View Newsletter - Chemical Insight & Forecasting

View Newsletter - Chemical Insight & Forecasting

View Newsletter - Chemical Insight & Forecasting

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A monthly compilation of SRIC<br />

report abstracts and news<br />

June 2008<br />

CEH Marketing Research Report Abstract<br />

ACRYLONITRILE-BUTADIENE-STYRENE RESINS<br />

By Emanuel V. Ormonde and Kazuteru Yokose<br />

Acrylonitrile-butadiene-styrene resins (ABS) are the largest-volume engineering thermoplastic resin. ABS is a bridge between<br />

commodity plastics (e.g., polystyrene) and higher-performance engineering thermoplastics (e.g., polycarbonate). ABS resins<br />

are composed mainly of styrene (over 50%) and varying amounts of butadiene and acrylonitrile. The styrene base provides<br />

rigidity and ease of processability and acrylonitrile offers chemical resistance and heat stability. The butadiene portion of ABS<br />

supplies toughness and impact strength. The composition of ABS resins can vary widely, allowing the production of many<br />

different grades which can thus be tailored for different end-use applications.<br />

Large-volume applications for ABS resins include appliance parts (including electrical/electronics) and automotive/<br />

transportation uses. Approximately 60% of total world consumption of ABS resins was for these two main end uses. In these<br />

markets, ABS competes with specialty thermoplastics such as polycarbonates, as well as with commodity polymers such as<br />

polyvinyl chloride and polypropylene resins. Additionally, ABS resins are frequently used in polymer blends, notably with<br />

polycarbonate (PC/ABS) for many differing applications.<br />

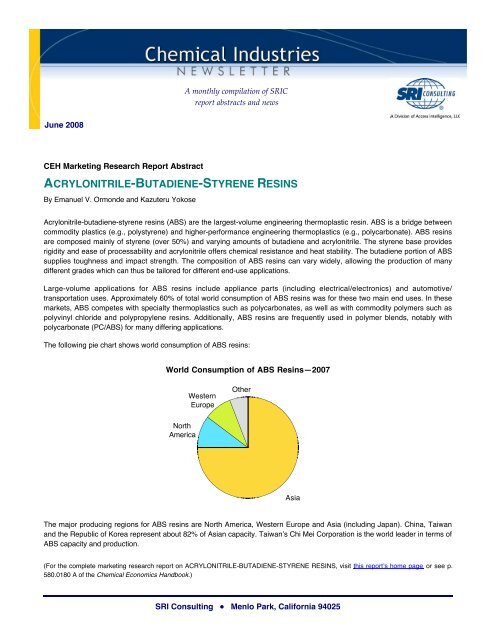

The following pie chart shows world consumption of ABS resins:<br />

World Consumption of ABS Resins—2007<br />

Western<br />

Europe<br />

Other<br />

North<br />

America<br />

Asia<br />

The major producing regions for ABS resins are North America, Western Europe and Asia (including Japan). China, Taiwan<br />

and the Republic of Korea represent about 82% of Asian capacity. Taiwan’s Chi Mei Corporation is the world leader in terms of<br />

ABS capacity and production.<br />

(For the complete marketing research report on ACRYLONITRILE-BUTADIENE-STYRENE RESINS, visit this report’s home page or see p.<br />

580.0180 A of the <strong>Chemical</strong> Economics Handbook.)<br />

SRI Consulting ● Menlo Park, California 94025

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

CEH Marketing Research Report Abstract<br />

CHLORINATED METHANES<br />

By James Glauser with Chiyo Funada<br />

This report covers the four chlorinated methanes—methyl chloride, methylene chloride, chloroform and carbon tetrachloride<br />

(CTC). These chlorinated methanes are chiefly used as precursors—methyl chloride for silicones and other materials,<br />

methylene chloride for its solvent properties, chloroform for hydrochlorofluorocarbon-22 (HCFC-22) and CTC for<br />

chlorofluorocarbons-11 and -12 (CFC-11 and CFC-12).<br />

Most of the growth forecast for chlorinated methanes is in Asian countries (China in particular), while demand will decline in<br />

developed countries due to Montreal Protocol legislation on fluorocarbons. Other than in Asia, which will continue to see<br />

growth in HCFC-22 production past 2010, a major transition to HFC-32 (using methylene chloride) and HFC-245fa and HFC-<br />

365mfc (using carbon tetrachloride) will occur globally in developed countries.<br />

The following pie charts show world consumption of these four chlorinated methanes.<br />

World Consumption of Methyl Chloride—2007<br />

C/E Europe<br />

India<br />

Taiwan<br />

Other<br />

Rep. of Korea<br />

Thailand<br />

Japan<br />

United<br />

States<br />

World Consumption of Methylene Chloride—2007<br />

Thailand<br />

Mexico<br />

Other Asia<br />

Taiwan<br />

Rep. of Korea<br />

Middle East/Africa<br />

C/E Europe<br />

Central/South<br />

America<br />

India<br />

Other<br />

China<br />

China<br />

Japan<br />

Western<br />

Europe<br />

United<br />

States<br />

Western<br />

Europe<br />

World Consumption of Chloroform—2007<br />

Rep. of Korea<br />

C/E Europe<br />

Mexico<br />

India<br />

Other<br />

Oceania<br />

Japan<br />

World Consumption of Carbon Tetrachloride—2007<br />

India<br />

Mexico<br />

C/E Europe Central/South America<br />

Japan<br />

Western<br />

Europe<br />

United<br />

States<br />

China<br />

China<br />

Western<br />

Europe<br />

United<br />

States<br />

2 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

Worldwide, government regulations in developed countries have had a significant impact on the demand and use of<br />

chlorinated solvents in the past quarter century. Chlorinated methanes have been somewhat less affected than other types of<br />

chlorinated products (e.g., chlorinated ethanes), since they are used to a large extent as intermediates. Except for methylene<br />

chloride, workers and the general public are usually not exposed to chlorinated methanes.<br />

In September 2007, Parties to the Montreal Protocol on Substances that Deplete the Ozone Layer agreed to speed up the<br />

phaseout of hydrofluorocarbons (HCFCs). HCFCs were meant to replace chlorofluorocarbons (CFCs), but have been<br />

identified as a greenhouse gas (GHG). The accelerated phaseout requires developed nations to phase out HCFC by 2020,<br />

from 2040 in the original treaty. The new agreement freezes production of HCFCs at 2013 levels. In addition, developed<br />

countries have agreed to reduce production and consumption by 75% by 2010 and 90% by 2015, with the final phaseout in<br />

2020. Developing countries have agreed to cut production and consumption by 10% in 2015, by 35% by 2020, and 67.5% by<br />

2025, with final phaseout in 2030. A small amount, 2.5%, will be allowed in developing countries during the 2030–2040 period<br />

for “servicing” purposes.<br />

By 2010, HCFC-22 (R-22) producers will have to comply with the U.S. EPA’s HCFC consumption and production limits of the<br />

Montreal Protocol. The question is whether consumers will switch to the more expensive HFC blend–based equipment unless<br />

absolutely forced to. There currently is no ban on selling R-22-based AC/refrigerant equipment. Only equipment manufactured<br />

after 2010 cannot be filled with virgin R-22. If AC/refrigerant producers stockpile equipment, they can continue to purchase R-<br />

22 for the first fill, which may drive demand forward, within EPA limits, for virgin R-22 or for reclaimed R-22 (of which there is<br />

very little today). The greatest share of consumption is the service demand for existing equipment.<br />

(For the complete marketing research report on CHLORINATED METHANES, visit this report’s home page or see p. 635.2000 A of the<br />

<strong>Chemical</strong> Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

CUMENE<br />

By Elvira O. Camara Greiner<br />

Essentially all cumene worldwide is consumed for the production of phenol and acetone. As a result, demand for cumene is<br />

strongly tied to the phenol market. Trade in cumene accounts for only 4% of world production. The largest exporters of<br />

cumene are the United States (to Germany and the Netherlands) and Japan (to the Republic of Korea). Taiwan also imports<br />

large volumes of cumene for phenol production.<br />

Increased demand for bisphenol A and phenolic resins will result in strong demand for phenol in Asia (excluding Japan). As a<br />

result, consumption of cumene for phenol is forecast to grow rapidly in the region. China is forecast to add significant cumene<br />

capacity during 2007–2012 to supply its phenol/acetone plants that are slated to come on stream during the same period.<br />

Downstream bisphenol A and polycarbonate plants are also planned in the region. The world cumene operating rate was good<br />

in 2007, and as long as phenol/acetone demand remains high for bisphenol A and phenolic resins, the world operating rate<br />

should remain healthy (also taking into consideration the new cumene capacity in the Middle East).<br />

Cumene peroxidation is the largest source of phenol and acetone. Demand for phenol, rather than acetone, determines<br />

capacity utilization. With the exception of bisphenol A, phenol and acetone have no common markets. Historically, phenol has<br />

been the more desirable product. Various alternative phenol processes that bypass acetone have been developed that<br />

typically involve benzene-to-phenol conversion, using different catalysts. However, these new processes are not expected to<br />

affect cumene demand in the very near future.<br />

(For the complete marketing research report on CUMENE, visit this report’s home page or see p. 638.5000 A of the <strong>Chemical</strong> Economics<br />

Handbook.)<br />

Visit us at www.sriconsulting.com 3

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

CEH Marketing Research Report Abstract<br />

FLUOROCARBONS<br />

By Ray K. Will with Hiroaki Mori<br />

The fully halogenated chlorofluorocarbons (CFCs) and the partially halogenated hydrochlorofluorocarbons (HCFCs) (as well<br />

as hydrobromofluorocarbons [HBFCs], the Halons, carbon tetrachloride, methyl chloroform and methyl bromide) are<br />

stratospheric ozone depleters. Depletion of the ozone layer is a critical issue because that layer protects the earth from<br />

unacceptably high levels of ultraviolet radiation. High levels of ultraviolet radiation affect both human health and the<br />

environment through higher incidences of skin cancer, cataracts, immune system suppression, potentially reduced yields of<br />

certain crops, potential damage to aquatic plankton and, thereby, the global food chain, and increased formation of groundlevel<br />

ozone and smog.<br />

Fluorocarbon products that do not contain chlorine and/or bromine (i.e., fully fluorinated and hydrofluorinated [HFC] products)<br />

are not stratospheric ozone depleters and production of these products is not being eliminated by the Montreal Protocol. They<br />

are however, restricted by the U.S. Clean Air Act and must be recovered instead of released to the atmosphere. Similar<br />

national environmental laws implement the Montreal Protocol in the various nations that have ratified the agreement. The<br />

extent to which some HFC fluorocarbons, particularly HFC-134a, contribute to climatic change or global warming has become<br />

the subject of significant environmental concern, particularly in Europe, and raises questions about the continued use of these<br />

ODP-free CFC-replacement chemicals.<br />

As a result of the Montreal Protocol and Kyoto Protocol and subsequent amendments and ratification by individual countries,<br />

there are current and proposed regulations limiting the production, consumption and trade of CFCs, HCFCs and HFCs. Over<br />

the past two decades, the global fluorocarbons market has undergone a number of major transitions toward a greater use of<br />

non-ozone-depleting HFCs and non-global-warming, nonfluorocarbon alternatives in emissive applications.<br />

The following pie chart shows world consumption of fluorocarbons in 2007:<br />

World Consumption of Fluorocarbons—2007<br />

Central/South America Other<br />

Japan<br />

Other<br />

Asia<br />

North<br />

America<br />

Europe<br />

China<br />

Consumption of fluorocarbons in the largest market segment, refrigeration and air-conditioning, has been negatively impacted<br />

by the following:<br />

• Prevention of fluorocarbon escape from refrigeration and air-conditioning systems<br />

• Bans on fluorocarbon venting during system maintenance<br />

• Reuse (recycling) of fluorocarbons<br />

• Use of nonfluorocarbon alternatives in refrigeration such as ammonia and hydrocarbons (i.e., isobutane)<br />

4 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

Overall, the segment has many alternatives for the now-banned CFCs and soon-to-be-banned HCFCs in both new equipment<br />

and for servicing existing equipment. Non-fluorocarbon-based products, such as hydrocarbons, have been introduced and are<br />

now the established standard in Europe and Japan for home refrigeration. The major alternative for CFC-12 in vehicle airconditioning<br />

as well as home refrigeration in the United States, HFC-134a, grew strongly in the late 1990s, as the developed<br />

countries adopted this alternative to CFC-12. In 2003–2007, HFC-134a consumption in Japan declined, while in Europe and<br />

North America, consumption increased. In developing countries, consumption caused by the transition to HFC-134a from<br />

CFC-12 has generally lagged behind that of developed countries, except in China, where growth in the production of<br />

automobiles has caused strong HFC-134a consumption for mobile air-conditioning.<br />

Over the next five years, North American consumption of fluorocarbons will increase at a moderate average annual rate while<br />

the European market is expected to decline slowly; Japanese consumption will grow slowly. China is the world’s fastest<br />

growing fluorocarbon market.<br />

Compared with the United States, the European Union has been significantly more aggressive in its production reduction and<br />

scheduled reduction of HCFC production, and it is implementing restrictions on the use of HFCs in compliance with Kyoto<br />

Protocol goals to limit the emissions of global warming gases. The largest-volume fluorocarbons produced in Europe in 2007<br />

were HCFC-22, HFC-134a, HCFC-141b, HCFC-142b and HFC-365mfc.<br />

In 2007, the largest-volume fluorocarbon used as a refrigerant and coolant in Europe was HFC-134a, followed by HCFC-22,<br />

then blends based on HFC-143a, HFC-152a, HFC-125 and HFC-32. HFC-134a will be banned from automotive air<br />

conditioners in new vehicle models in 2011.<br />

Despite the 1996 production ban in developed countries, a continuing availability of CFCs has dampened the demand for CFC<br />

alternatives; however, this market is approaching insignificance as air-conditioning and refrigeration equipment ages to<br />

obsolescence and the energy efficiency of new equipment makes replacement an attractive option for equipment using CFCs.<br />

In the United States, stockpiled and recycled CFCs have allowed the continued operation of older refrigeration and airconditioning<br />

equipment.<br />

Chinese production of fluorocarbons has more than doubled over the last five years. In 2007 China was the world’s largest<br />

producer of HCFC-22 and ranked second to the United States in total fluorocarbon production, having surpassed Europe and<br />

Japan. China has rapidly emerged as the world’s second-largest market for fluorocarbons after the United States. China is<br />

different from the other major fluorocarbon consumers—the United States, Europe and Japan—because it is classified as a<br />

developing country and as such, can rely on HCFCs longer than the developed countries, as allowed under the Montreal<br />

Protocol.<br />

Consumption in China’s largest market segment, refrigeration and air-conditioning, is growing quickly. A major portion of<br />

China’s domestic refrigeration and air-conditioning equipment still uses HCFC-22, unlike the use of HFC-134a for the same<br />

purposes in the United States. Hydrocarbon refrigerants also account for a significant portion of China’s household<br />

refrigeration. As much as 85% of China’s HFC-134a consumption is used in the domestic automobile industry for mobile airconditioning.<br />

(For the complete marketing research report on FLUOROCARBONS, visit this report’s home page or see p. 543.7000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

LINEAR LOW-DENSITY POLYETHYLENE (LLDPE) RESINS<br />

By Andrea V. Borruso<br />

The world polyethylene (PE) business is undergoing rather extensive restructuring and consolidation. A number of mergers<br />

and acquisitions, alliances and joint ventures have recently taken place, designed to improve competitiveness, reduce costs,<br />

expand scale, enhance market position and expand geographic coverage.<br />

Visit us at www.sriconsulting.com 5

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

In addition, the construction of new projects in the Middle East and China in the last three years increases fears from existing<br />

producers outside the low-feedstock-cost region that a major downturn will occur when all the new capacity is on stream by<br />

2009–2010.<br />

The increasing cost of ethylene, driven by a sustained high crude oil price and the inability of converters to pass on the full<br />

extent of such large price increases, makes the traditional margin fluctuations a thing of the past with expectations that<br />

upstream integration is becoming an essential component of the economic success of PE operations outside the lowfeedstock-cost<br />

areas.<br />

In the current new business model, an asset foothold in the Middle East has become an essential component of business<br />

success, while owning technology and a large economy of scale have become a common goal for most producers.<br />

Consolidation continues to be one of the leading issues facing the industry. It is a natural response to economic conditions that<br />

occur as products become commodities and interact with business cycles. The result of consolidation is fewer and larger<br />

players and less fragmentation and an increasing focus on technical competencies.<br />

The short-term outlook for PE indicates that from the middle of 2008, LDPE, HDPE and LLDPE will have increments of<br />

capacity larger than increments of demand, with the result of a declining utilization rate. LDPE and HDPE will be the two<br />

products in larger oversupply, while LLDPE shows the best supply/demand balance among the three.<br />

This report provides historical data on linear low-density polyethylene (LLDPE) production and consumption with 2007 as the<br />

base year for supply and demand information and a forecast of production capacity and consumption to 2012. Geographical<br />

coverage is focused on North America, Western and Central/Eastern Europe, Japan and the Middle East. Summaries for<br />

LLDPE supply/demand data are included for Central and South America, Africa, Other Asia and Oceania. Many producing and<br />

consuming country official statistics, particularly trade, still do not distinguish between LLDPE and low-density polyethylene<br />

(LDPE) for reporting purposes and combine the two as LDPE. This report provides product balance LLDPE-only statistics.<br />

Capacity reporting also presents some complexity due to the allocation factor of the swing capacity to LLDPE and HDPE for<br />

each plant. While all the capacity tables report the total swing capacity, the LLDPE allocated capacity has been reported in<br />

summary in each country table.<br />

LLDPE has established itself as the third major member of the world polyethylene business along with LDPE and HDPE. The<br />

following pie chart shows world consumption of LLDPE:<br />

World Consumption of LLDPE—2007<br />

Africa<br />

Mexico<br />

Central/Eastern Europe Oceania<br />

Canada<br />

Middle East<br />

Japan<br />

Central/South<br />

America<br />

China<br />

Other Asia<br />

United<br />

States<br />

Western<br />

Europe<br />

The largest influence on future global LLDPE growth rates will be world economic growth. The replacement of LDPE down to<br />

hard-core levels is now limited to Asia and the rest of the world, as in North and South America, Europe and Japan such<br />

penetration appears to have substantially slowed. The fast growth of catalyst development activity has also created the<br />

possibility of penetrating new nonpolyethylene markets (such as PVC, metals and paper), some of which may include highervalue<br />

products. Material substitution will continue and new LLDPE products will create additional market opportunities. One<br />

6 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

offset to volume growth is the continuing trend toward downgauging, which is expected to have a small negative impact on<br />

consumption growth.<br />

World demand should be sustained by good growth for LLDPE and moderate growth for PE. However, the International<br />

Monetary Fund (IMF) has been forecasting a slowing of economic growth in the world during 2007–2010, which in conjunction<br />

with the impact of high oil prices will have a negative effect on the demand growth rate. Reasonably good market growth is<br />

expected, built on consumer confidence in the world’s ability to recover after the Iraq war.<br />

(For the complete marketing research report on LINEAR LOW-DENSITY POLYETHYLENE [LLDPE] RESINS, visit this report’s home page or<br />

see p. 580.1320 A of the <strong>Chemical</strong> Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

METHANOL<br />

By Guillermo A. Saade<br />

Over the last two decades, a major shift in regional methanol capacity and production has occurred. Countries with large<br />

reserves of natural gas and often limited domestic consumption have built world-scale methanol facilities to monetize their lowcost<br />

natural gas. The largest producing region/country in 2007 was China; in 2012, it will continue to have the largest capacity<br />

and be the largest producer.<br />

Another significant factor is that the size of the new mega-methanol plants (1.0–2.0 million metric tons per year) is much larger<br />

than existing plants. Thus, they will have reduced fixed costs, as well as greatly reduced natural gas costs due to strategically<br />

located feedstock giving a significant cost advantage. This will drive down the cost of methanol, and cause major shifts in trade<br />

patterns. Locations for these large new methanol plants are (or will be) Iran, Saudi Arabia, Oman, and Trinidad and Tobago.<br />

These natural gas–advantaged countries export much of their product to developed regions such as North America, Western<br />

Europe and Japan. Consequently, producers in the more economically developed regions have shut down inefficient methanol<br />

capacity as cheaper imports have become more readily available. For example, Japan, once a major producer, now has no<br />

operating capacity. North American capacity accounted for 50% of world capacity as recently as the mid-1980s, but in 2007,<br />

accounted for less than 2%. This trend will continue, and in some regions, the effective capacity will be different from the<br />

nameplate capacity, as a result of expected idling of capacity.<br />

The following pie chart shows world consumption of methanol:<br />

World Consumption of Methanol—2007<br />

Canada<br />

Africa<br />

Central/South America Other<br />

Japan<br />

Central/Eastern<br />

Europe<br />

Other Asia<br />

China<br />

Middle East<br />

United<br />

States<br />

Western<br />

Europe<br />

Visit us at www.sriconsulting.com 7

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

Worldwide, formaldehyde production is the largest consumer of methanol. This demand is driven by the construction industry<br />

since formaldehyde is used primarily to produce adhesives for the manufacture of various construction board products.<br />

Historically, the major end product has been plywood, but in developed countries, demand is also driven by the expanding use<br />

of engineering board products such as OSB (oriented strandboard). These wood composite products require more<br />

formaldehyde-based resin per square foot of board than plywood. Demand for formaldehyde is highly dependent on general<br />

economic conditions, and, as an example, a slowdown in construction can considerably reduce formaldehyde demand.<br />

The second-largest market for methanol worldwide is methyl tertiary-butyl ether (MTBE). In the United States, consumption<br />

increased substantially when the Clean Air Act Amendments (CAAA) of 1990 mandated that oxygenated compounds be<br />

added to gasoline as one aspect of a program to alleviate air pollution. In recent years, MTBE has come under environmental<br />

attack, primarily because it has been found in groundwater that has come into contact with leaking underground gasoline<br />

tanks. California—formerly the leading consumer of MTBE—banned the use of MTBE at the end of 2003 and several states<br />

followed suit. Methanol consumption for MTBE has been on the decline in the United States since 1999 and it is likely that<br />

MTBE’s consumption will decline further at a steady level, supported only by export-driven demand.<br />

Acetic acid is the third-largest methanol derivative. A major portion of acetic acid is consumed for the production of vinyl<br />

acetate monomer (VAM). Demand for acetic acid tracks the demand for VAM, which (globally) is projected to grow at a<br />

moderate average annual rate from 2007 to 2012.<br />

(For the complete marketing research report on METHANOL, visit this report’s home page or see p. 674.5000 A of the <strong>Chemical</strong> Economics<br />

Handbook.)<br />

CEH Product Review Abstract<br />

NATURAL GAS<br />

By Sean Davis<br />

As world energy demand increases and alternative energy sources such as water, wind and solar power fail to make<br />

significant enough contributions to ease emissions from traditional fossil fuel–derived manufacturing, more countries are<br />

deferring to readily abundant, cleaner-burning natural gas to meet domestic energy requirements. The five countries with the<br />

largest natural gas reserves are (in order) Russia, Iran, Qatar, Saudi Arabia and the United States; these countries account for<br />

almost 65% of world proved natural gas reserves.<br />

Estimates of reserves can change over time as production depletes the reserve base. New reserve additions result from<br />

exploration in new areas as well as extension of existing reserves through drilling. In regions of the world such as Russia, the<br />

Middle East and Asia Pacific, the potential to add new reserves through exploration activities is very significant. Although oil<br />

has been the historical focus of the bulk of world exploration activity, the upside potential of the natural gas resource base<br />

continues to attract the interest of the international gas majors. Lower costs, higher efficiencies and environmental advantages<br />

have made natural gas a viable energy source.<br />

North America was the largest natural gas–consuming region in 2007, followed closely by Central and Eastern Europe and<br />

Asia and Oceania, which surpassed Western European consumption beginning in 2006. Consumption for both Asia/Oceania<br />

and the Middle East has grown significantly in the past few years and is forecast to continue further development through<br />

2012.<br />

In 2007, U.S. domestic natural gas production accounted for 80% of total U.S. natural gas consumption. Imports of natural gas<br />

originate mainly from Canada. Over the past few years LNG imports from Egypt and Nigeria have increased.<br />

Overall, Western European consumption has continued to increase because of increases in demand in the industrial and<br />

power generating sectors, and steady increases in all other sectors. Currently, natural gas accounts for about a quarter of<br />

Western Europe’s total energy usage. It is expected that gas consumption will continue to increase in Western Europe.<br />

The following pie chart shows world consumption of natural gas:<br />

8 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

World Consumption of Natural Gas—2007<br />

Central/South America<br />

Middle East<br />

Africa<br />

North<br />

America<br />

Western<br />

Europe<br />

Asia/<br />

Oceania<br />

Central/Eastern<br />

Europe<br />

Russia remains by far the largest producer of natural gas in Eastern Europe. Approximately 25% of total natural gas output is<br />

exported to Western Europe to meet declining supply. Further expansion and development of transmission lines between<br />

Russia, other CIS countries and Western Europe will lead to further growth; however, current growth is slow.<br />

(For the complete product review on NATURAL GAS, visit this report’s home page or see p. 229.2000 A of the <strong>Chemical</strong> Economics<br />

Handbook.)<br />

CEH Marketing Research Report Abstract<br />

POLYETHYLENE TEREPHTHALATE (PET)<br />

SOLID-STATE RESINS<br />

By Elvira O. Camara Greiner with Issho K. Nakamura<br />

Development and growth of the global PET solid-state resin market since 1996 has been impressive. Thirty-two years after<br />

their introduction in the mid-1970s, global consumption of these resins continues to grow at high single-digit rates. Three<br />

regions (North America, Europe and Asia) accounted for the majority of world production and consumption.<br />

Asia and the Middle East are expected to achieve double-digit consumption growth through 2012. Eastern Europe and South<br />

America have created import opportunities. Asian and Middle Eastern producers are expected to be the major suppliers of<br />

PET exports to Eastern Europe, Central and South America, and Oceania. Continued overcapacity and relatively lower<br />

feedstock costs compared with North America and Western Europe will be the primary drivers of Asian exports.<br />

The last remaining untapped major market for PET is beer packaging, but substantial conversion has yet to materialize. Use of<br />

PET beer bottles is gaining strength primarily in developing countries, such as Russia and China. In China, poor glass quality<br />

and the low capital barrier for PET have led to an increase in the number of beer bottles produced over the years. Globally,<br />

beer accounts for approximately 5% of the PET beverage market and of that, Russia alone consumes approximately 60%. In<br />

the United States, use of PET in beer packaging is insignificant and confined to niche markets. But in Western Europe, strong<br />

PET growth is expected from beer conversion. Bottle resins for beer have been embraced in Germany and the switch from<br />

glass could support moderate double-digit PET consumption growth rates.<br />

The following pie chart shows world consumption of PET solid-state resins:<br />

Visit us at www.sriconsulting.com 9

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

World Consumption of PET Solid-State Resins—2007<br />

Taiwan<br />

Oceania Thailand<br />

Canada<br />

India Other<br />

Africa<br />

United<br />

Japan<br />

States<br />

Middle East<br />

Mexico<br />

Central/South<br />

America<br />

Central/Eastern<br />

Europe<br />

China<br />

Western<br />

Europe<br />

PET bottle resin is a very important material driving growth in the developed economies, but growth of PET fiber remains<br />

dominant in terms of total polyester. PET growth is driven differently depending on the geographic region. In North America<br />

and Western Europe, PET growth is associated primarily with PET bottle resins; demand for PET fiber has been in decline<br />

since the late 1990s. PET growth in most other regions is primarily associated with PET fiber. Global polyester growth will<br />

continue to be driven by Asia and, more specifically, by the Chinese market.<br />

Because of persistent low margins, the global PET industry saw considerable consolidation in the last two years. Future<br />

success for improved margins will come from new and more economical technologies, perhaps more consolidation,<br />

rationalization of uneconomical capacity, vertical integration, and larger economies of scale.<br />

(For the complete marketing research report on POLYETHYLENE TEREPHTHALATE [PET] SOLID-STATE RESINS, visit this report’s home<br />

page or see p. 580.1180 A of the <strong>Chemical</strong> Economics Handbook.)<br />

SCUP Report Abstract<br />

OVERVIEW OF THE SPECIALTY CHEMICALS INDUSTRY<br />

By Uwe Fink with Yosuke Ishikawa, Wei Yang and Ray Will<br />

Specialty chemicals are produced by a complex, interlinked industry. In the strictest sense, specialty chemicals are chemical<br />

products that are sold on the basis of their performance, rather than for their composition. They can be single-chemical entities<br />

or formulations/combinations of several chemicals whose composition sharply influences the performance and processing of<br />

the customer’s product. Products and services in the specialty chemicals industry require intensive knowledge and powerful<br />

innovation.<br />

Commodity chemicals, at the other extreme, are sold strictly on the basis of their chemical composition. They are singlechemical<br />

entities. The commodity chemical product of one supplier is generally readily interchangeable with that of any other.<br />

Market-oriented specialty chemicals are groups of chemicals that are utilized by a specific industry or market, such as<br />

electronic chemicals or oil field chemicals. Functional specialty chemicals, on the other hand, are groups of products that serve<br />

the same defined function, such as adhesives, antioxidants or biocides. Technology-oriented specialty chemicals include<br />

nanochemicals and materials—particles, layers or composites—where at least one dimension is in the nanometer range, and<br />

biotechnology products, which include chemicals that are synthesized, modified and isolated from biomass by man or nature.<br />

In several specialty chemical markets prices have been falling, especially when volumes have increased and production has<br />

shifted overseas to places like China/Southeast Asia. This is a natural tendency of shifting from specialty to commodity<br />

10 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

chemicals over time. In the last three years, energy and raw material input prices have risen considerably; however, these cost<br />

increases have not always been passed on to customers through price increases.<br />

Over the last decade, the specialty chemicals industry has experienced slower growth and lower overall profitability within a<br />

more competitive environment than in the preceding decade. Between 2007 and 2012, the overall growth rate is forecast to be<br />

moderate.<br />

For the United States, Western Europe and Japan, the following segments are expected to experience good growth: specialty<br />

polymers, advanced ceramic materials, separation membranes, nutraceutical ingredients, and nanoscale chemicals. High<br />

growth rates are found in various subsegments.<br />

Five industries or subsegments in the three major regions are stagnating or declining—anticorrosion coatings, photographic<br />

chemicals, pesticides, textile chemicals and synthetic dyes. Pesticides is the largest of these industries. Contributing to the<br />

stagnation of pesticide consumption is the increased planting of genetically modified (GM) crops. The planted area for GM<br />

crops increased to 100 million hectares, an increase of more than 10%. <strong>Chemical</strong> consumption for photographic film<br />

manufacturing and development is forecast to decline significantly through 2012 because of the changeover from analog to<br />

digital cameras in consumer photography. Total sales of photofinishing solutions are expected to decline slowly through 2012.<br />

(For the complete June 2008 report, OVERVIEW OF THE SPECIALTY CHEMICALS INDUSTRY, visit this report’s home page or see vol. 2 of<br />

Specialty <strong>Chemical</strong>s—Strategies for Success.)<br />

SCUP REPORTS SCHEDULED FOR 2008<br />

Report Title Author Status<br />

Specialty <strong>Chemical</strong>s Business Overview Uwe Fink Published<br />

Nutraceuticals Laszlo Somogyi Published<br />

High Performance Anticorrosion Coatings Eric Linak Published<br />

High Performance Thermoplastics Fred Hajduk In production<br />

Lube Oil Additives Stefan Müller In production<br />

Water Management Ray Will In preparation<br />

Thermosetting Powder Coatings Eric Linak In production<br />

Electronic <strong>Chemical</strong>s: Semiconductor/IC Process <strong>Chemical</strong>s Uwe Fink In preparation<br />

Oil Field <strong>Chemical</strong>s Peter Allison In preparation<br />

Food Additives Laszlo Somogyi In preparation<br />

Flame Retardants Uwe Fink In preparation<br />

Biocides Stefan Müller In preparation<br />

Radiation Curable Coatings Uwe Fink In preparation<br />

To view a list of SCUP reports for sale separately, please see our website at<br />

http://www.sriconsulting.com/SCUP/Public/Reports/ . For additional information, please contact:<br />

R. J. Chang, Director<br />

Specialty <strong>Chemical</strong>s Update Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

Visit us at www.sriconsulting.com 11

June 2008<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

CEH REPORTS AND PRODUCT<br />

REVIEWS IN PREPARATION<br />

Report Title<br />

Acrylonitrile<br />

Air Separation Gases<br />

Animal Feeds: Phosphate Suppl.<br />

Butylenes<br />

Carbon Black<br />

Chlorine/Sodium Hydroxide<br />

Controlled Release Fertilizers<br />

Cyclohexane<br />

Cyclohexanol/Cyclohexanone<br />

Ethylene–Vinyl Alcohol Resins<br />

Explosives<br />

Fluoropolymers<br />

Glycerin<br />

Inorganic Pigments<br />

Monochloroacetic Acid<br />

Nitrile Elastomers<br />

Normal Paraffins<br />

Nylon Fibers<br />

Organometallics<br />

Petrochemical Industry Overview<br />

Phenol<br />

Plastics Recycling<br />

Polyacetal Resins<br />

Polyamide Elastomers<br />

Polycarbonate Resins<br />

Polyphenylene Sulfide<br />

Polypropylene Resins<br />

Polystyrene<br />

Polyvinyl Acetate<br />

Propylene<br />

SAN Resins<br />

Silicates and Silicas<br />

Sodium Chloride<br />

Sorbitol<br />

Specialty Inorganic Fibers<br />

Specialty Organic Fibers<br />

Unsaturated Polyester Resins<br />

Vinyl Acetate<br />

Zeolites<br />

Author<br />

Barbara Sesto<br />

Bala Suresh<br />

Jim Glauser<br />

Sean Davis<br />

Jim Glauser<br />

Eric Linak<br />

Mike Malveda<br />

Vimala Francis<br />

Henry Chinn<br />

Henry Chinn<br />

Stefan Schlag<br />

Ray Will<br />

Ralf Gubler<br />

Ray Will<br />

Vimala Francis<br />

Uwe Löchner<br />

Bob Modler<br />

Mike Malveda<br />

Bala Suresh<br />

Sean Davis<br />

Elvira Greiner<br />

Jim Glauser<br />

Thomas Kälin<br />

Uwe Löchner<br />

Henry Chinn<br />

RJ Chang<br />

Andrea Borruso<br />

Koon-Ling Ring<br />

Henry Chinn<br />

Michael Devanney<br />

Emanuel Ormonde<br />

Don Lauriente<br />

Stefan Schlag<br />

Sebastian Bizzari<br />

Bala Suresh<br />

Fred Hajduk<br />

Henry Chinn<br />

Henry Chinn<br />

Sean Davis<br />

This list is provided for the benefit of <strong>Chemical</strong> Economics<br />

Handbook users who may simultaneously be undertaking their<br />

own studies in these areas. Clients are welcome to write or call<br />

us in order to discuss the work in progress.<br />

CEH REPORTS AVAILABLE SEPARATELY<br />

To obtain a list of CEH marketing research reports or product<br />

reviews for sale separately, please see our website at<br />

http://www.sriconsulting.com/CEH/Public/Reports/ or<br />

contact:<br />

Koon-Ling Ring, Director<br />

<strong>Chemical</strong> Economics Handbook Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

12 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> June 2008<br />

CHEMICAL INDUSTRIES NEWSLETTER<br />

The <strong>Chemical</strong> Industries <strong>Newsletter</strong> is published monthly by SRI Consulting. The contents of the <strong>Newsletter</strong> are drawn from current research<br />

and publications of SRIC’s multiclient programs. Readers are welcome to call or write for more information about the subjects and programs<br />

mentioned (see addresses and telephone/fax numbers below).<br />

SRI Consulting offers the world’s most comprehensive ongoing multiclient databases on the chemical industry. The major multiclient programs<br />

include<br />

<strong>Chemical</strong> Economics Handbook<br />

Directory of <strong>Chemical</strong> Producers<br />

The China Report Canada Mexico<br />

Process Economics Program China Middle East<br />

Specialty <strong>Chemical</strong>s Update Program East Asia South/Central America<br />

World Petrochemicals Europe United States<br />

India<br />

Companies may participate in these continuing programs for the chemical industry through annual subscriptions or by purchasing individual<br />

reports. Each program is supported by inquiry and consulting privileges; electronic access is also available for all of these products.<br />

SRI Consulting.......................................................John Pearson, President and CEO<br />

George Intille, Senior Vice President<br />

Ralf Gubler, Vice President<br />

Russell Heinen, Vice President<br />

Linda Henderson, Vice President<br />

<strong>Chemical</strong> Economics Handbook..................................Koon-Ling Ring, Director<br />

Directory of <strong>Chemical</strong> Producers....................................Carolyn Read, Director<br />

Process Economics Program.....................Greg Bohlmann, Assistant Director<br />

Production/Databases ...................................................Steven F. Read, Director<br />

Specialty <strong>Chemical</strong>s Update Program..................................RJ Chang, Director<br />

World Petrochemicals............................................................Ed Gartner, Director<br />

About SRI Consulting<br />

SRI Consulting provides the world’s most comprehensive ongoing databases on the chemical industries. We offer an array of research-based<br />

programs designed to provide clients with specific market intelligence and analysis. These programs, combined with strategic information<br />

services, help clients define new market opportunities, identify and communicate future challenges, formulate and implement business<br />

strategies, and develop innovative products, processes and services. SRIC provides creative yet practical strategies, supported by renowned<br />

industry and technology expertise and delivered by multidisciplinary teams working closely with clients to ensure implementation. SRI<br />

Consulting is a division of Access Intelligence, LLC.<br />

About Access Intelligence, LLC<br />

Access Intelligence, LLC is a full-service global information and marketing solutions provider of competitive business-to-business information.<br />

The company publishes daily news services, premium-value newsletters, subscription-based websites, magazines, directories, and<br />

databases.<br />

SRI Consulting<br />

Headquarters<br />

_________________________ International Offices ____________________________<br />

Menlo Park, CA Europe, Middle East and Africa Beijing<br />

John Pearson, President and CEO Alfred-Escher-Strasse 34 Suite 1606, Tower B, Global Trade Center<br />

4300 Bohannon Drive, Suite 200 CH 8002 Zürich, Switzerland 36 North Third Ring Road East<br />

Menlo Park, CA 94025 Telephone: 41 44 283 63 33 Dongcheng District, Beijing 100013<br />

Telephone: (650) 384-4300 Fax: 41 44 283 63 30 China<br />

Fax: (650) 330-1149 zürich@sriconsulting.com Telephone: 8610-58256826<br />

menlopark@sriconsulting.com Fax: 8610-58256830<br />

beijing@sriconsulting.com<br />

U.S. Offices<br />

East Asia<br />

Houston<br />

Takeda Honcho Building, 8th Floor<br />

2002 Timberloch Place, Suite 110 2-1-7 Nihonbashi Honcho<br />

The Woodlands, TX 77380<br />

Chuoku, Tokyo 103-0023, Japan<br />

Telephone: (281) 203-6280 Telephone: 81 3 5202-7320<br />

Fax: (281) 203-6287 Fax: 81 3 5202-7333<br />

houston@sriconsulting.com<br />

tokyo@sriconsulting.com<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

Ellen Blue, Editor<br />

© 2008 by SRI Consulting.<br />

All rights reserved. Unauthorized reproduction prohibited.<br />

Visit us at www.sriconsulting.com 13