View Newsletter - Chemical Insight & Forecasting

View Newsletter - Chemical Insight & Forecasting

View Newsletter - Chemical Insight & Forecasting

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CHEMICAL INDUSTRIES<br />

NEWSLETTER<br />

A monthly compilation of SRIC report abstracts and news<br />

January 2006<br />

CEH Marketing Research Report Abstract<br />

ETHYL ALCOHOL<br />

By<br />

Michael P. Malveda<br />

with<br />

Hossein Janshekar and Yoshio Inoguchi<br />

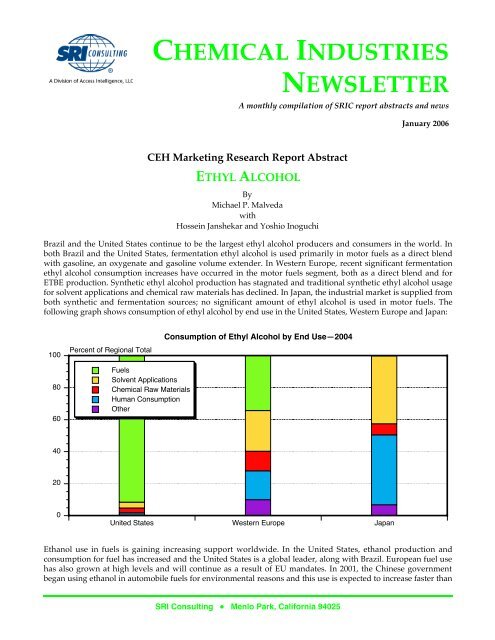

Brazil and the United States continue to be the largest ethyl alcohol producers and consumers in the world. In<br />

both Brazil and the United States, fermentation ethyl alcohol is used primarily in motor fuels as a direct blend<br />

with gasoline, an oxygenate and gasoline volume extender. In Western Europe, recent significant fermentation<br />

ethyl alcohol consumption increases have occurred in the motor fuels segment, both as a direct blend and for<br />

ETBE production. Synthetic ethyl alcohol production has stagnated and traditional synthetic ethyl alcohol usage<br />

for solvent applications and chemical raw materials has declined. In Japan, the industrial market is supplied from<br />

both synthetic and fermentation sources; no significant amount of ethyl alcohol is used in motor fuels. The<br />

following graph shows consumption of ethyl alcohol by end use in the United States, Western Europe and Japan:<br />

100<br />

Percent of Regional Total<br />

Consumption of Ethyl Alcohol by End Use—2004<br />

80<br />

60<br />

Fuels<br />

Solvent Applications<br />

<strong>Chemical</strong> Raw Materials<br />

Human Consumption<br />

Other<br />

40<br />

20<br />

0<br />

United States Western Europe Japan<br />

Ethanol use in fuels is gaining increasing support worldwide. In the United States, ethanol production and<br />

consumption for fuel has increased and the United States is a global leader, along with Brazil. European fuel use<br />

has also grown at high levels and will continue as a result of EU mandates. In 2001, the Chinese government<br />

began using ethanol in automobile fuels for environmental reasons and this use is expected to increase faster than<br />

SRI Consulting ● Menlo Park, California 94025

January 2006<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

any other ethanol use. Likewise, in India, the government decided to allow the sale of E-5 (5% ethyl alcohol blend<br />

in gasoline) in 2002. As a result, more ethanol plants are being constructed.<br />

Technological progress continues to increase production efficiency from feedstocks such as corn and sugar crops.<br />

Cost-effectiveness would aid producers and consumers alike. Continued research and development in cellulose<br />

production of ethanol would benefit the ethanol industry in the future.<br />

Legislation is a key factor worldwide for increasing and promoting ethanol fuel use. The new Energy Bill in the<br />

United States, the EU Biofuels Directive, the continued Caribbean Basin Initiative (CBI) tariff waivers, the<br />

privatization of ethanol industries, and promotion of and research into ethanol fuel use by some Asian<br />

governments all contribute to legislation and support for ethanol use. Ethanol’s use in solvent applications will<br />

continue to be affected by volatile organic compound (VOC) laws and regulations. This will limit ethanol use in<br />

this market segment.<br />

(For the complete marketing research report on ETHYL ALCOHOL, visit this report’s home page or see p. 644.5000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

ETHYLENE-PROPYLENE ELASTOMERS<br />

By<br />

R. J. Chang<br />

with<br />

Masahiro Yoneyama<br />

Ethylene-propylene elastomers (EP elastomers) are the third-largest synthetic rubber consumed worldwide, after<br />

styrene-butadiene rubber and polybutadiene rubber. EP elastomers are characterized by their outstanding<br />

resistance to oxygen, ozone and heat, making them particularly useful in many applications such as automotive,<br />

roofing and power cables. Two basic types of EP elastomer are produced: ethylene-propylene copolymer (EPM),<br />

which requires vulcanization by means of free radical generators, and ethylene-propylene terpolymer (EPDM),<br />

made by copolymerizing ethylene and propylene with a small amount of a nonconjugated diolefin that is<br />

vulcanized in the conventional manner with sulfur or with peroxides. EPDM is estimated to account for 80–85%<br />

of total world production of ethylene-propylene elastomers. The following pie chart shows world consumption of<br />

EP elastomers in 2004:<br />

World Consumption of EP Elastomers—2004<br />

Other Asia<br />

India<br />

China<br />

Rest of<br />

the World<br />

North<br />

America<br />

Japan<br />

Eastern Europe<br />

Latin<br />

America<br />

Western<br />

Europe<br />

2 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> January 2006<br />

Supply was very tight in 2004 and some end users were put on allocation as consumption outstripped production<br />

slightly. It is believed that off-grade materials and changes in stocks accounted for the production deficit. Supply<br />

is expected to remain tight at least for the next two years because 2005 capacity includes 140 thousand metric tons<br />

of metallocene-based plants built by Dow and ExxonMobil, which are primarily for making ethylene/alpha-olefin<br />

copolymers. Although they can act as swing capacity for making metallocene-based EPDM, it is difficult or<br />

undesirable in practice. Thus, the effective operating rate for making EPDM is estimated at 91% in 2004–2005.<br />

Mitsui has announced plans to build a new metallocene-based plant with 75 thousand metric tons of capacity<br />

totally dedicated to production of EPDM, but the plant will not come on stream until 2007.<br />

(For the complete marketing research report on ETHYLENE-PROPYLENE ELASTOMERS, visit this report’s home page or see p. 525.2600 A<br />

of the <strong>Chemical</strong> Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

HYDROGEN PEROXIDE<br />

By<br />

Stefan Schlag<br />

with<br />

Kazuteru Yokose<br />

Apparent consumption of hydrogen peroxide on a global basis is believed to have been almost 3 million metric<br />

tons in 2004. Consumption has increased substantially over the past few years, driven by global growth in the<br />

pulp and paper industry, in particular in China, Southeast Asia and South America. In South America, mining is<br />

a growing demand sector. In North America, consumption is projected to grow by about 1.8% and growth in<br />

Japan is forecast to be about 4.5%. Consumption will increase in Western Europe at an average annual rate of<br />

4.8% over 2004–2009, with the largest part of the additional consumption accounted for by the production of<br />

propylene oxide using the HPPO process.<br />

The following graph shows consumption of hydrogen peroxide by end use in North America, Western Europe<br />

and Japan:<br />

Consumption of Hydrogen Peroxide by End Use—2004<br />

100<br />

80<br />

60<br />

Percent of Regional Total<br />

Pulp and Paper<br />

<strong>Chemical</strong>s and Laundry Products<br />

Textiles<br />

Environmental Applications<br />

Mining<br />

Other<br />

40<br />

20<br />

0<br />

North America Western Europe Japan<br />

Visit us at www.sriconsulting.com 3

January 2006<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

The primary factor driving past and projected growth in hydrogen peroxide consumption is concern for the<br />

environment. Hydrogen peroxide, which decomposes into water and oxygen, is replacing oxidizing compounds<br />

such as chlorine in pulp bleaching and other applications. Hydrogen peroxide is also used as-is or in an activated<br />

form to treat inorganic and organic pollutants in industrial and municipal applications. While the hydrogen<br />

peroxide market has traditionally been diversified across a broad spectrum of uses, rapid growth in consumption<br />

in pulp bleaching has forced the business to be driven primarily by demand in this one application.<br />

Over the 2004–2009 period, hydrogen peroxide consumption will continue to be driven by demand in pulp<br />

bleaching and the new application of propylene oxide production, which is scheduled to start in 2008 and will<br />

consume an estimated 150 thousand metric tons by 2009. Demand in China, South America, Eastern Europe and<br />

Other Asia is projected to grow faster than in the developed regions.<br />

(For the complete marketing research report on HYDROGEN PEROXIDE, visit this report’s home page or see p. 741.5000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

CEH Marketing Research Report Abstract<br />

NATURAL FATTY ACIDS<br />

By<br />

Michael P. Malveda<br />

with<br />

Milen Blagoev, Ralf Gubler and Kazuo Yagi<br />

Many new fatty acid plants have been built in Southeast Asia, which is the major source of coconut, palm and<br />

palm kernel oils used as raw materials for C 8 -C 14 fatty acids. Altogether, producers of fatty acids from oil<br />

splitting in these countries (excluding China and India) have a total capacity of almost 2 million metric tons.<br />

Significant amounts of this increasing production are being exported to other world areas, including North<br />

America, Western Europe and Japan, all three of which are now net importers of fatty acids derived from fat and<br />

oil splitting.<br />

Worldwide production of fatty acids from splitting is dominated by two large producers—the Uniqema Group<br />

(formerly known as the Unichema Group and now owned by the Imperial <strong>Chemical</strong> Industries PLC) and the<br />

Cognis Group. The Uniqema Group operates four plants in different European countries, one plant in the United<br />

States and a joint venture in Malaysia, all with a total capacity of over 800 thousand metric tons. The Cognis<br />

Group operates one plant in the United States, one in Canada, one in Europe and a joint venture in Malaysia, with<br />

a total annual capacity of over 400 thousand metric tons. These capacity estimates exclude any fatty acid capacity<br />

that is part of the continuous soapmaking process and also exclude any capacity in Latin America or Eastern<br />

Europe. Indonesian producers Acidchem, Palm Oleo and Natural Oleochemicals also account for a significant<br />

amount of fatty acid splitting capacity. Another large producer is the Akzo Nobel <strong>Chemical</strong> Group, which<br />

operates plants in North America, Europe and Asia. In North America, Twin Rivers Technologies is a major<br />

producer.<br />

By far the largest worldwide tall oil fatty acid (TOFA) producer is the International Paper Company, which owns<br />

Arizona <strong>Chemical</strong> in the United States as well as TOFA producers in Finland, Sweden and the United Kingdom.<br />

It operates five plants.<br />

Global fatty acids supply continues to exceed fatty acids demand. In 2004, capacity utilization rates increased<br />

slightly in North America to about 85–90%. Industry sources believe that European capacity utilization is less<br />

(71%) than in North America. In Southeast Asia, capacity utilization rates are reported to be running at 80–90%.<br />

Asia currently accounts for 35% of global production and is expected to account for more than 50% of global fatty<br />

acid production by 2010.<br />

4 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> January 2006<br />

Whether used as such or in the form of various derivatives, fatty acids are ultimately consumed in a wide variety<br />

of end-use industries. The economic growth of many of these industries (e.g., rubber, plastics and detergents) is<br />

often a good indicator of the overall economic performance of a region. Not surprisingly, historical growth in the<br />

consumption of fatty acids has tended to approximate growth in regional GNP.<br />

(For the complete marketing research report on NATURAL FATTY ACIDS, visit this report’s home page or see p. 657.5000 A of the <strong>Chemical</strong><br />

Economics Handbook.)<br />

CEH Product Review Abstract<br />

POLYPHENYLENE SULFIDE RESINS<br />

By<br />

R. J. Chang<br />

with<br />

Thomas Kälin and Goro Toki<br />

Polyphenylene sulfide (PPS) resins exhibit exceptional resistance to thermal degradation and high heat distortion<br />

temperatures, as well as outstanding chemical and flame resistance. Major markets include automotive, electrical<br />

and electronics, industrial and appliances. World demand for PPS grew briskly at 9–11% per year during<br />

2001–2004, driven primarily by automotive applications. Although growth in the production of automobiles in<br />

North America, Western Europe and Japan has been sluggish, PPS resins have benefited from the ever-increasing<br />

under-the-hood temperatures of automobiles and the need for fuel and flame resistance in many automotive<br />

parts. This trend is expected to continue, and demand is projected to grow at approximately 10% per year during<br />

2004–2009.<br />

The following graph shows regional supply/demand for PPS resins as a percentage of the world total:<br />

World Supply/Demand for Polyphenylene Sulfide Resins—2004<br />

100<br />

Percent of World Total<br />

80<br />

60<br />

40<br />

20<br />

United States<br />

Western Europe<br />

Japan<br />

China<br />

Rest of the World<br />

0<br />

Annual Capacity Production Net Imports Net Exports Consumption<br />

In 2004, Japan and the United States remained the two dominant producing countries. In November 2005, supply<br />

was tight, and lead time in the United States was approximately twenty weeks. With world consumption<br />

Visit us at www.sriconsulting.com 5

January 2006<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

expected to grow at approximately 10% per year during 2004–2009, all producers announced plans to increase<br />

capacity.<br />

World capacity for PPS is expected to grow at an average annual rate of about 13% during 2004–2009.<br />

Consumption is forecast to grow at an average annual rate of 10%. China is expected to show the highest rates of<br />

growth in capacity and consumption (20% per year). The rest of the world (mostly other Asian countries) is also<br />

expected to show high growth rates of 20% per year. Consumption growth will be fueled mainly by automotive<br />

under-the-hood applications and by new extrusion and thermoforming grades that have been introduced into the<br />

market in the past two years.<br />

(For the complete product review on POLYPHENYLENE SULFIDE RESINS, visit this report’s home page or see p. 580.4600 A of the<br />

<strong>Chemical</strong> Economics Handbook.)<br />

PEP Report Abstract<br />

ADVANCES IN NAPHTHA STEAM CRACKING<br />

By<br />

Anthony Pavone<br />

(PEP Report 248A, December 2005)<br />

This PEP report is designed to help clients better understand the technology changes that are being incorporated<br />

in modern, state-of-the-art naphtha steam crackers, and also to assist operators of existing steam crackers in<br />

providing incremental upgrades to improve performance and profitability.<br />

For grass roots naphtha steam crackers, we provide an engineering process design and corresponding production<br />

economics for a 1.2 MM tpy naphtha steam cracking unit that incorporates state-of-the-art technology. These new<br />

developments include mercury and arsenic pretreatment of feedstock, DMSO addition to naphtha very low in<br />

sulfur content, furnace operation for both maximum ethylene and maximum propylene business objectives, front<br />

end depropanizer fractionation trains, dual depropanizer tower optimization, front end hydrogenation of<br />

diolefins with dilute hydrogen, mixed refrigerant cryogenics, and low pressure (20 bar) process compression. For<br />

this configuration, we have also provided material balances for light and full-range naphtha operated for both<br />

maximum ethylene and propylene yields.<br />

We have also prepared a comparison of the licensed process offerings currently made by KBR, Lummus, S&W,<br />

Technip and Linde.<br />

We also explore typical debottlenecking strategies to incrementally increase production capacity. These include<br />

cracked gas and refrigeration compressor upgrades, major driver modifications, quench oil and water wash tower<br />

modifications, and fractionation train tray and packing modifications.<br />

To extend major turnaround frequency to five-year intervals, we identify the major equipment that needs to be<br />

upgraded and/or made redundant. These include heavy service reboilers, compressor interstage coolers, TLE<br />

operation, upgraded furnace tube metallurgy, and quench cooler upgrades.<br />

Given the emphasis currently applied to on-line, real time economic optimizers, we review the vendor offerings,<br />

and describe the sources of economic credits that justify this type of SCADA investment.<br />

Lastly, we explore unit operating strategies to improve conversion and selectivity, reduce the volume of coke<br />

production and frequency of steam air decoking, and keep the unit running clean. We examine on-line washing of<br />

the cracked gas compressor, naphtha additives to reduce furnace tube coking and extend tube life, current<br />

hydrogenation catalyst availability, green oil management, intermediate draw-off trays on the primary<br />

fractionator for kerosene and diesel recovery, and improved process computer control offerings made by<br />

Honeywell and Foxboro.<br />

6 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> January 2006<br />

PEP Review Abstract<br />

BIODIESEL VIA AXENS HETEROGENEOUS CATALYSIS<br />

ESTERFIP-H PROCESS<br />

By<br />

Ronald G. Bray<br />

(PEP Review 2005-07, December 2005)<br />

Biodiesel is the methyl ester of fatty acids derived from renewable resources such as virgin vegetable oil, animal<br />

fats and used cooking oil. This biofuel can be used as a replacement for petroleum-based diesel in compression<br />

ignition engines with minimal modifications.<br />

The annual rate of growth in consumption of biodiesel during 1999–2004 exceeded 32%, reaching a global level of<br />

4.84 million tons/yr in 2004 (<strong>Chemical</strong> Economics Handbook estimates). Expansion is projected to continue at this<br />

phenomenal rate as a result of a variety of factors, including concerns about energy security, the environment and<br />

the skyrocketing cost of petroleum.<br />

The consumption of this biofuel is encouraged through various governmental incentives. EU Directive<br />

2003/30/EC set targets for a minimum fuels content from renewable resources with the goal of increasing content<br />

from today’s

January 2006<br />

CEH REPORTS AND PRODUCT<br />

REVIEWS IN PREPARATION<br />

Report Title<br />

Alkyl Acetates<br />

Amino Acids<br />

Calcium Chloride<br />

Cellulose Acetate Flake<br />

Cellulose Acetate/Triacetate Fibers<br />

Chlorobenzenes<br />

C 2 Chlorinated Solvents<br />

Ethanolamines<br />

Ethylbenzene<br />

Gasoline Octane Improvers<br />

Hydrochloric Acid<br />

Isophthalic Acid<br />

Isopropanolamines<br />

Lime/Limestone<br />

Neopentyl Polyhydric Alcohols<br />

Oxo <strong>Chemical</strong>s<br />

Phosphate Rock<br />

Plasticizer Alcohols<br />

Plasticizers<br />

Polyamide Resins (Nonnylon)<br />

Polyester Polyols<br />

Polyether Polyols for Urethanes<br />

Polyurethane Elastomers<br />

Polyurethane Foams<br />

Propylene Oxide<br />

Sodium Bicarbonate<br />

Sodium Carbonate<br />

Sodium Cyanide<br />

Styrene<br />

Styrenic Copolymers<br />

Sulfur<br />

Author<br />

Sebastian Bizzari<br />

Mike Malveda<br />

Stefan Schlag<br />

Stefan Müller<br />

Stefan Müller<br />

Thomas Kälin<br />

Jamie Lacson<br />

Elvira Greiner<br />

Koon-Ling Ring<br />

Michael Malveda<br />

Jamie Lacson<br />

Koon-Ling Ring<br />

Elvira Greiner<br />

Stefan Schlag<br />

Sebastian Bizzari<br />

Sebastian Bizzari<br />

Bala Suresh<br />

Sebastian Bizzari<br />

Sebastian Bizzari<br />

Elvira Greiner<br />

Henry Chinn<br />

Henry Chinn<br />

Henry Chinn<br />

Henry Chinn<br />

Henry Chinn<br />

Stefan Schlag<br />

Stefan Schlag<br />

Bala Suresh<br />

Koon-Ling Ring<br />

Koon-Ling Ring<br />

Bala Suresh<br />

This list is provided for the benefit of <strong>Chemical</strong> Economics<br />

Handbook users who may simultaneously be undertaking their<br />

own studies in these areas. Clients are welcome to write or call<br />

us in order to discuss the work in progress.<br />

CEH REPORTS AVAILABLE SEPARATELY<br />

To obtain a list of CEH marketing research reports or product<br />

reviews for sale separately, please see our website at<br />

http://www.sriconsulting.com/CEH/Public/Reports/ or<br />

contact:<br />

Ralf Gubler, Director, or<br />

Sebastian Bizzari/Koon-Ling Ring, Assistant<br />

Directors<br />

<strong>Chemical</strong> Economics Handbook Program<br />

SRI Consulting<br />

4300 Bohannon Drive, Suite 200<br />

Menlo Park, CA 94025<br />

Tel. (650) 384-4300 Fax: (650) 330-1149<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

NEW, Expanded<br />

Chemweek’s Business Daily<br />

Try 10 issues for FREE—your daily<br />

“executive briefing” of chemical industry<br />

news, insight and intelligence.<br />

As an SRIC client,<br />

you are eligible for<br />

a special free trial<br />

subscription to<br />

Chemweek’s<br />

Business Daily,<br />

the newly enhanced<br />

publication that<br />

delivers an<br />

executive briefing of<br />

the latest and most<br />

relevant chemical<br />

industry news—<br />

right to your<br />

desktop.<br />

Chemweek’s Business Daily is the chemical<br />

industry’s premiere source for news, insight and<br />

intelligence covering the global chemical and allied<br />

industries. You get a daily executive briefing on:<br />

Strategic moves, M&A activity, and<br />

financial plays<br />

Market and pricing movements for a<br />

growing list of 20 chemical categories<br />

Global regulatory and security issues<br />

New research, technologies and services<br />

that can provide a quantum shift in the<br />

global chemical business<br />

Key developments in petrochemical news,<br />

especially regarding pricing<br />

Special features include individual product focus<br />

reports and statistics on leading indicators,<br />

exclusive reports on specialty and fine chemicals,<br />

the latest in construction projects, price reports on<br />

basic chemicals and the CW 75 Stock Index with<br />

analysis and commentary.<br />

So, take advantage of this offer and see why<br />

readers consider this the daily must-read<br />

publication in the chemicals marketplace.<br />

To get your free 10 issues, click here<br />

http://www.chemweek.com/daily/<br />

and key in GBO335 when prompted.<br />

ACT NOW to take advantage<br />

of this special offer.<br />

8 Visit us at www.sriconsulting.com

<strong>Chemical</strong> Industries <strong>Newsletter</strong> January 2006<br />

CHEMICAL INDUSTRIES NEWSLETTER<br />

The <strong>Chemical</strong> Industries <strong>Newsletter</strong> is published monthly by SRI Consulting. The contents of the <strong>Newsletter</strong> are drawn from current research<br />

and publications of SRIC’s multiclient programs. Readers are welcome to call or write for more information about the subjects and programs<br />

mentioned (see addresses and telephone/fax numbers below).<br />

SRI Consulting offers the world’s most comprehensive ongoing multiclient databases on the chemical industry. The major multiclient programs<br />

include<br />

The ASEAN Report<br />

Directory of <strong>Chemical</strong> Producers<br />

<strong>Chemical</strong> Economics Handbook Canada Mexico<br />

The China Report China Middle East<br />

Process Economics East Asia South/Central America<br />

Specialty <strong>Chemical</strong>s Europe United States<br />

World Petrochemicals<br />

India<br />

Companies may participate in these continuing programs for the chemical industry through annual subscriptions or by purchasing individual<br />

reports. Each program is supported by inquiry and consulting privileges; electronic access is also available for all of these products.<br />

SRI Consulting................................................................John Pearson, President and CEO<br />

George Intille, Vice President<br />

<strong>Chemical</strong> Economics Handbook................................................Ralf Gubler, Director<br />

Directory of <strong>Chemical</strong> Producers...........................................Carolyn Read, Director<br />

Process Economics .................................................Russell Heinen, Group Director<br />

Production/Databases..........................................................Steven F. Read, Director<br />

Specialty <strong>Chemical</strong>s Update Program..................................Phil Calderoni, Director<br />

World Petrochemicals ..............................................Russell Heinen, Group Director<br />

About SRI Consulting<br />

SRI Consulting provides the world’s most comprehensive ongoing databases on the chemical industries. We offer an array of research-based<br />

programs designed to provide clients with specific market intelligence and analysis. These programs, combined with strategic information<br />

services, help clients define new market opportunities, identify and communicate future challenges, formulate and implement business<br />

strategies, and develop innovative products, processes and services. SRIC provides creative yet practical strategies, supported by renowned<br />

industry and technology expertise and delivered by multidisciplinary teams working closely with clients to ensure implementation. SRI<br />

Consulting is a division of Access Intelligence, LLC.<br />

About Access Intelligence, LLC<br />

Access Intelligence, LLC is a full-service global information and marketing solutions provider of competitive business-to-business information.<br />

The company publishes daily news services, premium-value newsletters, subscription-based websites, magazines, directories, and<br />

databases.<br />

SRI Consulting<br />

Headquarters<br />

_________________________ International Offices _________________________<br />

Menlo Park, CA Europe, Middle East and Africa Beijing<br />

John Pearson, President and CEO Toedistrasse 23, 1st Floor COFCO Plaza<br />

4300 Bohannon Drive, Suite 200 8002 Zürich, Switzerland Suite 420–421, Tower B<br />

Menlo Park, CA 94025 Telephone: 41 44 283 63 33 No. 8 Jianguomennei Avenue<br />

Telephone: (650) 384-4300 Fax: 41 44 283 63 30 Beijing, China 100005<br />

Fax: (650) 330-1149 zürich@sriconsulting.com Telephone: 86 10 6526 0698<br />

menlopark@sriconsulting.com Fax: 86 10 6526 0934<br />

beijing@sriconsulting.com<br />

U.S. Offices<br />

East Asia<br />

Houston<br />

Takeda Honcho Building, 8th Floor<br />

16945 Northchase Drive 2-1-7 Nihonbashi Honcho<br />

4 Greenspoint Plaza, Suite 1910 Chuoku, Tokyo 103-0023, Japan<br />

Houston, TX 77060 Telephone: 81 3 5202-7320<br />

Telephone: (281) 876-6923 Fax: 81 3 5202-7333<br />

Fax: (281) 876-6947 tokyo@sriconsulting.com<br />

houston@sriconsulting.com<br />

<strong>Chemical</strong> Industries <strong>Newsletter</strong><br />

Ellen Blue, Editor<br />

© 2006 by SRI Consulting.<br />

All rights reserved. Unauthorized reproduction prohibited.<br />

Visit us at www.sriconsulting.com 9