For the Years Ending June 30 - Blount County Government

For the Years Ending June 30 - Blount County Government

For the Years Ending June 30 - Blount County Government

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

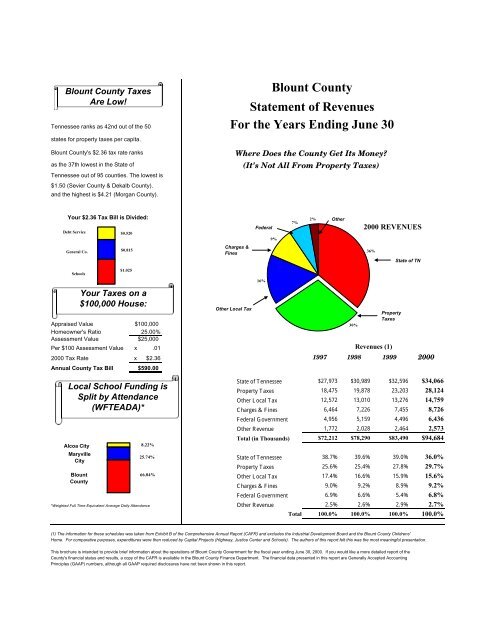

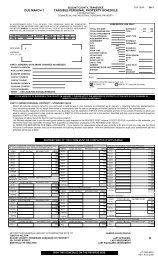

<strong>Blount</strong> <strong>County</strong> Taxes<br />

Are Low!<br />

<strong>Blount</strong> <strong>County</strong><br />

Statement of Revenues<br />

Tennessee ranks as 42nd out of <strong>the</strong> 50 <strong>For</strong> <strong>the</strong> <strong>Years</strong> <strong>Ending</strong> <strong>June</strong> <strong>30</strong><br />

states for property taxes per capita.<br />

<strong>Blount</strong> <strong>County</strong>'s $2.36 tax rate ranks<br />

as <strong>the</strong> 37th lowest in <strong>the</strong> State of<br />

Tennessee out of 95 counties. The lowest is<br />

$1.50 (Sevier <strong>County</strong> & Dekalb <strong>County</strong>).<br />

and <strong>the</strong> highest is $4.21 (Morgan <strong>County</strong>).<br />

Where Does <strong>the</strong> <strong>County</strong> Get Its Money<br />

(It's Not All From Property Taxes)<br />

Your $2.36 Tax Bill is Divided:<br />

Debt Service<br />

$0.520<br />

Federal<br />

9%<br />

7%<br />

2%<br />

O<strong>the</strong>r<br />

2000 REVENUES<br />

General Co.<br />

$0.815<br />

Charges &<br />

Fines<br />

36%<br />

State of TN<br />

Schools<br />

$1.025<br />

Property<br />

Taxes<br />

Appraised Value $100,000<br />

<strong>30</strong>%<br />

Homeowner's Ratio 25.00%<br />

Assessment Value $25,000<br />

Per $100 Assessment Value x .01 Revenues (1)<br />

2000 Tax Rate x $2.36 1997 1998 1999 2000<br />

Annual <strong>County</strong> Tax Bill $590.00<br />

Alcoa City<br />

Your Taxes on a<br />

$100,000 House:<br />

Local School Funding is<br />

Split by Attendance<br />

(WFTEADA)*<br />

Maryville<br />

City<br />

<strong>Blount</strong><br />

<strong>County</strong><br />

8.22%<br />

25.74%<br />

66.04%<br />

O<strong>the</strong>r Local Tax<br />

State of Tennessee $27,973 $<strong>30</strong>,989 $32,596 $34,066<br />

Property Taxes 18,475 19,878 23,203 28,124<br />

O<strong>the</strong>r Local Tax 12,572 13,010 13,276 14,759<br />

Charges & Fines 6,464 7,226 7,455 8,726<br />

Federal <strong>Government</strong> 4,956 5,159 4,496 6,436<br />

O<strong>the</strong>r Revenue 1,772 2,028 2,464 2,573<br />

Total (in Thousands) $72,212 $78,290 $83,490 $94,684<br />

State of Tennessee 38.7% 39.6% 39.0% 36.0%<br />

Property Taxes 25.6% 25.4% 27.8% 29.7%<br />

O<strong>the</strong>r Local Tax 17.4% 16.6% 15.9% 15.6%<br />

Charges & Fines 9.0% 9.2% 8.9% 9.2%<br />

Federal <strong>Government</strong> 6.9% 6.6% 5.4% 6.8%<br />

*Weighted Full Time Equivalent Average Daily Attendance O<strong>the</strong>r Revenue 2.5% 2.6% 2.9% 2.7%<br />

Total 100.0% 100.0% 100.0% 100.0%<br />

16%<br />

(1) The information for <strong>the</strong>se schedules was taken from Exhibit B of <strong>the</strong> Comprehensive Annual Report (CAFR) and excludes <strong>the</strong> Industrial Development Board and <strong>the</strong> <strong>Blount</strong> <strong>County</strong> Childrens'<br />

Home. <strong>For</strong> comparative purposes, expenditures were <strong>the</strong>n reduced by Capital Projects (Highway, Justice Center and Schools). The authors of this report felt this was <strong>the</strong> most meaningful presentation.<br />

This brochure is intended to provide brief information about <strong>the</strong> operations of <strong>Blount</strong> <strong>County</strong> <strong>Government</strong> for <strong>the</strong> fiscal year ending <strong>June</strong> <strong>30</strong>, 2000. If you would like a more detailed report of <strong>the</strong><br />

<strong>County</strong>'s financial status and results, a copy of <strong>the</strong> CAFR is available in <strong>the</strong> <strong>Blount</strong> <strong>County</strong> Finance Department. The financial data presented in this report are Generally Accepted Accounting<br />

Principles (GAAP) numbers, although all GAAP required disclosures have not been shown in this report.