AB36 - Student Awards Agency For Scotland

AB36 - Student Awards Agency For Scotland

AB36 - Student Awards Agency For Scotland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

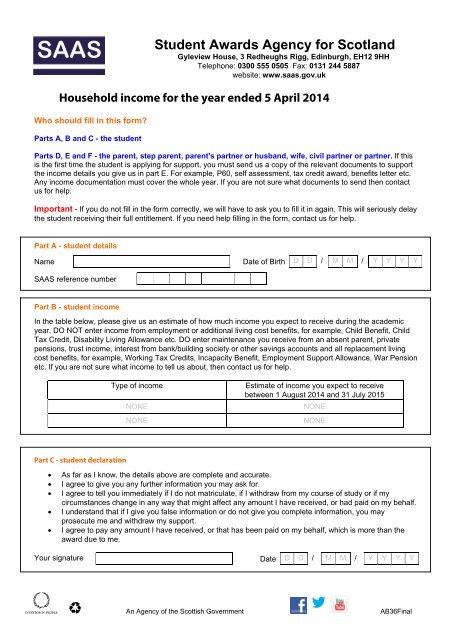

<strong>Student</strong> <strong>Awards</strong> <strong>Agency</strong> for <strong>Scotland</strong><br />

Gyleview House, 3 Redheughs Rigg, Edinburgh, EH12 9HH<br />

Telephone: 0300 555 0505 Fax: 0131 244 5887<br />

website: www.saas.gov.uk<br />

Household income for the year ended 5 April 2014<br />

Who should fill in this form<br />

Parts A, B and C - the student<br />

Parts D, E and F - the parent, step parent, parent's partner or husband, wife, civil partner or partner. If this<br />

is the first time the student is applying for support, you must send us a copy of the relevant documents to support<br />

the income details you give us in part E. <strong>For</strong> example, P60, self assessment, tax credit award, benefits letter etc.<br />

Any income documentation must cover the whole year. If you are not sure what documents to send then contact<br />

us for help.<br />

Important - If you do not fill in the form correctly, we will have to ask you to fill it in again. This will seriously delay<br />

the student receiving their full entitlement. If you need help filling in the form, contact us for help.<br />

Part A - student details<br />

Name Date of Birth D D / M M / Y Y Y Y<br />

SAAS reference number<br />

Part B - student income<br />

In the table below, please give us an estimate of how much income you expect to receive during the academic<br />

year. DO NOT enter income from employment or additional living cost benefits, for example, Child Benefit, Child<br />

Tax Credit, Disability Living Allowance etc. DO enter maintenance you receive from an absent parent, private<br />

pensions, trust income, interest from bank/building society or other savings accounts and all replacement living<br />

cost benefits, for example, Working Tax Credits, Incapacity Benefit, Employment Support Allowance, War Pension<br />

etc. If you are not sure what income to tell us about, then contact us for help.<br />

Type of income<br />

NONE<br />

NONE<br />

Estimate of income you expect to receive<br />

between 1 August 2014 and 31 July 2015<br />

NONE<br />

NONE<br />

Part C - student declaration<br />

<br />

<br />

<br />

<br />

<br />

As far as I know, the details above are complete and accurate.<br />

I agree to give you any further information you may ask for.<br />

I agree to tell you immediately if I do not matriculate, if I withdraw from my course of study or if my<br />

circumstances change in any way that might affect any amount I have received, or had paid on my behalf.<br />

I understand that if I give you false information or do not give you complete information, you may<br />

prosecute me and withdraw my support.<br />

I agree to pay any amount I have received, or that has been paid on my behalf, which is more than the<br />

award due to me.<br />

Your signature Date D D / M M / Y Y Y Y<br />

abcde a =========================== An <strong>Agency</strong> of the Scottish Government============================== =====================<strong>AB36</strong>Final ==<br />

=

Part D - person 1 and person 2 details<br />

Name<br />

Relationship to student<br />

National Insurance Number<br />

Are you retired or unemployed<br />

Address of person 1 and 2<br />

Father, stepfather, parent’s partner or<br />

husband, wife, civil partner (Person 1)<br />

Mother, stepmother, parent’s partner<br />

(Person 2)<br />

Part E - person 1 and person 2 gross income and deductions<br />

Important - if you do not enter income for both person 1 and 2, please tell us why in the box below, for example,<br />

'separated'. You will need to send us relevant evidence that proves your single status.<br />

Reason for one person’s income<br />

Gross yearly income and deductions Person 1 Person 2<br />

PAYE income for year ending 5 April 2014 from salary, wages, commission, bonuses<br />

and overtime. Write the total before deduction of income tax, National Insurance and<br />

superannuation contributions.<br />

Net Profit from self-employment income from year ending between 6 April 2013 and<br />

5 April 2014.<br />

NONE<br />

NONE<br />

NONE<br />

NONE<br />

Taxable income from property and land. NONE NONE<br />

Income from Working Tax Credit (DO NOT include Child Tax Credit). NONE NONE<br />

Income from private, employers or retirement pensions. NONE NONE<br />

Social Security benefits, including pensions and allowances. Enter the yearly amount<br />

(DO NOT include Child Tax Credits or Child Benefit).<br />

NONE<br />

NONE<br />

Income from bonds, trusts, bank and building society accounts or investments. NONE NONE<br />

Dividends you receive. NONE NONE<br />

Other income (DO NOT include Child Tax Credit or Child Benefit). If you RECEIVE<br />

maintenance, you only need to enter this if it is for another student in further or higher<br />

education. DO NOT enter maintenance for a child still at school.<br />

If you PAY maintenance for a child in further or higher education (not the applicant in<br />

part A), enter their name, date of birth and how much you pay.<br />

NONE<br />

NONE<br />

Important - if you did not enter income in any of the boxes above, please tell us why in the box below, for<br />

example, 'housewife/husband/partner’ or ‘unemployed and not entitled to benefits’.<br />

Reason for no income<br />

NONE<br />

Part F - person 1 or person 2 declaration<br />

<br />

<br />

<br />

<br />

As far as I know, the details above are complete and accurate.<br />

I agree to give you any further information you may ask for.<br />

I agree to tell you immediately if my circumstances change in any way that might affect this application for<br />

support.<br />

I understand that if I give you false information or do not give you complete information, you may<br />

prosecute me and withdraw the support.<br />

Your signature Date D D / M M / Y Y Y Y<br />

abcde a =========================== An <strong>Agency</strong> of the Scottish Government============================== =====================<strong>AB36</strong>Final ==<br />

=