Downloadable - IA.TSE Local 80

Downloadable - IA.TSE Local 80

Downloadable - IA.TSE Local 80

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The cost of one quarterly receipt stamp and its allocation is as follows:<br />

Allocation of Quarterly Stamp<br />

Richard<br />

Walsh/<br />

Alfred W.<br />

Cost<br />

Convention DiTolla/<br />

of One and Harold<br />

Quarterly General Defense Per Diem Spivak<br />

Stamp Fund Fund Fund Foundation<br />

Period<br />

Jan.1, 2012 - April 30, 2012 $48.00 $41.90 $4.00 $2.00 $.10<br />

Jan. 1, 2011 - Dec. 31, 2011 47.00 40.90 4.00 2.00 .10<br />

May 1, 2010 - Dec. 31, 2010 45.00 38.90 4.00 2.00 .10<br />

Note 7 - Royalty income<br />

During 1997, the International entered into an agreement with the A.F.L.-C.I.O. granting<br />

them the right to use the International Union trademarks and membership lists. In<br />

consideration for this license, the A.F.L.-C.I.O. pays annual royalties to the International<br />

based on usage. The annual royalties received by the International during fiscal 2012 and<br />

2011 amounted to $163,957 and $154,532, respectively. The term of the existing agreement<br />

expires on February 28, 2017.<br />

Note 8 - Real and personal property<br />

Real and personal property is recorded at cost and consists of:<br />

April 30<br />

2012 2011<br />

Land $1,147,391 $1,147,391<br />

Buildings 2,892,829 2,740,907<br />

Furniture and equipment 2,715,563 2,276,706<br />

Total 6,755,783 6,165,004<br />

Less accumulated depreciation 2,460,303 2,111,214<br />

$4,295,4<strong>80</strong> $4,053,790<br />

In April 2012, the International through its wholly-owned subsidiary, the General Building<br />

Corp., entered into a purchase agreement with an unrelated third party seller to purchase<br />

three condominium units located at 207-217 West 25th Street, New York, New York. Under<br />

the terms of the agreement, the International made a $1,061,<strong>80</strong>2 deposit for the purchase<br />

of the condominium units. In connection with the closing of the Condominium units on June<br />

29, 2012, the International paid the seller the remaining balance of $9,556,218.<br />

Note 9 - Employee 401(K) Savings Plan<br />

The International maintains a 401(K) defined contribution savings plan through Merrill<br />

Lynch. All those employed by the International who have attained the age of 21 and<br />

completed one year of service are eligible to participate. Each employee is permitted to<br />

contribute up to 15% of their compensation up to the maximum amount permitted under<br />

the law and is 100% vested in the amount contributed. There is no matching contribution<br />

made by the International.<br />

Note 10 - Rental income<br />

The Realty Corp. and General Building Corp. as lessors under five commercial leases,<br />

which expire during various dates ranging from fiscal 2012 through 2017, will receive<br />

minimum base rents during the term of the leases as follows:<br />

Fiscal Year<br />

2013 $260,266<br />

2014 224,191<br />

2015 40,077<br />

2016 33,788<br />

2017 2,753<br />

$561,075<br />

Note 11 - Contingency<br />

The International has been named in a number of lawsuits that arose in the normal course<br />

of business. It is the opinion of management the eventual disposition of these legal actions,<br />

based on available insurance coverage and the assessment of the merits of such actions by<br />

counsel will not have a material adverse effect on the financial position of the International.<br />

Note 12 Unrestricted Net Assets<br />

Total Unrestricted Pension<br />

Net<br />

Liability<br />

Assets Adjustments<br />

Balance April 30, 2010 $ 25,072,727 $ 38,477,242 $(13,404,515)<br />

Change in net assets 1,823,511 1,823,511 -<br />

Pension related changes<br />

other than benefit cost (530,617) - (530,617)<br />

1,292,894 1,823,511 (530,617)<br />

Balance April 30, 2011 26,365,621 40,300,753 (13,935,132)<br />

Change in net assets 704,265 704,265 -<br />

Pension related changes<br />

other than benefit cost (6,168,661) - (6,168,661)<br />

(5,464,396) 704,265 (6,168,661)<br />

Balance April 30, 2012 $ 20,901,225 $ 41,005,018 $ (20,103,793)<br />

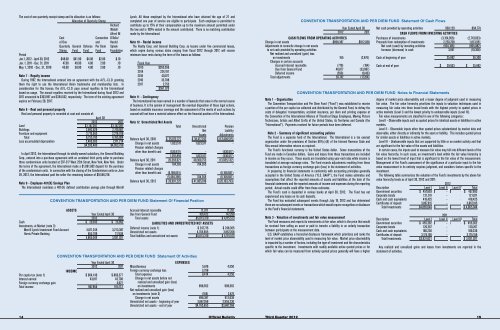

Convention Transportation and Per Diem Fund Statement Of Financial Position<br />

Assets<br />

Year Ended April 30<br />

2012 2011<br />

Cash $ 29,933 $ 25,992<br />

Investments, at Market (note 3)<br />

Merrill Lynch Investment Fund Account 4,011,245 3,213,387<br />

Harris Private Banking 853,799 717,634<br />

4,865,044 3,931,021<br />

Accrued interest receivable 11,971 11,261<br />

Due from General Fund 106,422 147,299<br />

Total assets $5,013,370 $ 4,115,573<br />

Liabilities and Unrestricted Net Assets<br />

Deferred income (note 1) $ 247,715 $ 248,305<br />

Unrestricted net assets 4,765,655 3,867,268<br />

Total liabilties and unrestricted net assets $5,013,370 $ 4,115,573<br />

Convention Transportation and Per Diem Fund Statement Of Activities<br />

Year Ended April 30<br />

2012 2011<br />

Income<br />

Per capita tax (note 1) $ 864,149 $ 866,377<br />

Interest earned 43,817 43,708<br />

Foreign currency exchange gain - 4,027<br />

Total income 907,966 914,112<br />

Expenses<br />

Miscellaneous 5,616 4,550<br />

Foreign currency exchange loss 3,798 -<br />

Total expenses 9,414 4,550<br />

Change in net assets before net<br />

realized and unrealized gain (loss)<br />

on investments 898,552 909,562<br />

Net realized and unrealized gain (loss)<br />

on investments (note 3) (165) 2,476<br />

Change in net assets 898,387 912,038<br />

Unrestricted net assets - beginning of year 3,867,268 2,955,230<br />

Unrestricted net assets - end of year $4,765,655 $3,867,268<br />

Convention Transportation and Per Diem Fund Statement Of Cash Flows<br />

Year Ended April 30<br />

2012 2011<br />

Cash flows from operating activities<br />

Change in net assets $898,387 $912,038<br />

Adjustments to reconcile change in net assets<br />

to net cash provided by operating activities<br />

Net realized and unrealized (gain) loss<br />

on investments 165 (2,476)<br />

Changes in certain accounts<br />

Accrued interest receivable (710) (164)<br />

Due from General Fund 40,877 (33,087)<br />

Deferred income (590) 18,463<br />

Total adjustments 39,742 (17,264)<br />

Net cash provided by operating activities 938,129 894,774<br />

Cash flows from investing activities<br />

Purchases of investments (3,154,956) (2,719,033)<br />

Proceeds from redemption of investments 2,220,768 1,813,951<br />

Net cash (used) by investing activities (934,188) (905,082)<br />

Increase (decrease) in cash 3,941 (10,308)<br />

Cash at beginning of year 25,992 36,300<br />

Cash at end of year $ 29,933 $ 25,992<br />

Convention Transportation and Per Diem Fund Notes to Financial Statements<br />

Note 1 - Organization<br />

The Convention Transportation and Per Diem Fund (“Fund”) was established to receive<br />

a portion of the per capita tax collected and distributed by the General Fund, to defray the<br />

costs of delegates’ transportation, accident insurance, per diem and printing expense at<br />

the Convention of the International Alliance of Theatrical Stage Employees, Moving Picture<br />

Technicians, Artists and Allied Crafts of the United States, its Territories and Canada (the<br />

“International”). Payments received for future periods have been deferred.<br />

Note 2 - Summary of significant accounting policies<br />

The Fund is a separate fund of the International. The International is a tax exempt<br />

organization under the provisions of Section 501(c)(5) of the Internal Revenue Code and<br />

files annual information returns as required.<br />

The Fund’s functional currency is the United States dollar. Some transactions of the<br />

Fund are made in Canadian dollars. Gains and losses from these transactions are included<br />

in income as they occur. These assets are translated using year-end rates while income is<br />

translated at average exchange rates. The Fund records adjustments resulting from these<br />

transactions as foreign currency exchange gain (loss) in the statement of activities.<br />

In preparing its financial statements in conformity with accounting principles generally<br />

accepted in the United States of America (“U.S. GAAP”), the Fund makes estimates and<br />

assumptions that affect the reported amounts of assets and liabilities at the date of the<br />

financial statements and the reported amounts of income and expenses during the reporting<br />

period. Actual results could differ from those estimates.<br />

The Fund’s cash is deposited in various banks at April 30, 2012. The Fund has not<br />

experienced any losses on its cash deposits.<br />

The Fund has evaluated subsequent events through July 19, 2012 and has determined<br />

there are no subsequent events or transactions which would require recognition or disclosure<br />

in the Fund’s financial statements.<br />

Note 3 - Valuation of investments and fair value measurement<br />

The Fund measures and reports its investments at fair value, which is the price that would<br />

be received from selling an asset or paid to transfer a liability in an orderly transaction<br />

between participants at the measurement date.<br />

U.S. GAAP establishes a hierarchal disclosure framework which prioritizes and ranks the<br />

level of market price observability used in measuring fair value. Market price observability<br />

is impacted by a number of factors, including the type of investment and the characteristics<br />

specific to the investment. Investments with readily available active quoted prices or for<br />

which fair value can be measured from actively quoted prices generally will have a higher<br />

degree of market price observability and a lesser degree of judgment used in measuring<br />

fair value. The fair value hierarchy prioritizes the inputs to valuation techniques used in<br />

measuring fair value into three broad levels with the highest priority to quoted prices in<br />

active markets (Level I) and the lowest priority to unobservable inputs (Level III).<br />

Fair value measurements are classified in one of the following categories:<br />

Level I - Observable inputs such as quoted prices for identical assets or liabilities in active<br />

markets.<br />

Level II - Observable inputs other than quoted prices substantiated by market data and<br />

observable, either directly or indirectly for the asset or liability. This includes quoted prices<br />

for similar assets or liabilities in active markets.<br />

Level III - Unobservable inputs that are supported by little or no market activity and that<br />

are significant to the fair value of the assets and liabilities.<br />

In certain cases, the inputs used to measure fair value may fall into different levels of the<br />

fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is<br />

based on the lowest level of input that is significant to the fair value of the measurement.<br />

Management of the Fund’s assessment of the significance of a particular input to the fair<br />

value measurement in its entirety requires judgment, and considers factors specific to the<br />

investment.<br />

The following table summarizes the valuation of the Fund’s investments by the above fair<br />

value hierarchy levels as of April 30, 2012 and 2011:<br />

2012<br />

Description Level I Level II Level III Total<br />

Government securities $ 457,693 $ - $ - $ 457,693<br />

Corporate bonds 121,011 - - 121,011<br />

Cash and cash equivalents 418,425 - - 418,425<br />

Certificates of deposit 3,867,915 - - 3,867,915<br />

Total Investments $4,865,044 $ - $ - $ 4,865,044<br />

2011<br />

Description Level I Level II Level III Total<br />

Government securities $ 455,362 $ - $ - $ 455,362<br />

Corporate bonds 120,267 - - 120,267<br />

Cash and cash equivalents 1<strong>80</strong>,236 - - 1<strong>80</strong>,236<br />

Certificates of deposit 3,175,156 - - 3,175,156<br />

Total Investments $3,931,021 $ - $ - $ 3,931,021<br />

Any realized and unrealized gains and losses from investments are reported in the<br />

statement of activities.<br />

14 Official Bulletin<br />

Third Quarter 2012 15