BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMMITTED TO COMMUNITY<br />

FHLBANK MEMBER COREFIRST BANK & TRUST<br />

USES FHLBANK PRODUCTS TO ENHANCE ITS<br />

COMMUNITY OUTREACH<br />

by Laura Maag Lutz<br />

AVP, Congressional and Community Outreach<br />

<strong>FHLBank</strong> <strong>Topeka</strong><br />

COREFIRST: AHP IN ACTION<br />

Imagine having 13 kids under your roof<br />

– the logistics of preparing dinner for such<br />

a rowdy bunch and supervising homework<br />

each night is mind-boggling. It doesn’t faze<br />

Ken Davis, however. He and his wife, Kellie,<br />

are house parents at The Villages in <strong>Topeka</strong>,<br />

a nonprofit corporation that provides family-style<br />

group homes for youth ages 6 to 18<br />

years who have been abused, abandoned<br />

or neglected. Ken has watched The Villages<br />

grow during the last 11 years that he and his<br />

wife have served as house parents, and he’s<br />

been witness to the fact that it’s not always<br />

easy for a non-profit to make ends meet.<br />

That’s why Davis, as well as executives and<br />

the board of directors of The Villages, are<br />

grateful for the recent assistance the organization<br />

has received thanks to a partnership<br />

between <strong>FHLBank</strong> <strong>Topeka</strong> and CoreFirst<br />

Bank & Trust.<br />

<strong>FHLBank</strong> member CoreFirst helped The<br />

Villages apply for grant assistance from<br />

<strong>FHLBank</strong>’s Affordable Housing Program,<br />

which resulted in the organization qualifying<br />

for two grants totaling $610,000. The funds<br />

are being used to renovate five homes in<br />

<strong>Topeka</strong> and two in Lawrence that house<br />

up to 10 youth each along with their house<br />

parents. The homes are getting new siding,<br />

windows, exterior doors, roofs and gutters.<br />

“One of the first things I noticed as I walked<br />

into one of the homes that had the siding<br />

and windows replaced was how quiet it<br />

was,” said Villages’ executive director Sylvia<br />

Crawford. She hopes the grants, which<br />

have been referred to as Another 40 Years,<br />

will live up to their name and help breathe<br />

another four decades of life into The<br />

Villages’ ranch-style homes.<br />

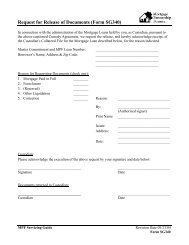

L to r: John Fager, Kent Fager and Bob Derstein of CoreFirst Bank & Trust; Sylvia Crawford, executive director of<br />

The Villages; and Terry Wright, <strong>FHLBank</strong> account manager.<br />

Long-time Villages board member and CoreFirst senior vice president and trust officer, Bob<br />

Derstein, said, “These grants were a shot in the arm. It allowed us to make a number of needed<br />

improvements much sooner than we’d have been able to otherwise.” The majority of The<br />

Villages’ income comes from reimbursement for care, Derstein said, but that just covers the<br />

basics. “We’ve always been dependent on outside resources beyond feeding and clothing<br />

the kids,” he added.<br />

CoreFirst’s support of The Villages is typical of the bank’s community-minded spirit. The<br />

Villages’ grants represent CoreFirst’s 5th and 6th successful <strong>FHLBank</strong> AHP applications since<br />

becoming a member of <strong>FHLBank</strong> <strong>Topeka</strong> in 1993. All total, CoreFirst has secured $987,000 in<br />

AHP grant funds, which has helped develop 167 units of affordable housing in the <strong>Topeka</strong> area.<br />

CoreFirst chairman, president and CEO, Duane Fager, who served on the <strong>FHLBank</strong> board of<br />

directors from 1997 to 2004, recalled, “When the board would look at the impact the AHP<br />

was having across the Tenth District and all of the money that went to different organizations<br />

and to different programs, it’s just phenomenal. We’re glad to be just a little piece of<br />

that here in the <strong>Topeka</strong> community. There are some organizations and programs in this area<br />

that wouldn’t be nearly as good as they are today without these programs. The <strong>FHLBank</strong><br />

housing programs are so valuable,” Fager said.<br />

Given CoreFirst’s commitment to community, it’s no surprise that in October, the FDIC<br />

gave the institution, which has assets of more than $1 billion, an outstanding rating on its<br />

10<br />

<strong>FHLBank</strong> Focus | Winter 2007