Fiscal policy rules for managing oil revenues in Nigeria

Fiscal policy rules for managing oil revenues in Nigeria

Fiscal policy rules for managing oil revenues in Nigeria

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

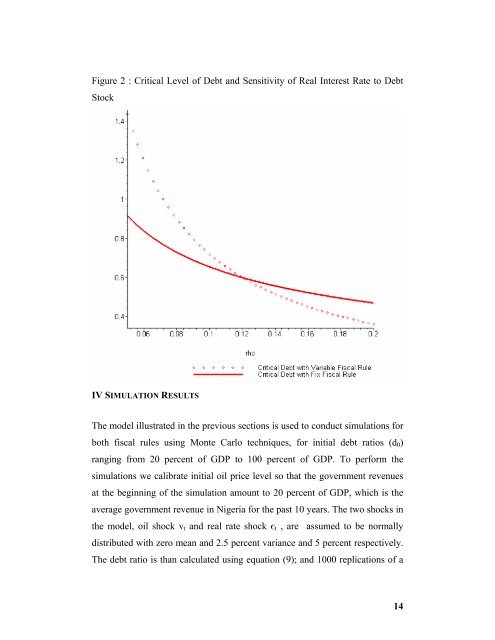

Figure 2 : Critical Level of Debt and Sensitivity of Real Interest Rate to Debt<br />

Stock<br />

IV SIMULATION RESULTS<br />

The model illustrated <strong>in</strong> the previous sections is used to conduct simulations <strong>for</strong><br />

both fiscal <strong>rules</strong> us<strong>in</strong>g Monte Carlo techniques, <strong>for</strong> <strong>in</strong>itial debt ratios (d 0 )<br />

rang<strong>in</strong>g from 20 percent of GDP to 100 percent of GDP. To per<strong>for</strong>m the<br />

simulations we calibrate <strong>in</strong>itial <strong>oil</strong> price level so that the government <strong>revenues</strong><br />

at the beg<strong>in</strong>n<strong>in</strong>g of the simulation amount to 20 percent of GDP, which is the<br />

average government revenue <strong>in</strong> <strong>Nigeria</strong> <strong>for</strong> the past 10 years. The two shocks <strong>in</strong><br />

the model, <strong>oil</strong> shock v t and real rate shock є t , are assumed to be normally<br />

distributed with zero mean and 2.5 percent variance and 5 percent respectively.<br />

The debt ratio is than calculated us<strong>in</strong>g equation (9); and 1000 replications of a<br />

14