PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

PORT OF TYNE ANNUAL REPORT AND ACCOUNTS 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

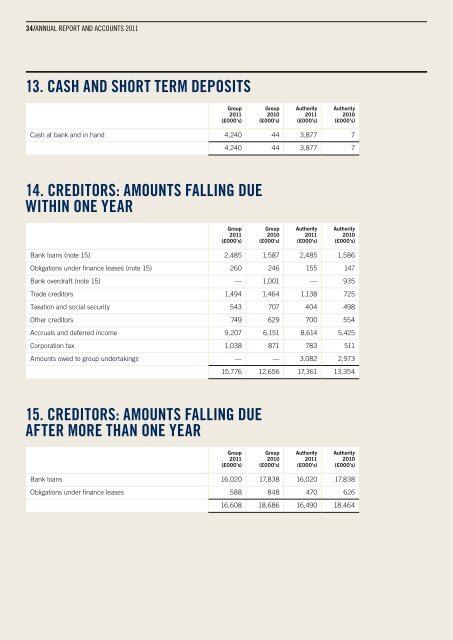

34/<strong>ANNUAL</strong> RE<strong>PORT</strong> <strong>AND</strong> <strong>ACCOUNTS</strong> <strong>2011</strong><br />

NOTES TO THE FINANCIAL STATEMENTS/35<br />

13. CASH <strong>AND</strong> SHORT TERM DEPOSITS<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

14. CREDITORS: AMOUNTS FALLING DUE<br />

within one year<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Cash at bank and in hand 4,240 44 3,877 7<br />

4,240 44 3,877 7<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Bank loans (note 15) 2,485 1,587 2,485 1,586<br />

Obligations under finance leases (note 15) 260 246 155 147<br />

Bank overdraft (note 15) — 1,001 — 935<br />

Trade creditors 1,494 1,464 1,138 725<br />

Taxation and social security 543 707 404 498<br />

Other creditors 749 629 700 554<br />

Accruals and deferred income 9,207 6,151 8,614 5,425<br />

Corporation tax 1,038 871 783 511<br />

Amounts owed to group undertakings — — 3,082 2,973<br />

15,776 12,656 17,361 13,354<br />

In September 2009 the Authority exercised<br />

the option to extend the Dexia loan<br />

drawn down in 2004 for a further 4 years.<br />

A replacement loan of £4,531,000 was<br />

drawn, repayable by quarterly instalments<br />

of £40,000 with a bullet repayment of<br />

£3,931,000 in July 2013. The agreement<br />

is secured on land at Maritime Industrial<br />

Estate, North Shields. Interest is charged<br />

at 4.81%. At 31 December <strong>2011</strong> the amount<br />

drawn on the facility was £4,172,000<br />

(2010 – £4,332,000).<br />

In July 2006 the Authority entered into a<br />

revolving credit facility (RCF) with Barclays<br />

Bank PLC up to the sum of £15,700,000.<br />

The purpose of the facility was to help<br />

finance the large scale development<br />

programme beginning in 2007. Monies<br />

drawn are secured on the Tyne car terminal<br />

up to the amount of the facility utilised.<br />

ANALYSIS <strong>OF</strong> DEBT<br />

Debt can be analysed as falling due:<br />

In one year or less, or on demand<br />

Between one and two years<br />

Between two and five years<br />

In five years or more<br />

Interest is charged at a rate of LIBOR +<br />

0.5625%. The LIBOR element of the rate<br />

is hedged using an interest rate swap at<br />

3.96%, based on the projected nominal<br />

value of the loan. The current mark to<br />

market valuation of this swap is £89,357<br />

out of the money (2010 – £211,276 out of<br />

the money) At 31 December <strong>2011</strong> the<br />

amount drawn on the facility was £nil (2010<br />

– £1,325,000). The largest balance owed<br />

on this loan during <strong>2011</strong> was £4,575,000.<br />

In November 2009 the Authority entered<br />

into a multiple advance medium term loan<br />

facility with Barclays Bank PLC up to the<br />

sum of £16,300,000. The purpose of the<br />

facility was to finance the new facility for<br />

handling biomass in 2010. Monies drawn<br />

are secured on a number of assets at Tyne<br />

Dock, South Shields. Interest is charged at<br />

a rate of LIBOR + 1.9057%. The LIBOR<br />

element of the rate is hedged using an<br />

interest rate swap at 4.95%, based on the<br />

projected nominal value of the loan.<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

2,746<br />

6,603<br />

7,287<br />

2,717<br />

Group<br />

2010<br />

(£000’s)<br />

1,832<br />

1,884<br />

10,583<br />

6,220<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

2,639<br />

6,500<br />

7,283<br />

2,708<br />

Authority<br />

2010<br />

(£000’s)<br />

1,732<br />

1,778<br />

10,477<br />

6,210<br />

19,353 20,519 19,130 20,197<br />

The current mark to market valuation of<br />

this swap is £1,536,241 out of the money<br />

(2010 – £1,204,209 out of the money).<br />

At 31 December <strong>2011</strong> the amount drawn<br />

on the facility was £14,333,000 (2010 –<br />

£13,768,000).<br />

The business has a bank overdraft facility<br />

which is secured on the Tyne car terminal<br />

up to the value of the agreed overdraft.<br />

Obligations under finance lease are secured<br />

against the assets to which they relate.<br />

15. CREDITORS: AMOUNTS FALLING DUE<br />

AFTER MORE THAN one year<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Bank loans 16,020 17,838 16,020 17,838<br />

Obligations under finance leases 588 848 470 626<br />

16,608 18,686 16,490 18,464<br />

The maturity of obligations under finance<br />

leases, which are included within the figures<br />

above, is as follows:<br />

Group<br />

<strong>2011</strong><br />

(£000’s)<br />

Group<br />

2010<br />

(£000’s)<br />

Authority<br />

<strong>2011</strong><br />

(£000’s)<br />

Authority<br />

2010<br />

(£000’s)<br />

Within one year 305 305 185 185<br />

In the second to fifth years 627 930 510 695<br />

Over five years 11 13 — —<br />

943 1,248 695 880<br />

Less: future finance charges (95) (154) (70) (107)<br />

848 1,094 625 773