PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

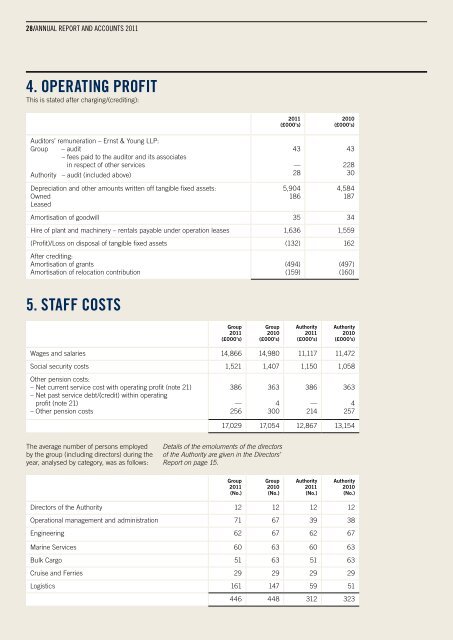

28/<strong>ANNUAL</strong> RE<strong>PORT</strong> <strong>AND</strong> <strong>ACCOUNTS</strong> <strong>2011</strong><br />

NOTES TO THE FINANCIAL STATEMENTS/29<br />

4. OPERATING PR<strong>OF</strong>IT<br />

This is stated after charging/(crediting):<br />

Auditors’ remuneration – Ernst & Young LLP:<br />

Group – audit<br />

– fees paid to the auditor and its associates<br />

in respect of other services<br />

Authority – audit (included above)<br />

Depreciation and other amounts written off tangible fixed assets:<br />

Owned<br />

Leased<br />

5. STAFF COSTS<br />

The average number of persons employed<br />

by the group (including directors) during the<br />

year, analysed by category, was as follows:<br />

Details of the emoluments of the directors<br />

of the Authority are given in the Directors’<br />

Report on page 15.<br />

<strong>2011</strong><br />

(£000’s)<br />

43<br />

—<br />

28<br />

5,904<br />

186<br />

2010<br />

(£000’s)<br />

43<br />

228<br />

30<br />

4,584<br />

187<br />

Amortisation of goodwill 35 34<br />

Hire of plant and machinery – rentals payable under operation leases 1,636 1,559<br />

(Profit)/Loss on disposal of tangible fixed assets (132) 162<br />

After crediting:<br />

Amortisation of grants<br />

Amortisation of relocation contribution<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

(494)<br />

(159)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

(497)<br />

(160)<br />

Authority<br />

2010<br />

(£000’s)<br />

Wages and salaries 14,866 14,980 11,117 11,472<br />

Social security costs 1,521 1,407 1,150 1,058<br />

Other pension costs:<br />

– Net current service cost with operating profit (note 21)<br />

– Net past service debt/(credit) within operating<br />

profit (note 21)<br />

– Other pension costs<br />

386<br />

—<br />

256<br />

363<br />

4<br />

300<br />

386<br />

—<br />

214<br />

363<br />

4<br />

257<br />

17,029 17,054 12,867 13,154<br />

6. TAX<br />

a) Tax on charge on ordinary activities<br />

The tax charge is made up as follows:<br />

Current tax<br />

UK corporation tax on the profit for the year<br />

Adjustments in respect of prior periods<br />

<strong>2011</strong><br />

(£000’s)<br />

2,376<br />

(277)<br />

2010<br />

(£000’s)<br />

Total current tax (note 6b) 2,099 872<br />

Deferred tax<br />

Origination and reversal of timing differences<br />

Adjustment in respect of previous years<br />

Effect of change in tax rate<br />

Deferred tax on FRS 17 movement<br />

706<br />

281<br />

(487)<br />

(24)<br />

872<br />

—<br />

917<br />

42<br />

(190)<br />

(20)<br />

Total deferred tax (note 17) 476 749<br />

Tax on profit on ordinary activities 2,575 1,621<br />

b) Factors affecting current tax charge<br />

for the year:<br />

The tax assessed for the year is less than<br />

the standard rate of corporation tax in the<br />

UK of 26.5% (2010 – 27%). The differences<br />

are explained below:<br />

<strong>2011</strong><br />

(£000’s)<br />

2010<br />

(£000’s)<br />

Profit on ordinary activities before tax 8,953 4,400<br />

Tax on ordinary activities multiplied by standard rate or<br />

corporation tax in the UK of 26.5% (2010 – 27%) 2,372 1,232<br />

Effects of:<br />

Income not taxable<br />

Expenses not deductible for tax purposes<br />

Capital allowances for period more than depreciation<br />

Adjustments to tax charge in respect of previous periods<br />

Marginal relief<br />

Other short term timing differences<br />

—<br />

743<br />

(635)<br />

(277)<br />

(2)<br />

(102)<br />

—<br />

580<br />

(785)<br />

—<br />

(4)<br />

(151)<br />

Current tax for the year (note 6a) 2,099 872<br />

Group<br />

<strong>2011</strong><br />

(No.)<br />

Group<br />

2010<br />

(No.)<br />

Authority<br />

<strong>2011</strong><br />

(No.)<br />

Authority<br />

2010<br />

(No.)<br />

Directors of the Authority 12 12 12 12<br />

Operational management and administration 71 67 39 38<br />

Engineering 62 67 62 67<br />

Marine Services 60 63 60 63<br />

Bulk Cargo 51 63 51 63<br />

Cruise and Ferries 29 29 29 29<br />

Logistics 161 147 59 51<br />

446 448 312 323<br />

c) Factors affecting future tax charges<br />

The UK government has announced its<br />

intention to reduce the UK corporation<br />

tax rate to 23% by 1 April 2014. The<br />

reduction from 28% to 26% was<br />

substantively enacted on 29 March <strong>2011</strong><br />

and came into effect on 1 April <strong>2011</strong>.<br />

A hybrid rate of 26.5% therefore applies<br />

to current tax liabilities arising during the<br />

period. A reduction from 26% to 25%<br />

was substantively enacted on 5 July <strong>2011</strong><br />

and will come into effect on 1 April 2012.<br />

At the balance sheet date, the change in<br />

the tax rate to 25% has no effect on current<br />

tax liabilities arising prior to the effective<br />

date of change. The enacted reduction to<br />

25% will however apply to any deferred tax<br />

assets and liabilities arising at the balance<br />

sheet date of which none are recognised.<br />

The future tax charge will also be affected<br />

by the Government’s intention to reduce the<br />

main rate of capital allowances from 20%<br />

to 18% and from 10% to 8% with effect<br />

from 1 April 2012.