PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

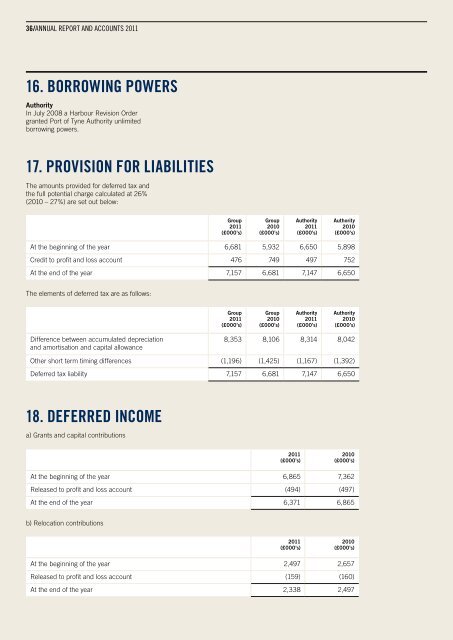

36/<strong>ANNUAL</strong> RE<strong>PORT</strong> <strong>AND</strong> <strong>ACCOUNTS</strong> <strong>2011</strong><br />

NOTES TO THE FINANCIAL STATEMENTS/37<br />

16. BORROWING POWERS<br />

19. RESERVES<br />

Authority<br />

In July 2008 a Harbour Revision Order<br />

granted Port of Tyne Authority unlimited<br />

borrowing powers.<br />

a) Profit and loss reserve<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

17. PROVISIOn FOR LIABILITIES<br />

The amounts provided for deferred tax and<br />

the full potential charge calculated at 26%<br />

(2010 – 27%) are set out below:<br />

At the beginning of the year 64,668 61,123 60,937 58,418<br />

Profit for the year 6,378 2,779 5,157 1,753<br />

Net recognised (losses) and gains in respect of FRS 17 (60) 766 (60) 766<br />

At the end of the year 70,986 64,668 66,034 60,937<br />

b) Revaluation reserves<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Investment properties <strong>2011</strong><br />

(£000’s)<br />

At the beginning of the year 6,681 5,932 6,650 5,898<br />

Credit to profit and loss account 476 749 497 752<br />

At the end of the year 7,157 6,681 7,147 6,650<br />

At the beginning of the year 27,879<br />

Revaluation in year 833<br />

At the end of the year 28,712<br />

The elements of deferred tax are as follows:<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

The movement on total group reserves is<br />

represented by the total gains and losses<br />

recognised since the last annual report.<br />

Difference between accumulated depreciation<br />

and amortisation and capital allowance<br />

8,353 8,106 8,314 8,042<br />

Other short term timing differences (1,196) (1,425) (1,167) (1,392)<br />

Deferred tax liability 7,157 6,681 7,147 6,650<br />

20. COMMITMENTS<br />

a) Capital commitments at the end of the<br />

financial year, for which no provision has<br />

been made, are as follows:<br />

18. DEFERRED INCOME<br />

a) Grants and capital contributions<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Contracted 532 1,483 532 1,483<br />

<strong>2011</strong><br />

(£000’s)<br />

2010<br />

(£000’s)<br />

b) Annual commitments under noncancellable<br />

operating leases are as follows:<br />

At the beginning of the year 6,865 7,362<br />

Released to profit and loss account (494) (497)<br />

At the end of the year 6,371 6,865<br />

b) Relocation contributions<br />

Group <strong>2011</strong><br />

(£000’s)<br />

Operating leases which expire:<br />

Within one year<br />

In the second to fifth years inclusive<br />

Over five years<br />

257<br />

1,275<br />

—<br />

2010<br />

(£000’s)<br />

117<br />

1,477<br />

—<br />

<strong>2011</strong><br />

(£000’s)<br />

2010<br />

(£000’s)<br />

Deferred tax liability 1,532 1,594<br />

At the beginning of the year 2,497 2,657<br />

Released to profit and loss account (159) (160)<br />

At the end of the year 2,338 2,497