007 report on CATALYSTS: EMISSION CONTROL CATALYSTS, visit this report’s home page or see vol. 5 of<br />

Specialty <strong>Chemical</strong>s—Strategies for Success.)<br />

SCUP Report Abstract<br />

CATALYSTS: PETROLEUM AND CHEMICAL PROCESS<br />

By Masahiro Yoneyama with Uwe Fink, Fred Hajduk, and Wei Yang<br />

This report focuses on petroleum and chemical process catalysts. See the SCUP Catalysts: Emission Control<br />

Catalysts report for information on that area.<br />

Process catalysts, a multibillion-dollar-per-year business worldwide, play a vital role in the economy. The value<br />

of products dependent on process catalysts, including petroleum products, chemicals, pharmaceuticals, synthetic<br />

rubber and plastics, and many others, is said to be in the hundreds of billions of dollars per year. About 90% of<br />

chemical manufacturing processes and more than 20% of all industrial products employ underlying catalytic<br />

steps. Petroleum refining, for example, which is the source of by far the largest share of industrial products,<br />

consists almost entirely of catalytic processes.<br />

For a number of catalysts, the strongest growth in demand through 2011 will occur in regions other than North<br />

America, Western Europe and Japan. Assuming no new economic crises prior to 2011, industrialized and<br />

developing countries in the Asia Pacific region and Latin America will become important markets for process<br />

catalysts. Rising incomes will drive demand for motor vehicles and transportation fuels in Asia and Latin<br />

America. Industrial chemical production, particularly of petrochemicals, is growing faster in Asia and the Middle<br />

East than in North America and Europe. This growth will be reflected in increased demand for a number of<br />

catalysts in the refinery segment (such as for hydroprocessing), for polymerization, and for hydrogen production.<br />

Low-sulfur mandates are also becoming more widespread in these regions.<br />

Legislation is driving growth in catalyst consumption in the developed countries in North America, Europe and<br />

Japan, while economic growth is the major driving force for developing countries of Asia. These regions are<br />

covered in detail in this report. More-stringent vehicle emissions standards are resulting in the development of<br />

advanced automotive catalysts that require low-sulfur fuel, thus driving demand for hydroprocessing catalysts<br />

(and refinery hydrogen). Increased use of hydroprocessing catalysts is also forecast for Western Europe. Overall<br />

catalyst demand growth in Japan will be more modest because of the continued shift of the manufacturing base<br />

overseas to other Asian countries. Catalyst consumption in both petroleum refining and chemical processing will<br />

grow fast reflecting high GDP growth in China.<br />

As the global refining industry moves to cleaner fuels, refiners are being squeezed on hydrogen availability and<br />

octane requirements. Gasoline desulfurization technology has advanced to limit hydrogen consumption and<br />

octane loss, but globally, the octane-barrel position of refiners will deteriorate. On the diesel side of the clean fuels<br />

challenge, a significant increase in hydrogen consumption is forecast to attain ultra-low-sulfur diesel (ULSD)<br />

from straight-run and cracked stocks containing refractory sulfur species. Increasingly, isomerization of light<br />

naphtha will be one of the preferred solutions to add octane to the gasoline pool, triggered by new catalyst<br />

formulations and optimized processes. Catalytic reforming is the technology of choice for the production of highoctane<br />

gasoline and is usually the main source of refinery hydrogen. Catalytic reforming and isomerization<br />

continue to grow because of their role in removing lead from gasoline in the developing world. Hydroprocessing<br />

is probably growing the most, in response to lower sulfur levels in gasoline and diesel.<br />

Major market segments for polymerization catalysts include polyethylene, polypropylene, polyethylene<br />

terephthalate, polyvinyl chloride and polystyrene. Polyolefin catalysts are the largest single market sector.<br />

Polyolefin catalyst consumption is nearly flat. Growth in polyolefin production is compensated mostly by the<br />

development and use of higher-efficiency catalysts.<br />

Technical improvements have reduced the cost of metallocene-produced polymers to levels more competitive<br />

with those produced with conventional Ziegler-Natta polymerization catalysts. Polymers based on single-site<br />

catalysts have unique properties and are expected to create substantial new markets; however, they will not<br />

18 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter December 2007<br />

displace conventional commodity polymers in existing markets. The initial slow growth of SSCs can also be<br />

attributed to intellectual property barriers.<br />

Advanced Ziegler-Natta catalysts have been developed that reportedly can produce polyolefins with properties<br />

similar to those produced by metallocenes, thereby resisting replacement. It is expected that Ziegler-Natta<br />

catalysts will remain the dominating technology because of its cost benefits.<br />

(For the complete December 2007 report on CATALYSTS: PETROLEUM AND CHEMICAL PROCESS, visit this report’s home page or see<br />

vol. 5 of Specialty <strong>Chemical</strong>s—Strategies for Success.)<br />

SCUP Report Abstract<br />

CONSTRUCTION CHEMICALS<br />

By Stefan Müller with Xiamong Ma and Yosuke Ishikawa<br />

In this report construction chemicals are defined as chemical compounds that are added as such or in<br />

formulations to or on construction materials at the construction site in order to improve workability, enhance<br />

performance, add functionality or protect the construction material or the finished structure made out of it. They<br />

undergo chemical reactions (e.g., cross-linking) or physical changes (e.g., solidification from melt) during their<br />

application. The following groups of chemicals will be discussed:<br />

• Concrete admixtures<br />

• Asphalt additives<br />

• Adhesives and sealants<br />

• Protective coatings<br />

Worldwide, the construction industry contributes significantly to the global GDP, and is one of the most<br />

important elements of every economy. Today’s demands on buildings, roads, bridges, tunnels and dams could<br />

not be met without construction chemicals. The strength of concrete has risen dramatically due to the<br />

development of construction chemicals. The diameter of a pillar needed to carry 100 tons was reduced from 100<br />

cm to 10 cm between 1920 and 2004. The cross section of such a pillar is one-hundredth of what was needed in<br />

1920. High-rise buildings must provide maximum space on minimum ground.<br />

The raw materials needed for the production of construction chemicals are manufactured by the large chemical<br />

producers. Polymers are the most important group of raw materials and are found in virtually every construction<br />

chemical formulation ranging from adhesives to waterproofing treatments. The development of new construction<br />

chemicals in many cases requires interaction of the chemical producer, construction chemical manufacturer and<br />

end user.<br />

Protective coatings are the most important group of construction chemicals, followed by adhesives and sealants,<br />

concrete admixtures and asphalt additives.<br />

Construction chemicals will certainly gain importance in the future. While in some regions, the construction of<br />

new buildings will predominate, the focus will shift to renovation in the older economies. This will directly<br />

influence the usage patterns—concrete admixtures are predominately used for new buildings while more<br />

adhesives and sealants are consumed during renovation.<br />

(For the complete December 2007 report on CONSTRUCTION CHEMICALS, visit this report’s home page or see vol. 6 of Specialty<br />

<strong>Chemical</strong>s—Strategies for Success.)<br />

Visit us at www.sriconsulting.com 19

December 2007<br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

SCUP Report Abstract<br />

ELECTRONIC CHEMICALS: PART 2<br />

PRINTED CIRCUIT BOARD (PCB) CHEMICALS<br />

AND SEMICONDUCTOR PACKAGING MATERIALS<br />

By Yoshio Inoguchi, Larisa Dorfman, Vivien Yang and Yosuke Ishikawa<br />

Specialty as well as commodity chemicals are used in virtually every step of the manufacture of printed circuit<br />

boards (PCB) and semiconductor packaging materials. This report covers the major chemicals that are consumed<br />

in the production of these PCB and semiconductor packaging.<br />

This study presents an overview of the PCB chemical and semiconductor packaging material markets worldwide<br />

with regional coverage and a focus on regions with rapid technological changes. Coverage includes the three<br />

major regional markets—the United States, Western Europe and Japan—as well as the Republic of Korea, Taiwan,<br />

China and ASEAN countries, where available.<br />

In 2006, the global market for electronic chemicals for the production of printed circuit boards (PCBs) and<br />

semiconductor packaging was valued in the billions of dollars. This diverse, complicated, technology-driven<br />

global market is projected to grow at a robust average annual rate through 2011. Key market trends fuel this<br />

engine and multiple industries come together to deliver electronic products to the marketplace.<br />

Market forces drive the demand for materials, wafers, equipment, IC devices, services, software and components,<br />

as well as packaging and PCBs. Materials are used in various applications of this continuous loop. The major<br />

macroeconomic drivers that influence this industry include:<br />

• Globalization. A product can be designed in one country and manufactured in other.<br />

• The rise of the consumer. Globalization has brought wealth to emerging economies.<br />

• The communication and information age. Businesses and people are spread out all over the globe.<br />

• The cost/performance paradox. Moore’s Law is still in effect.<br />

• The rise of Asia. This global trend cannot be overemphasized.<br />

Currently, the global growth of PCBs is being driven by the increased use of multilayered, flexible PCBs. The<br />

board density and design complexity keep increasing as electronic companies try to add more features to the<br />

product. The electronic designers are trying to design products with clock speeds in excess of 250 MHz. At these<br />

speeds, speed and power dissipation become an issue requiring the use of advanced materials that can maintain<br />

their physical properties under even more stressful conditions.<br />

The chemical markets for PCB fabrication and semiconductor packaging are greatly influenced by the demand for<br />

products in the key markets. Some of the fastest-growing electronic markets are high-definition televisions; small<br />

wireless devices, including mobile phones, PDAs, and GPS units; and integrated devices like the Apple iPhone ® .<br />

These markets are projected to grow at extremely rapid average annual rates through 2011.<br />

(For the complete December 2007 report on ELECTRONIC CHEMICALS: PART 2, PRINTED CIRCUIT BOARD [PCB] CHEMICALS AND<br />

SEMICONDUCTOR PACKAGING MATERIALS, visit this report’s home page or see vol. 7 of Specialty <strong>Chemical</strong>s—Strategies for Success.)<br />

20 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter December 2007<br />

SCUP REPORTS SCHEDULED FOR 2007<br />

Report Title Author Status<br />

Specialty <strong>Chemical</strong>s Industry Overview Uwe Fink Published<br />

Cosmetic <strong>Chemical</strong>s Stefan Müller Published<br />

Textile <strong>Chemical</strong>s Tad Sasano Published<br />

Flavors and Fragrances Laslo Somogyi Published<br />

Water-Soluble Polymers Ray Will Published<br />

Compounding of Engineering Thermoplastics Fred Hajduk Published<br />

Imaging <strong>Chemical</strong>s: Electrophotography Uwe Fink Published<br />

Process Catalysts Masahiro Yoneyama Published<br />

Surfactants Hossein Janshekar Published<br />

Construction <strong>Chemical</strong>s Stefan Müller Published<br />

Electronic <strong>Chemical</strong>s: Printed Circuit Boards Uwe Fink Published<br />

Emission Control Catalysts Masahiro Yoneyama Published<br />

To view a list of SCUP reports for sale separately, please see our website at<br />

http://www.sriconsulting.com/SCUP/Public/Reports/. For additional information, please contact:<br />

R. J. Chang, Assistant Director<br />

Specialty <strong>Chemical</strong>s Update Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

Visit us at www.sriconsulting.com 21

December 2007<br />

CEH REPORTS AND PRODUCT<br />

REVIEWS IN PREPARATION<br />

Report Title<br />

Acetonitrile<br />

Acetylene<br />

Acrylonitrile<br />

Aluminum <strong>Chemical</strong>s<br />

Boron<br />

Carbon Black<br />

Carbon Disulfide<br />

Dimethylformamide<br />

Dyes<br />

Elastomers Overview<br />

Ethyl Alcohol<br />

Ethyl Ether<br />

Furfural<br />

Furfuryl Alcohol<br />

Glycerin<br />

Helium<br />

High-Density Polyethylene<br />

Inorganic Pigments<br />

Isoprene<br />

Lithium, Lithium Minerals and<br />

Lithium <strong>Chemical</strong>s<br />

Natural Gas Liquids<br />

Nonene and Tetramer<br />

PET Solid-State Resins<br />

Polybutadiene Elastomers<br />

Polyimides<br />

Polyisoprene<br />

Polyvinyl Acetate<br />

Propylene Glycols<br />

Vinyl Acetate<br />

Author<br />

Barbara Sesto<br />

Sean Davis<br />

Barbara Sesto<br />

Bala Suresh<br />

Stefan Schlag<br />

Jim Glauser<br />

Milen Blagoev<br />

Sebastian Bizzari<br />

Yosuke Ishikawa<br />

RJ Chang<br />

Eric Linak<br />

Vimala Francis<br />

Ralf Gubler<br />

Ralf Gubler<br />

Ralf Gubler<br />

Bala Suresh<br />

Andrea Borruso<br />

Ray Will<br />

Emanuel Ormonde<br />

Jim Glauser<br />

Sean Davis<br />

Bob Modler<br />

Elvira Greiner<br />

Emanuel Ormonde<br />

Uwe Löchner<br />

Emanuel Ormonde<br />

Henry Chinn<br />

Henry Chinn<br />

Henry Chinn<br />

This list is provided for the benefit of <strong>Chemical</strong> Economics<br />

Handbook users who may simultaneously be undertaking their<br />

own studies in these areas. Clients are welcome to write or call<br />

us in order to discuss the work in progress.<br />

CEH REPORTS AVAILABLE SEPARATELY<br />

To obtain a list of CEH marketing research reports or product<br />

reviews for sale separately, please see our website at<br />

http://www.sriconsulting.com/CEH/Public/Reports/ or<br />

contact:<br />

Koon-Ling Ring, Director<br />

<strong>Chemical</strong> Economics Handbook Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

Sign Up for a Free<br />

Issue of<br />

Chlor-Alkali<br />

Report<br />

From<br />

Harriman Chemsult Limited<br />

As an SRIC client, you are eligible for a free<br />

issue of Harriman Chemsult Ltd’s Chlor-Alkali<br />

Report—the most reliable, comprehensive,<br />

and authoritative resource for current chloralkali<br />

market trends and pricing. Monthly<br />

analysis of supply, operating rates, demand,<br />

inventory, and import/export trends in the<br />

caustic soda markets includes:<br />

• Contract, spot and market pricing<br />

• Coverage of all international markets,<br />

including American, European and<br />

Asia/Pacific regions<br />

• Detailed tables, graphs, charts<br />

• In-depth coverage of caustic soda<br />

(liquid and solid), chlorine, soda ash,<br />

sodium sulfate, caustic potash and<br />

major chlorinated derivatives.<br />

• Plant and project news<br />

Pricing and market insights gathered by<br />

experts in the U.S., Europe, Southeast Asia,<br />

China, and South America. Subscription<br />

includes monthly publication, weekly<br />

indicators report, market alerts, and access to<br />

experts with historical database support.<br />

Receive a free one month trial of Chlor-Alkali<br />

Report services by visiting:<br />

http://www.harriman.co.uk.<br />

Harriman Chemsult Ltd. * 24-25 Scala Street * London<br />

W1T 2HP* U.K.<br />

Tel: +44 (0) 20 7462 1860 * Fax: +44 (0)20 7462 1861<br />

www.harriman.co.uk<br />

22 Visit us at www.sriconsulting.com

<strong>Chemical</strong> <strong>Industries</strong> Newsletter December 2007<br />

CHEMICAL INDUSTRIES NEWSLETTER<br />

The <strong>Chemical</strong> <strong>Industries</strong> Newsletter is published monthly by SRI Consulting. The contents of the Newsletter are drawn from current research<br />

and publications of SRIC’s multiclient programs. Readers are welcome to call or write for more information about the subjects and programs<br />

mentioned (see addresses and telephone/fax numbers below).<br />

SRI Consulting offers the world’s most comprehensive ongoing multiclient databases on the chemical industry. The major multiclient programs<br />

include<br />

<strong>Chemical</strong> Economics Handbook<br />

Directory of <strong>Chemical</strong> Producers<br />

The China Report Canada Mexico<br />

Process Economics Program China Middle East<br />

Specialty <strong>Chemical</strong>s Update Program East Asia South/Central America<br />

World Petrochemicals Europe United States<br />

India<br />

Companies may participate in these continuing programs for the chemical industry through annual subscriptions or by purchasing individual<br />

reports. Each program is supported by inquiry and consulting privileges; electronic access is also available for all of these products.<br />

SRI Consulting.......................................................John Pearson, President and CEO<br />

George Intille, Senior Vice President<br />

Ralf Gubler, Vice President<br />

Russell Heinen, Vice President<br />

Linda Henderson, Vice President<br />

<strong>Chemical</strong> Economics Handbook..................................Koon-Ling Ring, Director<br />

Directory of <strong>Chemical</strong> Producers....................................Carolyn Read, Director<br />

Process Economics Program.....................Greg Bohlmann, Assistant Director<br />

Production/Databases ...................................................Steven F. Read, Director<br />

Specialty <strong>Chemical</strong>s Update Program ................RJ Chang, Assistant Director<br />

World Petrochemicals............................................................Ed Gartner, Director<br />

About SRI Consulting<br />

SRI Consulting provides the world’s most comprehensive ongoing databases on the chemical industries. We offer an array of research-based<br />

programs designed to provide clients with specific market intelligence and analysis. These programs, combined with strategic information<br />

services, help clients define new market opportunities, identify and communicate future challenges, formulate and implement business<br />

strategies, and develop innovative products, processes and services. SRIC provides creative yet practical strategies, supported by renowned<br />

industry and technology expertise and delivered by multidisciplinary teams working closely with clients to ensure implementation. SRI<br />

Consulting is a division of Access Intelligence, LLC.<br />

About Access Intelligence, LLC<br />

Access Intelligence, LLC is a full-service global information and marketing solutions provider of competitive business-to-business information.<br />

The company publishes daily news services, premium-value newsletters, subscription-based websites, magazines, directories, and<br />

databases.<br />

SRI Consulting<br />

Headquarters<br />

_________________________ International Offices ____________________________<br />

Menlo Park, CA Europe, Middle East and Africa Beijing<br />

John Pearson, President and CEO Toedistrasse 23, 1st Floor Suite 1606, Tower B, Global Trade Center<br />

4300 Bohannon Drive, Suite 200 8002 Zürich, Switzerland 36 North Third Ring Road East<br />

Menlo Park, CA 94025 Telephone: 41 44 283 63 33 Dongcheng District, Beijing 100013<br />

Telephone: (650) 384-4300 Fax: 41 44 283 63 30 China<br />

Fax: (650) 330-1149 zürich@sriconsulting.com Telephone: 8610-58256826<br />

menlopark@sriconsulting.com Fax: 8610-58256830<br />

beijing@sriconsulting.com<br />

U.S. Offices<br />

East Asia<br />

Houston<br />

Takeda Honcho Building, 8th Floor<br />

2002 Timberloch Place, Suite 110 2-1-7 Nihonbashi Honcho<br />

The Woodlands, TX 77380<br />

Chuoku, Tokyo 103-0023, Japan<br />

Telephone: (281) 203-6280 Telephone: 81 3 5202-7320<br />

Fax: (281) 203-6287 Fax: 81 3 5202-7333<br />

houston@sriconsulting.com<br />

tokyo@sriconsulting.com<br />

<strong>Chemical</strong> <strong>Industries</strong> Newsletter<br />

Ellen Blue, Editor<br />

© 2007 by SRI Consulting.<br />

All rights reserved. Unauthorized reproduction prohibited.<br />

Visit us at www.sriconsulting.com 23