HYFLUX LTD AND SUBSIDIARIES

HYFLUX LTD AND SUBSIDIARIES

HYFLUX LTD AND SUBSIDIARIES

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○<br />

○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○ ○<br />

NOTES TO THE FINANCIAL STATEMENTS (CONTINUED)<br />

FOR THE YEAR ENDED 31 DECEMBER 2002<br />

36. FINANCIAL INSTRUMENTS<br />

FINANCIAL RISK MANAGEMENT OBJECTIVES <strong>AND</strong> POLICIES<br />

The main risks arising from the Group’s financial instruments are interest rate, liquidity, foreign exchange and credit risks.<br />

The management reviews, manages and monitors each of these risks and will recommend necessary actions to the Board<br />

as appropriate.<br />

INTEREST RATE RISK<br />

The Group obtains additional financing through bank borrowings and leasing arrangements. The Group’s policy is to obtain<br />

the most favourable interest rates available without increasing its foreign currency exposure.<br />

Surplus funds are placed with reputable banks.<br />

Information relating to the Group’s interest rate exposure is also disclosed in the notes on the Group’s borrowings, including<br />

leasing obligations.<br />

LIQUIDITY RISK<br />

The Group’s main exposure to liquidity risk is in respect of funding of its project costs and other operating expense.<br />

The Group monitors and maintains cash and cash equivalents deemed adequate by the management to finance the Group’s<br />

operations. Short-term credit facilities are available for contingency purposes.<br />

FOREIGN EXCHANGE RISK<br />

The Group’s income is mainly in Singapore Dollar (S$), United States Dollar (US$) and China Renminbi (RMB). Any significant<br />

fluctuation in US$ and RMB against the Group’s base currency, S$, will result in fluctuation in the Group’s income.<br />

Currently, the Group does not have a foreign currency hedging policy. However, the management monitors foreign exchange<br />

exposure and will consider hedging material foreign exposure should the need arise. It is the Group’s policy not to trade in<br />

derivative contracts.<br />

CREDIT RISK<br />

For project contracts, management has a credit policy in place and the exposure to credit risk is monitored on an ongoing basis.<br />

The carrying amount of cash and cash equivalents, trade debtors, other debtors and intercompany balances represent the<br />

Group’s maximum exposure to credit risk in relation to financial assets. No other financial asset carries a significant exposure<br />

to credit risk.<br />

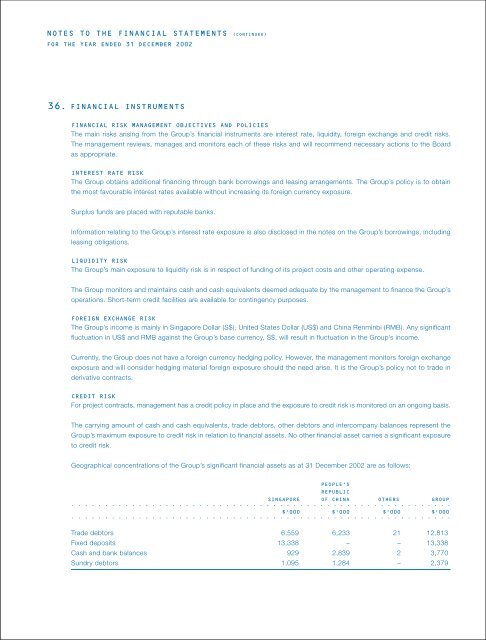

Geographical concentrations of the Group’s significant financial assets as at 31 December 2002 are as follows:<br />

PEOPLE’S<br />

REPUBLIC<br />

SINGAPORE OF CHINA OTHERS GROUP<br />

$’000 $’000 $’000 $’000<br />

Trade debtors 6,559 6,233 21 12,813<br />

Fixed deposits 13,338 – – 13,338<br />

Cash and bank balances 929 2,839 2 3,770<br />

Sundry debtors 1,095 1,284 – 2,379